According to the Federal Reserve, the average student loan payment is between $200 and $299, but this figure only includes borrowers who are actively making payments.

Your monthly student loan payment can vary dramatically depending on the details of your student loans and other financial information, like discretionary income and family size.

Considering the number of repayment plans available and the gap between the when you take out your student loans and when you start paying them off, it’s common for borrowers to be confused about what they’re loan payment will actually look like.

Here’s what you need to know to estimate how much your monthly student loan payment will be.

How to calculate your federal student loan payment

One of the greatest benefits of having federal student loans is having the ability to take advantage of various repayment options. But having those options can make figuring out your monthly payment complicated.

Depending on the repayment plan you choose, the government will look at several primary areas of information to determine your monthly student loan payment. For example:

- Standard Repayment Plan: Calculated based on your loan amount and interest rate over a 10-year repayment period

- Graduated Repayment Plan: Monthly payments start off smaller and significantly increase over time

But there are other plans that can make your payment more affordable while also providing an option for loan forgiveness after the repayment period has been completed.

How payments are adjusted on income-driven repayment plans

On an income-driven repayment (IDR) plan, your monthly loan payment is calculated each year based on your income and family size. IDR plans include:

1. Revised Pay As You Earn (REPAYE)

Your payment is based on 10% of your income. Your repayment term will be 20 years for undergraduate loans and 25 years for graduate school loans.

2. Pay As You Earn (PAYE)

Your payment is based on 10% of your income. To qualify, you must have borrowed a Direct Loan after October 1, 2007, and had a disbursement on or after October 1, 2011. Your repayment term will be 20 years.

3. Income-Based Repayment (IBR)

If you took out federal loan before July 1, 2014, your monthly payment will be calculated based on 15% of your income. Your repayment period will be 25 years.

4. IBR for new borrowers

If you’re a new borrower — meaning you borrowed after July 1, 2014 — your payment will be 10% of your income. Your repayment term will be 20 years.

5. Income-Contingent Repayment (ICR)

Your payment is based on 20% of your income or on a fixed payment over 12 years, whichever is less. Your repayment term will be 25 years.

Although IDR plans can reduce your monthly payment, there are additional nuances for each plan that require consideration. For example, you must recertify and update changes to your income and family size each year under an IDR plan. This update can cause your payment to fluctuate over time.

Additionally, you could be faced with a significant tax bomb when your remaining loan balance is eventually forgiven.

How to calculate your payment on an IDR plan

To calculate your IDR monthly payment, your loan servicer uses your discretionary income and family size to determine your monthly payment.

To figure out your discretionary income that will determine your monthly payment, follow these steps:

- Look up the Federal Poverty Line (FPL) for your family size.

- Multiply the FPL number for your family size by 150% to get your deduction.

- Take your adjusted gross income (AGI) from last year’s tax return and subtract the deduction from it.

The discretionary income formula looks like this:

AGI – (FPL x 1.5) = Discretionary Income

Each IDR plan then uses a percentage of your discretionary income to determine your monthly payment.

To estimate your payment under each plan, multiply your discretionary income by the IDR plan’s income percentage. Then split this amount into 12 monthly payments.

| Plan | Percentage |

|---|---|

| REPAYE (20-25 years) | 10% |

| PAYE (20 years) | 10% |

| Old IBR (25 years) | 15% |

| New IBR (20 years) | 10% |

| ICR (20 years) | 20% (or fixed payment over 12 years) |

The IDR monthly payment formula is broken down like this:

(Discretionary Income x IDR Percentage) / 12 Months = Monthly Payment

Keep in mind that you won’t be automatically enrolled in an IDR plan. You must submit an IDR application and then recertify your income each year after.

Compare how much your payment will be on different plans

Let’s look at how your loan payment could change based on the repayment plan you choose. We’ll focus on the most common IDR plans and the standard repayment plan for this example.

Let’s say you’ll end up with $200,000 with in federal loans and your expected AGI is $100,000.

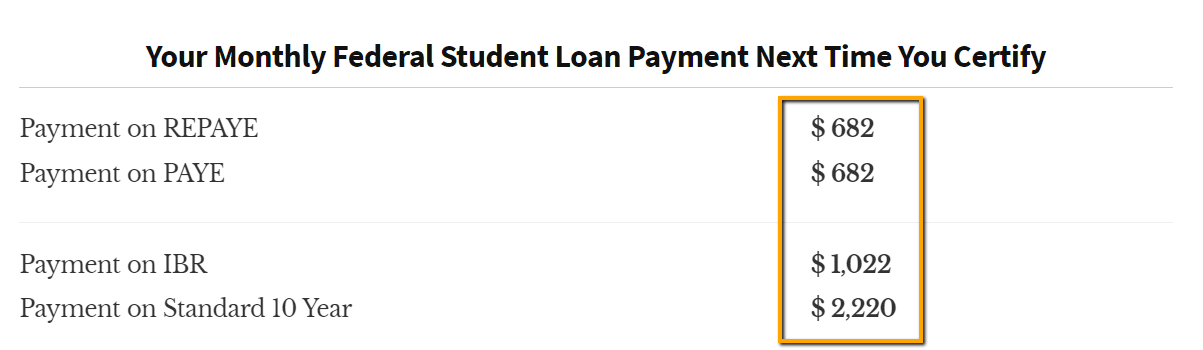

The chart below from Student Loan Planner®’s free student loan payment calculator breaks down monthly payments under each IDR plan:

If you aren’t married and don’t have any dependents, your payment would be over $2,000 a month on the standard repayment plan.

But if you apply for REPAYE or PAYE, your monthly payment could start off in the $600-$700 range instead.

Factors that can impact your monthly federal student loan payment amount

Your monthly payment can change for a variety of reasons, but there are a couple of general scenarios that can act as a guide when figuring out your monthly payment:

- Changes to your family size. For every dependent added to your household, you can expect your monthly payment to drop by about $50 on an IDR plan.

- Your tax filing status. If you’re married and on the PAYE or IBR plans, you may be able to reduce your monthly payment by filing as “married filing separately.” Your payment will then be calculated using only your income.

Use our Student Loan Payment Calculator below to quickly compare repayment options based on your student loan situation.

Student Loan Payment Calculator

Your Monthly Federal Student Loan Payment Next Time You Certify

How to estimate your payment for private student loans

If you have private student loans, your monthly payment will depend on how much you borrowed, your interest rate and your loan repayment term.

Private student loans generally fall under a 10-year repayment plan, but you can find other options depending on your needs and the loan terms.

Key differences of private student loan payments

As a general guide, you can expect your monthly payment to be as follows:

- To pay off a 10-year loan, your monthly payment will be approximately 1% of the principal balance.

- To pay off a 5-year loan, your monthly payment will be around 2% of the principal balance.

Unlike federal loan servicers, your private loan company won’t typically offer a repayment plan based on your income. So, you’ll need to be prepared to make the full required payment each month throughout your entire repayment period.

Refinancing your private student loans

You can refinance your private student loans at any time to take get a lower interest rate or better terms.

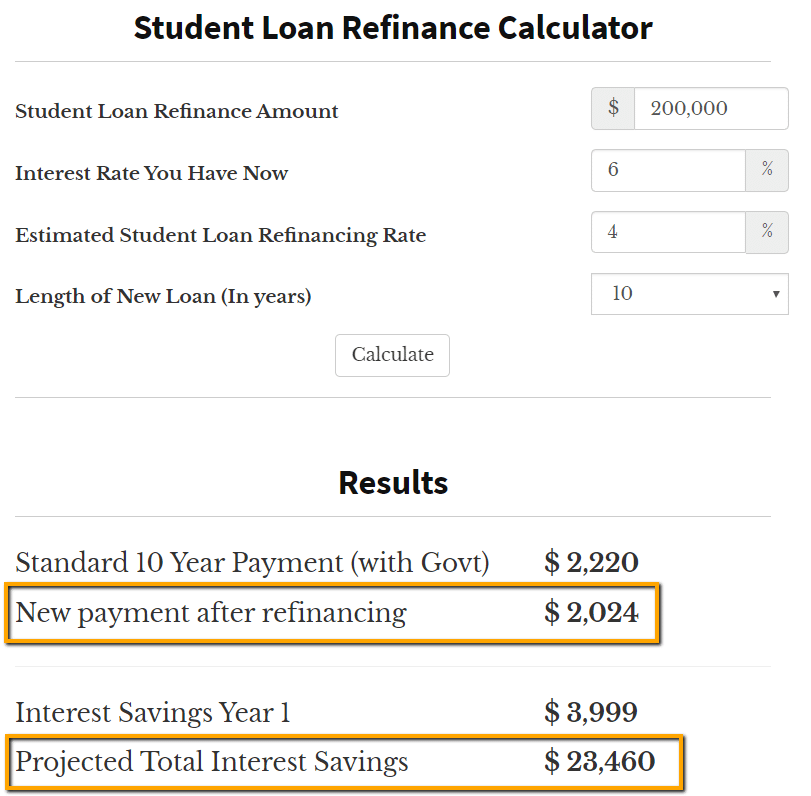

Similar to our previous example, let’s say you have $200,000 in private loans with a 6% interest rate over a 10-year repayment period. Your monthly payment would be $2,220.

Using our Student Loan Refinance Calculator, you could save approximately $200 a month — or more than $23,000 over the life of your loans — by refinancing to a 4% interest rate.

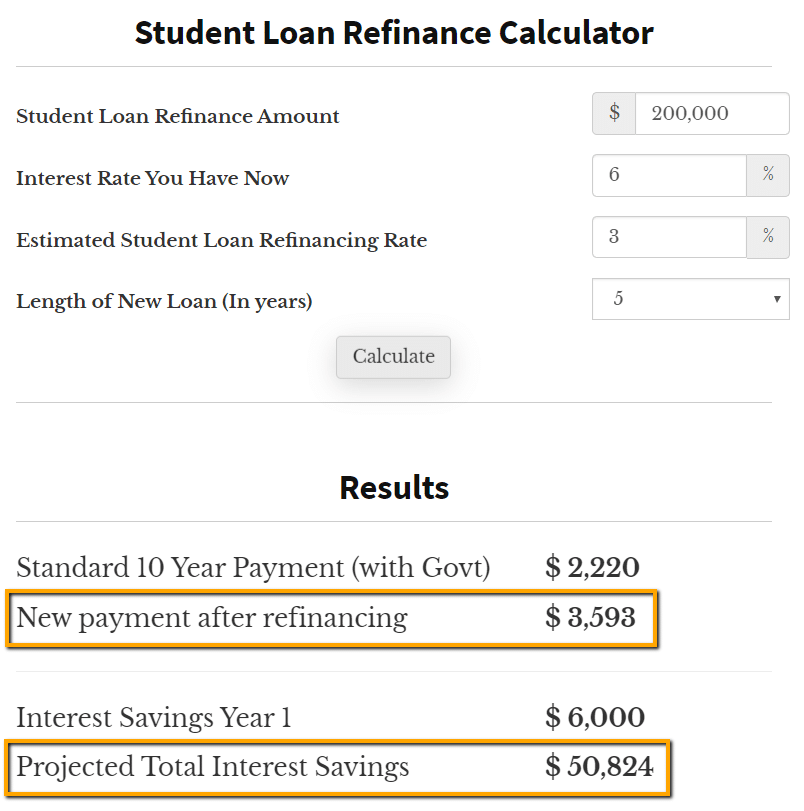

If you can afford higher monthly payments, you can save more in the long run by refinancing with a five-year plan, which can score you an even lower interest rate.

Impacts of lower interest rates

Let’s say you’re able to secure a 3% interest rate with a five-year term. Your monthly payment would significantly increase, but you’d also save over $50,000 in interest.

To see how much you could save by refinancing, use our Student Loan Refinance Calculator to plug in your own numbers.

Student Loan Refinancing Calculator

Student Loan Balance ($) Enter the total balance of all student loans you wish to refinance.

Current Interest Rate (%) Enter the weighted average interest rate of all of your student loans.

Term Remaining (years) Enter the number of years left until you pay off your current loan(s).

Interest Rate After Refinancing (%) Enter the estimated interest rate of your new (refinanced) student loan.

Term length of new loan (5 years) Enter the term length of your new (refinanced) student loan.

| Monthly Payment | Interest Cost Over the Next 12 Months | Total Interest Paid | |

| Current Loan (10 Year Term at 7%) | |||

| Refinanced Loan (5 Year Term at 5%) |

After Refinancing

| Monthly Payment | Interest Cost Over the Next 12 Months | Total Interest Paid |

Current Loan Amortization Table

Refinanced Loan Amortization Table

What happens if I have federal and private student loans?

Any payment calculations for your federal loans are independent of your private loans — and vice versa.

Because of this, you shouldn’t choose to refinance just a portion of your federal student loans. If you do, your payments will stack on top of each other rather than reducing your overall payment.

Don’t make this refinancing mistake

Let’s see how refinancing would play out using our previous federal loan example of a $200,000 loan balance.

We know under an IDR plan, your payment would be $682 a month. If you refinanced $50,000 of your highest interest rate loans to a 10-year loan at 4%, your federal IDR payment would still remain at $682.

But now, you’d also have an additional $500+ payment in private loans. So even though you thought you would benefit from refinancing, you’d unintentionally cause your total monthly payments to balloon to over $1100.

The only way a private loan truly replaces a federal loan is if you refinance your full loan balance. Otherwise, the new private loan becomes and added payment, which can quickly result in an even bigger financial burden.

Find the best repayment plan for your student loans

Each student loan journey is unique, so you’ll need to try out different calculations using your own finances to find the best student loan payment plan for you.

If you want access Student Loan Planner®’s powerful student loan repayment calculator, provide your name and email using the button below.

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, IDR, or refinancing (including the one lender we think could give you the best rate).