There are several programs available to federal student loan borrowers looking for help with repayment. It’s important to know how each option stacks up against the others.

Popular student loan income-driven repayment plans (IDR) with the U.S. Department of Education include Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Saving on a Valuable Education (SAVE), which used to be called Revised Pay As You Earn (REPAYE).

What are the key differences between each program, and how do you determine which is right for you? Here’s what you need to know.

Income-driven repayment plan basics: Minimum required payments and years of repayment

Here's a quick comparison of each income-driven repayment plan's main benefits:

| Repayment plan | Payment (Based on discretionary income) | Timeline |

|---|---|---|

| Income-Based Repayment (IBR) | 10% to 15% | 20 or 25 years |

| Pay As You Earn (PAYE) | 10% | 20 years |

| Income-Contingent Repayment (ICR) | 20% | 25 years |

| Saving on a Valuable Education (SAVE) | 10% | 20 or 25 years |

SAVE: The New Biden IDR Plan

President Biden established a new IDR repayment plan for student loans that's better for borrowers in most situations than the existing PAYE and IBR plans. Here are some of the main highlights:

- The new SAVE plan allows borrowers with undergrad loans to pay 5% of their income for 20 years.

- Grad school borrowers will pay 10% of their income for 25 years.

- The poverty line deduction will increase from 150% to 225%.

- No interest will accrue if your IDR payment is less than your interest.

You can model this plan with our SAVE Plan calculator.

PAYE vs. SAVE: What's the difference?

With the PAYE plan, your monthly payment is based on 10% of your discretionary income. Your discretionary income is determined by taking your adjusted gross income (AGI) and subtracting 150% of the federal poverty line for your family size. As for loan forgiveness, PAYE allows student loan forgiveness after 20 years of qualifying payments.

Whereas SAVE (formerly the REPAYE program) carries an interest subsidy that PAYE doesn't have, and it increases the income exemption to 225% of the poverty line. Additionally, it reduces payments for undergraduate loans by dropping it to 5% of discretionary income (10% for graduate loans). If you have both, you'll pay a weighted average based on the original principal balances. Depending on how much you borrowed, loan forgiveness could be as short as 10 years for balances less than $12,000 up to 20 or 25 years for larger balances.

In comparison, under the IBR plan, your monthly student loan payments will be 10% to 15% of your discretionary income, depending on when you took your loans out. Depending on your loan disbursement date, IBR forgiveness can be achieved after 20 to 25 years.

Note that there's an additional repayment plan: Income-Contingent Repayment (ICR). This plan's payments are based on the lesser of either 20% of your discretionary income or what you'd pay with fixed payments over 12 years. ICR forgiveness requires 25 years of payment.

For the purposes of this comparison, we'll focus on IBR, PAYE and SAVE plans.

Let's do some hypothetical loan simulator case studies for some of the occupations I see with large debt loads using our free student loan repayment calculator.

Our assumptions when comparing IDR plans

In the following hypothetical examples, I assume a 7% interest rate for the federal student debt and income increases of 3% for the folks we’re modeling.

Graduate programs have a cap of $138,500 in aggregate borrowing for federal loans. But borrowers enrolled in certain health profession programs might meet eligibility requirements for additional Direct Unsubsidized Loan amounts.

I’m using the option of refinancing to a 10-year 5.5% interest rate as an alternative baseline to compare against.

Another big assumption is that schools would only charge the maximum borrowing limit for the cost of education. However, this could be wildly incorrect if they can convince the private sector lenders to start originating private student loans to cover the difference in revenues.

Finally, because I encourage all my clients to max out their retirement accounts, we’ll assume everyone is saving $22,500 a year in their 401(k) or 403(b) on a pre-tax basis. This strategy lowers student loan payments.

With each example, we pretend that our single borrower could choose between the PAYE, SAVE, and IBR plans.

We don't cover married borrowers in these examples. For borrowers who may need to consider a spouse's income or cases where you may be married filing separately, check out this post.

If you're a Parent PLUS loan borrower, head over to this post for help.

Want me to do a comparison for your specific situation? We offer one-on-one consultations.

Example 1: More debt than income

Let’s say Wendy is a veterinarian who graduated from the University of Pennsylvania and has way more debt than income. I currently see Penn alumni veterinarians come out with a loan balance of around $390,000 if their education was financed completely with student debt.

But let's assume Wendy has a federal student loan debt balance of $225,000 and works for Banfield Pet Hospital making $70,000 a year. Since she maxes out her pre-tax retirement contributions, her adjusted gross income is $47,500.

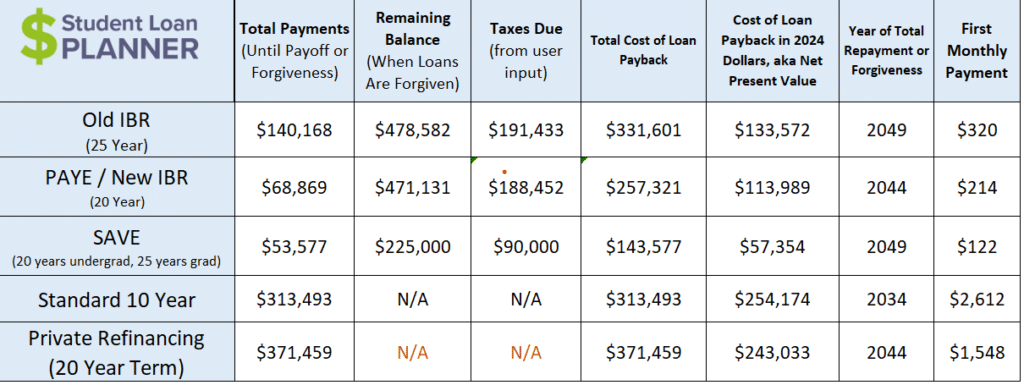

Let’s look at the cost of PAYE vs. SAVE vs. IBR for Wendy's situation below.

Under PAYE, Wendy's student loan payment amount would start out at $214 per month and adjust with her income and family size over time. But under SAVE, her payment would only be $122 per month. Remember that your payments on PAYE vs. SAVE have little connection to your actual debt with the Federal Direct Loan program.

However, she'd reach forgiveness five years earlier with the PAYE plan. This means she'd only pay back about $69,000 before having her remaining balance wiped away versus paying about $53,500 on SAVE with forgiveness after 25 years. Either way, she might have to pay a monster tax bomb on the forgiven amount, so she'd need to start saving for it now.

It’s clear the IBR plan would cost her substantially more. Refinancing her student loans would be a suboptimal decision, as well.

It’s difficult to look at the total cost column and make judgments without thinking about the cost of each path in today’s dollars. After all, these repayment periods are over different loan terms, and we need to adjust for alternatives where you could invest your money.

That’s why the relevant takeaway when looking at this chart is the cost in today’s dollars.

Example 2: Slim chance of repayment

For this example, meet Jim, who is an associate chiropractor. Most chiropractors come out of school burdened by a ton of debt with incomes that are not all that different from what they could’ve made as non-specialized college graduates.

Perhaps this is due to the proliferation of chiropractors coming from private schools that charge a ridiculously high amount of tuition for the value of the degree.

Are there plenty of exceptions? Of course. I’m simply speaking in the aggregate.

Suppose Jim graduates from Palmer College of Chiropractic and becomes an associate for another doctor long-term. He brings in $55,000 a year and left school with about $275,000 of loans on the Direct Loan program.

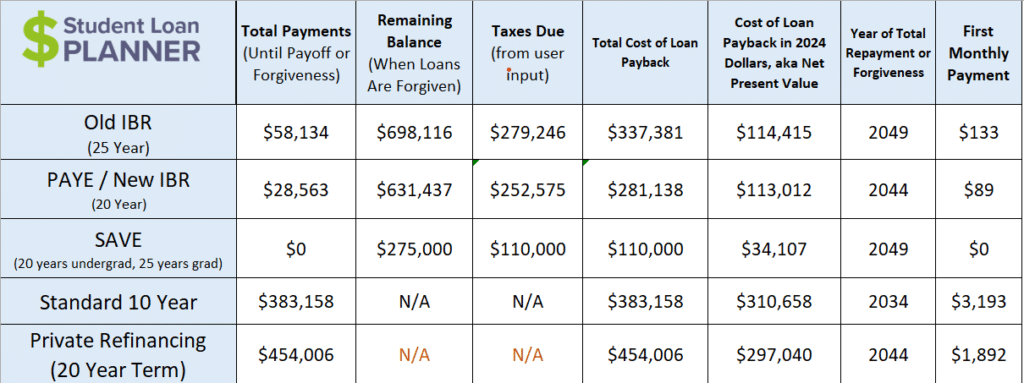

This is what the cost looks like for each repayment option:

If Jim maxes out his retirement, his AGI would be $32,500. His federal student loan payments would start out at $89 under PAYE or a whopping $0 under SAVE. If his salary stays in line with a steady 3% increase every year and he continues to max out his retirement, he might end up not having to make any payments under the SAVE plan.

Note that both plans could result in Jim having to pay a big tax bomb. But he'd clearly be much better off than staying on the Standard 10-Year Repayment plan or refinancing to a lower interest rate.

Example 3: Planning on Public Service Loan Forgiveness (PSLF)

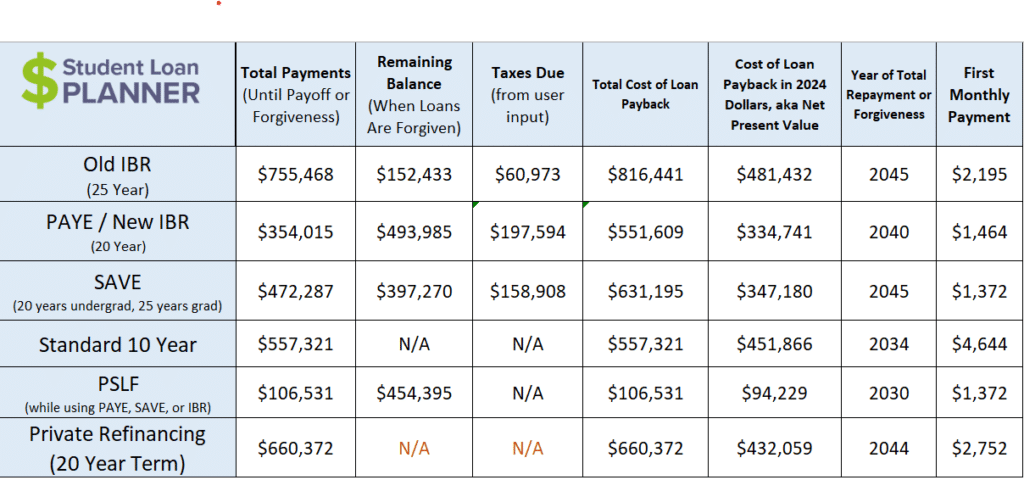

For this example, let’s use the fictional story of Christine, a doctor who plans to pursue Public Service Loan Forgiveness (PSLF). We’ll assume Christine is an OB/GYN resident who just graduated and will have an attending salary of $220,000. She works for a nonprofit hospital and qualifies for PSLF.

Let’s assume that under the Direct Loan program, she owes $400,000 from attending the University of New England College of Osteopathic Medicine.

We’ll also assume under both scenarios that she has built up four years of credit toward forgiveness during residency.

After maxing out her retirement contributions, her AGI is $197,500. Her monthly payment amount would be $1,372, and she'd qualify for forgiveness after 120 PSLF qualifying payments. That's right. All of her unpaid interest and principal will be wiped clean after ten years with no tax consequences.

Look at the massive difference between PSLF versus other IDR plans and private student loan refinancing. We're talking hundreds of thousands of dollars in savings by sticking with PSLF.

Example 4: High-income earners

For our final example, let's assume Josh lives large in the big city. Although Big Law salaries increase at a rate much faster than 3%, let’s just assume for sake of simplicity that Josh, the Big Law attorney, went to the University of Virginia and has an annual income of $180,000 in New York City with inflation-level raises. He left school with about $250,000 of student debt under the Direct loan program.

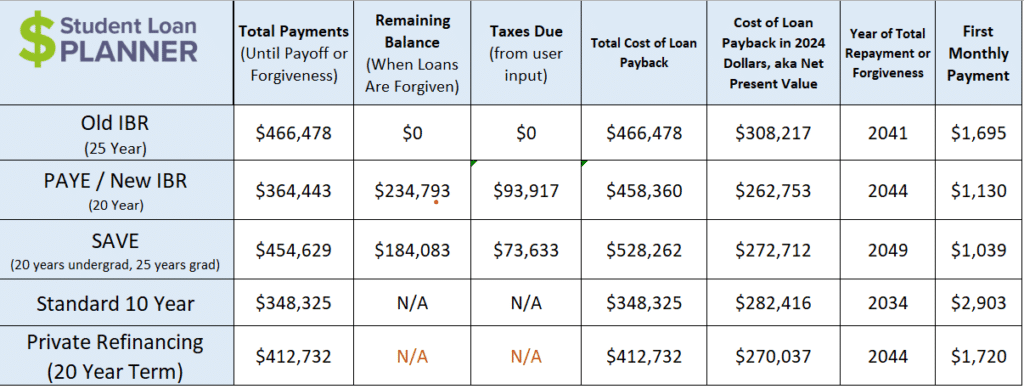

By maxing out his retirement, he lowers his AGI to $157,500. Here are his repayment options for SAVE vs. PAYE vs. IBR. We've also added refinancing for comparison.

Josh would have the lowest monthly payment under the SAVE and PAYE options. But he'd have to pay back loans over a long period and still have a tax bomb to deal with.

That said, the tax bomb is unlikely to happen (think about all the upset 50- to 70-year-old voters). Thus, since the cost of paying back his loans isn't all that different from the SAVE and PAYE plans, it's better to keep his loans federal for now instead of refinancing since federal loans have superior borrower protections.

Choosing the best IDR or Non-IDR repayment strategy

When it comes to student loans, there is no universal solution that works for everyone. Depending on individual circumstances, it may be necessary to choose between PAYE and SAVE plans in some cases, particularly when pursuing loan forgiveness programs. In other cases, refinancing your student loans to obtain better repayment terms or lower interest rates may be the best course of action.

The best repayment strategy will depend on several factors, including your student debt and income. But it should also include your personal and professional goals.

If you currently have student debt from your undergraduate study or graduate school, we’re every bit as intense and analytical with each one of our client’s student debt consultations to make sure they have the best plan in place to minimize their costs. Set up a time to review your student debt situation with one of our experts.

Not sure what to do with your student loans?

Take our 11-question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, SAVE or another IDR plan, or refinancing (including the one lender we think could give you the best rate).

Comments are closed.