A Certified Public Accountant (CPA) is anyone who has passed the CPA exam. They must also meet the educational and work experience requirements to become licensed as a CPA.

Passing the CPA exam is incredibly difficult in its own right. But, in most states, you’ll need an additional 120 to 150 college credit hours and six months to two years of experience working with a licensed CPA.

With such stringent requirements, it's clear that CPAs are some of the most educated and highly trained tax professionals in the United States. But does your situation require the help of someone with that level of specialized knowledge?

And, if so, how do you find a CPA that’s reputable and will be a good fit for your situation, especially if you have a ton of student loan debt?

You may have federal student loans and private loans, switch repayment plans, and want to know about debt forgiveness and deductions. You need a good student loan accountant who knows what they're doing. Here’s what you need to know about working with a CPA.

Who needs a CPA?

In an era when people are more comfortable than ever with DIY tax filing, do you even need a CPA? If you meet any of the following criteria, hiring a CPA could save you time and money:

- You’re self-employed: A CPA could help freelancers and small business owners maximize their eligible small business deductions offered by the federal government and avoid mistakes that could lead to an audit down the road.

- You make over $200k: According to TurboTax, once you reach that income level, your chances of becoming audited quadruple.

- You have multiple income sources: If you have money coming in from several different places (small business, rental properties, stock investments, etc), calculating your adjusted gross income (AGI) and expected income tax can become more complicated.

- You need to determine the value of your business: Whether you plan to sell your business or need to take out a loan (potentially with a high interest rate), a CPA can help you find an accurate value. For specialized assistance, look for CPAs with the AICPA’s Accredited in Business Valuation (ABV) credential.

- You plan to take out a business loan: A CPA can go over risks with you, determine how much debt your business can handle, and help you choose the best source of financing so you can manage your payments and avoid bankruptcy.

Don’t meet any of those criteria? Then you’re most likely a W2 employee with a relatively simple tax situation. In that case, it may not be worth paying for the services of a CPA.

Do student loan borrowers need a CPA?

While student loans can affect your tax strategy (such as which payment plans to go on, married filing jointly or separately on IDR, etc.), having student debt doesn’t necessarily mean you need a CPA or student loan accountant. Instead, you might want to consider hiring an enrolled agent (EA).

Enrolled agents are federally authorized to represent taxpayers before the IRS (like CPAs) at all levels. Unlike CPAs, enrolled agents don’t specialize in giving business advice and strategic development.

But if you’re just looking for help preparing your taxes, an enrolled agent could get you high-quality results for a lower cost, which could be good if you're low-income or have a middle-class income.

So if you have questions about your taxable income, student loan interest, or how student loan forgiveness may affect your taxes, you can reach out to a CPA or EA.

How to find a CPA

Once you’ve decided that you need a CPA, how do you find the right person? Here are five tips on how to find a CPA that’s right for you.

1. Read online CPA reviews.

Looking at Google reviews for local CPAs is a good place to start. You could also see if they have business listings and reviews on other platforms like Yelp, Angie’s List or Thumbtack.

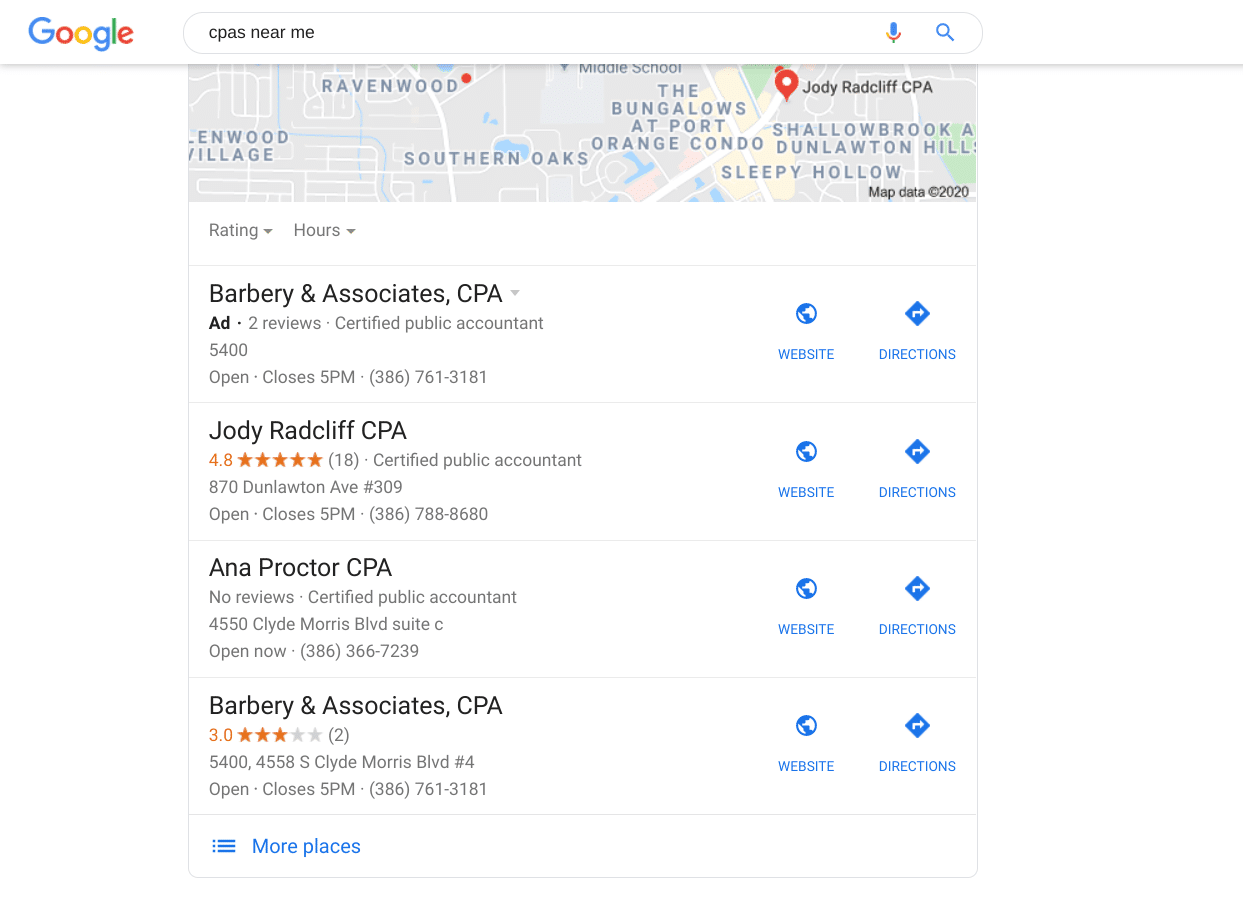

Depending on where you live, however, you may not get very far with online reviews. People don’t leave reviews for CPAs as often as they do for other businesses, like restaurants or hotels. For example, I did a quick search of “CPAs near me.” Here were my search results:

As you can see, the top CPA in my Google My Business snippet (not counting the first ad) had only 18 Google Reviews.

That’s not terrible. But notice that the second CPA on the list had zero reviews and the third CPA only had two.

If you live in a larger city, you may have more luck with online reviews. But, in many cases, you’ll need to dig a little deeper to find the best CPAs near you.

2. Ask your peers and colleagues for CPA referrals.

This is one of my favorite ways to find a great CPA. Simply ask around for recommendations from people you trust.

If several professionals in your industry have glowing reviews of the same CPA, there’s a good chance you’ll be happy with them, too.

If you own a law firm, ask some of your lawyer friends if they have a CPA that they recommend. Or if you own a veterinary clinic, ask other vets if they know a CPA who really understands the veterinary community and similar professions.

By relying on your friends and peers, it may take you no time at all to compile your shortlist of CPA candidates.

3. Look for CPAs with good websites.

While a sharp website doesn’t necessarily prove a CPA’s competence, it does show that they’re familiar with modern technology. And that could mean that they communicate well by email, which is important to the millennial generation.

- Is it easy to book appointments straight from the website or do you need to call?

- Does the website mention a simple process for uploading forms and documents?

- Does the website mention that the CPA is willing to hold appointments via video call?

Answers to these types of questions are all indicators of whether or not the CPA has a modern approach and is comfortable using technology to streamline the process.

4. Find a CPA who specializes in what’s most important to you.

Whenever possible, look for a CPA who specializes in things that matter to you. If you’re a dental practice owner, that means finding a CPA who only works with full-time dental practice owners. Or if you’re a physician practice owner, find one who only does returns for physician practices.

Perhaps you live in a city or state that has a particularly high income tax. In that case, you’d want to look for someone who has a firm understanding of your local tax ordinances.

Or if you run an online business, finding a CPA who understands the nuances of e-commerce could be a smart move. They may know of a particular deduction you can take advantage of and assess your eligibility.

You may not have a CPA near you who specializes in what you need. But you may be able to find qualified CPAs online. Simply search for terms that matter to you, like “best accountants for doctors” or “medical tax accountants.”

Someone who's experienced with your industry and can give business advice might cost more than a CPA who just does taxes. But business owners could find their expertise well worth the money.

5. Verify CPA credentials and licenses

Simply visit CPAVerify.org. CPAVerify is a central database for looking up CPAs and CPA firms. And their data comes directly from each participating state’s Board of Accountancy. See if your State Board of Accountancy sends its data to CPAVerify.

The bottom line

If you're looking for a student loan accountant who understands education loans and student loan repayment, you can see if working with a CPA is right for you.

A CPA may not be needed for everyone, so you can also look at working with an enrolled agent. But if you're dealing with tax stress and managing the nuances of federal loans and private student loans, you may want to get help.

Refinance student loans, get a bonus in 2025

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

For refinancing 100k or more (bonus from Student Loan Planner®, not SoFi®)

|

Fixed 4.49 - 9.99% APR

Variable 5.99 - 9.99% APR with all discounts with all discounts |

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 4.45 - 10:49% APR

Variable 5.88 - 10.49% APR

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 4.29 - 10.24% APPR

Variable 4.86 - 10.24% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 4.99 - 8.90% APR

Variable 5.29 - 9.20% APR

|

|

|

$1,099 Bonus

For 150k+, $300 to $500 for 50k to 149k.

|

Fixed 4.88 - 8.44% APR

Variable 4.86 - 8.24% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 3.85 - 11.38% APR

Variable 4.33 - 12.35% APR with autopay with autopay |

Not sure what to do with your student loans?

Take our 11-question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, SAVE or another IDR plan, or refinancing (including the one lender we think could give you the best rate).