Are dentists rich? Those who think the answer to that question is an obvious “Yes” probably aren't currently working in dentistry.

There are a lot of old stereotypes about the “rich dentist.” But the truth is that the cost of going to dental school in America makes it way more difficult for those in the dental industry to achieve wealth. Most have to slay an enormous amount of debt, conquer high prices to buy a practice, and navigate intense competition in many areas.

One Beverly Hills dentist once told me that three bad Yelp reviews would sink his practice. I’ve also had dentist clients who make a lot of money and make the profession look like the most lucrative job you could possibly do. But what's the financial situation of the average dentist. Let's take a look at the latest data to see.

Are dentists rich?

According to the Bureau of Labor and Statistics (BLS), the median pay for dentists is $170,910. Where a dentist works make a big difference in how much they earn. For example, Los Angeles dentists are some of the lowest earners, with a mean wage of about $165,000. Meanwhile, dentists in the top-paying states often make far above the median salary. Here are the mean dental wages in the top five states:

- Vermont dentist mean wage: $260,380

- Maryland dentist mean wage: $234,670

- Arizona dentist mean wage: $231,890

- Delaware dentist mean wage: $227,200

- Texas dentist mean wage: $220,000

Working in private clinics also tends to pay better than working in government offices. The American Dental Association (ADA) says that in 2019 the average dental private practice salary was $204,710 for general dentists and $343,410 for specialists.

While those are strong salaries, your paycheck isn't the only factor that affects your net worth. We also have to consider dental school debt. The American Dental Education Association (ADEA) statistics show the average debt load for recent graduates is $296,500. Here at Student Loan Planner® we've consulted with many dentists that have taken out far higher amounts of student loan debt.

In addition to educational costs, we need to consider the costs of running a dental office. For one, most dentists will need to take out a practice loan to finance the building of the practice and necessary equipment. There are also many ongoing costs related to dental health care that can lead to serious overhead including rent, liability insurance, lab bills, and endless supplies.

Is financial planning with SLP Wealth right for you?

Looking for student loan aware financial planning custom tailored for professionals like you? Check out the discounts below for becoming a client of SLP Wealth (our SEC Registered Investment Advisory firm).

SLP Wealth, LLC (“SLP Wealth”) is a registered investment adviser registered with the United States Securities and Exchange Commission with headquarters in Durham, NC.

How to become a rich dentist

After consulting with hundreds of dentists and helping them build student loan plans, we’ve found several factors that impact a dentists ability to accumulate wealth. No matter how big your student debt, you can follow these steps to becoming a wealthy dentist in less than 20 years.

Step 1: Fix your cash flow

If you don’t have at least $20,000 in the bank, then you haven’t gotten past the first step on the road to becoming a rich dentist. Most dentists I talk to don’t have credit card problems except for the first couple of years after graduation. That’s good because credit card debt is an emergency that needs to be fixed ASAP.

You have no power over your life and career until you have removed the cancer of credit card debt that doesn’t get paid off every month. After eliminating any short-term high-interest rate debt, then get to the $20,000 savings mark. Paying off your car, student loans, personal loans, and other debt can wait. Having liquid savings is incredibly important for dentists to qualify for practice loans.

The more savings, the better, up to a certain point. It’s a good idea to put something down on your house and to have a comfortable cash margin if you’re going to operate a dental practice.

I’d have at least 10% of the house purchase in cash. I'd also try to have 3% of the practice loan in cash even though you’re probably going to finance the purchase 100%. Within a few years, you should be able to easily hit a low five-figure amount in your savings account. That’s going to give you freedom long-term.

Step 2: Admit that most dentist stereotypes are outdated

Have you seen the hit ABC series “Fresh Off the Boat”? My wife is Asian American, so we love watching it especially with her parents since it’s about the Asian American experience.

The show has a character named Marvin. He’s a 69-year-old dentist married to a woman in her

late 20s. Marvin is old, white, male, and rich. He’s your typical “rich dentist” family friend or uncle. He makes loads of money, works four days a week, and has minimal stress.

Today’s dentists are far more likely to be young, female, non-white, and in deep debt from dental school, buying a practice, a home, and a car.

That older “rich dentist” benefited from an environment that no longer exists. Back when he started in the profession:

1. Practices sold for a fraction of what they do today.

2. Dental insurance reimbursement rates were higher.

3. Dental school costs were perhaps only 1/10th of what they are now.

4. Fewer dental schools produced fewer new graduates, minimizing competition.

5. The dental profession did not welcome women and minorities.

To become a rich dentist, you need to junk all the popular notions. And don't try to keep up appearances with your social peers. Admit (to yourself and to others) that the economic climate for dentists has changed.

But acknowledging these changes isn't enough on its own. You'll also need to modify your lifestyle to fit the current reality. If you expect to drive a $5,000 used Toyota to work, you have the right mindset to become a rich dentist and defy society’s expectations.

Step 3: Get a student loan plan built for your career goals

You need a plan for your student loans that reflect your goals. I mean the goals you have for things like how often you want to work, how long you want to work, and how much money you want to make.

If you owe a huge amount of student loan debt that’s more than one times your income, you should consider making a financial investment in a custom plan with us. But if you owe less than one times your income and your spouse doesn’t have loans, then you’re a fairly straightforward refinancing case.

Once you know the complex rules of loan repayment well enough, you can take advantage of them to maximize your financial situation. For example, assume you work full time and your payment on SAVE (formerly REPAYE) is $1,200 a month. You’re saving $1,000 a month for the tax bomb. You’re also maxing out your retirement accounts. Did you know that you could work fewer hours and have your payment drop significantly?

Let’s say you went from earning $170,000 a year to $90,000 a year working three days a week and you had a spouse that didn’t earn an income. Your SAVE payment would go from $1,200 to about $500 a month. Your tax bomb savings would go from about $350 a month to $500 a month because of the higher expected tax liability.

If you could cover your living expenses on the reduced income, you would benefit from a smaller outlay from the student loans. Some dentists, however, want to get rid of their debt as fast as possible. In that case, your plan needs to be set up for that goal.

For example, if you plan on running a practice in the middle of the country in a smaller town to earn 400k+, you might want to be on the SAVE plan. This option could save you thousands of dollars a year thanks to interest subsidies as you start out building your practice.

Step 4: Don’t forget about retirement savings

Did you know that maxing your retirement accounts is almost as important as having emergency savings? Dentistry is a physical career that takes a lot out of you. Many dentists tell me they don’t think they’ll be able to work until their late 60s.

Perhaps you’ll be an outlier. But you want to be prepared for losing the ability to practice dentistry or simply losing your passion for doing it one day. In 2024, the max contribution as an employee to a 401k plan is $23,000.

However, if you are an independent contractor, then you can use a solo 401k at a place like Charles Schwab or Vanguard. With that plan, you can contribute the employee portion of $23,000 plus an employer matching contribution on top of that (maxing out at $69,000 for 2024). I use a solo 401k for my own retirement savings. The only requirement to open one is that you must have no full-time employees (other than your spouse).

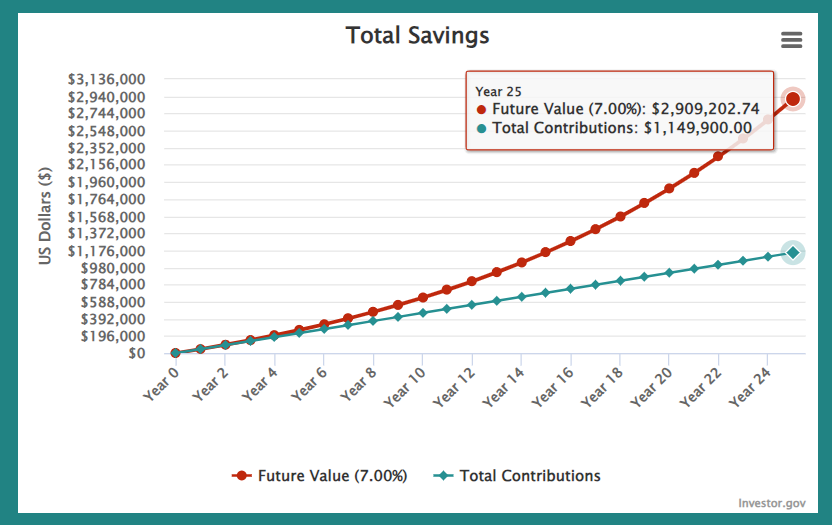

How much could you have if you and your spouse invested $23,000 per year each for retirement over 25 years? Let’s assume a 7% return and that you never increase your contributions. Using the Investor.gov compound interest calculator, we see that you'd have about $2.9 million by the end of year 25.

Unless you're hoping to buy your own private island after you quit working, $2.9 million should be a secure retirement nest egg. Contributing $46,000 a year might sound like lofty retirement goals. However, the cost in terms of take-home pay is probably below $3,000 per month to save $46,000 a year. That’s because you get a tax deduction for contributions and you get lower student loan payments.

Step 5: Start your own dental practice or partner up with someone

One of the top three most important decisions you can make to ensure being a rich dentist one day is to become an owner instead of an employee. If you spend your career as an associate, your compensation will likely average 33% of collections.

However, if you’re an owner or partner of a large dental clinic, your income prospects could skyrocket. You might average closer to 40% to 50% of collections. Some practices report margins even better than that. One thing is for sure, practices pass on higher margins to owners, not employees.

In addition to earning more, you also own an asset at the end of your career that you can sell. Right now, a typical dental practice might go for 60% to 100% of collections, depending on the market. If all you do is buy a moderately successful dental practice and pay off the practice loan over time, you’ll own a six or seven figure asset at the end of the loan term.

The default rate according to bankers that I’ve spoken with is about three in 1000. In two of those three cases, the reason for default was a substance or alcohol addiction. While this is anecdotal evidence, it’s clear dental practices are low-risk propositions for borrowing.

Owning a private practice means earning more for doing the exact same work. And, on top of, you own an asset that you can sell. For these reasons, practice owners have the best chances of becoming the rich dentists.

What practice financing product would you like a quote for? (check all that apply)

What is Your Occupation Status Currently?

What stage are you at in the practice financing process?

How soon do you hope to secure practice financing?

What size practice loan are you looking for?

How much cash savings do you have available for a down payment?

How many banks would you like quotes from?

Have you had any bankruptcies or short sales in the past 7 years?

Do you own all or part of a practice currently?

Full Name

Phone Number

State of residency

Metro area you would like to practice in

Specialty

Citizenship status

Communication preference

Would you like to add any additional details?

Step 6: Earn a good return on your investments

Dentists are smart. But that intelligence doesn’t necessarily carry over to managing money. Why? Because investing is intensely emotional.

When I joined a large mutual fund company out of undergrad, I heard stories of people who sold at the bottom in 2009 and bought back in the market years later. They cost themselves hundreds of thousands of dollars by making an emotional decision. Even if you think that won’t happen to you, you don’t truly know how you’ll respond until you see -50% on your statement.

Since smart people make mistakes, you either need to know enough to know that you should buy and hold for the long term or outsource your investing to a fee-only fiduciary financial advisor.

There are very affordable digital financial advisors like Betterment that will invest your money for you for about 75% less than the typical advisory fee. That referral link gets you a month to a year managed for free so you can try it out. After that, the fee starts at 0.25% of what you have invested.

A typical fiduciary advisor will want to charge you 1% of your invested assets. Others will charge a flat fee billed monthly. At SLP Wealth, we offer fiduciary financial planning for dentists at a lower cost than this.

If you decide to hire an advisor, beware of anyone who won't sign a fiduciary pledge. In the absence of that written pledge, you’re dealing with the equivalent of a car salesperson and not a professional like an attorney or accountant.

Step 7: Use a DDS Mortgage or DMD Mortgage for Your Home Purchase

A DDS Mortgage or DMD mortgage is a special type of “doctor mortgage” available to dentists. You can use a DDS / DMD Mortgage to purchase a home with a low or no down payment with no PMI and fixed interest rates comparable to conventional mortgages.

You might ask how buying a house with 0% to 10% down could possible make you rich. Keep in mind that most dentists will itemize their mortgage interest, which you can deduct on up to $750,000 of mortgage debt.

Student debt is not tax-deductible, so you could use the cash you saved up for your home to pay down your student loans faster and save money in taxes doing it.

Better yet, use your savings for needed renovations, furnishings, or live off your savings while you take an even bigger risk like doing a startup.

Just remember that cash is kind and it allows you to take more entrepreneurial risk, which is how most dentists end up becoming rich.

If you want to get a quote for a DDS Mortgage or DMD Mortgage, check out our quote engine here.

Being a rich dentist is about having options

It would be tremendous if you love practicing dentistry so much that you do it until you’re 93 years old. But most dentists I talk with want the option to be retired much sooner than that.

Others just like the idea of being able to have control over their lives. Getting your student loans set up the right way is a crucial piece of that puzzle. And we’d love to help solve that puzzle for you.

Follow these seven steps though, and you’ll be well on your way.

Get the best discounts for financial planning with SLP Wealth

See what discounts you could get by filling out the form below.

SLP Wealth, LLC (“SLP Wealth”) is a registered investment adviser registered with the United States Securities and Exchange Commission with headquarters in Durham, NC.

Do you think these seven steps are enough to become a rich dentist? Are there any you think I left out? Comment below!

Comments are closed.