Veterinary student debt is the elephant in the room. It's on the minds of virtually every veterinarian who wasn't blessed with rich parents. Maybe that's why Banfield Pet Hospital recently announced a student loan benefit for their veterinarians.

I've got an obvious conflict as a student loan consultant for veterinarians. Maybe Banfield will try to partner with me in the future, who knows? That said, I've helped enough vets to realize that this well-intentioned program is going to cause a ton of problems.

Banfield veterinary student debt relief is an example of a huge employer throwing money at a problem using old-school thinking. In fact, I'm going to show that this relief program might cost some of their employees over $100,000. That's two years of after-tax income lost from making one financial decision.

What is Banfield Veterinary Student Debt Relief?

According to their website, the program has 3 key parts.

- The option for its doctors to refinance their student loans through a third-party lender

- Banfield contributes $150 a month toward its full-time doctors’ student loans issued in the U.S.

- Banfield chips in $2,500 for each approved program you participated while in school prior to graduation for doctors hired after Nov 27, 2017. Program examples include Banfield Student Ambassador, Student Job Program, and the Externship Program.

A Special Refinancing Deal that Doesn't Seem All That Special

Part 1 is pretty straightforward. Banfield Pet Hospital partnered with one of the big refinancing companies to offer special rates to their veterinarians. Doctors will receive a 0.25% interest rate reduction with this agreement.

From what I've seen, vets are getting offers in the mid 5% range. Unfortunately, that's not particularly good. I like to tell my clients that if you aren't getting something that starts with a 4 for a fixed 10-year rate, it's a signal that maybe you shouldn't refinance at all.

In fact, the “good” offers I'm getting for well-qualified applicants right now are in the mid 4% zone.

I'm skeptical whenever employers or professional organizations make an exclusive deal with 1 third part financial institution. With some exceptions, the best refinancing offers come from shopping around. If all your employees check a single bank, the likelihood that they are missing out on a better deal is fairly high.

Test me. If you have a refinancing offer from the Banfield program, contact me and I'll tell you if I could get you something better for free. My guess is in 95% of cases I'd be able to find something better simply by suggesting you check at a couple other banks for competing for offers.

Better: Banfield Making Contributions on Student Loans

This is the best and most generous part of the Banfield veterinary student debt relief program. $150 a month towards student loans until they are paid off or the doctor parts with the practice is a really nice gesture.

That said, for the average vet school debt of $167,000, a $150 a month contribution will not make much of a difference. The $150 a month contribution might represent 2% to 3% of a new veterinarian's salary. It's something, but that sum isn't a game-changing kind of benefit. Banfield gives you $1,800 a year towards student loans and to offset the impact, will add a standard gross-up amount on a monthly basis to the paychecks of associates participating in the program.

Incentives to Participate in Banfield Programs on Campus

For the third pillar of the Banfield veterinary student debt relief program, the company will make a one-time student loan contribution for doing on-campus work for each qualifying Banfield student program in which the doctor participates prior to graduating, for a maximum of $10,000.

This benefit only applies to doctors hired after November 27, 2017. Unfortunately, doctors hired before this date can't receive this special one-time contribution. If you meet the qualifications, Banfield will make one time $2,500 payment towards your loans one year after you join the practice if you participate in the Banfield Student Ambassador, Student Job, and/or Externship Programs.

It's obviously a positive thing that they're doing. However, this part of the Banfield program seems the least exciting.

Unintended Consequences of Banfield Student Loan Program

Banfield's approach does not require you to refinance. You can take advantage of the contribution benefits without refinancing your loans with them, and you should. That said, I am concerned that the program features refinancing as an option, as veterinarians as a profession are often better suited to forgiveness strategies.

While any extra money towards loans helps, I would rather see them raise people's salary instead by the same amount before taxes.

I help hundreds of borrowers refinance their student loans. It can often be an awesome way to cut your interest rate from 7% to 5% or less and get out of debt sooner.

That said, refinancing can also be a terrible idea. This is particularly true for professionals with high debt to income ratios. I don't need to tell you that vet school is really expensive. A typical veterinarian might earn $70,000 coming out of school. Maybe they start earning production bonuses and hit $90,000 a few years out.

Perhaps the peak earnings in an average vet career might top $120,000 or more. How does this salary compare to typical debt burdens?

I mentioned the $167,000 number earlier as the “average vet school debt.” The issue is that I've seen a lot of examples with much higher numbers than this. In fact, my average DVM client owes $276,000 from vet school. Many of them have worked for Banfield too.

They should definitely utilize the Banfield contribution to their student loans. However, I'm just concerned that some will pull the trigger on refinancing when it's not in their interest. Run the numbers for yourself with my refinancing quiz to see what makes sense for you.

An Example of the Cost Differential of Refinancing vs Forgiveness for Banfield Veterinarians

For this scenario, let's assume Jennifer has $250,000 from vet school at 7% interest. She's worked for Banfield for 3 years and makes $85,000 per year. She expects her income to top out at $100,000 over 5 years' time, with 3% inflation level increases every year after that. She's built up 3 years of credit on Pay As You Earn (PAYE). That means she has 17 years to go. We'll assume she's single or is married to someone with a similar debt and income profile.

Another assumption we'll make is that Jennifer saves $18,000 per year in her 401k. That's one great benefit that Banfield already provides. Many veterinarians do not have access to a retirement plan through their workplace. So we'll assume that Jennifer takes full advantage of it. This max contribution limits her taxable income, which also limits her student loan payments.

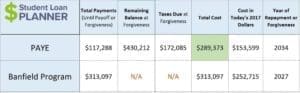

There's a lot of numbers on this simulation that I did, so let's look at the columns left to right. The payments in the first column represent the total dollars out of your pocket. The PAYE government program would leave you with a huge sum of forgiveness (remember you started with $250,000).

Forgiven debt under these government programs is taxable income. Hence, let's say you pay 40% in taxes on that forgiven balance in 2034, when the forgiveness would happen. Sum up the payments and taxes and you get about $289,000 total paid over 17 years. With a 10 year Banfield program, you'd pay $313,000 total (I'm accounting for the $150 a month payments too).

Since money is worth less over time from inflation, we need a way to compare a stream of low payments over 17 years with a balloon payment a the end to a stream of large payments over 10 years. Starting out, that difference is huge with $400 a month w/ PAYE vs $2500 with the Banfield program.

Converting these dollars to today's money, I get a difference of almost $100,000 in favor of PAYE, the government repayment program.

Who Could Be Severely Harmed by the Banfield Veterinary Student Debt Relief Program?

As the above numbers demonstrate, paying $2,500 a month for 10 years would be a terrible financial decision given the government funded alternatives. Per my calculations, if Jennifer the Banfield vet opted to refinance her loans, the only thing she would be doing is making herself an indentured servant.

With the PAYE option, she could use the 10% of income payment required to be portable with her career. The projected forgiveness would be a much better decision.

When should she participate in the new Banfield student loan program? Perhaps if her loans were below $150,000 or she had a spouse with no loans causing her PAYE payments to be very high, she could consider using this matching program.

Of course, some veterinarians have debt loads in the $300,000 to $400,000 range. These numbers would be more severe if I modeled that case instead. If I modeled the “average vet” with $167,000 in debt, you would see that even this person should not use Banfield's program from a purely financial perspective.

Will Banfield Protect Their Veterinarians From Making the Wrong Decision?

Banfield is trying to do a great thing for their employees. They're not trying to create dependency or anything like that. I think the reason they're doing this is that they truly do not understand the math behind deciding between forgiveness and refinancing. I'm worried that doctors who haven't run the numbers will move their loans to a private lender and potentially cost themselves tens of thousands from forgoing loan 20 to 25-year loan forgiveness.

Unfortunately, I expect many veterinarians at Banfield will make a bad financial decision and refinance when they shouldn't have. Hopefully, Banfield and other companies that employ veterinarians will add further educational components to enhance their debt relief programs. Veterinarians need a repayment strategy. Taking a “just pay it back” approach to vet school debt can be an expensive mistake under current federal loan rules.

Veterinarians are welcome to participate in any part of the program that they choose. I just hope they choose correctly for their unique situation.

If You're a Banfield Veterinarian Unsure of What to Do with Your Loans, I Can Help

If you want an independent look at deciphering your vet school loans, that's all we do. We've helped well over 100 vets this year with our flat fee student loan consult service. If you'd like to read more, check out how to save money here.

You can also send me an email, and I'll be happy to answer any questions you've got. When you owe more money than most people's mortgage, you can't rely on gimmicks and employer-sponsored programs to figure out what to do. We've got your back if you're ready to not worry about vet school loans anymore.

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, IDR, or refinancing (including the one lender we think could give you the best rate).