Maryland is home to John Hopkins University and many other top-notch colleges and universities. Although there are a variety of state-sponsored programs to help Maryland residents and students pay for school, it’s not always enough to cover the full cost of higher education.

The Institute for College Access & Success found that 2020 graduating seniors of a Maryland four-year institution carried an average student debt over $30,000. And of that debt, 75% was from federal student loans. This means Maryland graduates had to find alternative funding sources to cover a quarter of their total student debt.

If you’re in a similar situation, you might need to turn to private Maryland student loans to round out your finances. Below you’ll find some of the top local and national private lenders to consider, as well as some refinancing options for borrowers who’ve already graduated.

Options for Maryland student loans

The state of Maryland doesn’t provide student loan programs itself. But Maryland residents and students can qualify for federal student loans by submitting the Free Application for Federal Student Aid (FAFSA).

Federal student loans have low interest rates and unique perks, like the potential for loan forgiveness and access to flexible income-driven repayment (IDR) plans.

If your financial aid package isn’t enough to cover your college expenses, you can ask for a professional judgment with your school or explore private student loans to fill in any remaining financial gap.

Your local bank or credit union might offer private student loan opportunities to existing customers. You can also consider national lenders that provide funding to borrowers nationwide, such as Sallie Mae and Earnest.

Both of these lenders consistently rank as the top private student loan companies for our readers.

As you explore private student loan offers, compare interest rates, loan terms and in-school repayment options. And then plan to look into refinancing after graduation to ensure you have the best interest rate for your new financial situation.

Maryland student loan refinance options

The biggest advantage to refinancing is that you can lower your interest rate, which could save you thousands over the life of your loan. It can also adjust your loan terms and lower your monthly payment.

But before you decide to refinance your Maryland student loans, you should weigh the refinancing pros and cons based on the type of loans you have.

For example, federal student loan borrowers should evaluate their current and future goals before moving forward with refinancing. When you refinance federal student loans, you’ll no longer be able to tap into borrower protections for financial hardships or take advantage of IDR plans that limit your monthly payments.

If you’re interested in refinancing your student loans, check out these top refinancing lenders that we partner with. Our readers have had good experiences, and they offer generous cash-back bonuses that can be used for an extra payment.

- Earnest has consistently low interest rates and allows borrowers to customize their loan payments.

- Laurel Road is a good fit for medical professionals and Parent PLUS borrowers.

Additionally, you can quickly shop around with LendKey’s network of community banks and credit unions if you prefer to stick with a smaller lender. Here’s a detailed review of LendKey’s refinance loan and services.

How much can Maryland students save by refinancing?

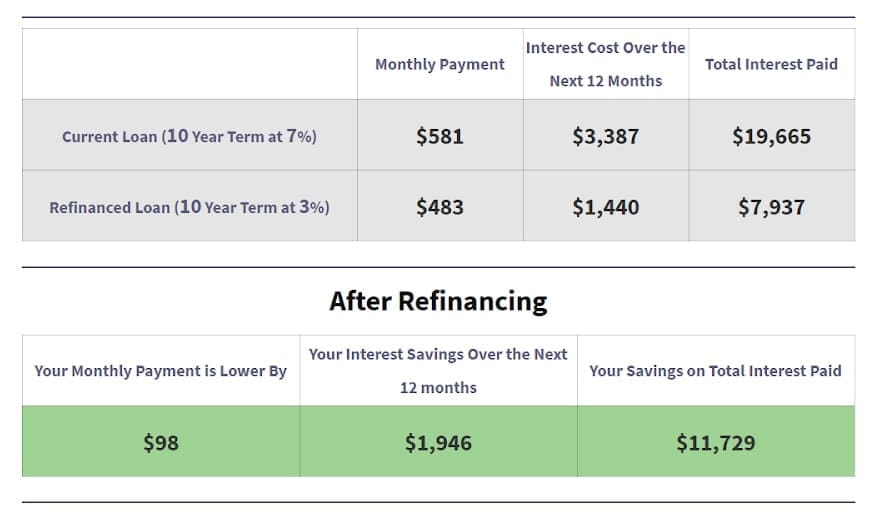

Here’s a quick example of how refinancing can save Maryland borrowers money.

Let’s say Christine graduated from the University of Maryland-College Park with $50,000 in undergraduate debt. Her average loan interest rate is 7%. She works for a private employer and wants to knock out her student debt as quickly as possible.

Using the Student Loan Planner® Refinance Calculator, we can see that Christine can lower her monthly payment by almost $100 by refinancing to a new 10-year loan with a 3% interest rate.

By continuing to make her new monthly payment of $483, she would save a total of $11,729 in interest alone.

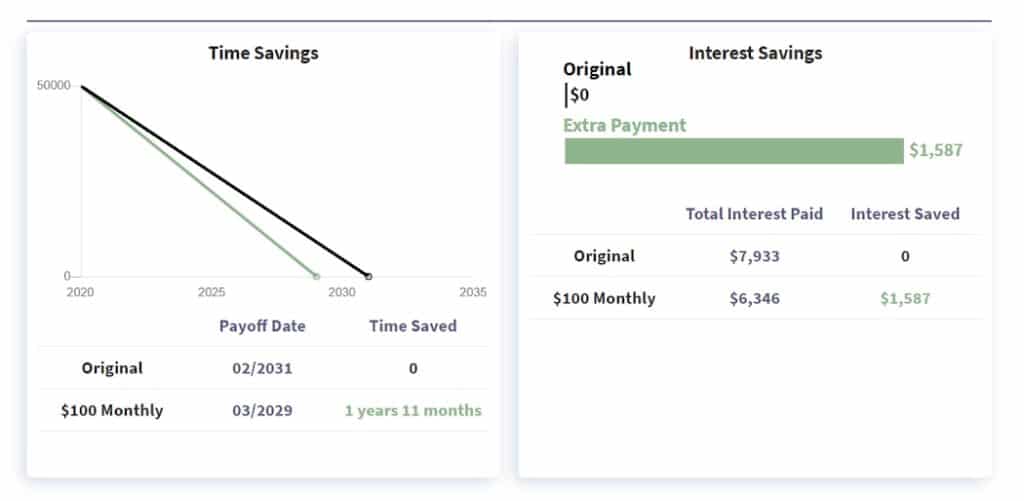

But what happens if she continues making that additional $100 payment each month?

Our Student Loan Payoff Calculator shows that Christine would save another $1,587 in interest charges and shave off almost two years of payments for her new refinanced loan.

If Christine were to dedicate even more funds to her student debt — let’s say an extra monthly payment of $500 instead of only $100 — she could pay off her entire loan balance within five years. And she’d keep thousands more in her pocket for other financial goals.

Maryland borrowers can lower their student debt

Maryland students can limit their debt burden by maximizing available financial aid opportunities, such as grants and scholarships.

The Maryland Higher Education Commission provides need-based and merit-based opportunities, such as:

- The Howard P. Rawlings Guaranteed Access (GA) Grant, which awards up to $19,400 to high school seniors and General Educational Development (GED) diploma recipients.

- The 2+2 Transfer Scholarship, which encourages Maryland community college students to transfer to a four-year college.

- Numerous tuition waivers and scholarship programs designed to benefit unique populations (e.g. foster care recipients and students with disabilities)

Additionally, there are many Maryland loan forgiveness programs that are specific to Maryland taxpayers and students.

Some of these state forgiveness programs focus on your profession, such as the State Loan Repayment Program for healthcare professionals. If you qualify for a program like that, also see if you can get a Maryland physician home loan. Just don't refinance your student loans into your mortgage since there aren't any tax advantages for doing so.

There’s also a Maryland Student Loan Debt Relief Tax Credit that is available to borrowers with at least $20,000 in existing student debt.

Keep in mind that if you have federal student loans, you might also be eligible for federal forgiveness programs.

For example, borrowers who work in the public or nonprofit sector can work toward Public Service Loan Forgiveness (PSLF). Federal borrowers who don’t work for a PSLF qualifying employer can pursue IDR forgiveness, which wipes away your remaining balance after 20 to 25 years of qualifying payments.

If you’re planning on attending college in Maryland, our team of student debt experts can help you figure out the best way to finance your degree. Schedule a pre-debt consult today.

Refinance student loans, get a bonus in 2025

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

Bonus for eligible users who refinance $100k or more (bonus from Student Loan Planner, not SoFi®)

|

Fixed 4.49 - 9.99% APR

Variable 5.99 - 9.99% APR with all discounts with all discounts |

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 4.45 - 10:49% APR

Variable 5.88 - 10.49% APR

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 4.29 - 10.24% APPR

Variable 4.86 - 10.24% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 4.99 - 8.90% APR

Variable 5.29 - 9.20% APR

|

|

|

$1,099 Bonus

For 150k+, $300 to $500 for 50k to 149k.

|

Fixed 4.88 - 8.44% APR

Variable 4.86 - 8.24% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 3.85 - 11.38% APR

Variable 4.33 - 12.35% APR with autopay with autopay |

Not sure what to do with your student loans?

Take our 11-question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, SAVE or another IDR plan, or refinancing (including the one lender we think could give you the best rate).