Millions of student loan borrowers are about to confront soaring income-driven repayment (IDR) payments far higher than most realize, and it’s going to start happening in waves in 2025. This “IDR recertification time bomb” could have major implications for the economy, and the pending challenges to the Saving on a Valuable Education (SAVE) plan could make this IDR time bomb much worse.

In this article, I’ll explain what the IDR recertification time bomb is, which borrowers might see their payments spike, and what steps you can take if you might be affected.

How IDR recertification delays are like the student loan pause

The student loan pause on payments and interest kept getting extended over and over again because it was politically painful to end it. In the same way, the IDR recertification deadline delay has also been extended multiple times, likely due to the political pain IDR recertification would inflict.

Consider the status quo. Anyone on an IDR plan before COVID has not had to recertify their income since March 13, 2020. Many borrowers had not even filed their 2019 tax return by that date.

Unless you graduated between March 2020 and now, your IDR payment likely reflects the taxable income you earned during calendar year 2018.

I’ve seen a lot of payments for professionals earning six figures over the past few years that look like this.

Do you remember what you earned back in 2018? I can’t without looking it up.

However, from looking at thousands of borrower IDR files, I can tell you that many people made very low incomes that year.

And those low taxable incomes caused low IDR payments that were put on ice.

When the Biden administration dealt with problems in the system, rather than push borrowers to recertify, they chose to extend the IDR recertification date each time. As of my writing this, the first borrowers would need to recertify around the election, but that’s likely going to be extended again due to the political calendar and the chaos from lawsuits challenging the SAVE plan.

Why low IDR payments are the norm early on in your career

If you’re a physician, you do a multi-year residency when you first come out of med school. A dentist might do an AEGD or GPR. Veterinarians sometimes do residency programs for additional training as well. Lawyers might do a clerk year.

Even if you don’t do one of these lower paying training type jobs first, when you graduate, your prior year taxable income is $0 when you were a student. In the second year, you recertify your IDR payment — you only worked part of the calendar year for the year prior, most likely, so your IDR payment remains low.

Hence, a huge number of borrowers start with low IDR payments, but they rapidly watch those IDR payments climb as they get higher-paying jobs.

But with the IDR recertification delays, these large IDR payment jumps have not occurred.

The danger of SAVE potentially being overturned coinciding with the IDR recertification delay ending

The dangerous scenario that is currently brewing is if the SAVE plan gets overturned, along with the IDR recertification delays ending.

Many borrowers have to recertify as of mid-2025 at this point. July to December is a common recertification date as many borrowers either consolidate right away wait until the end of their six-month grace period after graduation.

Mid-2025 is also when we could see legal actions overturning the SAVE plan (and potentially more than that, depending on how courts rule).

So let’s take a concrete example to show the danger here.

Physician with huge payment jump after IDR recertification

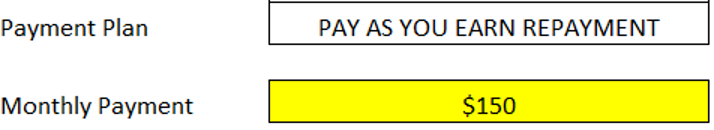

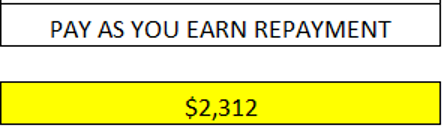

Imagine a physician with a $150 monthly payment on the Pay As You Earn (PAYE) plan who is also pursuing Public Service Loan Forgiveness (PSLF). Let’s assume PAYE survives the SAVE plan lawsuits, which could potentially impact PAYE, as well.

Our physician became an attending in 2022, and she currently earns about $300,000 a year. Here’s her payment after recertifying her income in June 2025.

What if this physician loses SAVE?

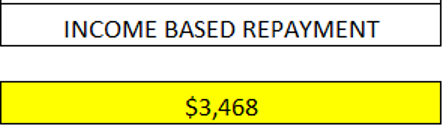

The SAVE plan was created with the same legal authority that created PAYE and Revised Pay As You Earn (REPAYE). In the unlikely event that courts find the entire Income-Contingent Repayment (ICR) law to be illegal, then her only option would be IBR.

If she borrowed her first loan prior to 2014, which many borrowers did, she has to pay under the Old Income-Based Repayment (IBR) plan, which is 15% of her income.

Here’s her payment now if this were to occur:

Related: The 11 Federal Student Loan Repayment Plans Ranked

Will student loan borrower budgets be able to handle giant payment increases?

From the example I used, imagine that a physician went from paying $150 a month to being asked to pay almost $3,500 a month.

With borrowers having gone for years without paying based on their recent incomes, there’s a risk that money has been pledged or spent in other areas.

If these areas are variable expenses or investing accounts, then borrowers will be able to adjust.

But if borrowers have used the extra breathing room to buy houses, cars or other fixed expenses, this could create significant economic strain on households with student loans.

What can borrowers do about the IDR recertification time bomb?

If the IDR recertification time bomb will affect you, first, figure out if you’d qualify for New or Old IBR (depending on when you borrowed for the first time).

Use something like our IBR repayment calculator to see what your payments would be under various IDR plans.

Then, decide whether you need to consider filing an extension on your income taxes before the 2024 tax filing deadline.

And be patient — we expect a lot of volatility in the student loan system as the lawsuits against President Biden’s student loan programs continue.

And, of course, if you need help with navigating this, reach out to our team of expert student loan consultants.

Not sure what to do with your student loans?

Take our 11-question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, SAVE or another IDR plan, or refinancing (including the one lender we think could give you the best rate).