If you're considering a career as a pharmacist, you undoubtedly have a passion for health care and counseling patients on prescriptions. But you'd be completely normal if you've also wondered to yourself: “Are pharmacists rich?”

The good news is that pharmacists are paid well above the median wages in the United States. But the bad news is that they also tend to end up with a lost of student loans.

So are pharmacists rich? Below, we take a closer look at the average pharmacist's financial situation to find out. We'll also see how any pharmacist can become rich by following a few simple steps.

Are pharmacists rich?

The average pharmacists make around $128,000 a year, according to the Bureau of Labor Statistics (BLS). That’s a really nice living, but it’s not as much as a general physician (MD) makes and it's not enough to guarantee becoming rich.

However, income is just a piece of the equation. As we'll see, you can become rich (i.e. build wealth) with a lower income than what pharmacists makes. On the other hand, many pharmacists have a negative net worth due to massive student loan debt.

According to the American Association of Colleges of Pharmacy (AACP), the mean student debt for 2020 pharmacy school grads was $179,514. The numbers were even more staggering for private university grads which took out a median debt load of $213,090.

Is financial planning with SLP Wealth right for you?

Looking for student loan aware financial planning custom tailored for professionals like you? Check out the discounts below for becoming a client of SLP Wealth (our SEC Registered Investment Advisory firm).

SLP Wealth, LLC (“SLP Wealth”) is a registered investment adviser registered with the United States Securities and Exchange Commission with headquarters in Durham, NC.

How to get rich as a pharmacist

Here at Student Loan Planner®, we’ve helped hundreds of pharmacists come up with the optimal plan to pay off their student loans. By working one on one, hearing their stories and doing our own research, we’ve found several factors that impact a pharmacist’s ability to build wealth.

I’m going to take you through those important factors in this article and show you how to leverage that nice income to build a lucrative career and get rich as a pharmacist.

1. Choose a pharmacy school that won’t destroy your finances

The first way to become wealthy is to spend only what’s necessary to get your Doctor of Pharmacy degree (PharmD) and not more than you have to in order to earn that nice pharmacist salary. Whether you have the money saved up for school or you have to take out debt, we want to keep the cost to a minimum.

There are 143 schools of pharmacy in the U.S., but not all are created equal. Some cost a bunch more than others without offering any benefit to future pharmacists. If you’re getting the same education, why pay more?

The best option is to choose an in-state school. No matter where you live, you should have plenty of in-state bachelors degree options. And 47 of the 50 states (plus Washington, D.C. and Puerto Rico) have pharmacology schools — all but Alaska, Delaware and Vermont. Not to say that all of these in-state schools are the cheapest, but it’s best to explore that first. The expected cost of attendance should be $170,000 or less.

Private schools are in the most expensive category. The cost of attendance is well into the $200,000-plus range, with many in the $250,000 range. Why spend $80,000 more for the same certification and credential? What else could you do with $80,000? I can think of many better ideas. These should be avoided at all costs.

Related: 4 Types of Pharmacy Schools Ranked By How Much They Destroy Your Finances

2. Choose a pharmacy job that pays well

There are a number of different places that those in the pharmaceutical industry can work. For example, a pharmacist can work at a hospital pharmacy, in a big-box retail store, a local pharmacy or even an online pharmacy. Where they work will impact their pay.

According to Salary.com, pharmacists that work in retail drug stores and grocery stores get paid the most. The average base salary is around $144,000 while a clinical pharmacist makes $127,000. That may not seem like a huge difference, but it’s $17,000 per year. That could be an extra $1,000 per month in take-home pay, depending on the pharmacist’s tax situation. That extra $1,000 of earning potential can go a long way if it’s saved — but we’ll get into that later.

That being said, plenty of pharmacists aren’t working full time. There have been layoffs, and many recent graduates entering the fray, making full-time, good-paying pharmacist jobs even more competitive. If there’s a decision between a lower hourly rate with full-time hours versus a higher hourly rate without being full-time, be sure to do some math to see which one will pay you more money each year.

Finally, don't forget to pay attention to the average pay for pharmacists in your state. If it's below average, you may want to consult the BLS database to find a state where pharmacists are more in demand. Currently, California and Texas have the highest employment levels for the pharmacist occupation:

3. Choose the right pharmacy student loan repayment plan

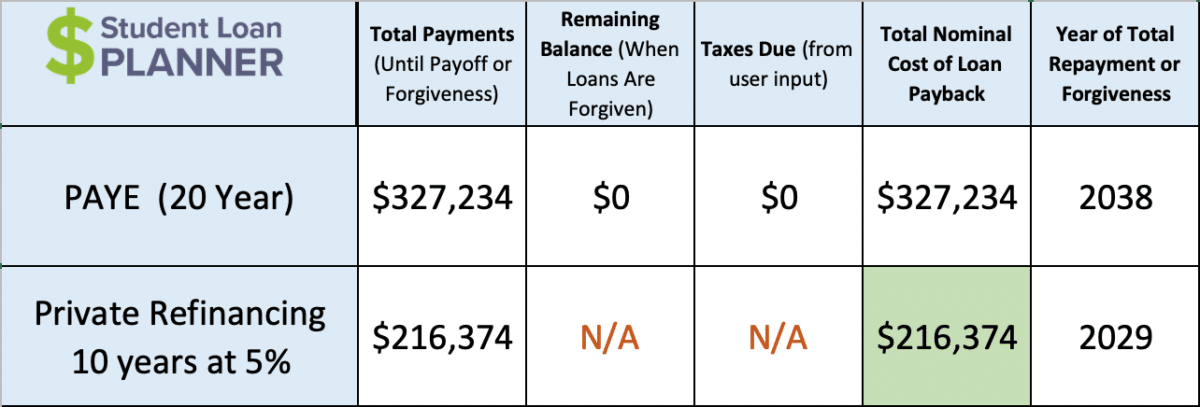

Meet Amber. She’s done everything she can to become a rich pharmacist. She went to a lower-costing school and left with $170,000 in student loans with a 6.5% interest rate. She’s now working at a retail pharmacy full time earning $140,000. Should she get on Pay As You Earn (PAYE), or should she refinance?

She makes the smart move to refinance to a 10-year term at a fixed 5% interest rate. This plan will save her about $111,000 paying back her loans compared to PAYE. That money is hers to keep!

PAYE isn’t even a viable option because her income-driven payments are projected to be high enough to pay off the loan in full in 19 years anyway. She’d be paying back a 6.5% loan over 19 yrs versus a 5% loan over 10 years. That’s where the six-figure savings comes from. Plus, she’d be debt-free in virtually half the time.

If Amber owed $200,000 while making $120,000 or was eligible for Public Service Loan Forgiveness, we’d want to find a better plan for her. It would be a good idea for her to schedule a consult with us if this were this case.

For this example, we're going to assume that Amber is not working in a Health Professional Shortage Area (HPSA). However, if she was, it would also be prudent for her to apply for the National Health Service (NHS) Corps Loan Repayment Program (LRP). The LRP program can provide up to $50,000 of repayment assistance over a two-year period.

4. Focus on your savings rate

Amber is in great shape. She kept her loans to a minimum by choosing an in-state school. She chose a high-paying job and is optimizing her student loan repayment. This on its own is pretty awesome.

Ready to boost the financial potential of your pharmacist career to the next level? I know Amber is! It all comes down to one simple factor: Savings rate.

Did you know that savings rate is one of the biggest predictors of whether or not you'll reach your financial goals? Income is important, but savings rate is even more critical than earnings. We’ve all heard about broke lottery winners. These are people who have won more money than 99.99% will ever have, yet they blow through it. Why? It’s not how much you make, it’s how much you have left over.

Feel like it’s impossible to become a millionaire with six figures of student loan debt? Quite the contrary — it’s extremely possible!

5. Intelligently Purchase Your Home, Possibly with a PharmD Mortgage

You might have heard of a doctor mortgage, but there is actually a special kind of mortgage made exclusively for pharmacists called the PharmD Mortgage.

The PharmD Mortgage allows you to buy a house with a much smaller down payment than with a conventional 20% down mortgage. A PharmD Mortgage also does not charge you PMI, or private mortgage insurance.

If you itemize mortgage interest, then you can borrow more for your house while more aggressively tackling your student loans, which are not tax-deductible.

The main thing that matters when buying a home is keeping the purchase price at a reasonable ratio compared to your household income (we suggest no more than 2.5x if you want to be able to retire in your 50s.

If you're ready to buy your next house, you can check out our quote tool for PharmD Mortgage quotes

What is a savings rate?

Before I go into more detail, let me define “savings rate”. What I mean by “savings rate” is how much money is left over after what is spent. Add student debt payments and retirement plan contributions back to this amount. Then take what’s left over and divide it by income.

For example, Amber’s refinanced student loan payments are about $1,800 per month ($21,600 per year). That’s 15% of her income ($21,600 / $140,000). If she only made payments toward her student loans, we’d consider that to be a 15% savings rate. If she were to do that and save an additional $14,000 (10% more of her income) in a retirement account, we’d call that a 25% savings rate.

What does “being rich” mean?

Next, let me talk about what I mean by being rich. When I say “being rich,” I’m referring to having a substantial net worth. Net worth is what you own of value, including money in savings, retirement, home value, and so forth minus what you owe in debt. Right now, Amber has zero in savings and owes $170,000 in student debt. She has a negative-$170,000 net worth.

The majority of pharmacists might look at this and think that they could never have $1,000,000 and be student debt-free. Not Amber. She knows how to pay off her loans and be a millionaire by the time she’s halfway through her career.

How does she do that? By focusing on her savings rate.

Savings rate examples

We’re making the assumption that the savings rate is first applied to making the student debt payment and that any money left over is invested. We’ll assume a 5% annual return on investment. Not super aggressive nor super conservative.

Let’s start with Amber keeping that 15% savings rate. First, all of that money is going toward her loans. But as her income grows by getting 3% raises each year, she now has money to invest after making her student loan payments.

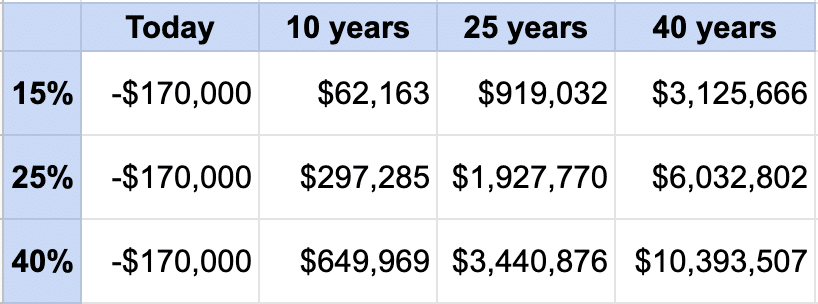

If Amber has a 15% savings rate and gets 3% raises each year, what would her net worth be over time? In 10 years, she’d have just finished paying off her student debt free and have $62,000 in investments. So, $900,000 in 25 years and over $3,000,000 in 40 years. Sounds pretty good, right?

But what about at a 25% savings rate? In 10 years, she’d have just finished paying off her student debt and have almost $300,000 in investments. Close to $2,000,000 in 25 years and over $6,000,000 in 40 years. That’s amazing!

Let’s go crazy here now. What about at a 40% savings rate? In 10 years, she’d have just finished paying off her student debt and have $650,000 in investments. So, $3,400,000 in 25 years — and yes, $10,000,000 in 40 years. That’s an eight-figure net worth!

OK, OK — a 40% savings rate is a little extreme, especially while you still have a mortgage. But 25% is totally attainable. Not bad to retire with $6,000,000 when starting from a $170,000 hole!

Take a look at this table to see how her net worth could change drastically by increasing her savings rate.

This, by the way, doesn’t include any spousal income. If she gets married, these numbers would get even higher with a dual household income.

Even if Amber did everything wrong — including going to an expensive private school, picking an inefficient student loan repayment strategy and taking a low-paying job — the savings rate still makes her a millionaire. It would just take an extra five to 10 years to get there.

How to become a rich pharmacist with pharmacy school debt

After all of the consults and research we’ve done with those in the pharmacist profession, here’s a summary of the four main factors to become a rich pharmacist, even with six figures of pharmacy school debt:

- Choose a credible but inexpensive in-state pharmacy school

- Take a high-paying, full-time position

- Get the optimal student loan plan

- Focus on savings rate

The biggest personal finance mistakes we see are the antithesis of these. Earning a good living is not a guarantee of attaining financial freedom. It takes a combination of all four of these factors.

If you make a mistake in one or two of these categories, it’s not the end of the world. Do what’s most in your control. The third and fourth factors are 100% in your grasp and up to you. Take the time to get the optimal student loan plan and, at the very least, focus on your savings rate.

Comments are closed.