Somer and Trent, ages 41 and 39, met at the University of Alabama in graduate school and fell in love. The couple eventually got married and have three children together, ages 13, 12 and seven. But finding love and starting a family wasn’t all they got from their school experience. The couple ended up with more than six figures of student loan debt as well. Both Somer and Trent work in education, and managing loan payments with a family of five was tough.

The student loans payments were overwhelming, but they found a light at the end of the tunnel: student loan forgiveness.

In the past year, student loan forgiveness has made headlines by appearing to be more myth than reality, with only 1% of borrowers getting their loans forgiven under Public Service Loan Forgiveness (PSLF).

But Somer and Trent’s story is the first of its kind, as they successfully got their student loans forgiven despite some bumps along the way. We spoke with them about their experience pursuing student loan forgiveness.

The news makes student loan forgiveness sound impossible, but Somer and Trent are living proof that it’s real. Read on to learn more about their story.

Taking on student loan debt for school

Somer grew up below the poverty line with a single mom and took out loans to go to school. While she received a lot of Pell Grants, she borrowed $160,000 for her undergrad and grad degrees.

Trent attended grad school to study sports management. He later realized he wanted to be an educator, so he earned a second master’s degree — borrowing a total of $89,000.

When they were at the University of Alabama, the financial aid office recommended they take out federal student loans. But after graduation, it was tough to manage so many different student loans.

Trent later turned to consolidation, which combined all of his various loans into one lump sum and locked in an interest rate to make repayment easier.

Somer had about 20 different Direct Loans, and after seeing how much she’d have to pay each month, she made a frantic call to her loan servicer.

“I can’t live on this and pay you what I’m paying you,” she told them. She was then put on the Extended Repayment Plan. Paying back student loans was a financial juggling act while supporting a family.

Trent and Somer were dealing with the weight of debt as they tried to repay their loans. While Somer was managing her loans, Trent became curious about the student loan forgiveness options available and decided to take action.

Trent’s journey toward Public Service Loan Forgiveness

Trent began teaching in 2007-08, and he discovered PSLF around the time the program first launched. He was told there was no paperwork or anything to do.

After expressing that he wanted to get set up on PSLF, he called his servicer a couple of times to make sure everything was on track. Since the program had just launched and the loan servicers didn’t have much information, he was put on a Graduated Repayment Plan.

Thinking he was set up, he continued to make payments on his loans for several years. Later on, he wanted to follow up and see where he was on the forgiveness track. His loans had been transferred to the Missouri Higher Education Loan Authority (MOHELA), and upon calling, Trent received disappointing news.

“You don’t have any payments towards Public Service Loan Forgiveness.”

Put on the wrong repayment plan

Trent was confused and mad, as he had thought he was working toward student loan forgiveness. Under the PSLF program, you need to pay your loans for 10 years to have them forgiven. Trent paid on his loans for five years, thinking he was halfway through the requirement. But instead, he got hit with this devastating blow. He wasn’t on the right repayment plan to qualify for student loan forgiveness.

To qualify for PSLF, you need to be on an income-driven repayment (IDR) plan, and Trent was on the Graduated Repayment Plan.

Just like that, he had to start over and begin again. All of the progress Trent thought he’d made did not, in fact, count toward PSLF. Eventually, he signed up for the Income-Contingent Repayment (ICR) plan and got on track for student loan forgiveness.

According to data from the U.S. Department of Education, the top reasons for PSLF rejection include non-qualifying payments, missing information, no eligible loans, incorrect employment dates and ineligible employment. There are a lot of moving parts that have to be just right in order to receive student loan forgiveness. Trent didn’t have qualifying payments on the right plan, and it was only when he followed-up that he got back on course.

Unlike Trent, Somer wasn’t as sure about getting on track for student loan forgiveness. She was hesitant to switch over to income-based repayment because she didn’t want to add any additional time to her loan payoff. Somer was on the 30-Year Extended Repayment Plan and had resigned herself to stay the course and not change her repayment plan.

Back on track to forgiveness

After Trent’s repayment plan error and losing five years of credit, he became obsessed with making sure he was eligible for student loan forgiveness.

“I had been trying to keep up with PSLF since my first year of teaching. When I found out after that first call, after paying for [five] years, I kept even closer watch on things,” explained Trent.

He heard about a newly launched program that could change everything. A couple of years ago, the Temporary Expanded Public Service Loan Forgiveness (TEPSLF) program was launched.

Temporary Expanded Public Service Loan Forgiveness program

According to the Federal Student Aid website, “The Consolidated Appropriations Act, 2018 provided limited, additional conditions under which you may become eligible for loan forgiveness if some or all of the payments you made on your William D. Ford Federal Direct Loan (Direct Loan) Program loans were under a non-qualifying repayment plan for Public Service Loan Forgiveness (PSLF). The U.S. Department of Education (ED) is referring to this reconsideration as the Temporary Expanded Public Service Loan Forgiveness (TEPSLF) opportunity.”

This program expanded the eligibility requirements for loan forgiveness for borrowers who might have qualified for PSLF but were on the wrong repayment plan. The good news is that like PSLF, the IRS won’t consider student loan forgiveness under TEPSLF taxable income. In other words, you won’t have to pay taxes on the forgiven amount like you would with forgiveness under an IDR program.

When I spoke to Trent about the process of pursuing the student loan forgiveness tax-free option through TEPSLF, he remarked, “It was a bit difficult. When I thought I reached 120 payments, I had not due to some forbearance, loans going to other loan servicers, I changed jobs a few times, there were some lapses in employment so a few more months got tacked on.”

It was a headache, but Trent persevered. After being transferred to FedLoan Servicing in 2017, he said things got a bit easier.

In order to apply for TEPSLF, you first have to apply for the PSLF program and get denied. After that, you send an email to have your case considered. Trent eagerly followed up several times after he knew that he’d made 120 payments. After that, it took a couple of weeks to verify his employment and payments.

One evening, he was curious about where he was at. During the Student Loan Planner® Podcast, Trent recalled:

“It was a Friday night. I’m lying in bed. I’m about to go to sleep, but I said, ‘I just got to look.’ It was probably 11:30 at night. And I log [in] on my phone, and I look and see that zero balance. And I just flip out. I’m so excited.”

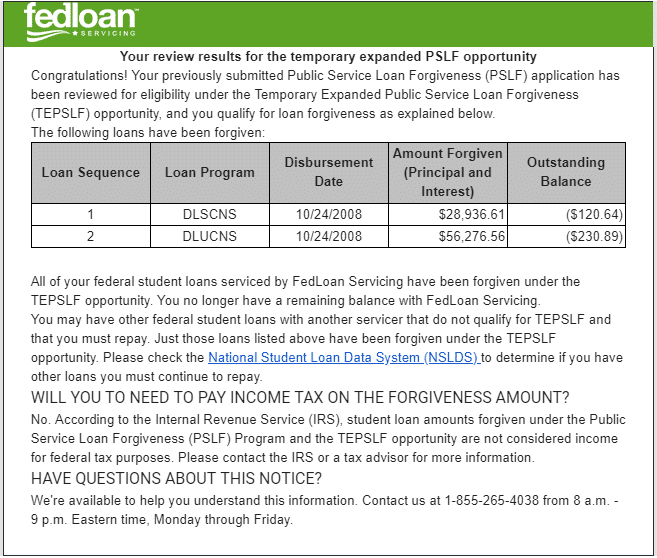

Trent learned that his student loans were forgiven that Monday. Later that week, he received an official letter announcing the status of his loans and the amount that was forgiven.

Somer’s student loan forgiveness path and obstacles

Somer’s journey toward student loan forgiveness through TEPSLF was somewhat smoother but also had some hurdles.

“My process was easier. I had 120 payments with one employer. I decided to wait until after the 10 years to apply,” she explained.

She knew she was going to be rejected for PSLF because she was on the Extended Repayment Plan and not on IDR. But she knew through her research and firsthand knowledge from her husband that she may qualify for TEPSLF.

Then Somer got some disturbing news. She was told that her employment qualified, but she didn’t have any payments recorded. Knowing that she’d been making payments diligently each month, she was confused.

As it turns out, some of her loans didn’t show up in the National Student Loan Data System (NSLDS). After getting married, Somer tried to change her surname, which ended up causing more trouble. Some of her loans were in her maiden name, and some were in her married name. Basically, the payments she had been making to Educational Financial (Edfinancial) Services hadn’t been connected to the NSLDS.

Somer changed her name through her Federal Student Aid (FSA) ID, and her loans then showed up in the NSLDS. She was notified that her payments were now recognized, though she was on the wrong payment plan for PSLF.

When she logged into her Educational Financial Services account, she saw a zero dollar balance. But it was a false alarm — she got an email from FedLoan Servicing that her loans had been transferred.

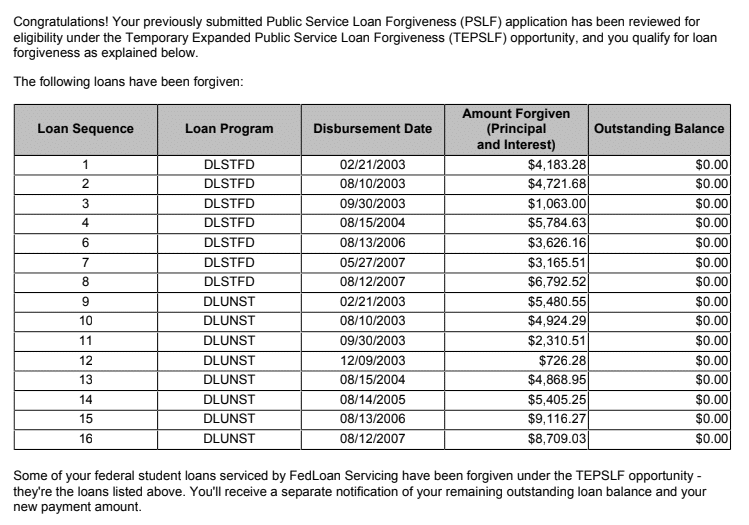

She was encouraged to get on the right repayment plan for IDR, but Somer knew she’d already made 120 payments. So she applied for TEPSLF and sent in the required paperwork. After several weeks, her loans were forgiven.

There was yet another issue, however. Somer realized one of her loans wasn’t forgiven like the others. During her follow-up, she learned there was a clerical error that had missed one of her loans. Her diligence in reaching out to clarify this situation resulted in a correction and having all of her loans forgiven.

Somer now only has a private loan of less than $10,000 to deal with. But she can manage the payments now that she’s saving hundreds of dollars each month by not having to pay her federal student loans.

Celebrating their PSLF goal

This past summer, Trent and Somer officially had their student loans forgiven in the amounts of $85,464 and $76,732.73, respectively. Having such a large amount forgiven has made a huge impact on their life and finances.

Trent said:

We were extremely excited as you can imagine. What that does for us now is that it opens the opportunity to make sure we can prepare our kids for college and putting money aside. We were basically making a mortgage payment in student loan payments and this frees us up to purchase a home.”

The couple has three children who are growing fast, but they no longer have to wonder about making certain purchases. They don’t have to worry about affording a new pair of shoes or getting extra groceries. They don’t have to perform the financial gymnastics of figuring out what and where to cut back to afford new items.

Somer says that they feel like “real adults” now and are no longer locked into payments for years to come. They can focus on building their life and retirement.

If you’d like to pursue forgiveness, the couple recommends being persistent and to keep following up.

Somer said:

I am extremely cynical and I didn’t believe any of it. But it’s real and it works. Don’t give up and keep fighting for it. It feels good that I own the degree hanging on my wall. This is a huge burden lifted.”

If you want more information on getting student loan forgiveness tax-free, see if you qualify for Temporary Expanded Public Service Loan Forgiveness. You won’t have to consider student loan forgiveness taxable income under this program.

Not sure what to do with your student loans?

Take our 11-question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, SAVE or another IDR plan, or refinancing (including the one lender we think could give you the best rate).

Comments are closed.