Founded in 1919, the Pennsylvania College of Optometry (PCO) was Salus University’s first college. And since then, its staff and students have been trailblazers in optometry academics.

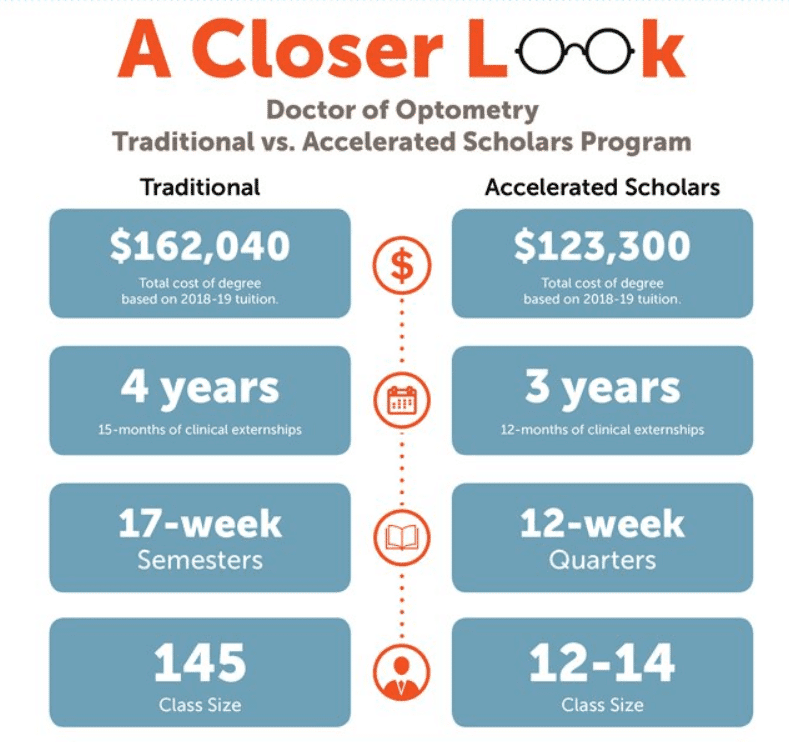

In addition to its traditional Doctor of Optometry program, the school also offers an Accelerated Scholars Program. And it has advanced placement programs, including for international students.

Salus University Optometry is the only optometry school to offer advanced studies certificates. Currently, students can earn advanced study certificates in the following specialties:

- Anterior segment

- Contact lens

- Binocular vision and vision therapy

- Neuro-ophthalmic disease

Salus University PCO students have the opportunity to experience being on the cutting edge of optometry research and education. And that could make Salus University Optometry very appealing to prospective students. But when it comes to picking out an optometry school, you also need to consider the cost.

Here’s a breakdown of Salus University Optometry tuition costs. We’ll also look at how much student debt you could end up with and how to handle it.

Salus University Optometry tuition

For the clearest picture of your Salus University Optometry costs, start with which degree program you plan to enroll in.

This is the current Salus University Optometry tuition for each program:

- Traditional Doctor of Optometry Program (4 years): $40,920 per year

- Doctor of Optometry Scholars Program (36 months): $41,510

- Master of Science in Clinical Optometry with Advanced Studies Certificate: $55,000

You’ll also pay administrative expenses of less than $1,000 with each program. Do you plan to enroll in the Advanced Placement OD Program? Salus University says that you’ll be charged the same tuition as students in the traditional program.

It’s important to point out that the total Salus University Optometry cost isn’t limited to tuition. You’ll also need to pay for books and equipment. On its website, Salus University Optometry also notes that students should plan for living expenses of around $2,200 a month.

How much Salus University Optometry student debt to expect

In Salus University Optometry’s four-year program (or Advanced OD Program), you’ll pay over $160,000 in tuition expenses alone.

And if you lived on campus for just 10 months out of every year, you could be looking at an additional $20,000 or more a year in living expenses. That could add another $80,000 to your Salus University Optometry cost of attendance:

$160,000 (Salus University Optometry Tuition) + $80,000 (living expenses) = $240,000

Yes, you could be looking at $240,000 or more of student debt from Salus University Optometry.

How to reduce your Salus University Optometry student debt

One of the best ways to reduce your Salus University Optometry cost is by enrolling in its Accelerated Scholars Program. If you’re able to get accepted to the program, it could cut a year’s worth of tuition off your total Salus University Optometry cost.

And you’ll also save a year’s worth of living expenses. The Accelerated Scholars Program is a great opportunity to minimize student debt.

PCO also lists a large number of internal scholarships and external optometry scholarships that are available to students. You’d be wise to check out those lists and apply to all the scholarships that you think you may qualify for. By taking advantage of these kinds of opportunities, you can reduce your student debt.

But don’t expect to eliminate it completely. According to College Scorecard, the median student debt for Salus University Optometry grads is $182,001.

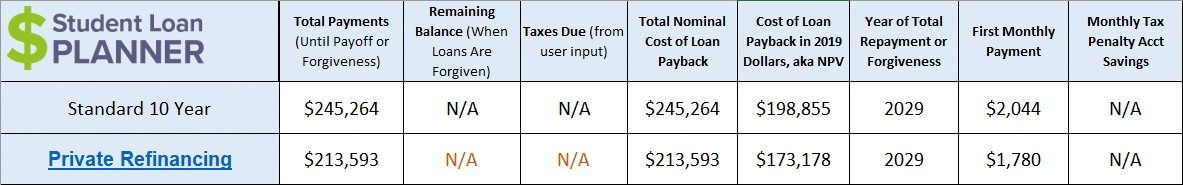

And if you enroll in the four-year program or don’t receive any grants or scholarships, you could easily pay more than that. After taking accrued interest into account, you could end up with over $250,000 of student debt.

Sound high? Actually, that number lines up with what Student Loan Planner® has seen in consultations with optometrists. The average OD that Student Loan Planner® consultants have worked with has $267,000 in student debt.

Is Salus University Optometry worth the student debt?

On its Careers in Optometry page, PCO mentions an American Optometric Associations survey that found average optometrists’ net incomes range from $140,013 to $172,356.

If you do a quick google search of the survey, you’ll have trouble finding it. But you will find several other optometry schools that proudly flash the same stat. And while an income of $140,000 to $172,000 sounds exciting, the devil is in the details.

Those numbers only applied to optometrists who owned their own private practice. The AOA’s most recent survey found that private practice non-owners had an average net income of $101,457. That’s still a nice income, but much less than the lofty numbers shown above.

According to the Bureau of Labor and Statistics (BLS), the median pay for all optometrists is $111,790. The good news is that the BLS expects optometry professions to grow 10% over the next 10 years.

If you’re able to land some scholarships to keep your total Salus University Optometry cost under $200,000 (less than two times the median optometrist pay), then it may be worth it. And if you’re able to open a private practice, the numbers could look even better. But your best option may be to look for a state optometry school that’s more affordable.

Related: Is an Optometrist Salary Worth the Student Debt?

What to do about high student debt from Salus University Optometry

These are three main options for repaying Salus University Optometry student debt:

- Pursue loan forgiveness and repayment programs.

- Secure the lowest monthly payments by choosing income-driven repayment (IDR).

- Pay as little as possible in student loan interest and overall cost by refinancing.

Let’s take a closer look at all three strategies.

Forgiveness and repayment programs

For some medical professionals, Public Service Loan Forgiveness (PSLF), is the best repayment strategy. Unfortunately, it can be more difficult for optometrists to find public sector jobs that qualify.

One possibility would be to work for Veterans Affairs. Working for community health centers or for the military would open up other options. If you do happen to work for a qualifying employer, PSLF could be a great choice.

Or if you’re willing to work in high-need facilities or do specific research, repayment programs like the Indian Health Service Loan Repayment Program or the NIH Loan Repayment Program could be worth applying for.

Income-Driven Repayment vs. Refinancing

For everyone else, you have two main options: income-driven repayment or refinancing. If you owe more than 1.5 times your income, an income-driven repayment plan could make your payments more manageable.

And you’ll be eligible for forgiveness after 20 to 25 years of payments. However, you’ll pay more in interest over the life of the loans.

Do you owe less than 1.5 times your income and have a good credit score? If so, you may want to consider refinancing instead. Depending on your credit and income situation, you may be able to lower your interest rate by three or more percentage points.

And that can make a huge difference in your total cost. For instance, let’s say you have $180,000 of student loans at an average interest rate of 6.5%. By refinancing at a 3.5% rate, you could save over $31,000!

We offer borrowers some of the highest cash bonuses available today. If you do plan to refinance your Salus University Optometry student loans, make sure that you shop around with several lenders before making your final choice.

Refinance student loans, get a bonus in 2025

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

For refinancing 100k or more (bonus from Student Loan Planner®, not SoFi®)

|

Fixed 4.49 - 9.99% APR

Variable 5.99 - 9.99% APR with all discounts with all discounts |

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 4.45 - 9.89% APR

Variable 5.88 - 9.99% APR

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 4.29 - 10.24% APPR

Variable 4.86 - 10.24% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 4.99 - 8.90% APR

Variable 5.29 - 9.20% APR

|

|

|

$1,099 Bonus

For 150k+, $300 to $500 for 50k to 149k.

|

Fixed 4.88 - 8.44% APR

Variable 4.86 - 8.24% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 3.85 - 11.69% APR

Variable 4.35 - 12.68% APR with autopay with autopay |