Being a speech-language pathologist (SLP) is a rewarding career. Think about how wonderful it is to work with people to overcome various obstacles for them to communicate more clearly to others as well as comprehend others communicating to them more easily. Interacting and communicating with other people is a vital part of life satisfaction. SLPs get to do this great work on a daily basis.

But a rewarding career in speech-language pathology comes at a financial cost, which may include student loans. In this post, I’ll cover how to pay off student loans on a speech-language pathologist's salary.

Speech-language pathologist salary and student loan debt

According to a report published by the American Speech-Language-Hearing Association, the average SLP starting salary is $74,000. The average for the entire profession is $84,140, according to the Bureau of Labor Statistics. Not bad considering the average college graduate earns about $66,000 with only a bachelor's degree.

In order to get that $18,000-per-year premium compared to the average college grad, a two-year master’s degree is required. There are 265 accredited programs to choose from. It looks like the majority of their tuition range from $15,000 to $25,000 per year, according to SpeechPathologyGraduatePrograms.org.

Let’s just say that it costs about $50,000 to get a master’s degree. It would take about 3 years using the extra salary to warrant the additional cost to get the degree. That’s not a bad financial payoff, especially compared to other graduate-level programs. If the education was funded solely with student debt, an SLP should be able to refinance and pay back the loans in five years or less, since they’ll end up owing less than their salary.

The average speech-language pathologist we’ve worked with here at Student Loan Planner® has about $131,000 in student loan debt. But that doesn’t tell the whole story. Some have had less than $100,000, while others have had over $200,000, which is a fairly wide range.

Why would this be the case? The ones with the higher debt went to more expensive out-of-state or private schools for undergrad or to a more expensive master’s program. The people we’ve worked with usually have a combination of undergrad and graduate loans.

So, what are the best strategies to pay off speech pathology student loans?

Income & Student Debt by Profession

How you compare to other

accountants stats*

| Average student debt | |

| Average income | |

| Average Debt-to-Income Ratio |

Statistics represent the population of Student Loan Planner clients in the respective profession referenced in the chart from 2017-2023. Sample excludes those in school or in training.*

Student loan repayment options for speech-language pathologists

Here at Student Loan Planner®, we’ve done over 5,875 consults and advised on over $1.44 billion of student debt. Our experience has uncovered two optimal ways to pay off student loans. They happen to be on opposite ends of the spectrum.

- Aggressive pay back: For people who owe 1.5 times their income or less (e.g. someone who makes $80,000 with loans at $120,000 or less), their best bet is to throw every dollar they can find into paying back their loans as fast as possible, for no more than 10 years.

- Pay the least amount possible: For those who owe more than twice their income (e.g., someone who makes $80,000 and owes $160,000 or more) or are eligible for Public Service Loan Forgiveness (PSLF), the goal is to get on an income-driven repayment plan that will keep their payments low and maximize forgiveness. This includes both tax-free (PSLF) and taxable loan forgiveness (on an income-driven plan). This works best when you take advantage of the low payments to save aggressively on the side.

The best option for SLPs may vary across the board, depending on how much they owe in student loans.

Income-driven repayment vs. refinancing on a speech-language pathologist salary

Because the repayment strategy will vary depending on the amount of student loan debt, I’ll walk you through two different scenarios.

Sarah and Greg are both speech-language pathologists working in private practice. Their speech-language pathologist salary is $80,000 each with projected 3% increases in income every year. The difference is that Sarah has a student loan balance of $70,000 at 6.5% interest, while Greg owes $180,000 at 6.5%. They both have consolidated loans and are currently on the 30-year Standard Repayment Plan.

Scenario 1: Sarah’s loan repayment

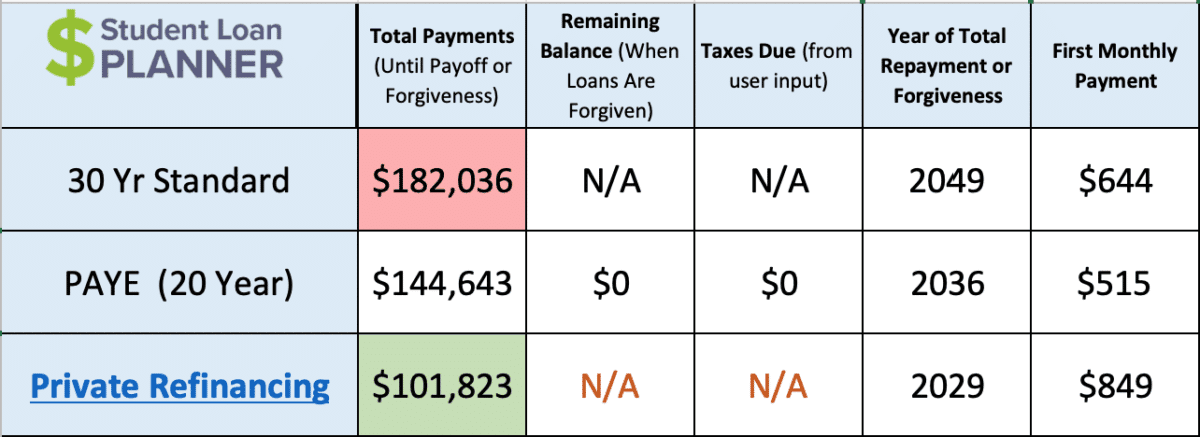

Let’s start with what Sarah’s loan repayment options look like. She’s deciding between staying on the 30-year Standard Plan, switching to Pay As You Earn (PAYE) — which means paying 10% of her discretionary income for 20 years — or refinancing at 5% with a 10-year term.

This is a no-brainer. Refinancing is the way to go. First of all, it’s projecting to save Sarah $81,000 and 20 years paying off her loans versus staying on the 30-year Standard Plan. All she has to do to make this happen is come up with $200 extra per month to put toward her loans.

PAYE isn’t as good as refinancing, either. The purpose of income-driven repayment is to keep payments low and maximize taxable loan forgiveness. But since Sarah owes less than 1.5 times her income (it’s actually 1-to-1), her payments will be so high compared to her loan balance that she’d actually end up paying off the loan before making it 20 years.

She’s projected to pay her loans off in about 17 years with no forgiveness at the end. Paying off a high-interest-rate loan over 17 years instead of paying off a lower interest rate loan in 10 years would be very costly. Refinancing instead would save Sarah a ton of money.

Scenario 2: Greg’s loan repayment

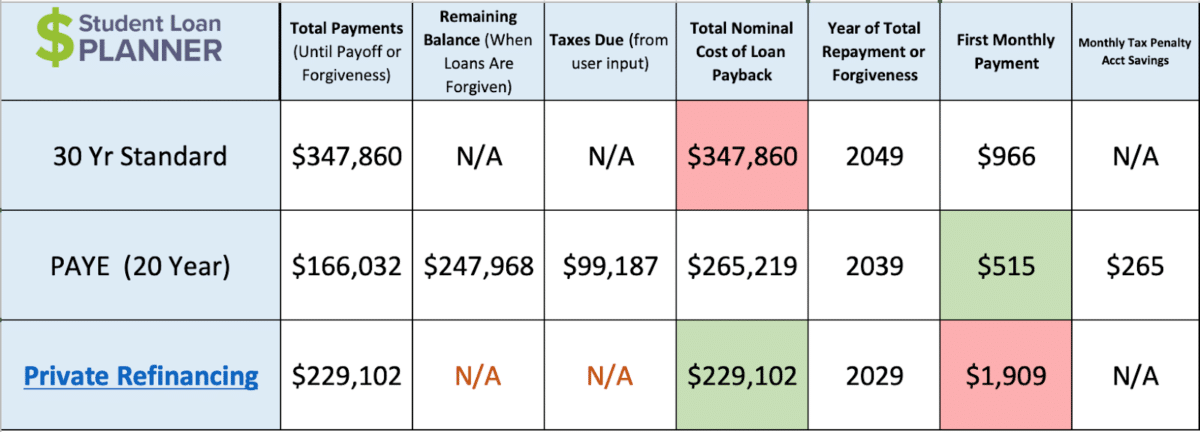

Now let’s take a look at Greg’s situation. Remember that he has the same income as Sarah, but he owes $180,000 worth of federal Stafford loans compared to the $80,000 that Sarah owes.

My, how the amount of debt drastically affects loan repayment!

Refinancing is projecting to save Greg the most money over time. But those monthly payments of $1,909 for 10 years are tough on his salary. The 30-year plan he’s on is abysmal, so he definitely needs to do something differently. Paying $966 per month for 30 years would end up costing him $347,860, which is about $182,000 more than the next best option of PAYE.

I’d recommend that Greg use PAYE in this scenario. Even though it costs a little more out of pocket, it’s spread over a longer period of time, which would allow him to keep his payments low and save up for his other financial goals. The only exception to consider anything other than PAYE would be if he’s super frugal and can come up with $3,000 per month to pay off the loans in under six years.

Greg likes the idea of PAYE but is a little nervous about owing taxes of $99,187 in 20 years. The tax bomb can seem scary, but it’s actually not as bad as it seems. If Greg invests only $265 per month along with his student loan payment for 20 years and earns 5% on average, he’d have the $100,000 to pay the taxes in one lump sum.

The key to Greg’s success is not only keeping his payments low but taking advantage of these lower payments to save aggressively in his pretax retirement account — and in other places, too, if he can.

Public Service Loan Forgiveness program

So now we know that Greg would be better off selecting PAYE for 20 years while saving aggressively, and Sarah is best served to refinance and pay off her loans quickly. But what does loan repayment look like if their employment qualifies for PSLF? Say they’re working in the public sector, such as a school or nonprofit hospital, full-time. How would they go about getting loan cancellation under a student loan forgiveness program?

Let’s back up and list the three main qualifications that someone has to meet to get PSLF:

- Have Direct Loans (not private loans or loans through the Federal Family Education Loan (FFEL) Program)

- Pay on one of the four income-driven repayment plans. These include PAYE, Saving on a Valuable Education (SAVE) — formerly REPAYE — Income-Based Repayment (IBR) and Income-Contingent Repayment (ICR). Extended and Graduated plans don’t count.

- Work full-time for a qualifying employer (e.g. nonprofit or government organizations).

The good news is that around 50% of speech language pathologists work for a potentially qualifying employer. Once they reach 120 qualifying payments, they can apply to have their remaining loans forgiven tax-free. Learn more about PSLF here.

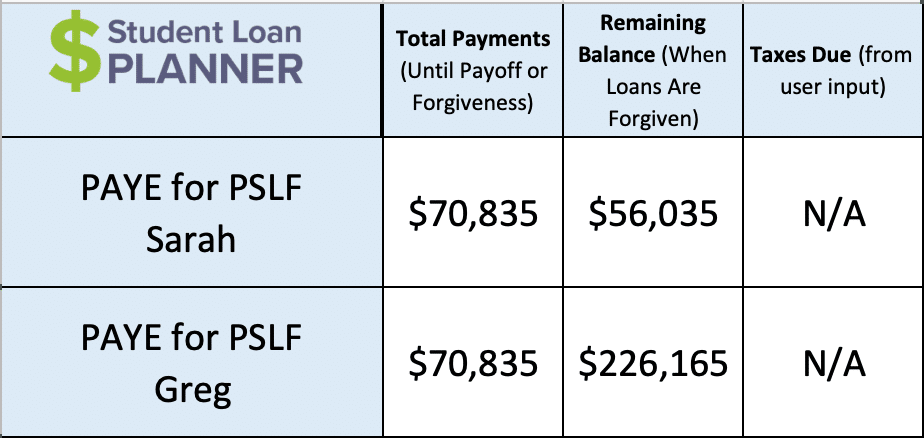

Assuming both Greg and Sarah have qualifying employment and Direct Loans, the 30-year Standard Plan doesn’t qualify for PSLF. So, they’d have to switch to an income-driven repayment plan. PAYE is usually a pretty solid choice for PSLF, so let’s take a look at what PSLF looks like while being on PAYE:

This is an awesome plan for Sarah. She’ll save $31,000 versus refinancing and be debt-free at the same time. It’s an even better plan for Greg. He'll save $95,000 by paying back his loans and be debt-free 10 years sooner than being on PAYE without PSLF.

Notice anything interesting here? How about the fact that the cost and payments for both Sarah and Greg are identical, even though Greg has $100,000 more debt than Sarah? That’s one of the more interesting things about income-driven repayment. They have the same income and therefore the same payments if they’re on the same plan. The amount of debt doesn’t impact it one bit here as far as payments. All this means is that there will be a different amount of loans forgiven.

Even though PSLF would save them the most money if they have qualifying employment, they should definitely have an aggressive savings plan along with going for PSLF. There’s a lot more that can be done to optimize PSLF, and we’ve put together our top tips when pursuing it.

SLPs need a play for student loan repayment

I just walked you through a few simple examples of how to save money by paying off student loans if you’re a speech-language pathologist. As you can see, the most important factors in determining the right strategy are how much you owe, how much you make and who you work for.

But there’s no one-size-fits-all approach. We all have different life circumstances that can affect loan repayment. Maybe you’re married, or maybe your spouse has their own portion of student loans. Maybe you’re considering taking another job. Or maybe you’re deciding whether to switch jobs to get PSLF, but you want to compare the numbers with the difference in salary between the two options.

Here at Student Loan Planner®, we’ve done thousands of individual consults covering more than a billion dollars in student loans.

If you owe less than 1.5 times your income and don’t have any plans to go for PSLF, then I'd suggest applying through our cashback refinancing links to see if you can cut your interest rate.

If you’re going for PSLF or owe more than two times your income in loans, definitely reach out about a consult. We’re looking forward to helping you get a clear path to pay off your student loans!

Income & Student Debt by Profession

How you compare to other

accountants stats*

| Average student debt | |

| Average income | |

| Average Debt-to-Income Ratio |

Statistics represent the population of Student Loan Planner clients in the respective profession referenced in the chart from 2017-2023. Sample excludes those in school or in training.*