Students who didn’t earn an income or are currently unemployed and are about to graduate from graduate school or a professional program might want to forgo filing a tax return. After all, if you earned a $0 gross income or a nominal amount, why do extra paperwork if you don’t have a tax bill or need to file?

Although this might seem like sound reasoning, student loan borrowers should always file a tax return. Filing a return, for example, is an easy way to sign-up for income-driven repayment (IDR) and can help in other situations as well. Find out more about filing taxes with student loans.

Filing taxes with student loans and no or low income

There are certain seasons of life where you might not earn money. Graduating, becoming unemployed, or dealing with a life-threatening illness such as cancer are some examples of when you might find yourself without an income. Whatever the reason, you might be able to avoid filing your taxes if you have no taxable income.

According to the Internal Revenue Service (IRS), single taxpayers under age 65 don’t need to file a tax return if their income is less than $12,550.

Although avoiding unnecessary paperwork during tax season can be an attractive option, submitting a $0 tax return has its advantages.

Maintains regular tax records

It’s good to have income records on file with the government. That way, there are no questions later on. It can also protect you from an extensive IRS audit—the IRS has a statute of limitations that puts a three-year limit on auditing your tax returns.

But the timer starts when you actually file your tax return. If you don’t file, the three-year limit doesn’t apply and the IRS can perform an audit at any time.

So, filing even if you have no income can limit the IRS from going back more than three years to audit your returns.

Easier access to government assistance

If you’re earning no money, you might qualify for specific government assistance programs such as the Supplemental Nutrition Assistance Program (SNAP), or what’s sometimes referred to as “food stamps.” Since you don’t have pay stubs to verify income, having a $0 income officially filed on a tax return might be helpful.

So if you aren’t making money or have an income that falls below the IRS income threshold for a tax return, it still makes sense to file.

Tax credits and deductions

If you qualify for the Earned Income Tax Credit or the Education Tax Credit, you may be eligible for a tax refund. Even if your tax return reports zero income in the previous tax year, but you qualify for certain credits, you might get money back during tax season.

Additionally, student loan borrowers can take advantage of certain tax deductions. For example, you might qualify for the student loan interest deduction and be able to deduct up to $2,500 in student loan interest. Look out for tax form 1098-E from your lender.

In this situation, a little paperwork and time can actually earn you some extra cash. This can be especially helpful for student loan borrowers looking for relief and additional financial assistance.

The good news is that filing your federal tax return should be free with IRS Free File, which is available for eligible tax filers who have an adjusted gross income (AGI) of $73,000 or less.

How filing a tax return can help student loan borrowers

Federal student loan borrowers who don’t earn income or have a low income can request an income-driven repayment (IDR) plan that potentially offers a $0 monthly payment.

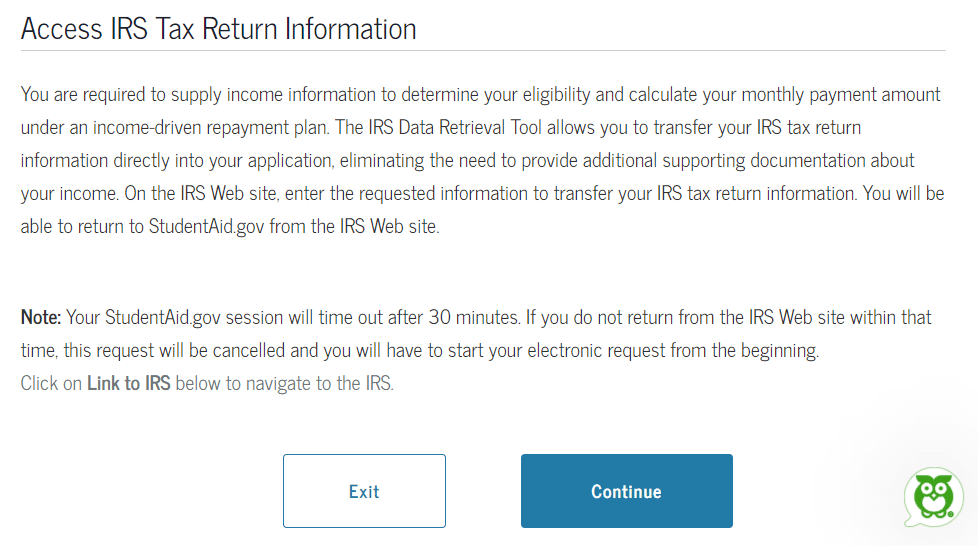

When you submit an Income-Driven Repayment Plan Request, you’ll need to verify your income so the Department of Education can calculate your new monthly student loan payment. By filing your taxes, despite having no or low income, you can use the IRS Data Retrieval Tool to help make the process seamless. Simply use the IRS data on file to illustrate your income and get your monthly payments set.

Additionally, married couples who file jointly may need to use both spouses’ incomes when calculating an IDR payment. This requirement might impact your monthly payment amount, and put you into a different tax bracket. Review your options and how your tax filing status affects your payments.

On an IDR plan, you need to recertify your income and family size each year. Filing a tax return — even with no income or an income that’s below the IRS threshold for a tax return — makes it easier for you and your loan servicer to confirm your income.

Additionally, filing taxes with student loans is a good option if you hope for student loan forgiveness. Income-driven repayment plans offer forgiveness on your remaining federal loan balance after 20 to 25 years.

You might need to pay federal income tax on the amount that’s canceled, however, that’s not due until at least 2025 thanks to new legislation. If you work in the public sector, you might also qualify for Public Service Loan Forgiveness (PSLF) after just 10 years.

Unfortunately, income-driven repayment isn’t available or an option for private student loans. So if you have a private lender, it might still benefit you to be a tax filer for other reasons but you won’t qualify for an IDR plan that reduces your monthly student loan payment.

The bottom line

Whether you’re in school and about to graduate, unemployed, or in a transition period, filing taxes can be advantageous even if you have no income or earn a low income. This is especially true for federal loan borrowers.

Consult a tax professional if you have specific questions about tax benefits that apply to your situation.

Need help managing your upcoming student loan repayment or student loan refinancing strategy? Get in touch with Student Loan Planner to book a consultation.

Not sure what to do with your student loans?

Take our 11-question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, SAVE or another IDR plan, or refinancing (including the one lender we think could give you the best rate).