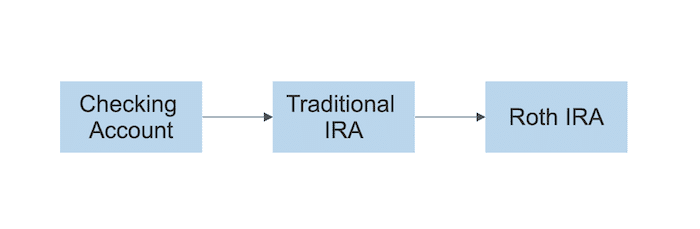

If you’ve never heard of a backdoor Roth IRA, here’s a little schematic that shows the flow of money from your checking account to the Roth IRA:

Essentially, it’s a strategy for high-income earners to get around Roth IRA income limits. Although the schematic looks basic, it’s slightly more complicated than it looks so don’t try it unless you’ve determined it’s the best move for your situation.

In this guide, we’ll cover the steps for a backdoor Roth IRA, mega backdoor Roth IRAs, how to prioritize your savings goals, and special considerations to keep in mind.

5 Steps for a backdoor Roth IRA

If your earnings are above the Roth IRA income limits (see IRS table) then the way to get money into a Roth IRA each year is as follows:

- Open a Traditional IRA (Individual Retirement Arrangement) or make sure your Traditional IRA balance is $0.

- Make a Traditional IRA contribution from your checking account. The amount you can contribute is the lesser of your calendar year earnings or $7,000 (plus $1,000 for those of you age 50 or older).

- Select or indicate a “non-deductible” contribution. When you make the transfer from your checking account to your Traditional IRA, you should be able to select the type of contribution. If you didn’t make an IRA (or Roth IRA) contribution in the previous calendar year — and as long as you had earnings to support the contribution amount — you can make a prior calendar year contribution up until the normal tax filing deadline (usually April 15) of the current calendar year.

- Do not invest the contribution just yet. Leave it in cash. The length of time you should leave the cash there isn’t defined and there are many opinions out there about how long to wait before moving on to the next step.

- Process a Roth IRA conversion. This will convert the contribution to your Roth IRA. The key difference between this step and making a Roth IRA contribution directly from your checking account is that a Roth conversion isn’t subject to income limits.

Related: Student Loans Over 50: 5 Tips to an Amazing Retirement

How to prioritize your savings buckets

There are a number of “savings buckets” available to you, but which one you should prioritize is situational. If you were to start from zero without student loans, the order that’s the most tax-efficient for the W-2 workers would probably look like this:

- Cash Cushion (i.e., emergency fund, cash-on-hand).

- Health Savings Account, if on a high deductible health plan.

- Traditional or Roth 401(k)/403(b).

- Roth IRA or Backdoor Roth IRA, depending on your income level.

- Traditional after-tax 401(k) (also called Mega Backdoor Roth), if allowed by employer.

- Taxable investment account.

Inserting your student loan strategy into that balance can be tricky, but know that as long as you’ve committed to your student loan strategy, it’s OK to mix up the order of the last four savings buckets above.

Related: Should You Pay Off Student Loans or Invest?

If your income and lifestyle allow you to save toward all of the last four savings buckets, the best thing to do is figure out the “cost” of choosing one savings goal over another.

Once you’ve chosen the order in which you’ll save toward your buckets, commit to the direction that resonates the most with you. It’s good to do the math, but it’s a waste of your time and sleep to waver on the precipice of deciding for too long.

Mega Backdoor Roth IRA

Some employers will allow their employees to make contributions to their 401(k) account above the typical contribution limits. Before I describe how this happens, let’s first start with the basics of a 401(k) plan.

- An employee can contribute up to $23,500 from their earnings each calendar year into a 401(k). An employee who’s 50 years of age or older can make an up to $7,500 catch-up contribution.

- It’s also common for an employer to provide an incentive (an employer match) for employees to contribute to their 401(k). An employer match could look like a dollar-for-dollar match up to 3% (or higher) of your compensation. Other employers will provide a set dollar amount or percentage, whether you contribute to your 401(k) or not.

- So you could be getting greater than $23,500 (or greater than $31,000 with a catch-up contribution) into your 401(k) each year through a combination of your contributions plus employer contributions.

Now for employees, the total amount that can be put into a 401(k) each calendar year (combination of employee contribution and employer contribution) is capped. That cap adjusts each year (see IRS table for 401(k) Defined Contribution limits) and is $70,000 as of writing.

Mega Backdoor Roth IRA example

Here’s where the Mega Backdoor Roth comes into play. If allowed into a 401(k) plan, an employee can contribute up to the difference between the $70,000 cap and the sum of employee contributions plus employer contributions.

Example:

An employee under the age of 50 contributes $23,500, and their employer contributes $10,000. So the employee has the option to make what’s technically called a traditional after-tax 401(k) contribution. The dollar amount in this example that could be contributed in this way would be $23,500.

As an employee, you can request a copy of your company’s 401(k) Summary Plan Description (SPD) to see if traditional after-tax contributions are allowed in the 401(k) plan. If you’re not sure or it’s unclear, go directly to your employer or start with your Human Resources department.

Now here’s the fun part. Let’s say that you make a traditional after-tax contribution into your 401(k) every calendar year. You do that for 20 years while following a long-term loan forgiveness strategy or a pay-it-down-to-zero with your student loans. Then, in year 20, you stop working. Your one 401(k) account has three types of contributions tracked by your employer:

- Employee contributions (traditional or Roth) principal and earnings.

- Employer contributions (all “traditional” tax-deferred) principal and earnings.

- Employee Traditional after-tax contribution principal and earnings.

The principal in each of the three types of contributions above represents the sum total of the amounts contributed in each calendar year. The earnings represent the investment growth over time for each type of contribution.

For the first type of contributions, the earnings are either income tax-deferred or tax-free, depending on whether the contribution was for a traditional or Roth IRA.

For the second contribution type, the earnings are all income tax-deferred.

For the third contribution type, the principal can be rolled (i.e. transferred) into a Roth IRA and the earnings can be rolled to a traditional IRA after you leave employment with that company. The principal amount that’s rolled to a Roth IRA is referred to as a “Mega Backdoor Roth IRA” strategy because the principal amount can be large for this movement of retirement money.

In the case of our example above, if you contributed $33,500 per year for 20 years, the eligible rollover amount to a Roth IRA from your traditional after-tax contributions would be $670,000.

Sure, the earnings would have to go to a traditional IRA (or to another 401(k) if you decided to do a direct rollover to another 401(k), because you’re not done earning yet!), but utilizing this strategy over time allows you to get more than the $23,500 traditional or Roth 401(k) limit + $7,000 backdoor Roth IRA limit each year.

Special considerations

Now the Mega Backdoor Roth isn’t for everybody. In fact, it’s not commonly available in 401(k) plans, and even when it is, it’s not common to have available cash in your peak earning years when that also could be your peak spending years due to other obligations or dependents in your household. So plan accordingly and utilize this strategy if it fits into your savings path.

Keep in mind that any traditional after-tax contribution principal and earnings generally can’t be rolled to a Roth IRA and traditional IRA while working for your employer unless your employer allows in-service withdrawals.

If in-service withdrawals are allowed, then you’re probably doing the Mega Backdoor Roth instead of a regular backdoor Roth IRA on a year-by-year basis. If in-service withdrawals are not allowed, then waiting until you leave your employer (for retirement or a new employer) is the inflection point for initiating a Mega Backdoor Roth.

Separate from the Mega Backdoor Roth, the regular backdoor Roth IRA strategy works just fine if you don’t have a traditional IRA open or have a $0 balance on a traditional IRA.

If you already have a sizable Traditional IRA balance and you’re keen on including a backdoor Roth IRA in your savings path over time, see if your employer 401(k)/403(b) plan allows a direct rollover of your traditional IRA balance before getting started with the backdoor Roth. If they don’t allow it, this strategy might be something to visit at a later date with a different employer.

When you do the backdoor Roth IRA, you’re processing a Roth conversion in the final step where you convert the traditional IRA dollars to your Roth IRA. That conversion is a taxable event and is subject to a five-year clock.

- Just because it’s a taxable event doesn’t necessarily mean there is a non-zero tax bill associated with it. This is a complicated topic, and I think Michael Kitces, Head of Planning Strategy at Buckingham Wealth Partners, does a fantastic job explaining the pros and cons of a Roth conversion as a step in the backdoor Roth IRA. To be sure, though, check with your tax advisor about your eligibility to fund a Roth through regular Roth contributions or through a backdoor Roth.

- Each year that you convert, say, $7,000 from IRA to Roth IRA, you start a new five-year clock for that $7,000 conversion. The five-year clock is relevant for timing of withdrawals without income tax or a 10% penalty. It’s an oversimplification to say this, but leave your conversion money in the Roth for at least five calendar years. For the converted amount (i.e., the $7,000 principal) and earnings, any withdrawals prior to five years from the date of the conversion are subject to a 10% penalty unless you’re over the age of 59 ½. Any earnings (growth on the principal amount converted) withdrawn are subject to income tax and a 10% penalty if withdrawn prior to age 59 ½.

If you’re wondering where your student loans fit into all of this, the best place to start is with a Certified Student Loan Professional. For specialized help, reach out to a Student Loan Planner Consultant.

If you’re wondering about where a backdoor Roth IRA or Mega Backdoor Roth fit into your savings bucket priorities, hire a fee-only fiduciary financial planner for tailored assistance.

Refinance student loans, get a bonus in 2025

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

For refinancing 100k or more (bonus from Student Loan Planner®, not SoFi®)

|

Fixed 4.49 - 9.99% APR

Variable 5.99 - 9.99% APR with all discounts with all discounts |

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 4.45 - 9.89% APR

Variable 5.88 - 9.99% APR

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 4.29 - 10.24% APPR

Variable 4.86 - 10.24% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 4.99 - 8.90% APR

Variable 5.29 - 9.20% APR

|

|

|

$1,099 Bonus

For 150k+, $300 to $500 for 50k to 149k.

|

Fixed 4.88 - 8.44% APR

Variable 4.86 - 8.24% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 3.85 - 11.38% APR

Variable 4.33 - 12.35% APR with autopay with autopay |

Not sure what to do with your student loans?

Take our 11-question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, SAVE or another IDR plan, or refinancing (including the one lender we think could give you the best rate).