Founded in 1865, George Washington University (GW) recently celebrated 150 years of academic excellence. GW Law students are not only given the opportunity to learn from some of the best minds in the world, but they get to live in D.C. while doing so. For an aspiring attorney, getting accepted to George Washington University may seem like the opportunity of a lifetime.

But those benefits come at a cost. According to the American Bar Association, George Washington Law School was one of the 15 most expensive law schools in the U.S. in 2018. And that means GW Law students are likely to graduate with a lot of student loans.

Related: Top 10 Most Affordable Law Schools in the US

Let’s take a look at what it costs to attend GW Law and what you can do about George Washington Law School debt.

Attendance at George Washington Law School

For the fall 2019 academic year, George Washington University received over 8,000 applications, the second-highest of any law school in the country. From those applications, 576 students entered GW Law this year.

On the George Washington website, George Washington Law School says it has a total enrollment of about 1,700. Of those students, approximately 1,400 are enrolled full time in the Juris Doctor (J.D.) degree program. The rest are either part-time students or are enrolled in graduate law programs.

Cost of George Washington Law School

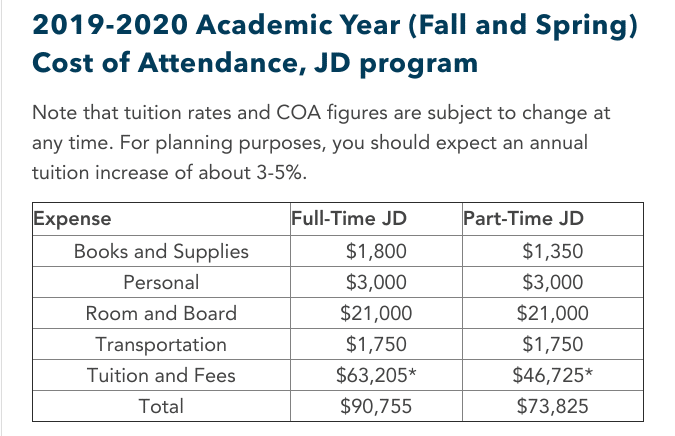

GW Law charges a flat rate for full-time students (12 credit hours or more per semester) and per credit hour for part-time students. Part-time students are charged a massive $2,225 per credit hour. And full-time students — wait for it — pay $63,205 in tuition per year. GW advises that students should expect a 3% to 5% rise in tuition per year.

But the costs don’t end there. Books, supplies, room and board, transportation, and personal expenses need to be considered as well. Room and board alone cost $21,000 at GW Law. All in, George Washington University estimates that the annual cost of attendance for law students will be $90,755 per year.

Source: GW Law

How much George Washington Law School debt to expect

GW Law says the typical full-time student will enroll in six semesters of study. That’s three full years of expenses:

$90,755 (annual cost of attendance) x 3 (years) = $272,265 total cost of attendance

Before taking anything else into consideration, we see you could end up with at least $272,265 of George Washington Law School debt. But in reality, many law students could graduate with even more, as the number above doesn’t take tuition increases or accrued interest into account.

How do you account for both of these factors? If you take the total cost of attendance and multiply by 1.25, you’ll probably get a more realistic estimate:

$272,265 x 1.25 = $340,331 total cost of attendance

That’s an intense amount of debt no matter how high of a salary you plan to earn during your career.

Could you cut your room and board cost by finishing your GW Law degree in two years instead of three? It’s unlikely. You need at least 84 completed credit hours to graduate. To complete 84 credit hours in four semesters would mean taking on a credit load of at least 21 hours per semester. Law school is tough enough as it is with a normal credit load, much less trying to follow an accelerated schedule.

However, you may be able to reduce your cost of living if you’re able to find a roommate, cook your own food or ditch your car. And keep in mind that this number doesn’t include any scholarships you may receive.

But without any adjustments, the entering class of GW Law School could realistically graduate with over $340,000 in student loans.

3 ways to manage George Washington Law School debt

So we’ve established that many GW Law students will graduate with a huge amount of George Washington Law School debt. But what can you do about it? Here are a few repayment strategies to consider.

Related: How to Pay for Law School: Guide to Law School Student Loans

1. Income-driven repayment and taxable loan forgiveness

Many GW Law School grads should consider enrolling in an income-driven repayment (IDR) plan like Revised Pay As You Earn (REPAYE) or Pay As You Earn (PAYE).

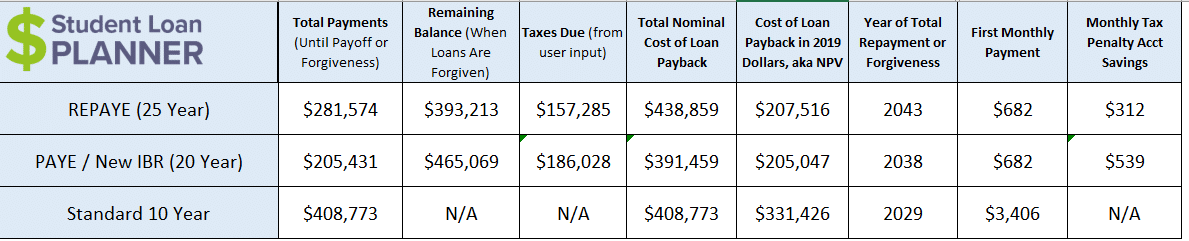

Let’s say you graduate with $300,000 of George Washington Law School debt and have a starting salary of $100,000. By plugging these numbers into the Student Loan Planner® calculator, you can compare the monthly payments of each repayment option:

So we see that both IDR plans would begin with monthly payments of $682. That’s over $2,700 less than the $3,406 monthly payment you’d have on the 10-Year Standard Plan. But it’s also important to point out that your payments won’t cut into your principal at all with either plan. Instead, your balance will grow over time.

With IDR, if you have a balance remaining at the end of your repayment period (20 or 25 years), it will be forgiven. But keep in mind that you’ll owe taxes on the forgiven amount. In the sample case above, our lawyer would receive between $393,000 and $465,000 of forgiveness — and that would generate a tax bill of $157,000 to $186,000.

If you decide to pursue a taxable loan forgiveness strategy, you’ll need to have a savings plan for the student loan forgiveness tax bomb.

Related: 5 Key Student Loan Forgiveness Programs in Washington, D.C.

2. Public Service Loan Forgiveness

If you decide to work in the public sector or for a nonprofit, you may qualify for the Public Service Loan Forgiveness (PSLF) program. PSLF offers tax-free forgiveness in as little as 10 years (120 qualifying payments).

But keep in mind that if you choose public sector or nonprofit employment, you’ll typically be passing up higher-paying jobs in the private sector. If you have a passion for public service or nonprofit work, though, PSLF could be an awesome side benefit.

But if you’re doing it just for the loan forgiveness, you’ll want to do the math first. In some cases, you may come out ahead by landing a high-paying job and paying off your loans as quickly as you can.

3. Refinancing and aggressive repayment

If you graduate from GW Law with less than 1.5 times your income in debt (e.g., you owe $225,000 or less and make $150,000), refinancing to a lower interest rate could be a smart move. The goal would be to save a ton on interest and pay off your loans as fast as possible.

It won’t be easy for George Washington University Law School graduates to meet the 1.5 times debt-to-income ratio criteria. For that to happen, you’ll probably need to earn some school scholarships or land a fantastic job at one of the top law firms in the country. But if your school debt is less than 1.5 times your income, refinancing could save you a lot of money.

Keep in mind that if you refinance federal student loans, you’ll lose out on benefits like income-driven repayment and loan forgiveness options. Before you refinance, you’ll want to weigh the pros and cons.

If you’re looking for advice on how to pay back your George Washington Law School debt, one of Student Loan Planner®s consultants could help. They’ll consider your specific situation and help you create a custom repayment plan. Book a consultation today.

Refinance student loans, get a bonus in 2025

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

Bonus for eligible users who refinance $100k or more (bonus from Student Loan Planner, not SoFi®)

|

Fixed 4.49 - 9.99% APR

Variable 5.99 - 9.99% APR with all discounts with all discounts |

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 4.45 - 10:49% APR

Variable 5.88 - 10.49% APR

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 4.29 - 10.24% APPR

Variable 4.86 - 10.24% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 4.99 - 8.90% APR

Variable 5.29 - 9.20% APR

|

|

|

$1,099 Bonus

For 150k+, $300 to $500 for 50k to 149k.

|

Fixed 4.88 - 8.44% APR

Variable 4.86 - 8.24% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 3.85 - 11.38% APR

Variable 4.33 - 12.35% APR with autopay with autopay |