At some point in your life, you probably had a member of your extended family tell you to forgo college and just be a plumber. Apparently, there's good reason.

A little over a decade ago, Laurence Kotlikoff, a professor of economics at Boston University, made waves by claiming future plumbers would have about the same spending power throughout their lives as doctors. He cited the expensive cost of college and lost wages as two major reasons that future doctors (or other professions that require advanced degrees) would struggle at building wealth faster than plumbers.

At the time, many pundits criticized and tried to poke holes in Kotlikoff's hot take. But how reasonable would his ideas seem today? I found that to be an interesting question. So, I thought it'd be fun to run some numbers and compare being a plumber vs doctor over the long run using some 2021 data.

We're analyzing the two occupations solely in terms of wealth-building potential. First, we'll take a look at if the doctor pays back all his student loans as fast as possible. Next, we'll adjust the simulation for the Public Service Loan Forgiveness program (PSLF) and see if this popular federal student loan program tips the scales in this debate.

How do you become a plumber and how much do they make?

The big upside of being a plumber is how fast you can start working and making money. In most cases, plumbers start out as apprentices making around $12 an hour. They work under a licensed plumber for a few years and eventually make it to the journeyman plumber level, where they're getting about $18 an hour.

After several years of training, you can sit for the master plumber exam in many states and increase your pay commensurately. Master plumbers might get an hourly rate of $30, depending on the state. According to my research for this article, plumbers frequently have to work more than 40 hours a week, so I'm assuming they're going to be eligible for overtime for 10-20 hours a week.

If you annualized these hourly wage numbers, a plumber might start out around $30,000 as an apprentice, move up to $60,000 as a journeyman with a little overtime, then top out around $100,000 as a master plumber. The whole process takes about six to ten years to reach the top rank of the profession.

How do you become a doctor and how much do they make?

Becoming a doctor takes a long, long time. You have to go to four years of college, take a lot of science and math classes, and knock the MCAT out of the park. Then you apply to a bunch of med schools and spend four years of your life there.

Following that, you have to complete a residency that's three to seven years in length. Finally, if you want to be a specialist, you'll add an additional two to three years for fellowship.

During the residency, you make something between $50,000 and $70,000 a year. Fellowship might be a little more than that, but not much more. Once you're at the end of your training, you can expect a big salary increase depending on what kind of job you take and where you work.

If it's in academic medicine, you're going to earn a lot less than private practice. Outside of the big money specialties like derm, neuro, ortho, and cardio, you would probably start out somewhere around $200,000 to $300,000, as long as you specialized.

Most doctors have to take out student debt

There's one complication to this that we need to address. Doctors have to take out student debt and a lot of it. If you factor in the loan origination fees, the long training period during which interest continues to accrue, yearly tuition increases, and undergraduate degree student loan burdens on top of medical school loan burdens, docs have a lot of debt once they finish their training.

How much debt do they have? The latest report from the American Association of Medical Colleges found that the median debt for medical school graduates was $200,000. While some students get financial assistance from their family, its important to note that many of the ones who don't have a lot more debt than the median. So, assume that tuition costs about $50,000 annually over four years of medical school.

First round: plumber vs doctor during med school, residency, and fellowship

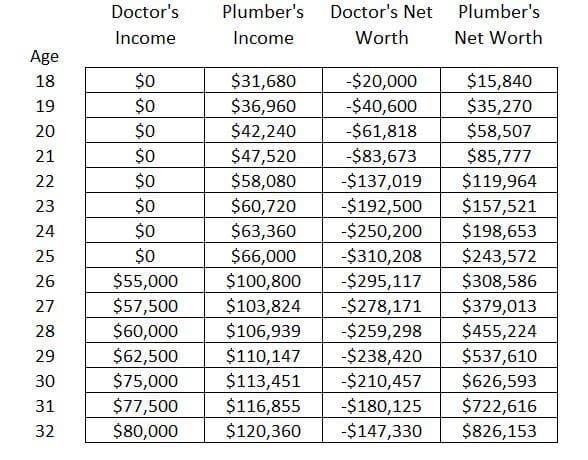

Here are the assumptions. The doctor spends $20,000 a year on undergrad and $50,000 a year on med school. The plumber's income steadily increases from $12 to $18 to $30 per hour as they climb the apprentice, journeyman, master plumber career ladder. Both put 50% of their pay to either investments or debt.

The doctor's debt has a 4% interest rate because he uses the Revised Pay As You Earn plan to get an interest subsidy, perhaps because he hired me as a student loan consultant to optimize his debt. I'm trying to give the doctor every advantage here. Still, the stats below are a reality check.

Let's say the doctor is a urologist. After all, the plumber handles leaky pipes where people relieve themselves and urologists take care of the internal bodily pipes, so I think it's a nice comparison. Urologists generally have five-year residency programs.

Let's also say our doc – let's call him Brad – decides to go to a two-year fellowship after residency. At the age of 32, our plumber – let's call him Joe – has been a master plumber for several years. Our urologist doc, Brad, is about to start making real money at the end of his fellowship and transition into an attending position.

Second round: plumber vs doctor after training

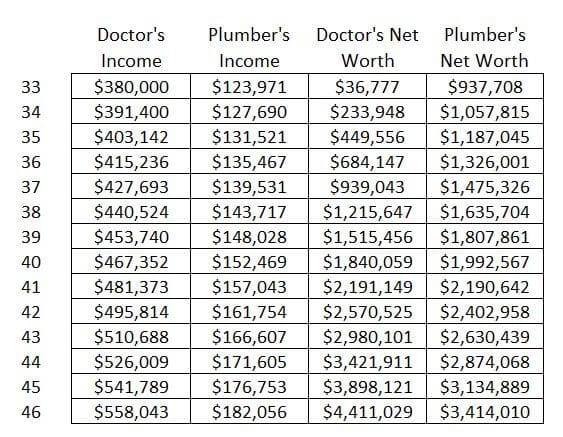

Private practice urologists make a lot of money. They are among the top paid specialties in medicine. Anyhow, Salary.com puts median earnings in urology at around $387,000.

I don't think our doc Brad would start at that level. But let's give him the benefit of the doubt and say that he'll have a starting salary just below that level of $380,000. Both jobs will receive a pay increase each year of 3% to keep up with inflation.

At age 41, Brad finally overtakes our plumber’s net worth. Consider that Brad has been out of college for almost 20 years. That's a long time to wait for a break-even period. What if our plumber Joe built a plumbing business with his expertise and hired a bunch of workers? It's clear that Joe would leave Brad in the dust.

And that would likely still be the case even if Brad refinanced his student loans and gets his interest rate down to under 3% after he no longer qualifies for SAVE (formerly REPAYE) interest subsidies. So, what if Brad goes the not-for-profit hospital route as an employee? Then we need to look at the PSLF program.

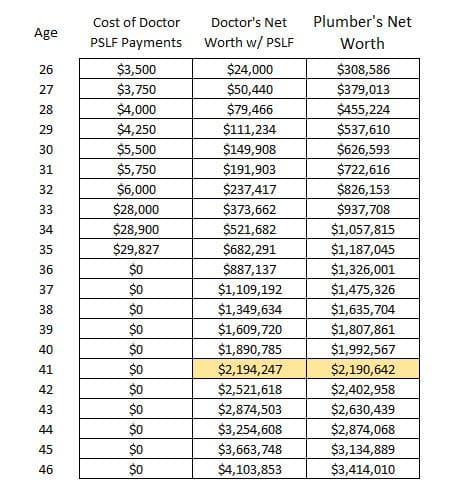

Third round: plumber vs doctor using PSLF

If we assume that Brad decides to work at a not-for-profit hospital, then he'll get a lower salary but also the ability to use the PSLF program to pay a fraction of what he owes on his med school debt. Brad's total payments are about $119,000 before all the debt gets wiped away, courtesy of the US taxpayer. At his peak indebtedness, Brad owed about $310,000. Since he's working at a hospital, he'll make a lower salary of $300,000.

Interestingly, the break even period is almost identical. Brad the urologist starts winning at about age 41. Even with PSLF, Brad has to wait a long time before he's finally getting a great return on his investment.

What did I leave out?

If you wanted to scroll back up and take a look at my numbers again, you'll notice I'm assuming a lifetime savings rate (towards debt and investments) of 50%. That's really, really high. Very few doctors or plumbers would be able to maintain that level of savings in the face of family, kids, marriage, mortgage, car payments, etc.

However, consider that the doctor is in a higher tax bracket than the plumber. The doctor also probably has lifestyle expenses that the plumber doesn't have. Do you expect the guy who fixes your toilet tank to show up in anything but jeans, a T-shirt, and maybe some kind of construction overalls when they're doing a job for you?

Exactly. Plumbers have much lower social life expectations for everything from the car they drive to the house they live in. And plumber liability insurance typically only costs $500 to $1,500 per year. Needless to say that pales in comparison to the professional liability insurance costs that doctors face.

Some folks will say that the higher income positions that doctors live on will make it easier to save. Others will say that I'm not taking into account the higher quality of life the doctor enjoys with the leftover income available for living expenses after saving and investing. Perhaps that's right. But I made sure to weight the scales in favor of the doctor over the plumber. I made Brad the doctor a urologist instead of a pediatrician or family doctor, for example.

The two things you need to come out ahead as a doctor

If you want to end up with a higher net worth at the end of your career than the guy you call to fix office bathroom issues at your private practice, the first thing you need to do is pick a higher paying specialty. Obviously, surgeons earn fantastic incomes. But there are other specialties outside of surgery that earn well above the median physician salary. See the top-paying specialties of 2021, according to Medscape.

The second thing you need is a solid personal finance strategy to pay back your student loans. In the scenario above, I modeled Brad the urologist doing everything perfectly, and that could've easily not been the case. He could've used forbearance during residency, neglected to file his PSLF paperwork during training, forgotten to refinance his loans when he became an attending, and more.

So in short, if you want your decision to become a doctor make financial sense over the guy that fixes your pipes, get ready to work a long time and make smart decisions with your debt.

You can get help for your med school loans

Our team has helped hundreds of doctors make a plan and can likely help you save thousands of dollars too. If you have a six figure student loan burden from medical school, contact us to see what we can do for you. We help physicians conquer huge student loan balances with flat fee consultations.

We'll perform a holistic loan analysis with our proprietary simulation tool to see what your best available repayment options are (government, private refinancing, etc). We've saved the average client tens of thousands of dollars. Book your consultation below.

Comments are closed.