If you need to lower your student loan payment because of the economic disaster brought on by the coronavirus pandemic, you’re not alone. We’ll show you exactly how to accomplish this payment adjustment.

President Trump declared Friday, March 13, that he has waived “interest on all student loans held by federal government agencies” until further notice. This blanket statement came with a lot of unknowns, however.

Thankfully, Congress passed the CARES Act, so you don't need to worry about federal loan payments until October 1. Trump passed a student loan order to extend this pause of payments until December 31. We expect continued interest suspension and payment suspension into 2021.

Eventually though, you'll need to recertify. So this article will show you tricks on how to keep your payments low when you have to start paying again.

If you have federal student loans and are concerned about your upcoming payments due to a loss of income, drop in income, or job insecurity right now because of COVID-19, you have options.

You can immediately request that your Income-Driven Repayment plan amount be recalculated. Here’s how:

If you’re already on an income-driven plan

If you already signed up for Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE) or Income Contingent Repayment (ICR), you'll need to follow these steps to get your monthly payment recalculated to a lower number right away.

STEP 1:

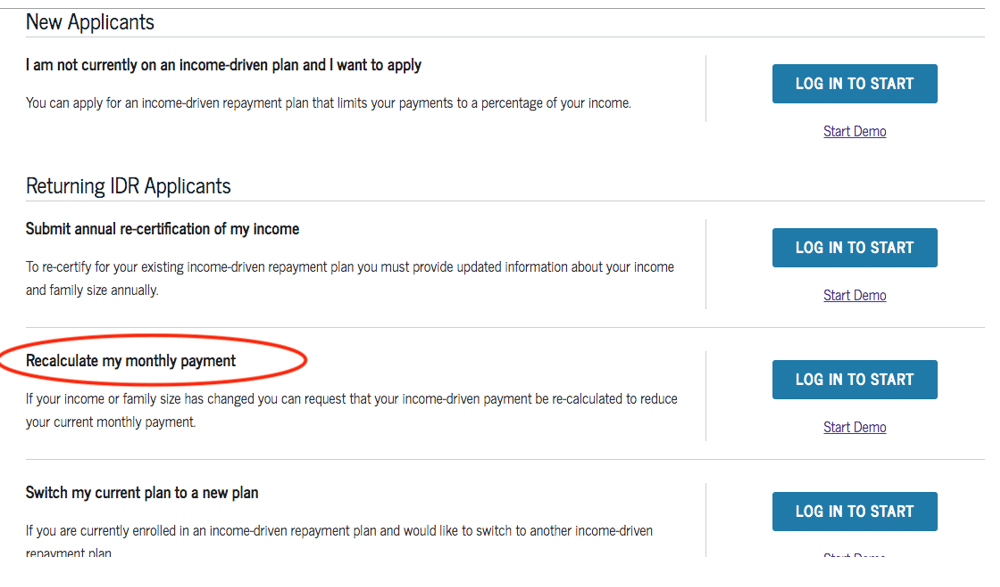

- Go to https://studentaid.gov/app/ibrInstructions.action.

- Go to the application: Recalculate My Monthly Payment.

- Log in.

STEP 2:

Follow the prompts to answer basic questions. If you’re married, sometimes this question trips people up:

If placed on the ICR plan, do you want to repay your Direct Loans jointly with your spouse?

You can say no to this unless you’re already on the Income-Contingent Repayment AND you want to pay your loans jointly with your spouse (including their income in your payment calculation). If you’re not on ICR, say no.

STEP 3:

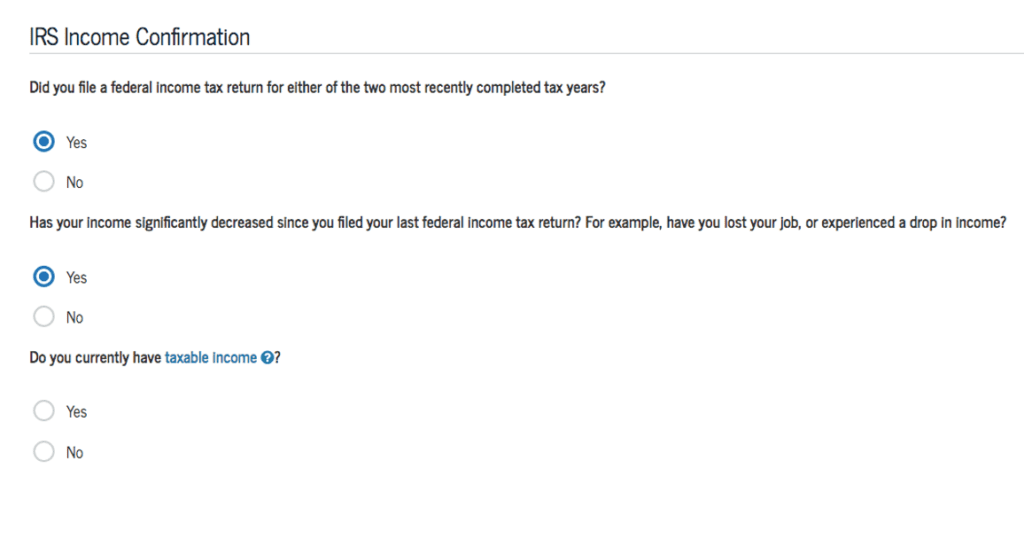

The application will automatically link back to your most recently filed tax return via the IRS data retrieval tool, which is okay. The next few questions will ask:

Has your income significantly decreased since you filed your last federal income tax return? For example, have you lost your job, or experienced a drop in income?

If this is the case, say yes to this question.

A) If you have experienced a drop in income, you will answer yes to the next question, “Do you currently have taxable income” and are required to submit Alternative Documentation of Income.

Your spouse will be required to cosign your application and provide documentation of his or her income as well (this will only be used if you file taxes married-joint and/or if you’re on the repayment plan REPAYE).

How you document your income:

- Documentation will usually include a pay stub or a letter from your employer listing your gross pay.

- Write on your documentation how often you receive the income — for example, “twice per month” or “every other week.’

- You must provide at least one piece of documentation for each source of taxable income.

- If documentation is unavailable or you want to explain your income, attach a signed statement explaining each source of income and giving the name and the address of each source of income.

- Copies of original documentation are acceptable.

- The date on any supporting documentation you provide must be no older than 90 days from the date you sign this form.

Taxable income is defined as income from employment, unemployment income, dividend income, interest income, tips or alimony. It does not include untaxed income such as Supplemental Security Income, child support, or federal or state public assistance.

B) If you have lost your job and currently have no taxable income, say no and continue on with the application. The application will be processed, and you should have a $0 generated.

STEP 4:

Complete your application, submit, and follow the instructions on where and how to submit your alternative documentation if required. Most servicers have online portals where you can upload documents, avoiding the need to snail-mail.

*Note: If you’re on an income-driven plan, your payment can also be adjusted if your spouse has had a loss or seen a drop in their income and your payment is based off of joint income because you file taxes married-joint.

If you are on the Standard 10-Year Plan or other amortized federal repayment plan

If you're on the Standard 10-year, Standard for Consolidation Loans, Graduated, Extended, or Extended Graduated plans, you follow these steps to see if you can lower your payment.

STEP 1:

Check out our Student Loan Income-Based Repayment Calculator to see if an income-driven plan could bring you relief based off of your current income. If you have lost your job, REPAYE or PAYE could be a great option to drop your payment down to $0 (this payment takes into account spousal income if you file taxes jointly).

If so, STEP 2:

- Go to https://studentaid.gov/app/ibrInstructions.action.

- Go to the application: I am not on an income-driven plan and I want to apply.

- Log in.

- Complete Steps 2 and 3 listed in the section above

STEP 3:

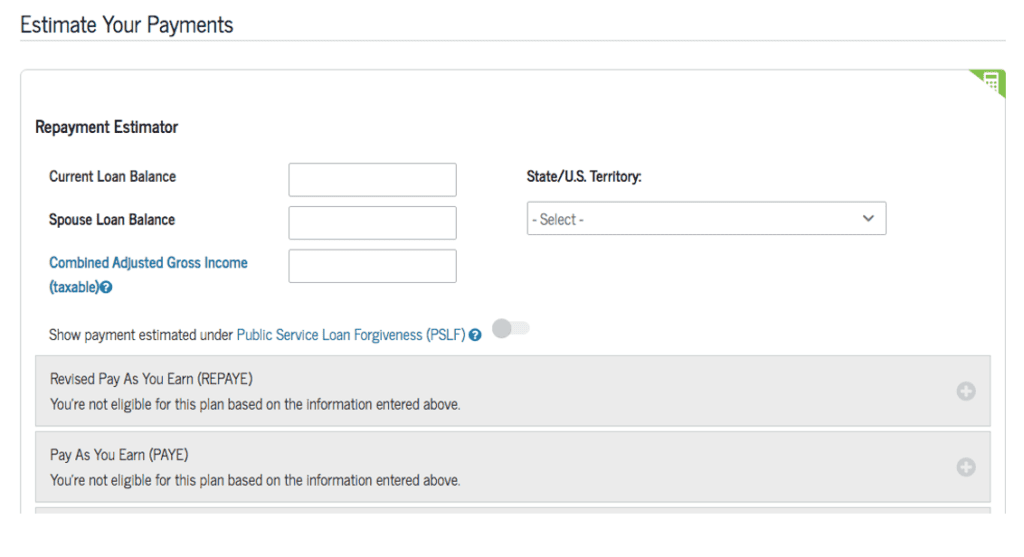

“Estimate your payments” and choose your income-driven plan. The estimation portion is arbitrary. They use your tax return or alternative documentation to verify your income. If you’ve lost your job, or have no income, put $0 for your adjusted gross income here.

You can find more information on each repayment option here: https://www.studentloanplanner.com/income-driven-repayment-plans-guide/.

You can get details about our consult service if you want a recommendation based on you specific circumstances here: https://www.studentloanplanner.com/hire-student-loan-help/.

STEP 4:

Complete your application, submit, and follow the instructions on where and how to submit your alternative documentation if required. Most servicers have online portals where you can upload documents to avoid using snail-mail.

For more tips on how your payments are calculated and to get answers to frequently asked questions, check out this article: https://www.studentloanplanner.com/how-to-recertify-income-drivien-repayment-form/

Why leverage an IDR plan and not go into forbearance, deferment or default?

Default is definitely not the answer. If you can honestly and legally get your payment down to $0/mo. due to your income level or loss of your job, do it and don’t wreck your credit by ignoring your loans. Federal loans do not go away. Having your federal loans in default can and will come back to haunt you in the form of wage and tax return garnishment. Plus, the high fees and interest tacked onto them at the collections company will balloon your balance, setting you back even more when you’re ready to face them again.

When you’re in forbearance or deferment, you are pushing back your forgiveness timeline for Public Service Loan Forgiveness or the maximum repayment periods of IDR. If you’re not going toward a forgiveness timeline, here’s an important point to note: Interest will accumulate on unsubsidized loans in forbearance and deferment and then will capitalize into the principal when you re-enter repayment.

If you avoid forbearance and deferment and stay on an IDR plan with an adjusted or reduced payment, then any unpaid interest could be waived or cut in half with interest subsidies (interest discounts) if your payment isn’t enough to cover interest and principal. This approach can keep your balance from growing.

Thankfully, federal loans can bring some relief in a time like this so you can focus on you, your family and the rest of your financial obligations. Let us know how else we can help: You can reach us by email or by using our contact form.

Not sure what to do with your student loans?

Take our 11-question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, SAVE or another IDR plan, or refinancing (including the one lender we think could give you the best rate).

Comments are closed.