Some folks are blessed with family who have more than enough financially. It’s only natural that parents, grandparents, and spouses who love you would want to help with your education expenses in some way. If you graduate without student loan debt because you have parents paying for graduate school, consider yourself lucky.

However, many other graduate students make one of the most common family financial mistakes to avoid for grad school. There is a dangerous middle ground developing because of the ridiculously high cost of a graduate degree. If you’re going to take financial help from family, it’s best if that help covers the entire cost of attendance for that program.

To reiterate, covering only a PART of someone’s grad school cost can be DISASTROUS. Here’s how to know if accepting money from family is helpful or just adding massive costs to the equation.

Mistake 1: Using the bank of grandma and grandpa for student loan refinancing

Grandparents love interest, but they can’t get any when savings accounts at the banks only yield 2%.

You, therefore, devise a plan together to have them fund a part of your education by making loans out to you off the books. You’ll save money and they’ll earn more income than at the bank.

No matter how low the interest rate is that you’re receiving from family, it won’t be as low as the effective rate you get if you’re on track to have much of your loans forgiven.

Alanna the vet getting money from grandma for vet school

To see how this could go wrong, let’s look at an example of a hypothetical veterinarian named Alanna who goes to Penn. She’s expecting to owe $380,000 if she finances the whole degree program.

Alanna’s grandma decides to help her out with the cost by covering $100,000 out of her savings. Alanna doesn’t want this to be a gift. So, she makes her grandma agree to accept payments at a low interest rate from her when she graduates.

First, let’s address the obviously morose. What if Alanna dies before paying back her grandma? That’s an unlikely scenario and one that’s easy to protect against. For example, she could check out the cost of a term life policy by getting a quick quote. Getting $100,000 in coverage should cost almost nothing.

The real risk here is that Alanna would still graduate with $280,000 in debt. That is impossible to pay back on a typical vet salary of about $70,000 to $100,000.

By refinancing with her grandma, Alanna has taken away $100,000 that was projected to be forgiven with federal student loans. If left on the federal government system, she could’ve paid perhaps 40% in income taxes on that money in 20 to 25 years on a forgiveness-based approach.

Also, Alanna’s payment is the same with $280,000 or $380,000 in federal loans because it’s a percent of her income. That means by refinancing with grandma, she’s effectively taken on two payments instead of one.

Rather than saving for retirement or putting money away for her expected tax penalty when the loans are forgiven, she’s making $1,000 per month payments to grandma to make good on her debt.

Even if the refinancing is considered a gift, it’s an extremely inefficient one.

Mistake 2: Using your home to contribute to grad school

I see this mistake made most frequently by East Asian and South Asian American families, although it’s not limited to this segment of folks. It's one of the common mistakes to avoid when paying for grad school.

In this scenario, parents are eager to help their grad school students achieve financial security with a high paying, guaranteed professional job.

The parents usually are not wealthy and might have a mid to high six-figure net worth. One of their primary assets is their home equity, and they might have a bit of retirement savings. The parents expect the child they’re helping to fund them in their older years.

Puja the dentist with parents taking on a second mortgage to help with grad school

To see how this works in practice and why it’s so damaging, let’s pretend Puja is a dentist graduating from NYU. She’ll owe $550,000 at graduation if she receives no help and finances the whole thing.

Puja’s parents are first-generation immigrants from India. They’ve got about $300,000 of home equity and approximately $500,000 in their retirement accounts. They’re in their early 60s and earn about $100,000 a year.

Puja receives $200,000 towards her dental school cost from her parents. The expectation is that she will repay them by helping take care of them financially in their old age.

When it comes to paying for grad school, Puja graduates with $350,000 in dental school debt. She decides that practice ownership is not for her, so she starts working as an associate at Heartland Dental. She’ll start off making $120,000 and eventually will top out around $180,000.

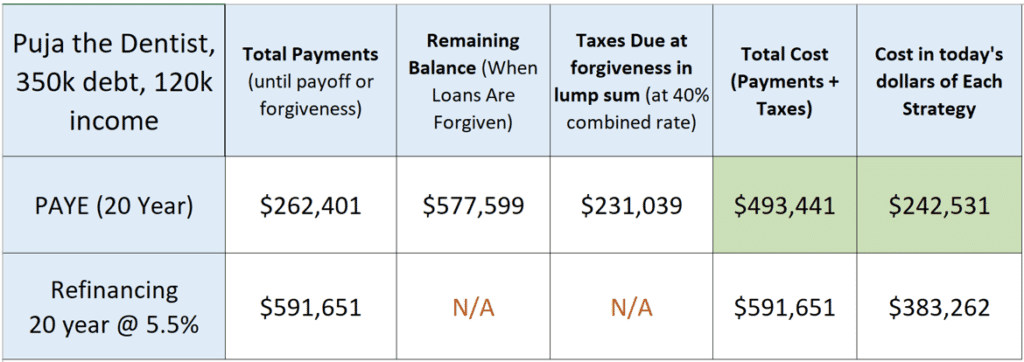

To make things simple, we’ll just include Puja in this analysis. Here’s what the cost of her options looks like with PAYE at 7% vs private lender refinancing over 20 years at a 5.5%.

The cost difference is understated if you just look at the total cost because much of the PAYE payments happen at the end of the 20-year payment period.

The cost difference is over $140,000 in today’s dollars, assuming a 5% rate of return on investable assets.

What does that mean in English? Puja’s parents are paying $200,000 but Puja is receiving a fraction of that in benefit from lower tax payments at the end.

All Puja’s parents have done is wipe away $200,000 of home equity and make their retirement less secure for the future. Puja is still going for loan forgiveness even with their generous support.

Mistake 3: Parents paying for graduate school with Parent PLUS Loans for literally everybody

Stafford loan limits for undergraduates are very low compared to grad school. Many parents feel an obligation in our culture to give their children whatever college experience they want.

I’ve seen this first hand when many parents paying for graduate school email me with huge balances that cannot be placed on the most generous repayment plans.

Parent PLUS are only eligible for Income Contingent Repayment (ICR IF they’ve been consolidated. That requires 20% of your income, so many parents will not be able to expect much forgiveness.

To see how this mistake happens, let’s look at Bob the corporate middle manager dad of three. Bob wants to retire in the next five to 10 years, but he also wanted to help his kids through school. Bob takes on about $100,000 in Parent PLUS Loans for each child to help pay for their undergraduate degree.

The children have the maximum undergrad Stafford loans, but they aren’t very large due to low loan limits.

Bob makes about $120,000 a year, but he finds out that his payments would be $3,000 a month if he was going to pay the loans back in 10 years. Because he’s trying to work towards retirement and pay off the last bit of his mortgage, those payments aren’t possible.

His children would like to help and take over their $100,000 of student loans, but only one can afford to do that since the payments would be $1,000 a month.

Parent PLUS Loans also carry the highest interest rate the government offers, at 7% right now.

It would’ve been far better to be realistic with the three children that just because the government will give you the money, it doesn’t make it smart, particularly with huge Parent PLUS Loans.

The children should have chosen lower cost programs or applied for ROTC scholarships if the schools they chose were truly non-negotiable for them.

Family doesn’t give income-based protections or forgiveness

The government offers the best protection for student loan repayment as well as getting more graduate school financial aid. Economic hardship? You can stop payments for three separate one-year periods. Disability or death? Loans are forgiven. Income drops due to job change or family reasons? Your income-based repayment decreases too.

Family cannot offer any of these protections (unless the loan represents a small slice of their net worth) when parents are paying for graduate school.

That’s why before accepting money from family for grad school, you should ask yourself these three questions:

- Will this contribution to my education delay or hinder my family member’s retirement in any way?

- Does this loan represent more than 10% of their net worth?

- Would this family member be upset if you became unable to pay back the loan in full?

If the answer is yes to any of these questions, grad students should not accept money from the family member.

The taxpayer is paying for our complex and messed up student loan system, so you might as well benefit from it rather than burden parents, grandparents, and spouses with the artificially high tuition prices we see presently in professional programs.

Student loans bring out any complicated family dynamics

Perhaps the most ferocious fight I’ve seen over money in a family was with a multimillionaire who passed away. He had several children, and two of the children had received loans of several hundred thousand.

The expectation with their father was that the kids would eventually pay the money back. He died, and then the estate was set to be split up.

The kids who received the loan contended that was a gift. They wanted their full share split equally among all the kids. The children who did not get the loan said that their siblings had received a portion of their inheritance early, and thus were not entitled to more.

I hope I’ve shown you that having parents paying for graduate school is a dangerous idea if you’re going to owe more than two times your salary anyway at graduation.

If you won’t have any debt thanks to family generosity, make sure it’s ok with all involved. If your mom and dad want to give you money for school but they haven’t done that for your brothers or sisters, make sure their wishes are clear, even if they’re hurtful.

You do not want a very kind and generous act of paying for school to turn into a family fight. Preemptively address any tension created by family financial support for grad school.

What if you make the wrong choice with your student loans?

While these three family financial mistakes to avoid before grad school can definitely cost you, say that I described you spot on in one of these mistakes that I mentioned, not all is lost. There are always ways to mitigate the damage from an unfortunate student loan strategy.

Feel free to check out our consult service where we can make a plan to effectively handle your six-figure student debt.

Not sure what to do with your student loans?

Take our 11-question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, SAVE or another IDR plan, or refinancing (including the one lender we think could give you the best rate).

Comments are closed.