One of the least paid attention to parts of the over $2 trillion CARES Act passed in March of 2020 was employer student loan repayment assistance. In Section 2206 of the CARES Act, Congress amended the law to allow employers to contribute up to $5,250 to your student loans.

Then in the Consolidated Appropriations Act of 2021, Congress decided to extend this benefit for 5 years. That's essentially telegraphing to large employers that Congress will make this benefit permanent.

Here's how the rules work:

- The benefit is double tax-exempt, meaning neither the employee nor the employer must pay tax on the contribution [Sec. 2206(b)]

- The payment can be made directly to the employee or the lender [Sec. 2206(a)]

- This benefit falls under Sec. 127(c) of the IRS code, which means the benefit cannot favor highly compensated employees and no more than 5% of the benefit may go to owners

We'll explain more what these four bullet points mean, what this program means for you and if you might be able to benefit.

The employer student loan repayment benefit is double tax-exempt

What does this mean? Employers and employees both do not have to pay income tax on up to $5,250 of student loan repayment assistance in 2020.

That's incredibly tax efficient. The employer gets a tax break, and so do you.

If this benefit were a long term thing, we'd see a ton of employers adopt it. After all, if you want to pay off your loans, you'd love to be able to do it with pre-tax money. And the employer would love to basically get to pay you more without actually having to spend more to do it.

Employer student loan programs do not require payment to your servicer

One of the most frustrating past components of employer student loan repayment programs was paternalism.

What I mean is many employers would require that the money go directly to the loan servicer instead of the employee.

That's fine if you are paying back your loan, but if you are repaying under an IDR type plan, that can actually get you little to no benefit.

In one example, a PSLF-eligible physician planned to have her loans forgiven completely after 10 years of service, tax-free.

The hospital where she worked insisted on paying $25,000 a year to her loan servicer, which was totally wasted because, at the time, the servicer would not apply these prepayments to what she owed.

To make matters worse, the benefit was considered taxable income as well. That means the employee had to pay income tax of over $10,000 a year for a benefit that netted her nothing, and the employer was out $25,000, too.

This new law incentivizes employers to trust their employees. The money can go directly to the employee or the lender, it doesn't matter as long as the employee made equivalent payments on student loans.

If the employee were not to use that money to pay loans, then the money would just be taxable income to the employee without consequences for the employer.

I hope more student loan repayment programs in the future give employees the money and let them worry about using it for the loans to get the tax benefit.

Keep in mind though that anything employers contribute over $5,250 in a year is still taxable income.

Can small business owners pay student loans tax-free?

I have to admit, when I heard about this program, I got really excited.

Imagine if you're a dentist and you own your own practice. Couldn't you call your CPA and ask them to have your business issue you a check for $5,250 that you could then use on your student loans?

Here's the major problem with this employer student loan repayment benefit: you can't do that.

Section 127(c) of the IRS code says that educational assistance programs cannot give owners of a business more than 5% of the benefit.

You also cannot give favorable treatment to highly compensated employees making more than $125,000 a year.

You also have to announce the rules to your employees of who would be eligible.

That seems pretty simple. You could just say that after one year of service, an employee is eligible for student loan repayment assistance up to 5% of their salary, at a maximum of $5,250.

The problem though is with the rules as they exist, you cannot pay your loans tax-free as a small business owner unless you had a massive number of employees.

Why this student loan repayment program mostly benefits big business

Pretend you own a successful dental practice with one associate dentist and five support staff.

You decide it would be a great idea to offer student loan repayment.

You find out though, that none of the support staff has student loans, and let's say you pay your associate $130,000 a year.

Your CPA looks at the rules and isn't sure if you can qualify because of that employee being “highly compensated.”

And the CPA also tells you that since you're an owner, you can only give yourself 5% of the total benefit.

Even if you pay the associate $5,250 tax-free for their loans, you could only pay yourself a few hundred bucks.

A big corporate dental group could use this student loan tax law for a big recruiting advantage

Corporate dental groups might have hundreds of locations with thousands of employees.

In many cases, they'll start their associates out at below $125,000 in pay.

That might make it easier for their student loan repayment program to qualify, even if they pay significantly more than $125,000 to dentists working in rural areas.

Additionally, if you worked for the big corporate group as an employee, you could benefit from the tax-free student loan payment.

However, as an owner, you cannot.

Furthermore, employees change jobs less frequently when they're offered significant benefits.

In a worst-case scenario, owner-dentists would have fewer people to sell their practice to in retirement, with fewer and fewer dentists wanting to leave the safety of large employment.

That trend has already happened in medicine.

The Public Service Loan Forgiveness program allows most any physician at a non-profit hospital to qualify, but only if they're an employee.

If you're a private practice family medicine doctor, which this country has a huge shortage of, you don't get loan forgiveness. But a neurosurgeon earning $700,000 a year at a non-profit hospital does.

Student loan benefits and programs have a long track record of being poorly thought out by policymakers. I hope that student loan repayment assistance becomes an easier benefit for small business owners to access if it's expanded beyond December 31, 2025.

How to use the employer student loan repayment tax benefit

If you've made it through this article so far and still want to offer a benefit, here's how to do it.

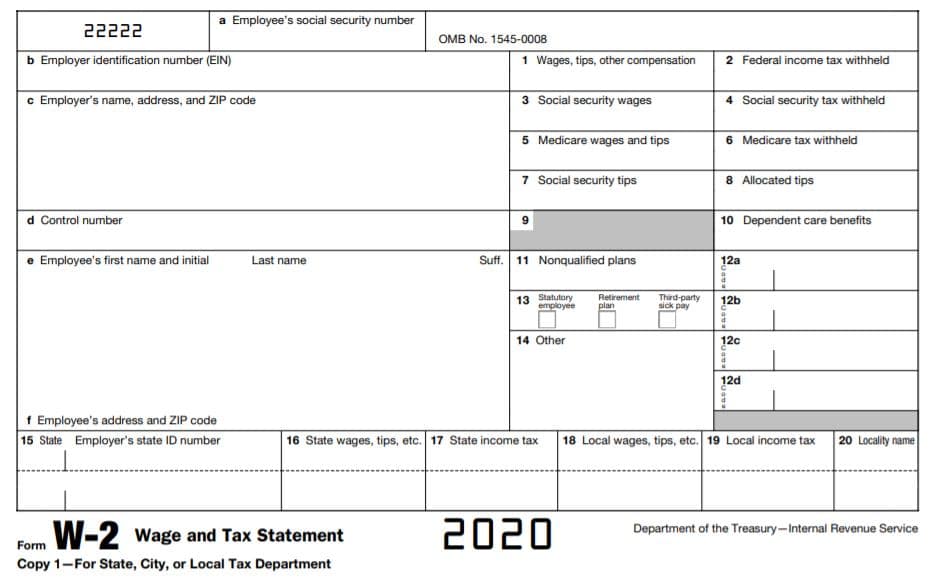

Just look at the W-2 for 2020 at box 14, entitled “Other.”

This is where employers list tuition reimbursement now.

Given the rapid and haphazard way this benefit got passed in March of 2020 and December 2020, the IRS will probably be lenient on any business that attempts to do this in good faith.

Make a quick printout explaining who is eligible for your student loan benefit at your business, and make sure you coordinate with your payroll company so that the money is not listed as wages. It must be separated out, or else employees will accidentally pay taxes on something that's supposed to be tax-free.

Remember that owners cannot give themselves more than 5% of the overall student loan repayment assistance.

That limits the benefit, but if you were planning on giving year-end bonuses anyway and you have a lot of younger employees with student loans, you might seriously consider adding this benefit.

Thoughts on employer student loan repayment? Let us know in the comments below!

Have I demonstrated how complicated student loans are? That's why you could benefit from a custom student loan plan from a firm that exclusively focuses on saving you the most money possible.

Refinance student loans, get a bonus in 2025

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

Bonus for eligible users who refinance $100k or more (bonus from SLP, not SoFi)

|

Fixed 4.49 - 9.99% APR

Variable 5.99 - 9.99% APR with all discounts with all discounts |

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 4.79 - 9.99% APR

Variable 5.88 - 9.99% APR

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 4.25 - 10.24% APPR

Variable 4.86 - 10.24% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 4.74 - 8.75% APR

Variable 5.04 - 9.05% APR

|

|

|

$1,099 Bonus

For 150k+, $300 to $500 for 50k to 149k.

|

Fixed 4.88 - 8.44% APR

Variable 4.74 - 8.24% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 3.99 - 10.30% APR

Variable 4.20 - 11.41% APR with autopay with autopay |

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, IDR forgiveness, or refinancing (including the one lender we think could give you the best rate).

Comments are closed.