Chiropractor student loans have some staggering statistics. Through my student loan consulting business, I've helped many chiropractors with stunningly high student loan debt relative to their income. That prompted me to start investigating to see what I could find, and the results are not good for the future of the profession.

Chiropractor student loans are among the most crushing of any profession in the United States relative to income prospects. In this article, I'm including my top tips on how to save thousands of dollars in interest while repaying your Doctor of Chiropractic student loans.

The average chiropractor student loan balance is over $150,000

The most recent survey I could find is dated all the way back to 2014, where it showed that 88% of new chiropractic grads had a loan amount above $100,000. An academic study from early 2014 found that 54% of new grads would owe over $150,000 in chiropractor student loans.

And that's literally the latest stats available today in 2023. You'd think the American Chiropractic Association (ACA) would want to update their average chiropractic school debt number for no other reason than to build their case for why chiropractors should be included in the NHSC Loan Repayment Program. But more recent studies haven't been published.

Also, College Scorecard still isn't showing debt levels and default rates for most major chiropractic schools like Palmer College of Chiropractic. So, given how little data is available on the true cost of chiropractic college, let's look at another source of information where we might be able to guess the scale of the problem.

My chiropractor client's average debt level

Of the clients I've worked with, the average chiropractor student loan amount has been approximately $260,000. And that number doesn't include any business loans that my clients may have taken out towards opening their chiropractic practices. This is what led me to investigate the magnitude of the student loan problem in the profession.

Since the overhaul of the Grad Plus loan rules in 2006, graduate students have been able to access unlimited sums of financial aid from the federal loan programs. Of course, tuition has exploded in almost every professional school in the country since then — and chiropractic schools are no different.

So, even if you're someone who filled out your FAFSA and applied for all the scholarships and grants that you could, you likely still finished chiropractic school with six-figure student debt.

Typical chiropractor incomes can't support their normal monthly payments

The Bureau of Labor Statistics (BLS) puts out salary information for various jobs across the country. The median income for a full-time chiropractor is $70,720. That's roughly in line with what I've seen from clients in my student loan consulting practice.

With such modest incomes, the average chiropractor has no hope of ever repaying their student debt. Even if chiropractors start their own practice, it's very difficult to make the necessary payments on chiropractic school loans and have a life at the same time.

What other repayment options are available?

I help chiropractic borrowers craft a student loan repayment strategy. If your debt-to-income (DTI) ratio is going to be above 2 for the duration of your career, then choosing the right income-driven repayment option is critical.

Additionally, most chiropractors work in the private sector. Hence, most aren't eligible for Public Service Loan Forgiveness (PSLF). They can still receive forgiveness at the end of a 20 or 25-year income-driven repayment plan. But the student loan forgiveness from these federal programs could be considered taxable income. I walk clients through how much they need to save a month to cover their future tax liability.

In most cases, I would help a chiropractor client evaluate the Revised Pay As You Earn (REPAYE) program or the Pay As You Earn (PAYE) program to figure out which option saved them more money. If you're already using the Income Based Repayment plan (IBR), it makes sense to think about switching.

You have to see how much accrued interest you have outstanding, as it would be added into the principal balance and start generating interest too if you change plans. However, there can be very good reasons to do so.

How to optimize chiropractic student loans

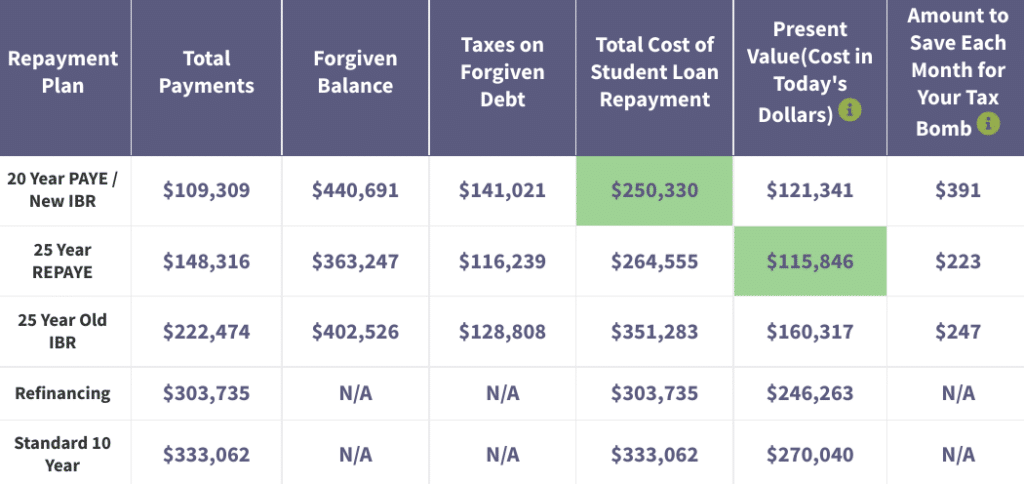

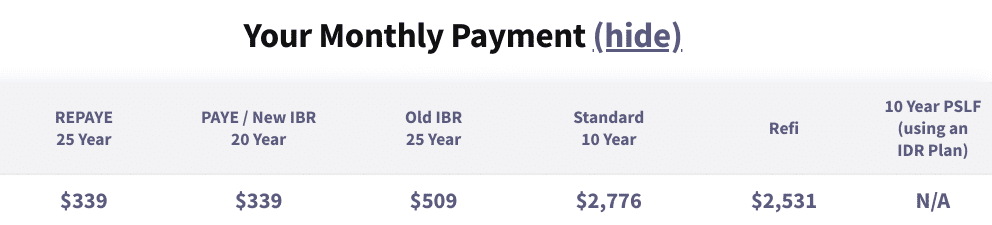

Let's assume that Brett graduates from chiropractic school this year with $250,000 in all federal loans at a 6% average interest rate. He starts out at $60,000 a year and expects his salary grows at a 3% inflation rate. Here's how much paying back his loans would cost under various repayment plans, estimated with the proprietary tool we use in student loan consults to create customized repayment strategies:

Let's understand this chart. Brett has three major income-driven repayment options available for his federal student loans. The old IBR plan is a legacy plan that's been around a long time. Old IBR requires 15% of your discretionary income. And after 25 years, the loans are forgiven and you're taxed on the leftover balance.

PAYE and REPAYE both require 10% of discretionary income, which is a lower payment than the old IBR plan. Under IBR, Brett would start off paying $509 a month. Under PAYE and REPAYE, Brett would only owe $339 a month.

If you look at the total cost column in the first image, clearly IBR is a big loser. The Standard 10-year plan is also untenable as it would require $2,776 a month in loan payments. Clearly the Standard plan is off the table. So, we're left with trying to figure out what plan is better for Brett: PAYE or REPAYE.

Choosing the right repayment plan

The total payment until forgiveness under REPAYE is about $148,000. The same figure for PAYE is roughly $109,000. The reason for this difference is because PAYE has a 20-year forgiveness period. REPAYE, on the other hand requires 25 years of payments before you can qualify for forgiveness. So in terms of total payments over Brett's career, PAYE wins here.

Now we look to the remaining balance on Brett's chiropractic student loans when they're forgiven by the federal government. Under REPAYE, that figure is about $363,000 and with PAYE it's about $440,000. Why does Brett have a lower balance under REPAYE even though the loans have an extra five years to grow?

The reason is because REPAYE comes with an interest subsidy. If you're not paying all your interest, which many chiropractors won't be, the government covers 50% of the unpaid interest. For that reason, REPAYE usually results in a lower balance at forgiveness.

Remember that the forgiven balance is taxable income under the IRS. I'm assuming a 32% tax rate. Why? Because Brett's forgiven amount will push him into a higher marginal bracket. That means Brett will owe a six-figure tax bill of roughly $116,000 under REPAYE and $141,000 under PAYE.

It's important to note that the American Rescue Plan recently made all student loan forgiveness tax-free until the end of 2025. We'll be monitoring legislation over the next few years. If there are discussions about extending this tax benefit, we'll let you know. But, for now, we recommend that borrowers who won't be finishing repayment by 2025 should plan as if they will be charged taxes on their forgiven balances.

How to save for the student loan tax bomb

To the far-right of the first chart, you'll see a column called “Amount To Save Each Month For The Tax Bomb.” This is the approximate amount I've estimated that Brett would need to save each month in an investment account to cover that corresponding tax penalty under each repayment plan.

For REPAYE, that sum is smaller because the tax penalty is lower. So Brett would need to save about $220 a month for 25 years to cover the tax bill.

For PAYE, the needed savings are higher because the forgiveness tax penalty happens sooner. This results in a higher forgiven balance and tax bill. I calculate Brett would need to save about $390 a month to cover this penalty.

Finally I'd have a discussion with Brett how much he wants to spend a month on his student loans. If he'd rather have them gone in 20 years with PAYE, he would spend about $340 a month in payments and $390 a month in tax penalty savings for $730 total. Perhaps he'd rather spread out the cost over 25 years.

In that case, Brett would pay about $340 a month in payments and $220 a month in tax penalty account savings. That would result in an estimated total of $560 a month.

Get a personalized chiropractic loan repayment strategy

The examples above outline best repayment strategies for one specific situation. But things could look very different if Brett had a lot of kids (in this case IDR becomes an even better option) or private loans (in which case refinancing to lower interest rates becomes virtually the only way to save money).

If you have a six-figure student loan burden from chiropractic school, click on the button to ask us a question about your situation below. Our team helps chiropractors conquer huge student loan balances with low cost, flat fee consultations.

We'll perform a holistic loan analysis with our proprietary simulation tool to see what your best available repayment options are for your type of loan. (government payment plans, refinance with private student loans, etc). We’ve helped over 90% of our clients an average of $50,000 projected over the life of their loans.

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, IDR, or refinancing (including the one lender we think could give you the best rate).

Comments are closed.