One of the biggest things that has kept me up at night having advised hundreds of millions in student loan debt is how to answer one simple question on the Income-Driven Repayment (IDR) Plan Request form:

“Has your income significantly changed?”

What does that mean? When you’re submitting your IDR Plan Request form for your federal student loans, you want to be honest. But you also don’t want to pay more than you need to.

What is the IDR form used for?

The IDR form is used for federal borrowers who aren't currently on an IDR plan and for those who need to recertify or make changes to their existing repayment plan. The same form is used by all federal loan servicers for each IDR plan, including Pay As You Earn (PAYE), Income-Based Repayment (IBR), Income-Contingent Repayment (ICR) and the new Saving on a Valuable Education (SAVE).

You can complete the IDR form online or by mailing it your loan holder. To complete your initial certification or recertification online, you'll need to log-in to your StudentAid.gov account using your FSA ID and password.

There are detailed instructions for filling out the IDR form. But you should be prepared to provide information about your adjusted gross income, household information (e.g. marital status and family size) and other eligibility requirements. You can use the IRS retrieval tool to quickly submit your income information or choose to support alternative documentation to reflect your current income.

How do you submit an IDR form correctly?

Physicians in residency frequently graduate and suddenly go from earning $60,000 to maybe $250,000. Should you show your new pay stubs or use the past year’s tax returns?

If you say “yes, you earn more” but didn’t need to reveal that, you just paid an extra five-figure amount for no reason.

If you say “no” when you shouldn’t have, you could be at risk of fines, not getting forgiveness or even criminal penalties.

Thank goodness a major change happened on the form that takes away any doubt.

The new IDR Plan Request form makes re-certifying guilt-free

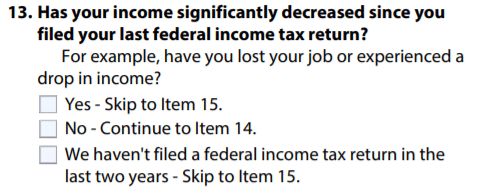

Here’s what the IDR form now says for the infamous question about your income:

From “Has Your Income Significantly Changed” to “Has Your Income Significantly Decreased”

Unless you’re a student loan nerd, then you might have totally missed the earth-shattering change that happened to this criteria question.

Remember, the repayment plan request form used to ask: “Has your income significantly changed?”

Now the IDR form says: “Has your income significantly decreased since you filed your last federal income tax return?”

IDR form submissions will now be much easier

Applying for your income-based recertification used to be a huge pain because of the ambiguity of this question.

But now that it’s clear that you only need to report your income from your last tax return unless that income has since decreased, you’re in the clear to use tax returns to certify in every case if you want to.

Imagine a brain surgeon who made $70,000 in 2022; $250,000 in 2023; and will make $600,000 in 2024 because they became an attending in September 2023.

That doctor could pay on their small income from 2023 to 2024, the half-year attending income from 2024 to 2025, then finally be paying on an attending level income from 2025 to 2026.

Many high-income doctors pursuing Public Service Loan Forgiveness will now be paying based only on their attending income for as few as one or two years.

Submitting lower income on an IDR form

Remember that just because you can use tax information from prior year tax returns doesn’t mean you have to.

Borrowers who experience a drop in income might do so for various circumstances:

- You went back to school part-time.

- Kids entered the picture and your family size information changed.

- You decided to buy a practice and have a lot of upfront expenses.

- Your spouse quit their job (IDR plans often include spouse’s income information).

- You decide to work remotely.

- Your work offers you a part-time position that you accept.

Since your IDR student loan payments come from what you earn, you have the right to request a recalculation in your payments any time your income falls.

Submitting for a new monthly payment amount using an IDR form is a smart strategy for borrowers who are looking to reduce their hours for family reasons or need low payments to take an entrepreneurial risk.

Can you file for tax extensions for IDR form purposes?

A remaining gray area — and something I’m debating right now with lawyers and student loan experts — is if the government rules allow you to file an extension on your taxes in order to get a lower IDR payment.

You can delay your taxes at no cost. The extended filing deadline is October 15 for tax year 2023.

Imagine that high-earning physician example. You could get into a situation where strategically delaying your tax filing might allow you to use your 2022 returns instead of 2023.

One student loan attorney I spoke with didn’t think this strategy would hold up to scrutiny. Another expert thought it would.

I’ve certainly seen borrowers decide to use that approach before, but we’re still too early for Student Loan Planner® to feel comfortable recommending it.

Since the gray area used to be whether you could use prior-year tax returns, I was super reluctant to recommend tax filing extensions.

But now that the gray area is gone on that issue, thinking about tax filing extensions warrants further consideration.

Need somebody who thinks about the IDR form for you?

We strategize all day about student loan repayment options. If you’d rather have experts who have advised on over $3.4 billion of student debt create a custom strategy for you, just let us know or check out the “Hire Us” part of the site menu.

What do you think about the new IDR form question? Are you as excited as I am? Let me know what you think below.

Comments are closed.