Editor's note: In 2022, Aidvantage took over for Navient for federal student loans. Navient announced on January 13, 2022, that they had reached a settlement with 39 state Attorneys General, providing $1.7 billion in forgiveness to some borrowers with private student loans held by the company (most of these loans were in default). In addition, in September 2024, Navient reached a settlement with the CFPB that will pay $120 million to some borrowers who had federal student loans serviced by Navient in the past. Several hundred thousand or more borrowers could qualify, with a potential average award in the couple hundred to few hundred dollar range. We include the full details of who qualifies and when to expect relief in the article below.

Navient has consistently ranked as one of the most disliked student loan servicers among borrowers. There are also several Navient lawsuits that contend the servicer’s missteps have indeed entered into criminal territory. With so many customer service and repayment guidance complaints, student loan borrowers need to be aware of options for Navient student loan forgiveness.

Here’s a quick update on major happenings with Navient.

- There have been several Navient lawsuits that contend the servicer’s missteps have indeed entered into criminal territory. A major settlement was reached in January 2022 that includes $1.7 billion in private student loan debt cancellation and $95 million in restitution payments to certain federal student loan borrowers.

- In September 2021, Navient announced its desired departure from the student loan servicing business, with plans to transfer its six million federal borrower accounts to a company called Maximus Education. However, Maximus created a subsidiary called Aidvantage, which will now be the official student loan servicer for those who were previously stuck with Navient.

It’s important to understand there are no exclusive Navient student loan forgiveness programs. However, there are many general student loan forgiveness programs that Navient borrowers may be eligible for. Additionally, some student loan borrowers might be automatically eligible for loan cancellation or restitution payments due to the recent settlement.

Let’s take a look at the Navient loan forgiveness options available today.

What kind of Navient student loans do you have?

Despite once being the same company, Navient and Sallie Mae are now completely separate organizations. Navient loan forgiveness is not the same as Sallie Mae loan forgiveness.

Because of its history with Sallie Mae, however, Navient services a mix of private and federal student loans. You’ll want to know which kind you have. It makes a big difference in terms of which forgiveness programs you qualify for.

To find out what kind of student loans you have with Navient, you can contact them directly or conduct a “Financial Review” on the National Student Loan Data System (NSLDS).

If you have federal student loan debt, those loans will be eligible for federal forgiveness programs like Public Service Loan Forgiveness (PSLF Program). But private student loans won’t be. Private student loans may be eligible for forgiveness through state or profession-specific student loan forgiveness programs. For a full list of programs, check out the Ultimate Guide to Student Loan Forgiveness.

Navient loan servicing failures: 2024 settlement details

The CFPB accused Navient of numerous practices that hurt borrowers financially during Navient's role as a federal student loan servicer.

These practices include:

- Charging the wrong monthly payments

- Steering borrowers into forbearance and deferment instead of low IDR payments

- Inaccurate credit reporting

- Providing incorrect information about PSLF

- Charging incorrect late fees

Navient is barred from servicing federal student loans again as part of the settlement.

How to Know if you Qualify for the 2024 Navient Settlement

$120 million may sound like a lot of money, but $100 million will be paid out to borrowers and $20 million will be paid to the civil penalty fund.

You will not need to apply for this settlement amount. The CFPB will work with Department of Ed to try and select borrowers automatically based on your account information.

However, some of the CFPB's accusations are easier to identify than others. For example, being told incorrect info about PSLF is more difficult to prove than if Navient charged a late fee that was much higher than it was supposed to.

Hence, we have low confidence in the fairness of the CFPB and Department of Ed's application of who would qualify for this settlement.

Additionally, if hundreds of thousands of borrowers (or more) qualify, that suggests an average award in the could hundred dollar range.

This per borrower award is not something to get overly excited about given its small average payout.

Navient loan cancellation and restitution payments: 2022 settlement details

On January 13, 2022, a major settlement was announced that will provide “relief totaling $1.85 billion to resolve allegations of widespread unfair and deceptive student loan servicing practices and abuses in originating predatory student loans”, according to the Pennsylvania Attorney General.

Although the settlement allows Navient to dodge any admission of misconduct, it requires Navient to:

- Cancel the remaining balances on $1.7 billion in subprime private student loan balances owed by more than 66,000 borrowers.

- Provide $95 million in restitution payments to approximately 350,000 federal loan borrowers who were steered into long-term forbearance, equaling about $260 each.

- Pay $142.5 million to the attorney generals.

- Conduct various internal reforms aimed at benefiting student loan borrowers.

If you qualify for loan cancellation under this settlement, you’ll be automatically notified by Navient by July 2022. You should receive a refund for any payments made on the canceled debt after June 30, 2021.

If you’re eligible for restitution payments, be sure to update your address and contact information within your StudentAid.gov account from the U.S. Department of Education. You should receive a postcard in the mail from the settlement administrator sometime in spring 2022.

Who qualifies for the 2022 Navient private student loan settlement benefits?

Although you don't have to do anything to receive loan cancellation or restitution payments under the Navient settlement, you might still be wondering if you qualify.

Here's a brief summary, including images from the “Common Questions” section of the Navient Multi-State Settlement informational website.

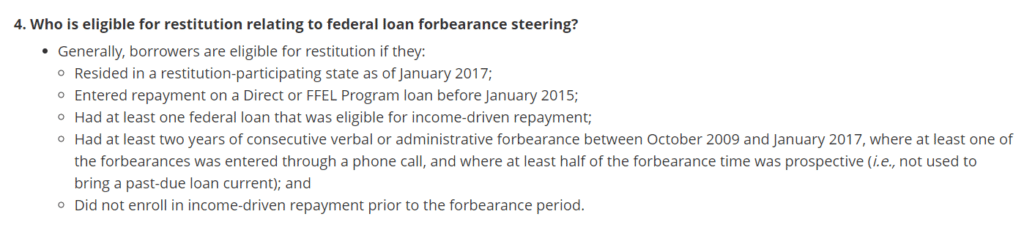

- Restitution eligibility. Federal loan borrowers who were placed in long-term forbearances instead of income-driven repayment plans (IDR plans). Must have been a resident of one of the following participating states or had an address with a military postal code as of January 2017: AZ, CA, CO, CT, DC, DE, FL, GA, HI, IA, IL, IN, KY, LA, MA, MD, ME, MN, MO, NC, NE, NJ, NM, NV, NY, OH, OR, PA, TN, VA, WA, and WI.

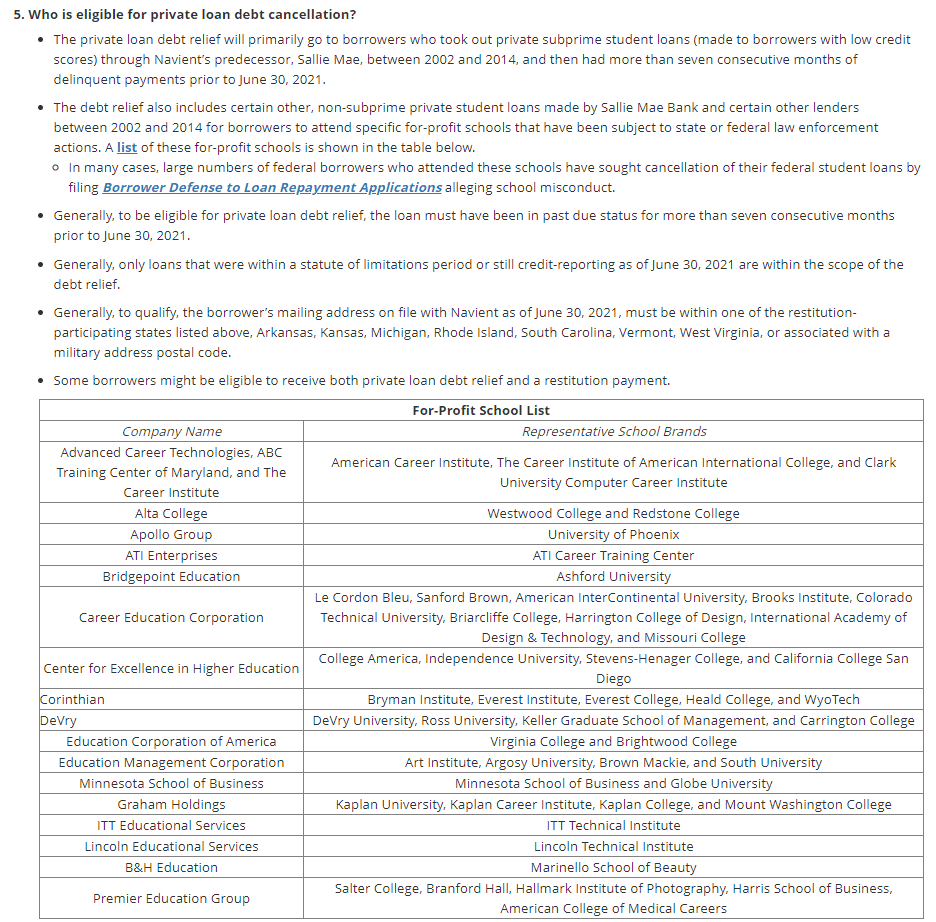

- Loan cancellation eligibility. Private student loan borrowers who took out subprime loans with Sallie Mae between 2002 and 2014, and then had more than seven consecutive months of delinquent payments. Must have mailing address on file with Navient as of June 30, 2021, with one of the above participating states or AR, KS, MI, RI, SC, VT or WV.

Navient student loan forgiveness for federal loans now at Aidvantage

If you had federal student loans with Navient, they are likely now with Aidvantage. Here are several forgiveness options that are available to you.

1. Income-driven repayment (IDR) forgiveness

Currently, the Office of Federal Student Aid at the Department of Education offers four income-driven repayment plans for its loans.

- Pay As You Earn (PAYE) Plan

- Saving on a Valuable Education (SAVE), formerly REPAYE, Plan

- Income-Based Repayment (IBR) Plan

- Income-Contingent Repayment (ICR) Plan

By taking advantage of these income-driven repayment plans, you may be able to lower your monthly payment amount. Plus, you may be eligible to receive Navient student loan forgiveness once you reach the end of your repayment schedule.

Depending on the plan that you choose, you’ll be eligible for forgiveness in 20 to 25 years. But you’ll want to stay vigilant to make sure that your federal student loan payments are being handled correctly. And you’ll need to recertify your income and family size each year.

And keep in mind, if you do receive forgiveness, you’ll owe income tax on the forgiven amount. So if income-driven repayment (IDR) forgiveness is your strategy, make sure to save a little money each year for the tax bill that’s coming down the road.

2. Public Service Loan Forgiveness (PSLF)

If you work for a qualifying employer in the public sector, such as the government or a non-profit organization, the Public Service Loan Forgiveness program is probably your best student loan forgiveness option. With PSLF, you can earn tax-free student loan forgiveness in as little as 10 years (or 120 qualifying student loan payments).

It should be pointed out that the Department of Education has selected FedLoan Servicing as the exclusive servicer of the Public Service Loan Forgiveness program. This means you can only qualify for this program if FedLoan is your servicer. But don’t worry if you’re with Navient right now.

You can apply for PSLF on the StudentAid.gov website. If you’re accepted to the program, Navient will automatically transfer your federal student loans to FedLoan Servicing. The Department of Education says that it will notify you if you’ve been accepted to the program. But if it’s taking longer than you think is reasonable to get an answer, you can call FedLoan Servicing at 1-855-265-4038 to ask for a status update.

Note that Parent PLUS Loans don't qualify for PSLF. However, Parent PLUS borrowers can become eligible by taking out a Direct Consolidation Loan. It's also important to understand that, with Parent PLUS Loans, it's the parent's employment that must qualify for PSLF, not the student's.

3. Teacher Loan Forgiveness

Teachers might be eligible for up to $17,500 of Navient student loan forgiveness through the Teacher Loan Forgiveness Program.

But to qualify, you’ll need to be considered a “highly qualified” teacher by the Federal Student Aid office at the Department of Education. And you’ll need to teach five consecutive academic years in a low-income elementary school, secondary school, or educational service agency.

It’s important to point out that PSLF and Teacher Loan Forgiveness don’t mix well. In many cases, you might be better off sticking with PSLF.

4. Loan Discharge

This isn't technically a “forgiveness” option. But it should be noted that there are several ways that federal student loan borrowers can become eligible to have their student loans discharged.

One example is Total and Permanent Disability (TPD) discharge. To qualify for TPD discharge, you'll need to provide medical documentation of your disability. Eligible loans for Total and Permanent Disability (TPD) discharge include Direct Loans, FFEL loans, and Perkins Loans.

The Federal Student Aid Office will also discharge your student loans if you die or, in the case of a Parent PLUS Loan, your parent dies. Other federal discharge options include closed school discharge, false certification or unauthorized payment discharge, and borrower defense discharge.

Get rid of Navient or Aidvantage by refinancing

If you have private student loans and don’t qualify for any of the above student loan cancellation programs — or even if you do — you may want to consider refinancing your Navient student loans. By refinancing, you could kill two birds with one stone.

It’s your chance to kick Navient to the curb, and you may save money on student loan interest, too. So, while refinancing isn’t student loan forgiveness, it could be your best Navient student loan strategy.

But how can student loan borrowers know when refinancing is the right move? Here are three questions to ask yourself:

1. Will you be eligible for federal forgiveness soon?

If you’re just starting student loan repayment, refinancing could save you a lot of money over the life of your loans.

But if you’ve already made three years of federal student loan payments toward Teacher Loan Forgiveness or five years toward Public Service Loan Forgiveness while working full-time, that changes the discussion completely. If you’re already well on your path toward earning Navient student loan forgiveness through a federal program, you should avoid refinancing with any private lenders.

If you do choose to stay with Navient, make sure you’re on the right repayment plan and filing your taxes the right way. You should also be vigilant in making sure that Navient is handling your loans correctly. If your loans are in default with Navient, you may need to reach out to a student loan attorney.

2. What is your financial situation?

When you refinance federal student loans, you become ineligible to base your monthly payment amount on your income or to apply for federal forbearance or deferment. Your loan type changes from federal to private. So in other words, federal student loan borrowers will have less payment flexibility with private student loans. Rain or shine, the bills will just keep on coming — while federal borrowers have taken advantage of the recent payment pause and are hoping for Biden's debt relief to go through.

So, do you have an emergency fund in place? If not, you may want to reach that goal before refinancing federal student loans.

There are two other financial factors to consider: your credit score and debt-to-income ratio. If you have a credit score over 650 and you owe less than 1.5 times your income, you could be a prime candidate for refinancing. Otherwise, you may want to stick with the loans you received from the Federal Student Aid office.

3. Have you achieved career stability?

If you only expect your income to grow over the next few years, refinancing could be a great move. Income-driven repayment plans will become progressively less helpful as you make more money. Plus, you’ll be shackled to your student loans for 20 years or more, and you’ll pay a lot more in interest.

But if your job situation is unstable, you may want to stick with federal student loans since they provide more repayment options. Knowing that income-driven repayment (IDR) is available if you were to need it can be a comfort. And if your job situation stabilizes, you can always refinance later.

Save money and hassle

Wondering if refinancing is worth it? Consider this. Let’s say you had $100,000 in student loans at 6.5% interest rate. Let’s also say that you chose to stay on the Standard 10-Year Repayment Plan. In that case, you’d pay $36,257 in interest over the life of your loans.

But by refinancing to private student loans at 3.5%, your interest cost would drop to $18,663. That’s a savings of over $17,500. Plus, you’d have a lower monthly payment amount along the way and would be free of Navient and its problems. Just make sure to review your credit report and score to see if you qualify.

If you’re thinking about refinancing your Navient student loans, Student Loan Planner® can help you find a great deal. By taking smaller payouts than our competitors for our referral links, we’re able to offer our readers some of the highest cash bonuses available online.

Depending on your student loan balance, you may be eligible to earn a $350 to $1,250 cash-back bonus. See how much you could save!

Refinance student loans, get a bonus in 2025

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

For refinancing 100k or more (bonus from Student Loan Planner®, not SoFi®)

|

Fixed 4.49 - 9.99% APR

Variable 5.99 - 9.99% APR with all discounts with all discounts |

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 4.45 - 9.89% APR

Variable 5.88 - 9.99% APR

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 4.29 - 10.24% APPR

Variable 4.86 - 10.24% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 4.99 - 8.90% APR

Variable 5.29 - 9.20% APR

|

|

|

$1,099 Bonus

For 150k+, $300 to $500 for 50k to 149k.

|

Fixed 4.88 - 8.44% APR

Variable 4.86 - 8.24% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 3.85 - 11.38% APR

Variable 4.33 - 12.35% APR with autopay with autopay |

Not sure what to do with your student loans?

Take our 11-question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, SAVE or another IDR plan, or refinancing (including the one lender we think could give you the best rate).

Comments are closed.