Dentists rank right near the top of two financial categories, one of which is good and the other is not so good. Any guesses? The answer is that the average dentist salary is among the top paid professionals out there (good). But dentists also graduate with more student debt than most other professionals (bad).

So, does the opportunity to earn a great salary offset the debt? Key factors in this equation, especially for general dentists, include what part of the country the dentist practices in and whether they own their own business. Both of which can impact not only dentists’ income and their student loan repayment options.

General dentist income versus dental specialists

According to the Bureau of Labor Statistics (BLS), there are about 140,000 dentists currently working in the field. Based on recent data from the American Dental Association (ADA) in conjunction with the Health Policy Institute, the average dentist salary is $220,950. That amount is misleading, especially for general dentists.

Those who choose to train for a specialization earn a substantial income premium. Endodontists, orthodontists, periodontists, prosthodontists, oral surgeons, as well as pediatric dentists, for example, all vastly out-earn general dentists on average.

Taking a closer look at the BLS data, 120,300 (about 86%) of all dentists are general dentists, and the average general dentist earns $180,830. That’s about $40,000 below the average dentist salary from the ADA data. How can that be?

If 86% of dentists are earning less than the average, that means that the other 14% of specialists must be earning well above average. The truth is that specialists earn $330,180 on average.

With those numbers, you might wonder why anyone would choose general dentistry over specializing.

Some like the continuity of relationships. Others want to start working right away rather than go through more training. This can mean more debt and pushing off a high income for many more years. Some dentists like to perform a variety of procedures rather than specializing. Some areas of the country don’t have certain specialist jobs available.

There are a number of reasons dentists choose general dentistry over specializing.

Income & Student Debt by Profession

How you compare to other

accountants stats*

| Average student debt | |

| Average income | |

| Average Debt-to-Income Ratio |

Statistics represent the population of Student Loan Planner clients in the respective profession referenced in the chart from 2017-2023. Sample excludes those in school or in training.*

General dentist income by state

In most professions, the more expensive it is to live in a city, the higher the pay. Employers are willing to pay more for talented people to come to New York, Los Angeles, Chicago, San Francisco, Boston, Seattle and other major metro areas. In many cases, employees negotiate higher pay so they can afford to live comfortably in these cities.

Not so for most dentists.

Dentists’ salaries can be substantially lower in the more expensive populated states and higher in more sparse parts of the U.S. The ADA created a map of the average annual income for general dentists by state that reflects this trend.

California, the most populated and one of the most expensive states to live in, for example, has the second-lowest dentist income in the country after adjusting for the cost of living. This issue is supply and demand. There are 30,000 dentists in California, but only 15,000 in Texas.

There are about 60 dentists per 100,000 people in the U.S. But California; Washington, DC; Massachusetts; and New Jersey are highly saturated at nearly 80 per 100,000. That’s 33% more dentists per capita.

The average dentist's incomes in those states are all below the national average. More dentists per person means more competition and fewer patients (and income) per dentist.

States with the highest dentist income (above $225,000) include:

- Alaska

- Delaware

- Minnesota

- North Carolina

- North Dakota

- Rhode Island

- Wisconsin

States with the lowest dentist income (under $175,000) include:

- California

- Colorado

- District of Columbia

- Florida

- Hawaii

- Illinois

- Louisiana

- Maryland

- Massachusetts

- Nebraska

- New Jersey

- New York

- Pennsylvania

- Utah

- Vermont

- West Virginia

- Wyoming

Whereas, states like Nevada, South Dakota, Iowa, Missouri, Michigan, Indiana, Ohio and Tennessee, Maine, New Hampshire have an average salary ranging between $200,000 to $225,000.

Dentists in states with lower populations and less competition, often in more rural areas, tend to make more money than those who live in densely populated areas that have an oversaturation of dentists.

Owning a dental practice versus working as an associate dentist

General dentists who are trying to maximize their income should consider going somewhere that has less competition and a greater need for dentists.

Here’s yet another drastic difference in dentist income. If you remember, the average general dentist earns $190,000. Looking at the same ADA survey, the average dentist employee earns $160,000. Meanwhile, the average solo practice owner makes $201,000, a 13% premium.

Scaling a practice definitely pays off even more though. A practice owner who has at least one more dentist working for them earns $235,000 on average. That’s 47% more income than the $160,000 earned as an associate.

Why do practice-owners make more? The average dental practice takes home about $0.40 to $.0.50 per dollar of revenue it brings in. An associate would get paid about $0.30 per dollar. The practice owner profits an extra $0.10 to $0.20 per dollar of production from their own business as well as from the production of other associate dentists they’d hire.

Being a practice-owning dentist takes a lot of work, though. Typically practice owners need to borrow money to purchase the practice and buy equipment not included with the purchase. They also have to put in the time to run the practice. The other advantage, aside from making more money per dollar of production, is that they’re buying and building something of value that they can sell down the road.

How to manage dentist student loan debt

We know that the average general dentist earns $180,830 in annual salary. But the average dentist also graduates with between $250,000 to $300,000 in student loans.

Here at Student Loan Planner®, we’ve done hundreds of individual student loan consults with dentists. The average debt for those clients is $385,000.

So, what’s the best way for dentists to pay back student loans?

The best student loan repayment options for dentists

We’ve worked with over 5,875 clients advising on $1.44 billion in student loans. What we’ve found is that there are two optimal ways to pay back student loans:

1. Aggressive repayment: This strategy entails doing everything you can to pay off debt as fast as possible. It should take no more than 10 years. The idea is to pay as little in interest as possible. That often means refinancing to pay less in interest and putting more money toward paying off the loan.

This plan works best for dentists who owe less than 1.5 times their income in student debt (e.g. a dentist making $200,000 who owes $300,000 or less).

2. Using an income-driven repayment (IDR) to maximize loan forgiveness: This strategy involves signing up for a PAYE, REPAYE or IBR plan to keep the monthly payments as low as possible. Then a dentist would want to take advantage of the low payments to save aggressively, preferably by maxing out pre-tax retirement and saving up for the potential tax bomb to start.

This strategy works best for dentists who owe more than twice their income in student loans (e.g. a dentist making $175,000 who owes $350,000 or more in student loans). It also works well for those who are looking to own a dental practice so they can have payment flexibility until they get things up and running.

When general dentists should refinance student loans

Here’s a hypothetical example of when a general dentist should refinance his student loans. James has $250,000 in student loan debt at 6.8% interest and he earns a general dentist salary of $190,000. His income is projected to grow slow and steady at 3% per year. Should he take the aggressive approach or go on income-driven repayment?

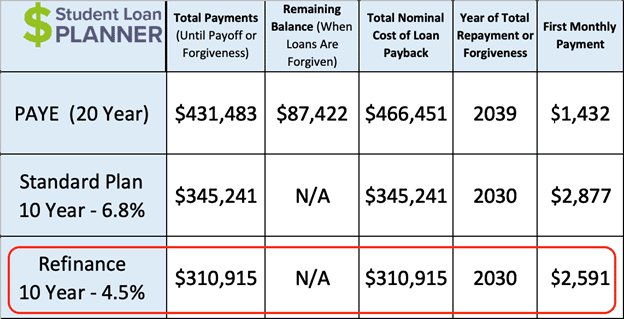

Let’s take a look at the numbers comparing PAYE, a standard 10-year plan and refinancing:

This is a clear refinancing case because refinancing will save James the most money by far when compared with the other two options.

PAYE would cost about $156,000 more to pay back his student debt and double the amount of time until he’s debt-free (20 years versus 10 years). The refi payments are $1,100 higher per month versus his initial PAYE payment, but he can easily afford that on a $190,000 income. It’s worth it to save six figures over the long run.

Why refinance with a private lender rather than leave it on the 10-year standard plan? Refinancing could lower his interest rate from 6.8% down to 4.5%, reducing the total cost of paying back his debt by lowering his monthly payment by about $300 per month and saving nearly $35,000 over 10 years.

When general dentists should get on an IDR plan

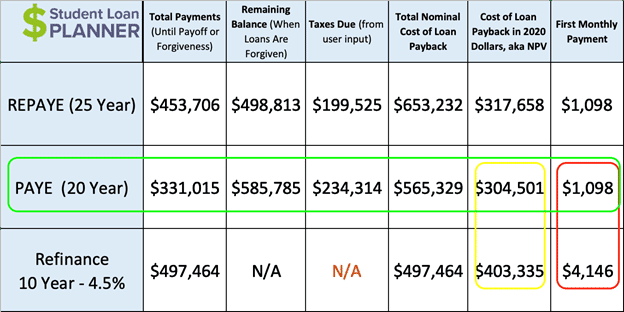

Now let’s consider another hypothetical example. Jane is a general dentist who lives in Southern California. Her income is $150,000, and she owes $400,000 in student debt from undergrad and dental school. She’s not planning to open her own practice, so her income should grow at the normal 3% per year.

Although it looks like refinancing costs less out of pocket, it isn’t actually the most affordable or optimal plan. Mathematically speaking, we want to go with the option that has the lowest net present value (NPV), or the cost in today’s dollars. Looking at it there, PAYE is nearly $100,000 less than refinancing. Essentially this means it’s cheaper to keep the payments low so she can save a lot money

Here’s what I mean by the lower NPV being more important than the total cost:

The combination of a high refinance payment ($4,146 per month) and a lower salary doesn’t leave much room to reach other financial goals, like buying a house or saving for retirement.

Her lifestyle would be pretty much nil as well. Let’s say her take-home pay is about $8,000 per month. More than half would go toward her refinancing payments over the next 10 years. This leaves her with just over $3,000 for regular monthly outflows while living in expensive Southern California. That’s pretty much a no-go.

On PAYE, her payment would start at $1,098 which would leave her with about $7,000 per month in take-home pay. Now we’re talking.

Remember though, that we need to save aggressively alongside PAYE. If she could save about $2,500 a month by maxing out her pre-tax retirement plan and saving for the tax bomb ($679 per month) she could reach other financial milestones along the way.

Assuming her $2,500 per month would be invested and grow at 5% per year, she could build up a $390,000 nest egg in 10 years. That would continue growing to $1,031,000 in 20 years. She’d still have a $797,000 nest egg after paying the tax bomb ($234,000) on the forgiven balance after 20 years of payments on PAYE. The kicker is that as her income grows, she can save even more money while also increasing her lifestyle.

Now, let’s say she refinanced, throwing all she can toward her loans and holding off on savings for 10 years. She’d be debt-free in 10 years and then could take the $4,146 payment she had been making and invest it over the next 10 years, ending up with $643,000. That isn’t bad but it ends up being over $100,000 shy of the PAYE plan that invests the difference in payment.

Jane would have a 24% higher net worth after 20 years by being on the PAYE plan instead of refinancing and paying off the debt in 10 years ($796,000 with PAYE versus $643,000 refinancing).

Is becoming a general dentist worth it?

It’s scary for dental school graduates to owe $300,000 or $400,000 in student loans. Honestly, it might not be worth it financially for aspiring dentists who want to be an associate for life working in a major metropolitan area.

On the other hand, becoming a dentist could be highly rewarding and lucrative for those who are willing to live in more rural locations and entertain the idea of pursuing practice ownership.

The good news is that there’s an optimal plan to pay dental school loans back no matter your situation.

How dentists can get on the right student loan plan

General dentists can find a clear path to pay back their student loans. A path that can not only save them significantly more money during repayment but also give them actionable steps and a clear way to get it done.

Student Loan Planner® has done thousands of student loan consultations for clients totaling over $1.44 billion of student loan debt. We can help you figure out the optimal path in just one hour. Plus, we also include email support after the consultation where we continue to answer questions and help you implement your plan. Learn more about our consultation process.

Income & Student Debt by Profession

How you compare to other

accountants stats*

| Average student debt | |

| Average income | |

| Average Debt-to-Income Ratio |

Statistics represent the population of Student Loan Planner clients in the respective profession referenced in the chart from 2017-2023. Sample excludes those in school or in training.*

Comments are closed.