According to a recent report by The Institute for College Access and Success (TICAS), 56% of Georgia university grads in 2019 had student debt. The average debt load for those graduates was $28,081, an 83% increase since 2004.

The aggregate federal student loan limit for dependent students who are pursuing an undergraduate degree is $31,000. This means that Georgia students with debt loads that are just slightly above the state’s average may face a funding gap that forces them to turn to private lenders for assistance.

Below is a list of a few lenders that offer private student loans for Georgia students. Several refinancing companies that are worth checking out if you’ve already graduated with Georgia student loans and are looking to improve your rates or terms.

State-specific Georgia student loans

If you’re a Georgia resident or are attending a Georgia university, you might be eligible for one or more of the three private student loan options listed below.

GSFC Student Access Loan (SAL)

The Student Access Loan (SAL) program is provided by the Georgia Student Finance Authority (GSFA). These loans offer a low fixed interest rate of 1%. To qualify for SAL, you must be an undergraduate enrolled in one of the following types of academic institutions:

- University System of Georgia (USG)

- Technical College System of Georgia (TCSG)

- Private postsecondary institution in Georgia

USG or private postsecondary students can borrow $500 to $8,000 per year, with a lifetime borrowing limit of $36,000. The limits are lower for technical college students who can borrow $300 to $3,000 annually, and $12,000 over their college lifetime.

These loans come with repayment terms of up to 15 years and offer loan cancellation options for students with graduate with high GPAs or who choose careers in public service. Downsides include a 5% origination fee and the fact that $10 Keep In Touch (KIT) payments are required while students are still in school.

Georgia’s Own undergraduate and graduate loans

Georgia’s Own Credit Union has over 200,000 members and is available to residents of nearly 50 Georgia counties. In addition to its banking, investing, and insurance products, Georgia’s Own offers a private education line of credit for both undergraduate and graduate students.

The borrowing limit for a Georgia’s Own in-school line of credit is $75,000 for undergraduates and $100,000 for graduate students.

A variable-rate APR is the only option with either program. The repayment term is 20 years for students who borrow less than $40,000 and 25 years for students with larger balances.

During school, Georgia’s Own student loan borrowers can make interest-only payments or choose full deferment of principal and interest until six months after graduating. But there is, unfortunately, no formal hardship forbearance policy for students who have already begun normal repayment.

Georgia United undergraduate loans

Georgia United Credit Union is a full-service financial institution that has been serving Georgia residents for over 60 years. As long as you live or work in one of the 30+ counties served by Georgia United, you’ll be eligible to join.

Currently, Georgia United offers in-school credit lines of up to $60,000 to eligible undergraduate students. You don’t have to attend a Georgia university to qualify as over 1,500 schools nationwide are approved.

The APR for Georgia United’s education lines of credit is variable. You’ll have 20 years to repay your line of credit if you borrowed less than $40,000 and 25 years if you borrowed more than that amount. Interest-only payments during school and full deferment until after graduation (with a 6-month grace period) are both available.

Georgia student loans from national lenders

There are several private student loan companies that are able to lend to college students nationwide. If you’re wanting to get a few more quotes, here are a few national lenders that we recommend at Student Loan Planner®:

- Sallie Mae. This lender offers undergraduate, graduate, and parent loans at competitive rates. Learn more about Sallie Mae in our full review.

- Earnest. Earnest offers undergraduate and graduate loans with flexible payment options. You can check your rates in as little as two minutes.

- Ascent. This company has a variety of cosigned and non-cosigned private student loans to choose from and offers one of the industry’s largest autopay discounts.

- College Ave. In addition to undergraduate and general graduate loans, College Ave offers parent loans and profession-specific graduate loans. This lender also offers flexible repayment terms (3).

To see more Georgia student loan options from national lenders, see our full breakdown of the best private student loan companies for 2021.

State-specific Georgia student loan refinance options

Refinancing your student loans could help you save money in interest charges or pay off your loans faster. But keep in mind that if you have federal loans, refinancing with a private lender will cause you to lose several borrower benefits and government protections.

Related: Should You Refinance Federal Student Loans? 5 Key Factors to Consider

For some borrowers, these benefits might be more valuable than the money they could save by refinancing. But for federal borrowers who aren’t using an income-driven repayment (IDR) plan or pursuing federal forgiveness, refinancing could still make sense.

If you think that student loan refinancing is right for you, below are two options that you can only take advantage of if you live in Georgia.

Georgia’s Own Student Choice Refinance Loan

In addition to its private student loan options discussed above, Georgia’s Own Credit Union also offers student loan refinancing. Borrowers can refinance up to $100,000 of private and federal student loans, including PLUS Loans.

Unlike its in-school line of credit, the Student Choice Refinance Loan from Georgia’s Own offers both fixed and variable rates with terms of 5 to 15 years.

Student Choice Refinance Loan borrowers who sign up for automatic payments will receive a interest rate discount of 0.25%. And by referring others to the Student Choice Refinance Loan product, existing members and their friends can each earn $100.

Georgia United student loan refinance loans

Georgia United Credit Union members can refinance $5,000 to $100,000 of their existing student loans. These loans come with fixed rates and terms of five to 15 years.

Advantages of Georgia United’s refinance loans include the abilities to transfer a Parent PLUS Loan into the child’s name and to release a cosigner after 48 consecutive on-time payments. But note that you won’t be able to place your loans in deferment should you decide to go back to school.

Georgia student loan refinance options from national lenders

If you’re not happy with the terms or rate of your state-specific Georgia student loan refinance options, you may want to expand your search to include national companies. Here are a few of our favorites at Student Loan Planner®:

- Earnest. This is one of the best student loan refinance companies for flexible repayment. Earnest offers up to a $1000 bonus for Student Loan Planner® readers. Read our review of Earnest.

- Laurel Road. Laurel Road specializes in providing financing for medical profession students. You can also get a bonus of up to $1,050 from Laurel Road.

- ELFI. ELFI places a strong emphasis on customer service. Student Loan Planner® readers can receive a cash bonus of up to $1,099.

- Credible: Credible is your best choice if you’re looking to compare multiple student loan refinancing lenders at the same time. Get a $350 to $1,250 Credible bonus depending on the amount refinanced.

Want even more options for a Georgia student loan refinance? See all 11 of our favorite banks for refinancing student loans.

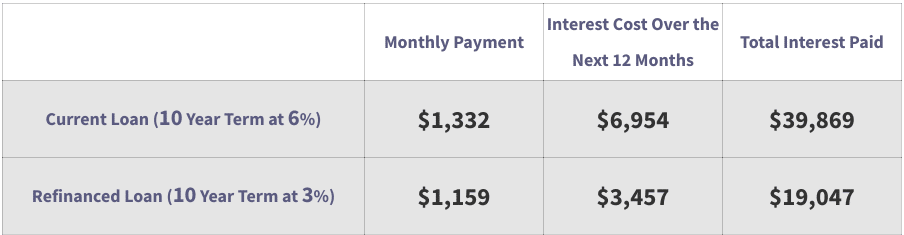

How much could Georgia students save by refinancing?

Using a school’s published cost of attendance estimates, you can estimate how much debt you may end up with at graduation. We’ve done that below for two Georgia schools to give you an idea how much the typical graduate from those schools could save by refinancing their student loans.

First, let’s consider Georgia Tech (GT). The average annual tuition for GT students for the 2020-2021 academic year is $10,058. But tuition charges only account for about a third of GT’s total cost of attendance. After food, room and board, books and supplies, and mandatory fees are accounted for, the annual cost to attend GT increases to $29,158 per year.

Multiplying $29,158 by four, and the cost of a bachelor’s degree at GT is closer to $116,632. But, again, that’s not the full story. With the exception of subsidized loans, interest will accrue on those loans while students are in school. Also, the estimate above doesn’t take annual tuition increases into account.

To keep things simple, we’ll conservatively estimate that GT students who don’t have access to alternate funding sources may need to borrow $120,000 to cover the cost of a bachelor’s degree. With an average loan interest rate of 6.00% and a refinance rate of 3.50%, the Student Loan Planner® calculator shows that GT graduates would save more than $20,000 over the life of their loans.

For another example, let’s consider students who earn their MBAs from Emory University. Currently, the cost of attendance for the Emory MBA program is $134,200.

After accounting for interest accumulation and tuition inflation, we’ll assume that the average graduate ends up with $170,000 of student loans. At that debt level, you could save nearly $30,000 by refinancing from an average interest rate of 6.00% down to 3.00%.

These examples only show how much the average student at two popular Georgia schools could save by refinancing. Although they can help you estimate your own potential savings, try using the Student Loan Planner® refinance calculator if you’d like to see more concrete numbers.

How to qualify for student loan forgiveness in Georgia

One great way to reduce your out-of-pocket education cost in Georgia is to earn student loan forgiveness. In addition to federal options like the Public Service Loan Forgiveness (PSLF) program, here are a few Georgia-specific student loan forgiveness programs.

- Student Access Loan (SAL) Program: Program participants can earn one year of corresponding student loan cancellation for each qualifying year of public service work, or apply for full loan discharge after graduating with a cumulative GPA of at least 3.5.

- Physicians for Rural Areas Assistance Program (PRAA): Physicians who participate in the program can receive up to $25,000 per year ($100,000 four-year maximum) of cancellable student loans for medical professionals. You must work in one of Georgia’s underserved rural areas.

- Georgia Physician Loan Repayment Program (GPLRP): Physicians from qualifying specialties who participate in this program can receive up to $25,000 per year ($100,000 four-year maximum) of cancellable student loans. Physicians must provide direct patient care in a rural Health Professional Shortage area.

- Dentists for Rural Areas Assistance Program (DRAA): Dentists who participate in the program can receive up to $25,000 per year ($100,000 four-year maximum) of cancellable student loans. Providers must offer direct patient care in rural areas of Georgia that are medically underserved.

- Physician Assistant Loan Repayment Program (PALRP): Physician assistants who participate in the program can receive up to $10,000 per year ($40,000 four-year maximum) of cancellable student loans. You’ll need to work in underserved, rural areas of Georgia.

- Advanced Practice Registered Nurse Loan Repayment Program (APRNLRP): APRNs who participate in the program can receive up to $10,000 per year ($40,000 four-year maximum) of cancellable student loans. A requirement for the program is providing direct patient care in an underserved, rural area of Georgia.

Planning to attend college in Georgia? If so, consider scheduling a pre-debt consultation with a Student Loan Planner® advisor. An advisor can work with you to find the best ways to finance your bachelor’s or graduate degree.

Refinance student loans, get a bonus in 2025

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

For refinancing 100k or more (bonus from Student Loan Planner®, not SoFi®)

|

Fixed 4.49 - 9.99% APR

Variable 5.99 - 9.99% APR with all discounts with all discounts |

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 4.45 - 10:49% APR

Variable 5.88 - 10.49% APR

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 4.29 - 10.24% APPR

Variable 4.86 - 10.24% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 4.99 - 8.90% APR

Variable 5.29 - 9.20% APR

|

|

|

$1,099 Bonus

For 150k+, $300 to $500 for 50k to 149k.

|

Fixed 4.88 - 8.44% APR

Variable 4.86 - 8.24% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 3.85 - 11.38% APR

Variable 4.33 - 12.35% APR with autopay with autopay |

Not sure what to do with your student loans?

Take our 11-question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, SAVE or another IDR plan, or refinancing (including the one lender we think could give you the best rate).