Cardiologists rank in the top five for highest compensated physicians. But like all physicians, they also can rack up hundreds of thousands of dollars in student debt during medical school. Is taking on six-figure student debt worth it to go into cardiology?

To answer that question, we’ll take a look at cardiology income when working for a hospital versus going into private practice. We’ll also take a look at how cardiologist employment opportunities affect income and student loan repayment options.

Comparing this field’s average salary, debt and other factors can help answer the question as to whether this career is worth the time and cost it takes to enter.

Moreover, student debt is different from other types of debt, so conventional approaches to paying back traditional debt could lead you down the wrong financial path. We’ll take a look at student loan repayment options for paying back such a large amount of debt. The optimal loan repayment strategy can also be a factor in deciding whether to pursue a career as a cardiologist.

Requirements to become an cardiologist

It’s a long road for most physicians to start their careers. There’s pre-med in undergrad followed by the rigors of the med school curriculum. Then that’s followed by residency. To become a cardiologist, the road is even longer due to the extra education required to specialize in one of the most important organs in the body, the heart.

To get the extensive training needed, cardiologists go through the normal three-year internal medicine residency after graduating from medical school. From there, an additional three-year fellowship is required.

It’s a long road but it can be rewarding both financially and professionally. Ninety percent of cardiologists say they’d choose this career path again, and the pay is in the top five of physicians’ professions.

When cardiologists are done with their training, many end up working for a hospital but they also can choose to go into private practice and possibly cardiology practice ownership. These tracks could require different approaches to managing their student loan debt effectively.

Cardiologist student loan debt

Undergraduates can take many steps to keep their student debt low, but med school students may not be able to do that. Working during undergrad is manageable, but not so much during medical school.

Additionally, the high cost of medical school is hard to save up for in advance. For these reasons, many cardiologists graduate with student debt in the multiple six-figures.

Some sources say the typical medical school debt amount is $200,000 for MDs or $300,000 for DOs, but those numbers may underestimate the actual amount of student loans that a physician could graduate with. The Student Loan Planner® team has worked individually with more than 600 physicians. These clients had an average of $331,000 in student debt.

Worse yet, pursuing the wrong repayment strategy can make paying the debt back even more expensive by tens or hundreds of thousands of dollars.

Income & Student Debt by Profession

How you compare to other

accountants stats*

| Average student debt | |

| Average income | |

| Average Debt-to-Income Ratio |

Statistics represent the population of Student Loan Planner clients in the respective profession referenced in the chart from 2017-2023. Sample excludes those in school or in training.*

The best loan repayment strategy for a cardiologist

In our experience advising with nearly 4,000 clients on over $1 billion in student loans, we’ve found that there are three solid options to pay back student debt. For cardiologists specifically, they can:

1. Pay off their loans aggressively with a goal of being debt free in 10 years or less.

This approach could involve refinancing student loans if it would lower their interest rate and they could afford the payment. This plan could work for those looking to enter a private cardiology practice and who have a low debt-to-income ratio. Typically, residents and fellows wouldn’t want to start with this plan until they become attending physicians.

2. Work for a nonprofit hospital, government employer or academic institution and go for Public Service Loan Forgiveness (PSLF).

This plan would include having Direct federal student loans, making payments on an income-driven repayment plan and working for a PSLF-eligible employer.

Normally, cardiologists can complete up to six years’ worth of PSLF-qualifying payments during residency and fellowship and have just four more years to go when they become attending physicians.

3. Sign up for an income-driven repayment plan like PAYE or SAVE, make payments based upon income for 20 to 25 years, then pay taxes on the forgiven balance.

This approach could be another solid option for a cardiologist in private practice with a high debt-to-income ratio or for single physician-owned practices, but this option is the least used path for cardiologists.

With the first option, a cardiologist should throw every extra dollar they can toward getting debt free. The remaining options are the exact opposite: Pick an income-driven repayment plan that will keep payments as low as possible and maximize student loan forgiveness.

Pursuing a strategy somewhere in between or switching back and forth between repayment plans could be a needless waste of thousands of dollars. It’s better for cardiologists to have a solid and clear plan so they can keep as much extra money in their pockets as possible.

To figure out which one of these options would be best depends on each individual’s specific situation. Let’s walk through a hypothetical case study based on Student Loan Planner® consultants’ work as well as cardiology industry data.

Cardiology private practice income vs. hospital cardiology income

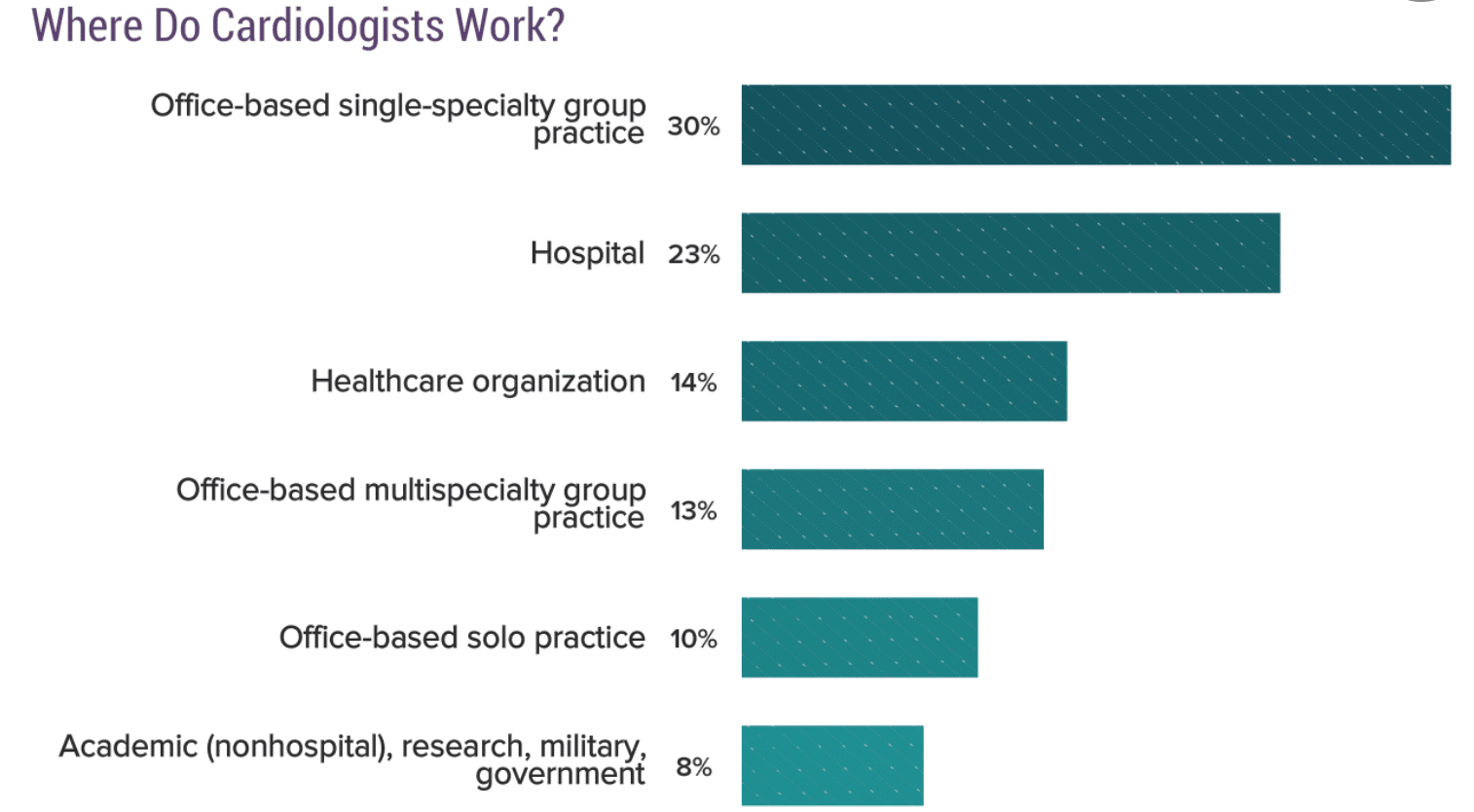

It’s close to a 50-50 split between cardiologists who work for a private practice versus hospital, healthcare or academic position, according to the Medscape 2019 compensation survey:

The Medscape 2019 survey found that cardiologists who work for an employer (mainly in hospitals) earned $422,000 on average while self-employed cardiologists (in private practice) earned $449,000, a $27,000 (6.4%) difference.

That’s not a huge income gap, and it might not be worth it to give up the opportunity to get PSLF by working for a 501(c)(3) employer.

Physician-owned private practice jobs can still be an excellent opportunity because owning a cardiology practice can put a cardiologist in the driver’s seat in many ways. They can have autonomy, earn more money for the same patient load and build wealth within their practice even if the income is only slightly higher. If you want to see what you could qualify for, fill out our quote form just below.

Let’s explore some case studies on how cardiologists could pay back their loans when working for a cardiology practice or for a PSLF-qualifying employer.

Cardiologist student loan repayment case study

Let’s use a hypothetical example to illustrate a loan repayment option. Mindy just finished her fellowship. After six years of training, she has two job offers:

- Work for a PSLF-qualifying employer making $422,000.

- Work for a private practice as a partner making $449,000.

She currently has $331,000 of Direct federal student loans with an average interest rate of 6.8%. Mindy started repayment six years ago on an Income-Based Repayment plan and then switched to REPAYE when that option became available in order to get the interest subsidy because she wasn’t sure if she’d go for PSLF or pay off the loans in full during private practice.

She’s thinking about taking the private practice job and going on the extended repayment plan to keep her payments low as she gets situated in her new job and lifestyle. Because private practice wouldn’t be PSLF eligible, she’s not worried about being on an income-driven repayment plan.

The extended repayment plan is expensive

First, we’ll take a look at her repayment options with a private job.

With the nearly 4,000 consultations the Student Loan Planner® team has done, the extended plan is one of the worst options over 99% of the time. First of all, in our example with Mindy, she’d pay a very high-interest loan back over 25 years. That lower monthly payment is more affordable now but may prove to be very costly in the long run.

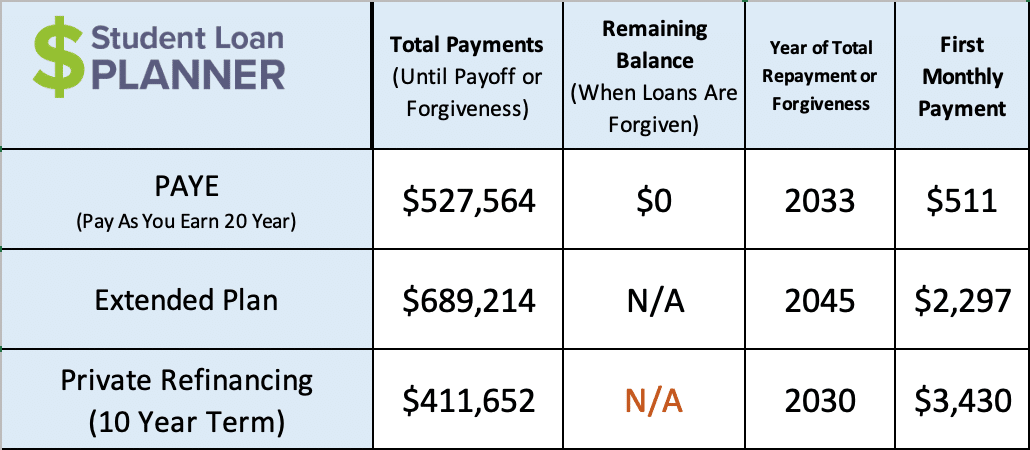

Let’s compare refinancing $331,000 of federal student loans to a 10-year term with a 4.5% interest rate to the extended repayment plan, where she’d pay back a 6.8% loan over 25 years. Let’s also throw in the PAYE plan to make sure we’re looking at an income-driven repayment option (for PAYE, we’re starting by using her final year fellowship salary to certify her income, then it would grow to an attending salary of $449,000):

Refinancing is the best option for Mindy if she goes into private practice. Sometimes it’s challenging to see the big picture when fixated on the monthly payment. The monthly payment after refinancing is about $1,133 a month more than the extended plan, which can be somewhat intimidating at first. But let’s reframe the numbers here.

Refinancing would save Mindy $277,562 as she’s paying back her loans — 100% of the extra higher cost is interest! Plus, Instead of paying $2,297 per month for 25 wole years, she could pay $3,430 per month for 10 years and then have no more student loan payments 15 years sooner.

PAYE isn’t much better either in this scenario. Remember that the goal with this plan is to keep payments as low as possible and maximize forgiveness. The problem is that Mindy’s income would be high compared to her debt. Because of that, her PAYE payments would be large enough that she’d actually end up paying off her loan in full in 13 more years. That would cost her $115,912 more than refinancing with marginally lower payments that would increase as her income grows each year.

REPAYE, in comparison, would be about $25,000 better than PAYE due to the interest subsidy, but she’d still pay off the loan in full within 11 years and it would still cost over $500,000.

Mindy would be much better off budgeting an extra $1,133 per month to put toward student loans so she can refinance instead of going on the extended repayment plan. After seeing how much she’d save on her loan repayment, combined with the drastically higher income on the way, she is committed to using a portion of that high income to throw at her loans and committing to refinancing.

Cardiologist Public Service Loan Forgiveness

Now that we’ve narrowed down the repayment strategy to refinancing if our hypothetical Mindy takes the private practice job, we can better compare the two job offers. So, how does taking the cardiology private practice job and refinancing compare to the PSLF-qualifying job after we factor in loan repayment?

Because Mindy was making payments on IBR, then REPAYE, during residency, those six years of payments would count toward her 10 years of PSLF because her loans were Direct, she was on an income-driven repayment plan and worked full time at a qualifying employer the entire time. In other words, she’d only have four more years of qualifying payments to get the balance of her student loans forgiven with PSLF.

Keep in mind that PSLF and refinancing are vastly different approaches to loan repayment. Think of refinancing a 10-year term as just like a 10-year mortgage. You make the same payment each month, and the payments are based on paying off the entire loan with interest over that period of time. The payment is based upon how much debt is owed.

When we talk about PSLF, the amount of debt has very little, if anything, to do with how much it will cost to pay it back. Because PSLF requires being on an income-driven repayment plan, the payment is based solely upon income. Payments would go up or down in lockstep with income.

PSLF vs. refinancing for cardiologists

Even though Mindy has been on REPAYE, let’s focus on PAYE as the income-driven repayment plan we’d want to look at for Mindy as she goes for PSLF.

Payments for both PAYE and REPAYE are based upon 10% of discretionary income. But PAYE has other features and flexibility that could make it more appealing as she’s going for PSLF, including a cap on payments and the ability to exclude a future spouse’s income from her payments if she were to file taxes separately.

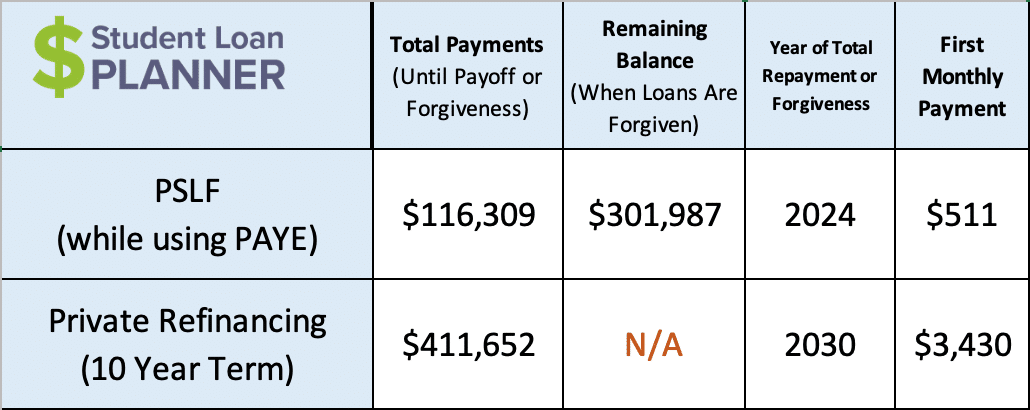

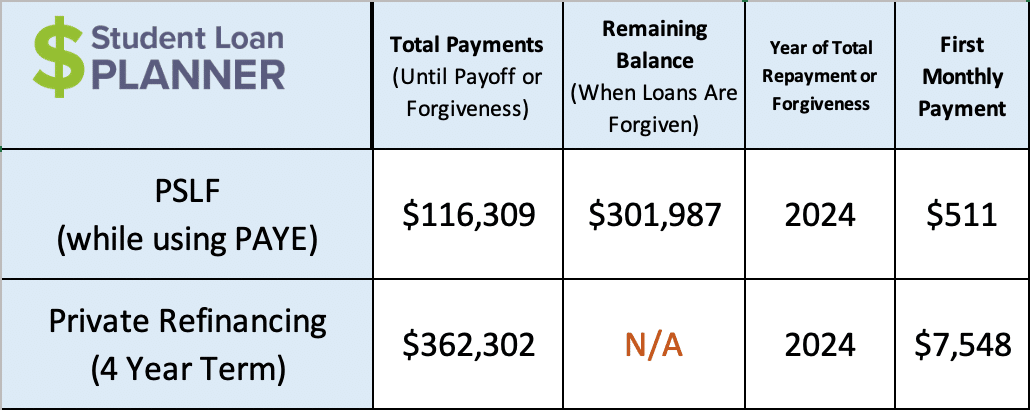

Let’s compare the numbers between PSLF using PAYE with the hospital job versus refinancing:

PSLF offers a monster savings compared to refinancing. You can see by the chart that PSLF would end up saving her $295,343 and six years of paying back her loans versus refinancing to a 10-year term with the private practice job.

After seeing that stark difference, let’s say Mindy asks what refinancing would cost if she paid it off in four years and became debt free on the same schedule as PSLF. Let’s take a look at what refinancing and paying off the loan in four years looks like:

Paying the debt back six years sooner could save her close to $50,000 in interest compared to the 10 year refi. It is still projecting to cost Mindy $245,993 more to become student debt free over the same time period as PSLF, however.

How a cardiologist’s income affects their student loan repayment strategy

On the surface, it appears to be a no-brainer to go for PSLF, but that’s not the whole picture. The difference in pay matters too. It’s an important calculation to compare the true benefit of PSLF with a lower-paying job versus refinancing if you have a higher-paying job.

Generally, the types of jobs that qualify for PSLF pay less. But if the PSLF job pays too much less, taking the job for PSLF purposes could end up being more costly in the long run even though it would cost much less to pay back the debt. We have to break it down to see what amount of salary is worth it to give up the benefit.

Here’s how to choose between private practice and hospitals based on potential income

In our hypothetical example, PSLF would save Mindy $245,993 paying back her loans versus refinancing at 4.5%. That works out to an average savings of $61,492 a year for four years.

In other words, if she were to take the private job, she’d have to make an extra $61,492 in take-home pay and throw all of that extra money at the loans to break even financially. That number would be her take-home pay (aka after-tax dollars), so she’d probably have to make around $100,000 more in salary to take home $61,000 after taxes, as a ballpark estimate.

Another way to think about it is that the PSLF-qualifying employer is providing an extra $100,000 of compensation than their stated offer.

The private job is only offering her $27,000 more in salary ($449,000 vs. $422,000). But the PSLF-qualifying job is financially better after factoring in the benefit of PSLF in reducing how much it costs to pay back her loan.

The $100,000 PSLF “benefit” bumps up her $422,000 salary to $522,000 “total compensation” for four years, which is about $70,000 greater than making $449,000 in the private practice job.

We would probably recommend Mindy go with the PSLF job as long as it would be as fulfilling as the private practice job. Besides, she’d only need to work in the job for four more years to complete PSLF. After her loans are forgiven with PSLF, she can do whatever she wants.

Related: Cardiologist disability insurance: How to buy it & what to know

Is cardiologist student debt worth it?

A cardiologist’s salary is pretty good, but is the student loan debt to get there worth it? I would say yes.

Owing six-figures; worth of student debt is nothing to sneeze at, but cardiologists are in the unique position of earning more than they owe. That works out to be a pretty good investment, especially compared to other medical professions, such as primary care physicians who earn about half of that.

PSLF can be an incredible opportunity to pay back the loans for a fraction of the attending cardiologist salary — possibly 25% to 33% of one year’s income.

Even with refinancing, the cost of paying back the student debt is still less than the attending cardiologist’s salary.

That being said, making loan repayment mistakes can be costly.

Taking out that amount of debt is something to be taken very seriously. Before taking on the debt, it’s wise to know what loan repayment could look like and how to optimize it.

Cardiologists should prioritize a solid student loan plan

This hypothetical example above shows how to approach loan repayment and employment options, but every situation is unique.

Spousal income, spousal student loans, or lack thereof, as well as cost of living, private versus federal student loans, how far along into your career you are, and what repayment looks like so far are all factors that can come into play to design the ideal path to pay back your student loans.

Whether you work for a private practice, a PSLF-qualifying hospital or another employment situation, the team at Student Loan Planner® can help you figure out the optimal path in just one hour. Plus, we include email support after the consultation to continue to answer your questions and help you implement the plan.

Income & Student Debt by Profession

How you compare to other

accountants stats*

| Average student debt | |

| Average income | |

| Average Debt-to-Income Ratio |

Statistics represent the population of Student Loan Planner clients in the respective profession referenced in the chart from 2017-2023. Sample excludes those in school or in training.*