Chiropractors help people manage and heal from back pain, joint and nerves, sore muscles, spine issues, and more through chiropractic adjustments and spinal manipulation. But before you become a chiropractor, there's admission into chiropractic college, studying anatomy, chemistry, physiology, nutrition, physics, and biology, lots of exams, getting a license, and paying back school debt.

Chiropractors usually have a long road ahead of them to pay back their student loans. Would someone considering chiropractic school be better off going through three or more years of school to earn a Doctor of Chiropractic (D.C.) degree — or finding another fulfilling career?

Chiropractic schools can seem “affordable” when you look at the tuition on their own compared to the average salary. But the facts are that chiropractors end up leaving with more debt getting a doctor of chiropractic degree than they originally thought and struggle to earn a decent starting salary.

Chiropractors graduate with more student loans than anticipated

It takes more than three years to get a D.C., with 10 trimesters of school if a student is going full time. I will say it’s darn hard to find out exactly how much full tuition could cost. This is because most chiropractic school websites list it only by trimester.

Logan University tuition is about $13,520 per trimester as of January 2024, which would be about $135,000 in total tuition. Palmer College of Chiropractic tuition is $13,025 per trimester for about $130,250 in total estimated tuition.

These numbers are high but also misleading. Higher living expenses, tuition increases each year, interest accruing on the loans and leftover loans from undergrad push the cost of becoming a D.C. for chiropractic students well above what’s anticipated.

We’ve helped over 300 chiropractors here at Student Loan Planner®. Their average student loan debt is $251,000.

So is it financially worth it?

Chiropractor salary comparison

The average chiropractor salary is around $75,380 per year, according to the Bureau of Labor Statistics (BLS) as of 2022. This is a very nice salary. But the average starting salary could be in the $30,000 to $40,000 range. I couldn’t find the numbers, but many of the clients I’ve worked with struggle to find a decent paying job as they build up their numbers or take the overflow from a more established chiropractor. Pursuing chiropractic specialties (like sports medicine, nutrition, geriatrics, and pediatrics) can help but it can be a gamble.

But how does that compare to the average college graduate without an advanced degree?

According to a 2021 report from the BLS, the median wage for a college graduate is about $75,464. Here’s a graphical summary from The Balance Careers if you want more info.

So becoming a D.C. and providing chiropractic care could mean earnings per year that are even less than the regular college averages. But let's assume you could earn at least $5,000 more working within your specialty and with your certifications.

Suppose that $5,000 in extra income sustains throughout the entire 30-year career of a D.C. That works out to an extra $150,000 in lifetime earnings for a D.C. compared to someone with a bachelor’s degree. That might seem like a big number, but we have to adjust for the extra cost to get that degree.

Taking out $200,000 in loans for a chiropractic education to make an extra $150,000 doesn’t make any financial sense at all, but it’s even worse than that.

If we assume a combined 30% tax rate for federal and state, then we can reduce that $150,000 in earnings down to about $105,000 in extra take-home pay.

So now we’re talking about chiropractors having an extra $105,000 to pay off the $200,000 of student loan debt that made it possible to earn that chiropractor income.

Now that we have the income side figured out, let’s look at the loan repayment piece:

- These numbers don’t show how many chiropractors spend the first 20 to 25 years of their careers saddled with loan payments. They’re staring at student loan balances that don’t seem to change and often continue to grow.

- The other piece of the equation is that the cost of paying back the loans will be higher than the actual loan balance.

Let’s dive deeper into what repayment actually looks like for chiropractors who took out loans for doctor of chiropractic programs.

Income & Student Debt by Profession

How you compare to other

accountants stats*

| Average student debt | |

| Average income | |

| Average Debt-to-Income Ratio |

Statistics represent the population of Student Loan Planner clients in the respective profession referenced in the chart from 2017-2023. Sample excludes those in school or in training.*

D.C. student loan repayment options

Our experience here at Student Loan Planner® shows there are two optimal ways for chiropractors to pay off student loans. Each of them is on opposite ends of the spectrum.

Option 1 – Aggressive Pay Back: For people who owe 1.5 times their income or less (e.g., someone who makes $100,000 with loans at $150,000 or less), their best bet is to throw every dollar they can find into paying back their loans as fast as possible for no more than 10 years.

Option 2 – Pay the least amount possible: For people who owe more than twice their income (e.g., someone who makes $100,000 and owes $200,000 or more), the goal is to get on an income-driven repayment plan that will keep their payments low and maximize loan forgiveness.

Loan repayment for chiropractors

Let’s say Matt has $200,000 in student loans from undergrad and chiropractic school at 6.8% interest.

He just graduated and is about to start his student loan repayment. After passing the National Board of Chiropractic Examiners (NBCE) exam, he got a job with a local chiropractor who is growing the business and needs extra help.

Matt’s starting salary will be $40,000 starting out. Over the next 3 years, his chiropractor salary is expected to go up to $10,000 per year until it reaches $70,000. Then it will level out and grow at a normal 3%.

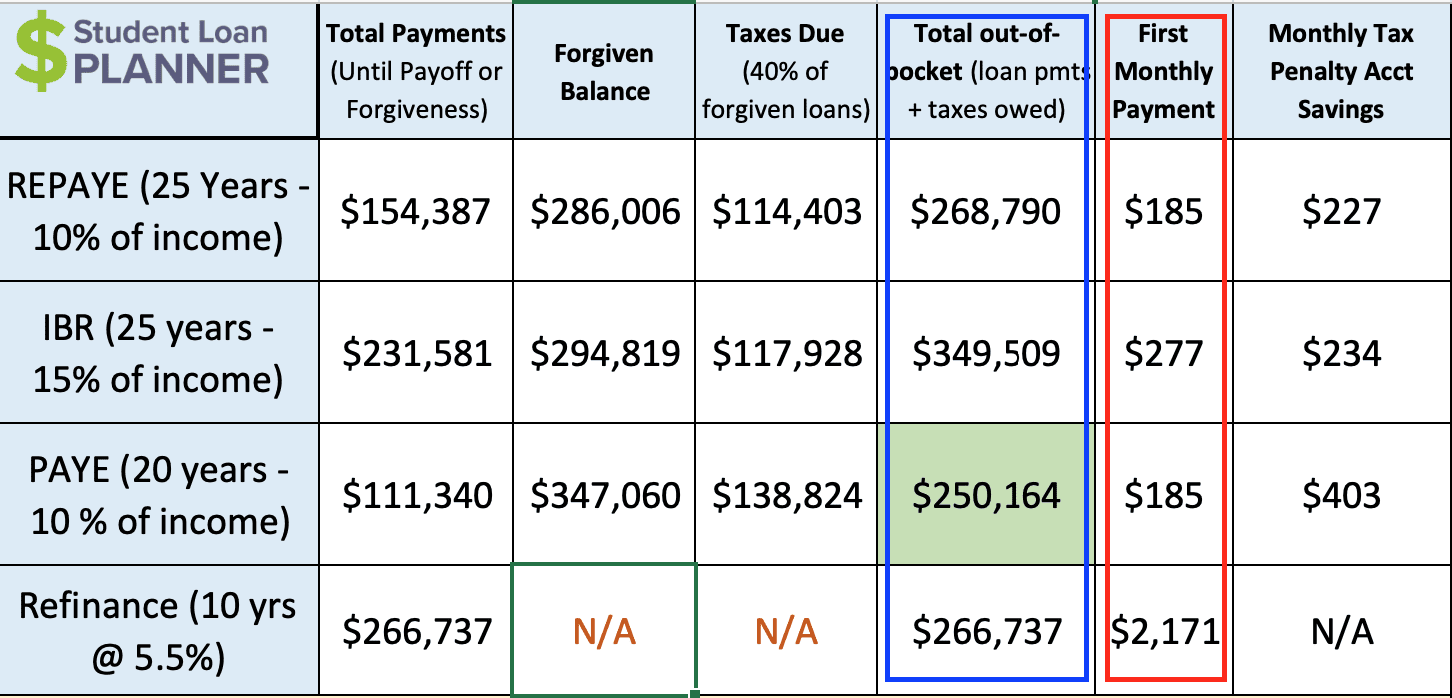

Let’s compare his loan repayment options from income-driven repayment to refinancing:

It looks like Pay As You Earn (PAYE) would be the best option, followed by what appears to be a virtual tie between refinancing and Revised Pay As You Earn (REPAYE). Income-Based Repayment (IBR) is the most expensive option, so there’s no need to discuss that further.

Let’s examine the difference between PAYE and refinancing, though, because we’re not looking at an apples-to-apples comparison.

PAYE vs. refinancing student loans

PAYE is a 20-year repayment plan based on income whereas refinancing is a 10-year aggressive repayment based on the loan amount. So even though the total out-of-pocket cost looks pretty close, refinancing will feel much tighter.

That refinancing payment is projected to be $2,171 at 5.5% interest, paid over 10 years. Matt will be starting with a $40,000 salary, which would be somewhere between $2,500 and $3,000 a month in take-home pay. Unless he’s living rent-free, that student loan payment will basically eat up all his money.

When he’s making $70,000, maybe he’ll be taking home $4,000 per month. He’d then be spending more than half of his take-home pay on the student loan.

What if he chose PAYE instead?

Well, his first-year payments are projected to be only $185 per month. That’s incredibly affordable! Now, his payments will grow as his income grows. His loan balance would continue to increase, and he’d have to pay taxes on the forgiven balance after 20 years.

But guess what? This path could help Matt save up for his other financial goals alongside loan repayment. Refinancing would mean he’d have to throw everything he can at paying off the loans in full and put everything else on hold until his loans are paid.

That tax bomb scares Matt a little bit. But if he puts $403 per month into an investment account projected to earn a 5% annualized rate of return, he’d have enough to pay the taxes. That savings is in addition to the student loan payment.

That’s about $600 per month on PAYE versus $2,171 to refinance. Totally doable.

In the end, Matt chooses PAYE. It’s projected to cost him about $250,000 out of pocket to pay off his student loans — $111,340 in payments over 20 years plus $138,824 in taxes in year 20, which he will be saving up for along the way.

Is becoming a chiropractor worth the cost?

The financial answer would be no in Matt’s case. He’d make an estimated $105,000 more in income providing chiropractic treatments, and it would cost him about $250,000 to pay back his loans. That means paying back the loan would cost $145,000 more than the extra income he’d take in.

Money isn’t everything though. The question Matt has to ask himself is if there’s something else he could do with a bachelor’s degree or other types of additional training. Something where he could make the same or more money, feel good about it and not take out a ton of loans to make it happen. There are plenty of other professions out there.

Someone in Matt’s situation would be saddled with debt for 20 to 25 years, watching their loan balance grow and dealing with the stress and anxiety around it. Making student loan payments will be a way of life during that time. It might get especially tight if the extra costs of getting married and raising kids come around which could cause lifestyle issues.

Bottom line is that you have to love chiropractic medicine, doing spinal adjustments, and be all in. This is because the reality is that most chiropractors will have to deal with student loans for 20 years. They’ll also have to deal with the background stress of the loans even if they have a successful career.

Like any profession, chiropractic candidates should only pursue this path if they’re all in and won’t let student loans make them regret their decision after projecting what life will look like 10 years after graduation.

Having a clear understanding of how loan repayment works and how to mitigate both the financial and psychological aspects of carrying that amount of debt is a must.

Chiropractors need a plan for student loan repayment

Chiropractors can find a clear path to pay back their student loans, despite how much their salary is. A path that could not only save them significant money but help them understand the actions steps to get it done.

Student Loan Planner® has done over 2,000 student loan consults for clients with over $500 million of student loans. We can help you figure out the optimal path in just one hour.

Income & Student Debt by Profession

How you compare to other

accountants stats*

| Average student debt | |

| Average income | |

| Average Debt-to-Income Ratio |

Statistics represent the population of Student Loan Planner clients in the respective profession referenced in the chart from 2017-2023. Sample excludes those in school or in training.*