Editor's note: The new SAVE Plan allows borrowers who file taxes as “married filing separately” to exclude their spouse's income from their payment. However, SAVE is currently tied up in court and will likely be repealed or replaced by the Trump administration. You can use our Married Filing Separate downloadable spreadsheet to model your potential added taxes and provide detailed examples below on how to select your tax filing status in light of this new plan. We also have a web-based version farther down this post.

For married student loan borrowers, your tax filing status — “married filing jointly” versus “married filing separately” — affects how much you pay in taxes. It also impacts how much you pay on your monthly student loan payment, especially if you're using the SAVE, PAYE, or IBR payment plans.

However, the decision to file separately or jointly can also impact your eligibility for various tax credits and benefits. For example, it might affect your access to the dependent childcare credit and healthcare premium subsidies on the Health Insurance Marketplace.

Borrowers need to decide if the savings of filing separate for student loans is larger than the extra tax costs of filing separate.

Below, we discuss when it makes sense to choose a filing status of “married filing separately” with student loans and when it doesn’t. If you still feel confused, you can get an expert plan.

More Borrowers Than Ever Are Choosing Married Filing Separate

The vast majority of American households file a joint tax return. However, more student loan borrowers are filing their taxes separately as they factor potential student loan savings into the equation.

Note that we expect your 2023 income tax filing status to be relevant for the first time in years. Most borrowers will be recertifying income between October 2024 and September 2025. However, notifications are currently going out with some certification dates extending into 2026.

That means if you file an extension, tax year 2023 could still be highly relevant.

You Can Amend from Separate to Joint if Necessary

You can't amend from joint to separate, but you can amend from separate to joint. That means many borrowers are leaving thousands on the table and don't even realize it.

If it turns out that 2023 taxes are irrelevant for IDR payments because the IDR recertification extension gets pushed out even more, you can simply amend your taxes to joint using form 1040X later on.

Even individuals with modest debt amounts who previously filed jointly may need to reconsider their filing status given that you can amend it if it turns out you made an unnecessary mistake in choosing separate.

How filing taxes separately saves money on loan payments

First, let’s look at how student loans and married filing separately are correlated.

When a federal student loan borrower is on an income-driven repayment plan (IDR) with the U.S. Department of Education, the payments depend on discretionary income (private student loans are ineligible). The higher the income, the higher the student loan payments. The lower the income, the lower the payments.

The income used for the student loan payment calculation is generally taken from the borrower’s latest tax return. If the borrower is married to someone who earns an income and they file their taxes jointly, the loan servicer uses their household combined income to calculate the payment.

Previously, two student loan repayment plans have allowed borrowers to file their taxes separately. This includes Pay As You Earn (PAYE) and Income-Based Repayment (IBR).

But now the new Saving on A Valuable Education (SAVE) plan, formerly known as Revised Pay As You Earn (REPAYE), is also on this list. However, the SAVE plan is currently on hold pending court proceedings and the new Trump administration.

With each of these payment plans, the income-driven payment is based only on the borrower’s earnings and not their spouse’s income. Now, you might be thinking, “Why wouldn’t they just file separately to keep their payments low?”

Well, the student loan payment is only one component. The amount of taxes paid for the household, as a whole, is affected by the way a couple files taxes, too.

Calculate Your Extra Tax Costs with Married Filing Separate

The biggest impact of married filing separate is that it tends to place the higher earning spouse into a higher tax bracket.

However, other relatively uncommon scenarios can skyrocket your tax bill if they happen to apply to you.

Situations that often result in a very high married filing separate penalty include:

- Additional Medicare tax

- Adoption expenses

- Dependent care credits for young children in daycare

- Higher Medicare Premiums

- Loss of ACA health insurance subsidies

- Loss of certain business tax deductions

- Loss of higher education credits for adult children in college

Use the married filing separate tax calculator below:

Your Income Last Year

Your Spouse’s Income Last Year

Number of children under age 13

How much do you spend on daycare annually?

Dependent Care FSA Contribution Usually $0 to $5,000. List what you’d normally contribute if you weren’t filing separately

Number of dependent children enrolled in college

Who in your family owns a small business?

How many children did you adopt this year?

Is anyone in your family currently on Medicare?

Do you receive federal health insurance subsidies? Specifically, do you purchase a subsidized health plan on the ACA marketplace

Have you contributed directly to a Roth IRA this year?

Do you live in AZ, CA, ID, LA, NM, NV, TX, WA, or WI?

| Estimated Extra Annual Cost of Filing Taxes Separately That is, the additional taxes you’ll pay under the married filing separate status compared with filing your taxes as married filing joint. Note that this estimate does not include the potential cost savings of a lower IDR payment when filing separate. |

Components of married filling separate cost

(Remember, this is just an estimate and shouldn’t be relied on as your true taxes. Consult a tax professional to get the numbers for your exact situation.)

If you so choose, you can download a more complete spreadsheet version of the calculator by visiting the button below to model more complex scenarios.

Tax differences between filing separately versus jointly

Couples typically owe more in taxes as a household when they file separately. This is primarily because each spouse’s income hits the tax brackets as individual filers.

Plus, some tax deductions and credits go away or are harder to get when filing separately, especially for couples with kids. Let’s take a look at the difference in estimated taxes paid in two different scenarios.

Note these are general scenarios with rough estimates. You’ll need to consult a tax professional to address your specific financial situation.

Scenario 1: Spousal incomes are vastly different

Let’s say a dentist is married to a social worker. The dentist earns $300,000, and the social worker earns $50,000. They have a joint adjusted gross income (AGI) of $350,000.

Let's illustrate their tax hit using 2022 federal tax brackets. If this couple files joint, they'd pay around $65,455 in federal income taxes. However, if they each file a separate federal income tax return, the dentist will owe about $74,220 on their tax return. The social worker will owe about $4,240. Together, this totals $78,460.

Filing separately could cost them over $13,000 in federal taxes as a household versus married, filing jointly. In this case, there are tax benefits for using joint income.

Scenario 2: Spouses have the same income

Let’s say a pharmacist and a nurse practitioner are married and making $110,000 each.

They could pay about $34,255 as a household if they file their taxes jointly. They’d each owe roughly $17,127 if they filed separately. So, their federal tax liability or tax bill would be the same as a household, no matter how they file their taxes.

Related: Student Loans and Taxes: Everything You Need to Know

Other important side effects of filing taxes separately

Tax brackets aren’t the only part of the equation when determining whether a couple should file separately or jointly.

Couples can lose out on some other tax deductions and credits. They can also miss out on subsidy opportunities with the Health Insurance Marketplace by filing separately.

Married filing separately disqualifies you from receiving a premium tax credit for healthcare

Subsidized healthcare coverage is available to people with incomes below certain levels via the Health Insurance Marketplace.

For example, your household income must be between 100% and 400% of the federal poverty level (FPL) to qualify for a premium tax credit, which lowers your insurance costs.

The state you live in and your household size also affect premiums and eligibility for subsidized programs, such as Medicaid or the Children’s Health Insurance Program (CHIP).

According to Healthcare.gov, married couples who file separately can enroll in a Marketplace healthcare plan together. But by filing taxes separately, you’ll forfeit eligibility for a premium tax credit or other savings that would reduce your monthly insurance payment.

Note that there are exceptions if you plan to file as head of household and meet other criteria (e.g., living separately) or if you’re a victim of domestic abuse, domestic violence or spousal abandonment.

This penalty for filing separately should be seriously considered for low- and moderate-income households who would otherwise qualify for health insurance subsidies.

According to data from the Centers for Medicare and Medicaid Services, 91% of Marketplace enrollees received advance premium tax credit (APTC) payments in February 2023. The average monthly APTC was $604.78, but this number varied widely by state. That’s an average annual benefit of roughly over $7,200.

Considering the cost of healthcare in the U.S., you might miss out on significant savings that might benefit your family in more ways than one.

Tax deductions and credits affected by married filing separately

The most relevant credit is the child dependent care tax credit (CDCTC) — which is not the same as the child tax credit (CTC). Additionally, the student loan interest deduction goes away.

Those two items might add up to an extra $2,000 to $3,000 in taxes a couple could pay if they file separately.

Filing taxes separately also drastically reduces the ability to deduct a Traditional IRA contribution, as well as eligibility for Roth IRA contributions. So, the lower income-driven student loan payments might be offset by the higher taxes and subtraction of other benefits.

Tax laws change, so consult the IRS website or a tax professional to learn about the differences in taxes filing separately versus filing jointly.

Which filing status will save you the most money paying back student loans?

Filing separately if both spouses have federal student loan debt eligible for IDR usually doesn’t make much sense for married borrowers.

This is typically a decision for married couples where only one has student loans.

The equation we use is a holistic one based on what’s best for the household, not one spouse. We need to look at the entire household taxes and student loan payments to see which method would be better.

Generally speaking, we know student loan payments will be lower if couples file separately, but they’ll most likely pay more taxes as a household.

Here’s the equation:

Student loan payment savings married filing separately (MFS) – increase in taxes by MFS

If the result is a positive number, then married filing separately will give the most household savings net of taxes. If it’s negative, then filing jointly will save the household the most money.

Keep in mind that there’s an extra layer of decision-making for households who qualify for subsidized coverage with the Health Insurance Marketplace. The key here is to take a holistic approach to evaluate what will benefit your household the most.

Importantly, new rules for IDR payments may change this analysis. With the discretionary income definition changing to income above 225% of the poverty line, families with children might find filing separately saves them hundreds of dollars per month in student loan payments. However, as mentioned above, SAVE plan lawsuits mean this generous benefit is likely toast.

Related: Is a student loan consult right for you?

The best IDR plans to keep payments low when filing separately

Both New IBR and PAYE allow the person with student loans to file taxes separately. This way, loan payments are dependent on their income alone.

IBR and PAYE are also both capped at the 10-year standard payment. This means that when the monthly payments are calculated based on income, the payment will never exceed the fixed payment that would pay off the loan in full in 10 years — kind of like a 10-year mortgage payment.

Each plan also has a “tax bomb” at the end (although this has been suspended until December 31, 2025). This means that while the remaining loan balance is forgiven, the federal government will issue a 1099 tax form with the forgiven amount. The forgiven balance will be added as income on that year’s tax return, and the borrower could then owe a large amount of taxes on the forgiven balance. It's definitely something taxpayers should be mindful of.

IBR and PAYE plans are 20-year programs with payments based on 10% of discretionary income for “new borrowers” on or after July 1, 2014.

If someone borrowed their first student loan before October 1, 2007, they generally aren’t eligible for PAYE. If they still want to file taxes separately, SAVE is their best option.

The SAVE Plan and Married Filing Separate Are a Powerful Combo to Keep Payments Low for Many

Here's a quick note about SAVE: This plan used to be called REPAYE, which previously included the spouse’s income regardless of how a couple files their taxes. However, this is no longer true under the new SAVE plan rules.

New REPAYE / SAVE will allow you to file separately with a deduction of 225% of the poverty line as of July 2024. If you're married, filing separately, you deduct one from your family size. This is handled automatically for you if you recertify your IDR payment.

However, pending the outcome of the SAVE plan lawsuit, this might be a moot point. It's also important to note that millions of student loan borrowers are stuck in SAVE administrative forbearance, which has allowed for $0 payments through the first quarter of 2025.

Borrowers eligible for PAYE: Will filing taxes separately or jointly save you the most money?

Here are two examples where one spouse is the breadwinner and owes the student loan debt and another where the breadwinner isn’t the spouse with the student loan debt.

When filing jointly could make sense

Jamie and Adam got married this year. Jamie is a psychologist with $250,000 in student loan debt with a 6.5% interest rate. She has her own practice, making $125,000, and has been on PAYE for five years. Adam is a teacher making $40,000 with no student loan debt. Both anticipate their incomes growing at 3%.

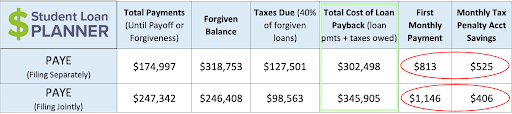

*Assumptions: Tax bomb savings growth rate is 5% per year. Tax rate at time of loan forgiveness is 40%.

The numbers here would show that there is an estimated $43,000 in savings on the student loans as a whole if Jamie and Adam filed their taxes separately for the next 15 years while Jamie finishes out PAYE. That’s about $2,866 per year on average in student loan payment savings.

If we just look at the payments this year plus the tax bomb savings, filing separately will cost Jamie $1,338 per month ($813 student loan payment + $525 tax bomb savings). However, filing jointly will cost $1,552 ($1,146 + $406). That’s only a $2,568 annual benefit to file their taxes separately.

They ran their taxes both ways, and it’s projected to cost them $3,000 more in taxes to file separately.

Using the equation:

($2,568 student loan payment savings MFS) – ($3,000 more in taxes MFS) = -$432.

Jamie and Adam should file their taxes jointly to save the most money this year. They can make a fresh decision each year on their tax filing status. But the numbers look like filing jointly will save them the most money net of taxes.

When filing separately could make sense

Now let’s switch it. Let’s say Amber is a chiropractor with $250,000 in student loan debt and is making $40,000 working part-time. She’s been on PAYE for five years as well. Her husband, George, works in IT, making $125,000.

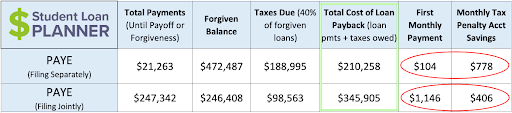

*Assumptions: Tax bomb savings growth rate is 5% per year. Tax rate at time of loan forgiveness is 40%.

Notice that PAYE filing jointly is the exact same as with Jamie and Adam. But the filing separately scenario is completely different, since the breadwinner isn’t the one with the student loans.

Now we’re looking at a difference of over $135,000 savings to pay back the student loans if they were to file separately. That works out to be about $9,000 per year over 15 years. Just like Jamie and Adam, Amber and George would pay $3,000 more in taxes by filing separately.

($9,000 student loan payment savings MFS) – ($3,000 more in taxes MFS) = $6,000

Amber and George should file their taxes separately to save the most money net of taxes as a household.

As income changes from year to year, so can the result of this equation. The good news is that they can compare the taxes to student loan payments and decide how to file their taxes each year if they’re on PAYE. They can and should make a fresh tax filing status decision each year.

In conclusion, there appears to be a greater benefit to filing separately if the spouse with student loans makes less money. The couple has the same tax penalty, regardless of who has the loans, but the cost to pay back the loans goes way down.

When to Use SAVE vs. New IBR / PAYE

If someone isn’t eligible for PAYE because they took out loans prior to October 1, 2007, your best option will be the SAVE plan. The only question is whether you should file joint or separate.

SAVE is almost always the better option for undergraduate loan borrowers, as it comes with a 20-year term, regardless of when you took out your loans. The only reason to not use SAVE would be the lack of a payment cap. And that's only relevant in rare cases, usually involving PSLF.

But graduate borrowers have to wait 25 years to earn student loan forgiveness on SAVE. If you took out loans before 2007, you don't have any other repayment options, so SAVE is the best plan.

However, if you took out your first loans after October 2007, you can choose between PAYE and SAVE. If you took out your first loans after July 2014, you also have the option to use New IBR.

For graduate borrowers, PAYE and New IBR usually work out to about $100 to $200 a month more than the SAVE plan.

Considering that you could shave five years off your forgiveness date with those plans, paying a small amount extra could make a lot of sense if you have exponentially increasing income.

When is SAVE the Better Choice for Graduate Borrowers

If you are planning to pay back your student loans, SAVE is always the best choice until your required payments are high enough that they cover your interest.

The reason? You receive an interest subsidy of 100% of the interest that your required SAVE payment doesn't cover.

Most borrowers could receive a large interest subsidy in the first two years after graduation at a minimum due to low taxable income for the first years after graduation.

Also, if a graduate-degree-holding borrower will never come close to the Standard Repayment 10-year payment cap and plans to use PSLF, she would be better off on the SAVE plan.

Other ideas to save money paying back your student loans when filing separately

A married couple will not pay as much taxes when filing separately if their income is fairly close. The wider the income gap, the more the household will generally owe in taxes if they file separately.

If the person with student loans has a higher income, then any and all deductions to Adjusted Gross Income (AGI) could change their side of the income equation.

For example, let’s say Doug earns $100,000 and owes $200,000 in debt, while Julie earns $70,000 and has no student loans. They are both contributing 6% of their income to get their maximum employer matching contribution to their retirement plan. They still have another $1,000 per month that they could put into retirement. Doug is on PAYE, and they’re filing their taxes separately.

Rather than splitting up the $1,000 evenly, Doug could put the $12,000 per year into his retirement only. That would reduce his AGI from $100,000 to $88,000. Julie’s would stay at $70,000.

Now, Doug can also put $7,000 into his HSA, which lowers his AGI to $81,000. By reducing Doug’s AGI by $19,000, their individual incomes are only $11,000 apart rather than $30,000. So, the extra taxes from filing separately should go down.

Doug would also benefit from lower student loan payments the following year. Remember that PAYE is based on 10% of discretionary income. So, lowering Doug’s income by $19,000 will reduce his student loan payment by $1,900 for the year. It’s a win-win…win! Less taxes, lower student loan payments and awesome additional nest egg savings!

“Married, filing separately” with student loans in a community property state

Someone with student loans who lives in a community property state might also be able to save even more money paying back student loans if they file taxes separately.

Nine states are community property states and have different laws around whose income is whose. These are Arizona, California, Idaho, Louisiana, New Mexico, Nevada, Texas, Washington and Wisconsin.

The gist of it is any salary, wages or other pay received for services performed by either or both spouses while married basically belongs to both spouses equally. There are other nuances that I’ll spare you, but feel free to read this from the IRS website.

The benefit to couples living in a community property state is that this community income is equally distributed between the spouses if they file separately.

In other words, if a doctor made $300,000 in income and her psychologist spouse made $100,000, they would each claim $200,000 on their income if they were to file separately, rather than their individually earned income, if it’s considered community income.

This typically means that a couple would pay less taxes by filing separately than they otherwise might in a common law state.

Where this is really attractive is if that doctor I mentioned had student loans and was going for Public Service Loan Forgiveness (PSLF). But their PsyD spouse didn’t have loans. This “breadwinner loophole” would lower the doctor’s income dramatically. And that would significantly lower their overall cost while pursuing the PSLF program.

If you’re interested to learn more, check out Student Loan Planner® Podcast Episode 6, where we talk about the “breadwinner loophole” in detail.

Should you file taxes separately if you both have student loans?

This is a fairly common question because it’s hard to find the right answer on how this works.

When both spouses have student loan debt and are on an IDR plan, filing taxes separately gives very little reduction in student loans. It usually ends up costing the couple more in taxes than it saves them in loan repayment.

Let’s say that both are on PAYE and that they file their taxes jointly. One spouse makes $150,000, and the other makes $50,000 — 75% of household income and 25% of household income.

The loan servicer will calculate the household payment based on the household income of $200,000. Of that monthly payment amount, 75% will go to the loans of the $150,000 earner. The other 25% will go to the loans of the $50,000 earner.

If this couple were to file taxes separately and certify their income using their individual tax returns, they might have significantly lower payments due to an extra deduction to their discretionary income.

Filing Separate When You Both Have Student Loans on the SAVE Plan

Borrowers may find that under the SAVE plan, you could save more on your loan payments than filing separate costs.

This is because the deduction for the SAVE plan is 225% of the poverty line based on your family size.

If you file taxes separately, you get to use your family size minus 1. But if you have children, only one spouse gets to claim them for family size purposes.

So, say each spouse in a family of four earns $50,000 a year. 225% of the poverty line for a family of four is $70,200.

However, 225% of the poverty line for a family size of 4-1 (i.e., 3) is $58,095.

225% of the poverty line for a family size of 1 is $33,885.

Filing separate would allow one borrower to use family size 3 and one borrower to use family size 1. They can earn a total of $91,980 before paying anything.

10% of the difference in deductions is about $2,000. So if filing separate costs less than $2,000, you should file separate even if you both have loans.

You can see how powerful filing separate could be under the new SAVE rules, even for borrowers who are both making payments. This math is significantly different than the old rules.

How to save the most money paying back student loans

There’s a ton of money at stake when we’re talking about paying back five or six-figure student loan debt. It makes sense for an expert to review your specific situation while taking family size, career path, household income, repayment amount, forgiveness programs and financial goals into consideration. This is especially true now, considering the SAVE rules could change how most borrowers pay their student loans.

This holistic approach will ensure that you’re saving the most money but also weighing additional factors, like qualifying for Health Insurance Marketplace savings.

Our team has helped thousands of clients create winning repayment and refinancing strategies to take on their student debt. We’d love to help you finally feel confident about how you’re handling your student loans and save as much money as possible.

After a consultation with us, you’ll understand the path that will save you the most money when paying back your loans. You’ll also gain the clarity you need to feel in control.

Not sure what to do with your student loans?

Take our 11-question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, SAVE or another IDR plan, or refinancing (including the one lender we think could give you the best rate).

Comments are closed.