Although pharmacy school is increasingly easier to get into, the path to becoming a pharmacist is expensive and downright hard.

A study by the American Association of Colleges of Pharmacy (AACP) determined the average student loan debt for a PharmD degree was $179,514. On top of the massive debt, pharmacy school students face a demanding curriculum that can easily become overwhelming for even the most committed students.

A recent mental health assessment published in Currents in Pharmacy Teaching and Learning found that over 25% of pharmacy students scored in the high-severity range for depression, anxiety, academic distress and eating concerns.

It’s no wonder the pharmacy school dropout rate is over 12%, according to the AACP. Many students change their minds about the profession or are at risk of failing pharmacy school due to a number of factors.

And that’s okay. Dropping out of pharmacy school isn’t the end of the world, even if you have student debt concerns weighing on you. Here are alternative career options and student loan repayment strategies to explore if you’re worried about failing pharmacy school.

Struggling through pharmacy school? You aren’t alone

Pharmacy school’s tough on its own. The first few years involve extensive coursework in pharmaceutical, biomedical and clinical sciences. PharmD students are then put through advanced training in a healthcare setting — all while juggling the many stressors of life outside of school.

Some students can’t adapt to the demanding workload due to poor study or attendance habits carried over from their undergraduate studies. Other students lose interest in the pharmacy field whether from a lack of interest at the start, or upon discovering its oversaturated job market.

Future job security should be of particular interest to pharmacy students. The job outlook for pharmacists has been at a decline in recent years, with job growth now projected to be in line with the average for all occupations, according to the Bureau of Labor Statistics. Additionally, major pharmacy chains like Kroger, Walgreens and Target often choose to hire part-time pharmacists to avoid paying full-time benefits.

Finally, there’s a multitude of external stressors that can compound the pressure of pharmacy school. Relationship, financial and personal issues can accelerate symptoms of stress, depression and anxiety.

The main things to remember are that you aren’t alone, and you have limitless options — even if it doesn’t quite feel like it.

Potential careers after failing or dropping out of pharmacy school

If you decide you don't like the environment of being a pharmacist, it might be time to make a hard pivot toward a new career. Although you can choose any career or degree that piques your interest, there are some professions that are a natural transition from pharmacy school.

If your heart and mind are pulled toward helping others, you can pursue a number of professions that are still in the healthcare setting.

Option 1: Become a physician assistant

Physician assistants have versatile roles similar to a doctor, but with less education and training requirements. Here’s what you can expect if you decide to become a physician assistant.

- Number of years to complete school: Two to three years of classroom and clinical training

- Average salary: $115,390 (varies by specialty and location)

- Average student debt: $119,161

Depending on when you drop out of pharmacy school, you can shave off at least a year or two of school. But there’s a chance you won’t necessarily save money on the cost of school.

Option 2: Specialize as a nurse practitioner

Nurse practitioners provide comprehensive, holistic care in a variety of settings and specialties. Here’s a condensed summary of what to expect if you become a nurse practitioner.

- Number of years to complete school: Two to three years for a Master of Science in Nursing (MSN), additional two years for Doctor of Nursing Practice (DNP)

- Average salary: $114,510 (varies by specialty and location)

- Average student debt: $40,000 to $55,000

Depending on the program you choose, you can break even on the number of years in school compared to your original pharmacy school plan. However, if you don’t already have a Bachelor of Science in Nursing (BSN), you’ll likely need to find an accelerated BSN program before being admitted to a graduate-level program. This can tack on additional years and student loans.

But you can limit your costs by choosing an affordable nurse practitioner program.

Option 3 through 1,000: Change your mind completely

Nothing says you have to continue in healthcare. Want to become a lawyer? Interested in studying engineering? Always dreamed of becoming a writer? Do it.

It might feel like you don’t have options or that you’re too old or too far along to change the trajectory of your career. But it’s not. Life’s too short to stay in a field that doesn’t serve you.

You might even be able to benefit by turning your pharmacy school training into a side hustle while you pursue other dreams and goals.

Pharmacy student loan repayment strategies to consider

Public Service Loan Forgiveness (PSLF) is one of the most powerful programs available to healthcare professionals. But it’s challenging for pharmacists to find a position with a PSLF-qualifying employer.

Pharmacists are often limited to working in a private pharmacy setting, such as drug and grocery stores. Only about one-third of students who graduate from pharmacy school have a residency spot available in a clinical or hospital setting. This lack of opportunity can further pigeonhole a pharmacist into working in the private sector.

However, it's relatively easy to get a residency with an alternative career as a physician assistant or nurse practitioner. There’s also a wide range of PSLF-qualifying employers that you can continue your career with, including government agencies (e.g. Veterans Affair clinic) and nonprofit hospitals.

Let’s look out how changing career paths could end up benefiting you in terms of paying back your pharmacy student loans.

Use PSLF to your advantage

Here’s a hypothetical case study. During her second year, Bridgette was at risk of failing pharmacy school. Some things changed in her personal life and her heart just wasn’t in the profession anymore.

Bridgette knew she wanted to continue in the medical field, but wanted a career with more hands-on care. She decided that becoming a nurse practitioner was the right path, but it required going back to school for her BSN, followed by an accelerated BSN to DNP program.

She originally had $90,000 in pharmacy school debt. The career pivot pushed her student loan balance to $140,000. This is much less than the pharmacist debt that Student Loan Planner® clients carry, which is often well over $220,000.

Bridgette’s new career also allowed her to pursue PSLF as a nurse practitioner by working for a nonprofit hospital, earning $100,000 with a consistent 3% raise each year.

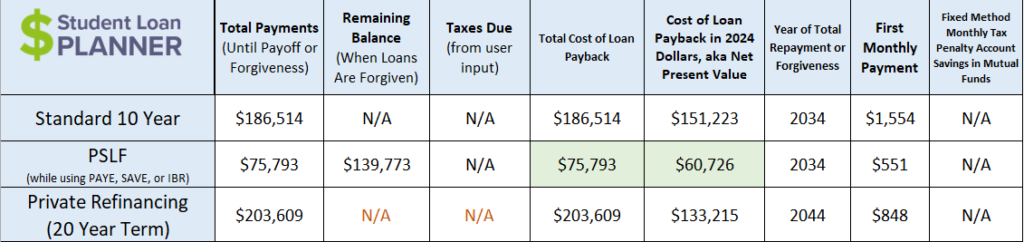

Using the Student Loan Planner® calculator, we can see that Bridgette would only pay about $75,793 under the PSLF program before her remaining student loan balance would be wiped away tax-free.

This is $100,000+ less than moving forward with the Standard 10-Year Plan or refinancing to a lower interest rate.

Alternative option: Treat your student loan debt as a tax

If PSLF isn’t an option due to working for a private practice, Bridgette could opt to treat her student loan debt as a tax on her income. By enrolling in an income-driven repayment (IDR) plan, she’d limit her monthly payment to a small percentage of her income.

Popular IDR plans include:

- Saving on a Valuable Education (SAVE) based on 5% to 10% of discretionary income, depending on undergraduate versus graduate debt. The 5% calculation kicks in July 2024.

- Pay As You Earn (PAYE) is based on 10% of discretionary income.

- Income-Based Repayment (IBR) calculates 10% to 15% of discretionary income.

- Income-Contingent Repayment (ICR) uses the lesser amount of a) 20% of discretionary income or b) a fixed amount over 12 years.

As an added benefit, Bridgette’s remaining student loan balance would be forgiven after 20 to 25 years of qualifying payments. But she would incur a tax bomb when her loans are eventually forgiven. She’d need to start planning for this large expense by setting aside funds in a non-retirement investment account.

Get a customized student loan repayment plan for your pharmacy school debt

Failing pharmacy school can be stressful, but there are many repayment strategies that can save you money and propel you forward in your new path.

In some cases, moving forward with PSLF or IDR forgiveness in a new career field can minimize your student loan payments and save tens of thousands (or more). However, depending on your financial, professional and personal goals, refinancing might be a better route to eliminate student debt, quickly.

Our team of student debt experts can help you decide on the most strategic repayment plan with a one-hour consult. If you still have lingering questions, you’ll have access to email support to help you implement your plan.