Key Takeaways:

- About 61 million adults in the United States are living with a disability.

- An estimated 25% of today’s 20-year-olds will become disabled before retirement age.

- At least 51 million working adults don’t have disability insurance coverage beyond basic Social Security disability.

- 65% of the private sector has no long-term disability insurance.

What are the chances of becoming disabled?

The Centers for Disease Control and Prevention (CDC) estimates that about 26% of adults in the U.S. are living with some type of disability. That translates to about 61 million people, not including children.

Using the most recent data from the CDC Disability and Health Data System, let’s look at disability rates by age group:

- 44% of people 65 or older have a disability.

- 28% of people 45 to 64 have a disability.

- 21% of people 18 to 44 have a disability.

Females have a slightly higher rate of disability at 29% versus males at 26%.

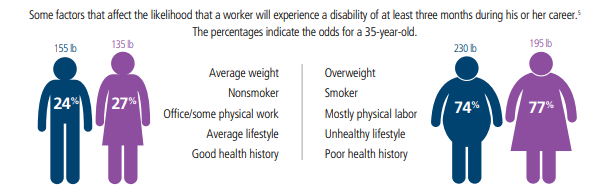

We can’t predict when a disability will occur. But there are known factors that affect the likelihood of becoming disabled.

Source: The Council for Disability Awareness

For example, someone who is overweight, a smoker and has a poor health history has significantly more of a chance of experiencing a disability than someone who leads a healthy lifestyle.

If a disabling event occurs outside of the workplace, it won’t be covered by workers’ compensation. In which case, your livelihood could be at risk.

Rates of unemployment among individuals with disabilities

Disabled workers encounter many challenges when it comes to securing accommodations and seeking new employment. The U.S. Bureau of Labor Statistics (BLS) reports:

- The unemployment rate for people with a disability (7.6%) is about twice as high as the rate for those without a disability (3.5%).

- 30% of workers with a disability are employed part-time.

- Employed people with a disability are more likely to be self-employed.

Technology has made it easier for some people with disabilities to find roles suitable for their talents. But people with more significant disabilities often face limited accommodations and discrimination — despite laws that are meant to protect them, such as the Americans with Disabilities Act (ADA).

The importance of income protection for your working years

The Social Security Administration (SSA) estimates that one in four of today’s 20-year-olds will experience a long-term disability before reaching age 67. Yet, millions of Americans don’t have adequate disability insurance coverage.

This is a serious problem when you consider that most families don’t have an emergency fund. And for those that do have emergency savings, 40% of them have less than $10,000 available for the unexpected.

Looking at data from the LIMRA 2022 Insurance Barometer Study, here are some disability insurance statistics for how quickly American households would face financial hardship if the primary wage earner became sick or injured:

- 11% after only one week.

- 18% after one month.

- 20% after six months.

- 13% after one year.

- 8% after two years.

- 14% after five years or more.

- 17% don’t know how long it would take.

Only about one-third of households are prepared to weather the financial storm of a sickness or injury that sidelines them from work for a year or longer.

What are the most common long-term disability claims?

Disabilities aren’t just caused by freak accidents. In fact, most long-term disabilities are a result of medical conditions, illnesses and progressive injuries that build over time — not work-related injuries.

Not what you were expecting? Let’s look at some of the most common disability claims as reported by the Social Security Disability Insurance (SSDI) Program:

- Diseases of the musculoskeletal system and connective tissue. This includes arthritis, back pain, and spine or joint disorders.

- Neoplasms. Many types of cancer and other tumors qualify for disability at various stages.

- Mental disorders. This includes aphasia, anxiety, depression, PTSD and many more.

- Diseases of the circulatory system. Heart attack, stroke and diabetes are leading causes of long-term disabilities.

- Diseases of the nervous system and sense organs. Common claims include Alzheimer’s, Parkinson’s and ALS (also known as Lou Gehrig’s disease).

For physicians, the most commonly reported disability categories include chronic health conditions, mobility issues, psychological disorders and other disabilities (e.g., essential tremors).

But many other health issues qualify for long-term disability. For example, hearing and vision loss can impact your ability to work.

- About 48 million Americans report some degree of hearing loss.

- Hearing loss is twice as common as diabetes or cancer.

- More than 3.4 million Americans aged 40 or older are blind or visually impaired.

What qualifies for a disability ultimately depends on the policy’s definition of disability.

Comprehensive coverage: The definition of disability matters

For Social Security disability benefits, you’ll need to meet a strict definition of disability that typically requires you to be unable to gainfully work due to an eligible medical condition. But the definition of disability for employer-provided and individually-purchased disability policies can greatly vary.

An own-occupation definition of disability will provide the most comprehensive coverage. It allows you to file a disability claim if you experience a disability that prevents you from working in your existing profession. But it also allows you to collect disability benefits even if you earn income from a different occupation while you recover.

Own-occupation coverage specifically protects your medical or dental specialty income. So, this type of coverage is crucial for medical and dental professionals who’ve sunk hundreds of thousands of dollars into their education and have the potential for high lifetime earnings.

Without this strong definition of disability, you could find yourself at the mercy of an any-occupation definition. In this case, your disability claim has a higher chance of being denied if you still have the ability to work in another capacity — even if that means a much lower salary.

Who provides disability insurance policies?

The Council for Disability Awareness reports that at least 51 million working adults don’t have disability insurance beyond Social Security disability coverage. But some people are able to rely on their employee benefits package to provide disability insurance, even if it’s not the greatest.

Unfortunately, this isn’t an option for all workplaces. Here are some BLS disability insurance statistics for employer-provided coverage:

- Only 35% of American workers in the private sector have access to long-term disability (LTD) insurance.

- Short-term disability (STD) insurance is available to 43% of private industry workers.

High income professions are more likely to have access to employer-paid disability coverage.

- 63% of the highest income earners have access to employer-paid STD and LTD.

- Only 18% of the lowest income earners have access to short-term coverage.

- Just 6% of the lowest earners have access to LTD coverage.

For those that do offer employer-sponsored disability plans, the coverage often falls short of what is actually needed. Group coverage typically has strict definitions of disability and limited benefits, which can leave you underinsured when you need the income replacement the most.

The disability insurance gap: Understanding the barriers to coverage

Lack of disability insurance can be attributed to multiple factors. But it’s safe to say that:

- There’s a disconnect between the chances of disability versus what people think they need.

- People assume Social Security disability benefits or their employer-provided coverage will be enough.

- Many people avoid buying disability insurance because of the cost and its complex nature.

Simply put, most people don’t understand the importance of having sufficient disability insurance.

Social Security disability requires a total disability, making it difficult to file a claim. The average denial rate for disability claims is 67%. Plus, the benefits are severely lacking. The maximum disability benefit for 2023 is $3,627 per month. But the average disability benefit is only $1,483.

Employer coverage usually has a maximum benefit that might not reflect your high earnings. For example, many employer disability plans cap monthly benefits at $5,000 or $10,000. Additionally, they usually come with a standard any-occupation definition of disability.

Depending on your situation, you might not be adequately insured for a sudden illness or injury. In which case, a supplemental insurance policy can fill the financial gap and provide you with a stronger definition of disability.

But the problem is that long-term disability insurance can be expensive, often getting pushed to the side due to competing financial priorities.

The cost of disability insurance

If you have employer-sponsored disability coverage, it’s likely provided at no cost to you. But there are still costs for the employer, which is why many workplaces don’t offer this benefit.

Here are some disability insurance statistics for private employer cost of compensation for disability insurance:

- Short-term disability insurance costs, on average, $0.08 per hour worked.

- Long-term disability costs an average of $0.05 per hour.

- Employers with 500 workers or more paid an average of $0.17 per hour for LTD.

Regardless of whether your job provides disability coverage or not, you have options for disability insurance. Although it can cost a couple of hundred dollars a month, the cost can be worth it with the right policy.

For individual disability insurance, you can expect to pay between 2% to 4% of your income for own-occupation coverage.

However, the true cost of disability insurance depends on a variety of individual factors, such as your age, gender, profession, medical history and location. For example, medical and dental specialties that perform invasive procedures will generally pay higher premiums than generalists.

Additionally, you can expect to pay more for coverage if you’re further into your career. Disability insurance is the cheapest when you’re at your youngest and healthiest stage of life.

Your disability premiums also depend on various policy decisions and whether you work with an experienced insurance broker. For example, SLP Insurance has access to some of the top discounts to help make coverage more affordable. It’s best to shop around to find the best coverage and rates for your situation.

Get supplemental disability insurance

Medical and dental professionals are at higher risk of disability due to the specialized nature of your job. If your employer provides basic disability, a supplemental individual policy can provide you with more comprehensive coverage.

Look for a policy with own-occupation coverage for the strongest income protection, and aim to have enough disability insurance to replace at least 60% of your gross income.

Fill out the form below to receive a quote for own-occupation disability coverage.

Compare disability insurance quotes and save

SLP Insurance will find you the best price on own occupation coverage, even if it's not with us. Fill out the form below for a quote with up to 30% discounts.