Is taking out student loans worth it to earn a certified nurse-midwife salary? We’ll dive into that and take a look at the loan repayment options.

What is a certified nurse-midwife?

Moms-to-be who want to go for a more natural childbirth process or would like an advocate during pregnancy and delivery could consider using a certified-nurse midwife (CNM). Ten percent of births were attended by a CNM in 2016, and that number is growing.

But a certified nurse-midwife doesn’t just deliver babies. They are Advanced Practice Registered Nurses (APRNs) who specialize in many areas of women’s health.

Their training goes beyond that of a normal labor and delivery nurse, as they have a specialized degree and extra training. They also focus on prenatal and postnatal care, family planning and other overlapping areas with an OB-GYN.

Certified nurse-midwife salary

According to the Bureau of Labor Statistics, the median pay for a CNM is $122,450. Not surprisingly, California has the highest average certified nurse-midwife salary at $169,530 and also employs more CNMs than any other state at 910. To understand if taking out student loans to go beyond undergrad is worth it, let’s examine the income of college graduates without advanced degrees.

The average college graduate in 2022 earned right around $84,240. So becoming a CNM offers a great income premium for the advanced degree.

That means a CNM nurse can earn about $38,000 more per year than the median college graduate. Let’s say that income difference sustains through a 40-year career. That works out to a CNM having about $1,520,000 in extra lifetime earnings compared to a college grad. That, of course, is pretax income, so let’s just say the extra earnings are taxed at 35%. That’s an extra $988,000 in take-home pay for a CNM vs. the median college graduate. Not bad at all!

So, is it worth spending the extra money to become a CNM — and spending it in the form of student loans? Let’s examine that cost.

Income & Student Debt by Profession

How you compare to other

accountants stats*

| Average student debt | |

| Average income | |

| Average Debt-to-Income Ratio |

Statistics represent the population of Student Loan Planner clients in the respective profession referenced in the chart from 2017-2023. Sample excludes those in school or in training.*

Cost of becoming a certified nurse-midwife

Becoming a certified nurse-midwife is a very close track to becoming a nurse practitioner (NP). In fact, a CNM nurse is a specialized NP. So let’s take a look at the NP track.

A nurse practitioner who takes the online program at Baylor University (based in Texas) could expect to spend $86,250 for the 75 credit hours it takes to go from their bachelor’s degree — a Bachelor’s of Science in Nursing (B.S.N.) — to their Doctor of Nursing Practice (D.N.P.). An Iowa resident could attend the University of Iowa with an estimated cost of $92,808.

The actual cost ends up being more than that, though. Higher living expenses, tuition increases each year, interest accruing on the loans and leftover loans from undergrad push the cost of becoming a CNM well above what’s anticipated.

The average NP/CNM we’ve worked with here at Student Loan Planner® has about $154,000 in student loans. And this is on the rise due to the tuition hikes.

So, is a CNM career financially worth it?

Certified nurse-midwife loan repayment options

We’ve done over 2,400 consults and advised on over $600,000,000 of student debt here at Student Loan Planner®. Our experience shows there are two optimal ways for certified nurse-midwives to pay off student loans:

- Aggressive Pay Back: For people who owe 1.5 times their income or less (e.g., a CNM who makes $100,000 with loans at $150,000 or less), their best bet could be to throw every dollar they can find into paying back their loans as fast as possible over 10 years or less. Often this includes refinancing student loans to get a better interest rate. CNMs should be sure to look at their Public Service Loan Forgiveness (PSLF) options before refinancing because refinancing means that PSLF eligibility is gone.

- Pay the least amount possible: For CNMs who owe more than twice their income (e.g., $100,000 salary and $200,000 or more in student loans), the goal is to get on an income-driven repayment plan that will keep payments low and maximize loan forgiveness, whether it’s through PSLF or taxable loan forgiveness.

A certified nurse-midwife’s employer (nonprofit or private practice) could be the biggest factor in choosing between either option.

PSLF vs. refinancing for a certified nurse-midwife

Let’s say April has $150,000 in student loans at 6.8% interest. She’s been a CNM in California for three years and was paying on the graduated plan to keep her payments low.

She just moved to a new job that qualifies for PSLF. She’ll be earning $100,000 with projected 3% salary increases for the foreseeable future. She’s not currently married.

April would want to switch off of the graduated plan immediately, since it’s not a payment plan that qualifies for PSLF, and go on an income-driven repayment plan, like Pay As You Earn (PAYE) or Income-Based Repayment (IBR).

So let’s compare starting on the PSLF path now versus refinancing to a 10-year fixed rate.

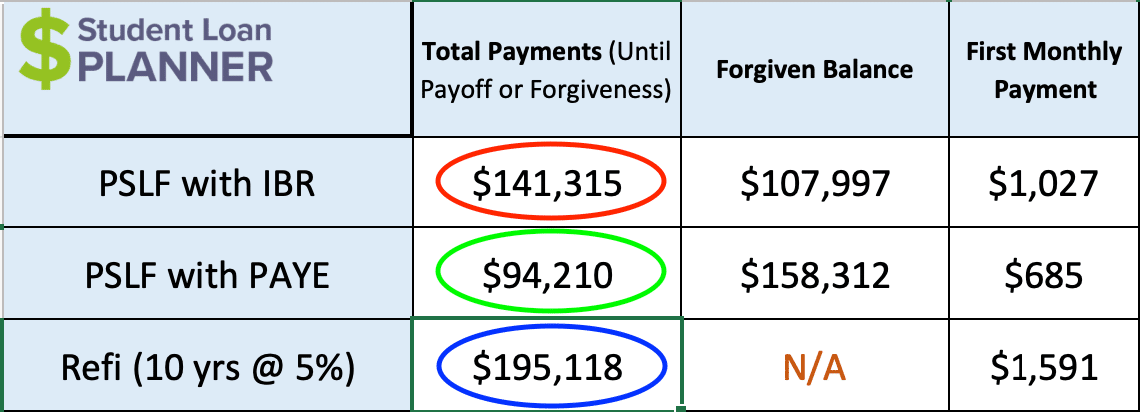

It’s important to see the difference in going for PSLF on PAYE versus IBR. You can see being on IBR would cost April about 50% more to pay back her loans compared to PAYE. A certified nurse-midwife with student debt who is eligible for PAYE should almost never be on IBR.

As for PSLF with PAYE versus refinancing, PSLF is the clear winner. It’s projected to cost about $100,000 less then refinancing — $94,210 versus $195,118.

But should April be beholden to a nonprofit employer just to get PSLF?

When is it OK for a certified-nurse midwife to forgo PSLF?

April likes her job working for the nonprofit hospital. But she got an offer for a private practice job where she’d earn $150,000. That’s an above-average certified nurse-midwife salary in California.

Would it make more sense financially to stay where she is and get PSLF? Or to take the new job, give up PSLF and make more money — but have to pay off her loans in full?

The job move could mean that paying off the loan in full would be better than PSLF. Based on the numbers shown earlier, her student loan repayment could cost $100,000 more over 10 years.

That’s a big number, which works out to paying about $10,000 more per year to become debt-free in 10 year. In other words, her take-home pay would have to increase by more than $10,000 for the year. All of that extra money would have to go toward paying back the refinanced loan to break even with PSLF.

But April is going to make an additional $50,000 in private practice and take home $35,000 more per year. If she pays an extra $10,000 toward her loan each year, she’d still have an additional $25,000 in take-home pay. Now that makes financial sense!

Even better is if she took that whole $35,000 increase and paid it toward her loans, in addition to the $7,000 she’d pay on PAYE for the year. If she did this, she’d be debt-free in less than four years.

If April and I were having a discussion about this, I’d let her know that refinancing means giving up PSLF for good. So we might talk about taking the job but keeping her loans in the federal program until she’s certain she wants to stay in the private arena. When she’s 100% certain, she could refinance her loans to drop the interest rate down from 6.8% into the 5% range and knock out the loans for good!

Is becoming a certified nurse-midwife worth the cost?

The pure financial answer is yes, since the projected lifetime earnings of a CNM versus the average college grad is $884,000 after taxes. This is compared to the $195,000 estimated cost of paying back student loans with the more-costly path.

Either way, most CNMs should have a goal to be student debt-free in 10 years or less, whether they refinance and pay it off in full or go for PSLF and save aggressively on the side.

Just like any profession, certified nurse-midwifery candidates should only pursue this path if they’re all in and student loans won’t make them regret their decision.

Having a clear understanding of how loan repayment works and how to mitigate both the financial and psychological aspects of carrying that amount of debt are a must before entering school.

CNMs need a plan for student loan repayment

Nurse practitioners can find a clear path to pay back their student loans. A path that could not only save them significant money but help them understand the actions steps to get through repayment.

Student Loan Planner® has done over 2,400 student loan consults for clients with over $600,000,000 of student loans. Our team can help you figure out the optimal path to pay back your loans in just one hour.

Income & Student Debt by Profession

How you compare to other

accountants stats*

| Average student debt | |

| Average income | |

| Average Debt-to-Income Ratio |

Statistics represent the population of Student Loan Planner clients in the respective profession referenced in the chart from 2017-2023. Sample excludes those in school or in training.*