Thanks to the American Physical Therapy Association’s Vision 2020 statement, all new physical therapists need to have the DPT degree in order to practice.

While the additional education will probably have positive outcomes for patients, what’s guaranteed is that schools have been able to charge ever-increasing amounts of money for the education. This often leads students to take out expensive DPT student loans.

Yes, the growth in the PT job market is expected to be above-average. Every media outlet and industry publication will remind you of that.

What they don’t like to talk about is the huge numbers of huge programs that continue to open to ensure that demand is met with more than enough supply. Schools won’t discuss the alternative motivation they had (revenue) to ensure that the DPT degree was mandatory.

The student loan racket affecting DPTs is a house of cards that will eventually fall. After all, when your tuition continues to escalate at a rate much faster than inflation even though salaries aren't growing at the same rate, something has to give.

We’ll diagnose the state of student loans in the DPT profession, show why physical therapists get the short end of the stick and discuss strategies on how to tackle expensive DPT student loans.

Why suggesting frugality as a strategy for managing DPT student loans is hilarious

How often has a financial aid employee or an administrator at your school suggested the key to keeping your student loans down is to live frugally like a college student. “If you live with roommates and stop buying new cars, then everything will work out.”

It’s true that keeping a strict budget and minimizing big living expenses will help. However, the biggest expense you’ll face in a DPT program involves handling the cost of physical therapy school including tuition and fees, and that’s not negotiable.

How Vision 2020 increased the cost of becoming a physical therapist

The Vision 2020 statement was the catalyst for increasing degree requirements in the physical therapy field of study. The APTA's vision has since been updated but it doesn't appear that it has turned away in any significant manner from Vision 2020's priorities.

One of those priorities was that all physical therapists would have a DPT degree instead of a master’s degree. The APTA followed through on this commitment in 2015 by requiring all future physical therapy students to have a DPT in order to be eligible to sit for the licensing exam.

Of course, this means longer periods of training, fewer years of earning money and more tuition revenue for schools. It also protects current physical therapists by slowing the addition of new entrants to the profession.

The Commission on Accreditation in Physical Therapy Education (CAPTE) has an excellent report on metrics for PT education.

In this report, it lists the median total direct costs of becoming a DPT at $66,074 for a public in-state program and $113,497 for a private school program. These figures do not include the cost of borrowing to pay for rent, health insurance, food, transportation and other expenses. The figures also do not include the costs of interest and origination fees.

Since there is a long history of physical therapy salaries increasing at roughly the rate of inflation, I do not expect to see a huge payoff for the student on the switch to the DPT degree. My guess is that most of the economic benefits will go to established players in the physical therapy profession.

How a physical therapist leaves school with so much debt

Finance charges are a big deal because those costs accrue while you’re in school. DPTs frequently leave with 25% to 30% more in debt than what you borrowed. For the median public in-state DPT grad, you might have taken out the $66,000 for tuition and fees but you borrowed $15,000 for each of the three years of your program. Now you’re at $111,000.

Tack on another 25% for finance charges on the loans, and you leave with about $138,750 of debt. That figure is what you graduate with if you’re:

- Cautious with your budget while in school

- Have no debt from undergrad (most people do)

- Don’t get slammed by an unexpected increase in tuition from the college

- Don’t have dependent children to pay for while in school

Now imagine you went to a private or public out of state DPT program. You could easily leave with debt levels of $200,000 of more.

What is the average physical therapist income?

According to the most recent data from the Bureau of Labor Statistics, the median PT makes $89,440 per year. The average is close to that level as well.

Of course, that number is after you’ve been working in the profession for a while. It also includes all different sectors that employ PTs.

The range of physical therapist incomes that I’ve seen is $60,000 to $100,000. The amount you earn will depend on the region of the country you work in.

What is the average debt for a physical therapy student?

According to a survey conducted by the APTA, the average total debt of physical therapists is about $116,000.

However, the average debt for physical therapy students that we've seen in our student loan consulting practice has been about $154,000. To be fair, the average debts of our clients tend to be higher than the average overall.

That said, I’ve seen debts over $200,000 for physical therapists from private schools. This debt loads balloon even more for a student who had to do a post-baccalaureate program to meet the prerequisites for the DPT program.

Can the average physical therapist afford to pay back her student loans?

If you graduated from an in-state public university and owe less than $100,000, you have a legitimate path to paying off your DPT student debt.

Assuming you’re working in a private sector setting, you can refinance that debt to a 10-year fixed rate. Making extra payments could also help you pay it off even sooner. And you could sign up with the National Health Service Corps to receive benefits for serving in a high-need area.

However, if you owe more than $100,000, the route to debt freedom becomes trickier. You could always live on rice and beans, and try to pay the debt off rapidly. But what if that pathway is not open to you? Perhaps you have aspirations to have a family, buy a house, save for retirement or other financial goals.

In this case, more strategies have to be considered to avoid being debt-free at 40 with nothing to show for it.

Case study: DPT grad from a private school uses PAYE

Pretend Jan just finished her DPT and owes $200,000 at a 6% interest rate. She earns about $80,000 per year in a private physical therapy clinic. She has no desire to start her own clinic. In fact, she would love to work at this site for most of her physical therapy career.

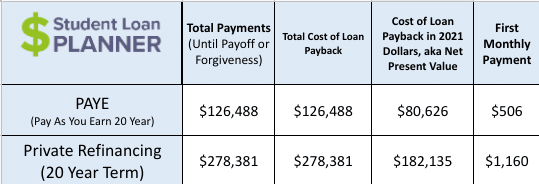

Assuming Jan remains single and doesn’t have children, here’s what the cost would look like under PAYE vs. refinancing at a 3.5%.

You’ll notice that the cost in today’s dollars is about $45,000 less. That’s the case because PAYE is paid over 20 years. If Jan saved the max in her 401(k), the savings presented here for PAYE would be even better.

Of course, Jan would need to run the numbers with something like our free student loan repayment calculator and determine what would happen if she got married and needed to include her spouse’s debt and income in the calculations.

Case study: physical therapist uses Public Service Loan Forgiveness

Let's explore student debt forgiveness for physical therapists. For this example, let’s assume Jim has $130,000 of 6% student debt from his in-state DPT program. We'll also assume that he's the primary breadwinner for his family.

I’ll assume his spouse doesn’t work and he has two young children. Jim just got a job at a hospital employee and qualifies for the PSLF program that also provides student loan forgiveness for therapists.

He can use this to pay 10% of his discretionary income and have the balance forgiven tax-free after 10 years of employment and student loan payments.

We’ll assume Jim makes $100,000 per year, which is well above average for a hospital employed DPT. We’re pretending Jim works in a geographically underserved area but doesn’t qualify for the NHSC program.

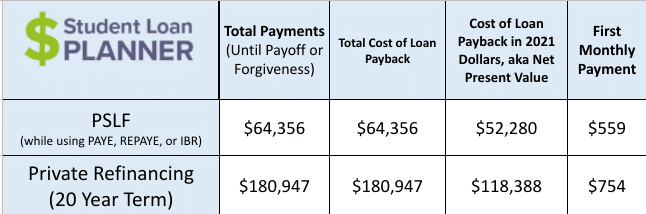

Jim might be tempted because of his high income to refinance, but that would be a big mistake. Here are the costs compared to a 10-year refinancing at 3.5%.

Not only is PSLF cheaper, Jim could save over $116,000 compared to refinancing. That’s equivalent to $11,000 extra per year of take-home pay.

Why physical therapists get a bad deal under federal student loan policy

Paying back your student loans shouldn’t be incredibly hard. Doctor of physical therapy programs should be a reasonable length. And it should put you no more than 100% of your expected first-year income in debt.

However, the federal student aid system enables schools to charge whatever they want. And students pursuing physical therapy, dentistry, optometry or other healthcare-related careers outside of actually becoming a physician often get the worst deals.

Any university can add a new DPT program. And while there are limits on how much can be borrowed in subsidized or unsubsidized loans while pursuing a bachelor’s degree, there are no such limits for the graduate PLUS loan program.

To prove this point, there were 25 new accredited or developing PT programs added from 2015 to 2020, according to the CAPTE.

A similar phenomenon already happened in the pharmacy profession. An influential federal report declared a massive shortage of pharmacists was imminent and the only way to stop the doom was to drastically increase the supply of graduates.

I believe we’re in the middle of that explosion in new DPT grads. The schools can charge anything they want, so they do.

While physical therapists always have options, they pale in comparison to the setup that physicians have. You might not know this, but most physicians qualify for the PSLF program. Their training during residency and fellowship counts, too. Many DPTs, however, work in private practice clinics which aren't eligible for PSLF.

Hence, a physical therapist and a physician might end up paying a similar amount to their student loans even though the MD will have significantly greater lifetime earnings and substantially more debt.

Related: How to pay for your PT or PTA education

Get a plan for your physical therapy student loans

If you're feeling overwhelmed by your DPT student loans, know that there are many student loan repayment options to explore. I’ve never met a DPT for whom our team couldn’t craft a custom student loan plan.

If you feel like your loan repayment strategy is straightforward, feel free to use our refinancing links to get a cash back bonus.

Do you fall into the “how will I ever pay off my massive student loans and live a normal adult life” category? If so, you should consider our student loan consult. We’ve made multiple plans for borrowers, and we can help physical therapists like you save money.

The forces arrayed against you are immense and we can certainly help with your expensive physical therapy student loans.

Rehab centers want a cheap supply of labor. The schools want to continually raise tuition. And the APTA wants more members who can afford to pay more dues. Someone has to look out for your financial interests, and it might as well be you (and us, if you feel like we’d be able to help).

Have an outrageous story about your DPT student loans? Comment below (and feel free to use a pseudonym if you’re worried about anonymity).

Comments are closed.