A Master of Business Administration degree can open many doors. The skill set acquired during school can be applied to a variety of companies and industries. MBA grads can choose to work in technology, healthcare, retail, financial services, consulting, and other fields. The options are nearly endless, unlike a doctor or dentist who will most likely stay in healthcare.

So is getting an MBA worth it? Let’s dive in and get to the bottom of it.

What does it take to get accepted to an MBA program?

Applying to full-time MBA programs doesn’t require a whole lot of pre-requisites. It’s fairly straightforward.

First, get your bachelor’s degree. Second, take the graduate management admission test (GMAT). Simple, right? However, it’s the nuances that matter.

If you want to get into Stanford Graduate School of Business, for example, it will take a GMAT score of at least 750, a display of business acumen through work and business experience, success that includes motivating others around you, and letters of recommendation. If you’re applying to Georgia Southwestern State University, then all you need are a few business school classes with a 3.0 GPA and a 540 GMAT score.

Either way, you earn the MBA and are ready to jump into your career. However, the cost of the degree and other expenses as well as your subsequent MBA salary could vary greatly.

MBA student loan debt

MBA student debt isn’t as cumbersome as the debt associated with many other graduate schools, even for top programs with good rankings. Veterinarians, chiropractors, doctors, and dentists graduate with much more student loan debt on average.

According to a Bloomberg Survey from 2018, 18% of graduate students borrowed more than $100,000 for their MBA — many of whom graduated with a degree from the highest-ranked business schools. As many as 17% borrowed between $50,000 and $100,000. That means 65% of MBA grads had less than $50,000 in MBA student loans. This isn't as bad as some other education statistics.

But the optimal loan repayment strategy depends upon how much you owe (including the debt from undergrad school) and your MBA salary.

But how does the MBA salary compare to what someone without an MBA earns?

Do MBA grads make more money?

Anyone who gets a master’s degree will make more money than someone who has a bachelor’s degree, right? The answer is typically yes, but the MBA salary increase is highly dependent upon one factor: the school on the diploma (such as Harvard Business School).

Salary.com’s April 2019 article, “The ROI of an MBA Degree,” looked at the salaries of popular business jobs and compared the MBA salaries versus the non-MBA salaries for the same jobs. Surprisingly, they found only a 1.3% “MBA salary lift,” meaning that there was no significant increase in pay after earning an MBA.

Take that with a grain of salt though. That one article doesn’t tell the whole story because some employers won’t look at candidates without an MBA, and those with an MBA typically are hired at a faster rate. Still, that difference (or lack thereof) in salary is surprising.

Anyone considering an MBA should take a serious look at the job they currently have versus the job they’d get after earning an MBA and compare the salaries. If they’re going to stay in the same job post-MBA, chances are it won’t be an immediate bump in their MBA starting salary, and the cost of getting the MBA might not be worth it.

Top MBA schools are a different story though. According to separate articles in the Wall Street Journal and Financial Times, MBA grads could double their income.

The average MBA salary varies depending on school and specialty, too, and most research focuses on median earnings, not the average. Yale School of Management, for example, reports its graduates earn a median salary of $127,100, not counting bonuses. The Graduate Management Admission Council’s 2019 Business School Hiring Report revealed that the median annual base starting salary U.S. companies will offer new MBA hires in 2019 is $115,000.

The cost of attending top MBA programs is certainly a premium compared to tuition at other schools, but with a jump in income from $75,000 to $150,000, for example, it might be worth the cost of admission.

The best student loan repayment strategy for an MBA

In our experience, the majority of MBA grads should choose one of two paths to eliminate their student loan debt:

- Pay back the loans as fast as possible. This path could include refinancing to get a lower interest rate and paying back the loans in 10 years or less. This path works best for those who have 1.5x their income or less in MBA debt (e.g., $150,000 or less in student debt with a $100,000 salary) and won’t want to pursue a career that would qualify for public service loan forgiveness (PSLF).

- Keep payments as low as possible and maximize taxable loan forgiveness. This path typically includes an income-driven repayment plan — like Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE) or Income-Based Repayment (IBR) — and paying on the loans for 20 to 25 years until the remaining debt is forgiven. The key here is to save aggressively in pre-tax retirement accounts to lower your adjusted gross income and also to save up for the looming tax bomb you’ll face when the debt balance is forgiven. This path works best for an MBA who owes 2x their income or more (e.g., $150,000 or more in student loans while earning $75,000 or less).

Editor's note: The REPAYE plan was replaced by the Saving on a Valuable Education (SAVE) plan. Learn how the SAVE plan can save you money on your MBA.

Case study 1: Student loan repayment for a top-tier MBA graduate vs. non-top 25 MBA programs

The two major factors that will determine whether MBA debt repayment should follow an aggressive approach or income-driven repayment are:

- The amount of debt

- The projected income

Let’s take a look at how a graduate of a top MBA program would save the most money paying back their loans.

Amanda just graduated from the Ross School of Business at the University of Michigan. She has $150,000 in MBA debt, federal student loans at 6.8% (Grad PLUS loan), and just got a job in healthcare earning $125,000. Her income is projected to grow to $200,000 in five years before leveling out.

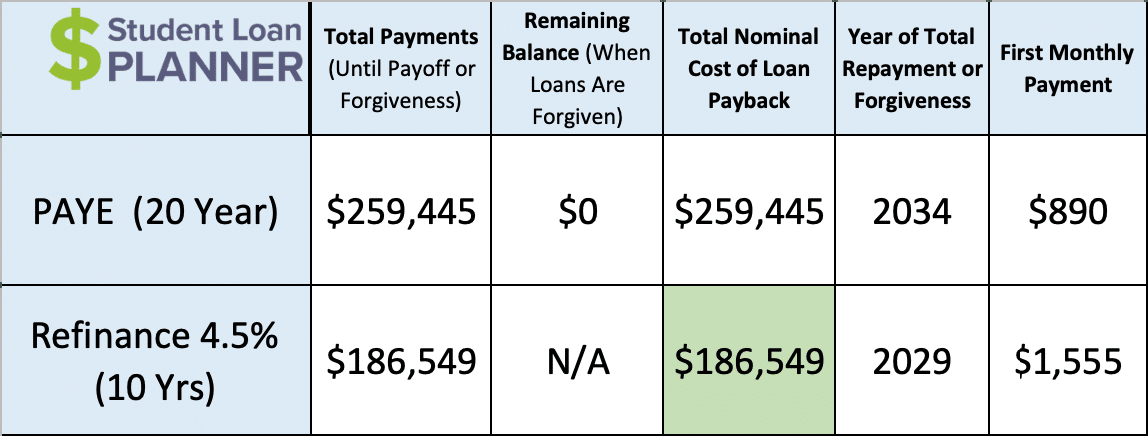

Let’s compare two repayment options — income-driven repayment with taxable loan forgiveness on PAYE versus refinancing to 4.5% and paying off the loan in 10 years:

Refinancing is clearly the better option here. Her payments on PAYE would be so high that there won’t be a remaining balance to forgive. It means that Amanda would end up paying back a 6.8% loan in full in 15 years on this path. She wisely chooses to refinance with a lender, lower her interest rate to 4.5% and pay it back in 10 years. This option will save her nearly $73,000 in interest versus going on PAYE.

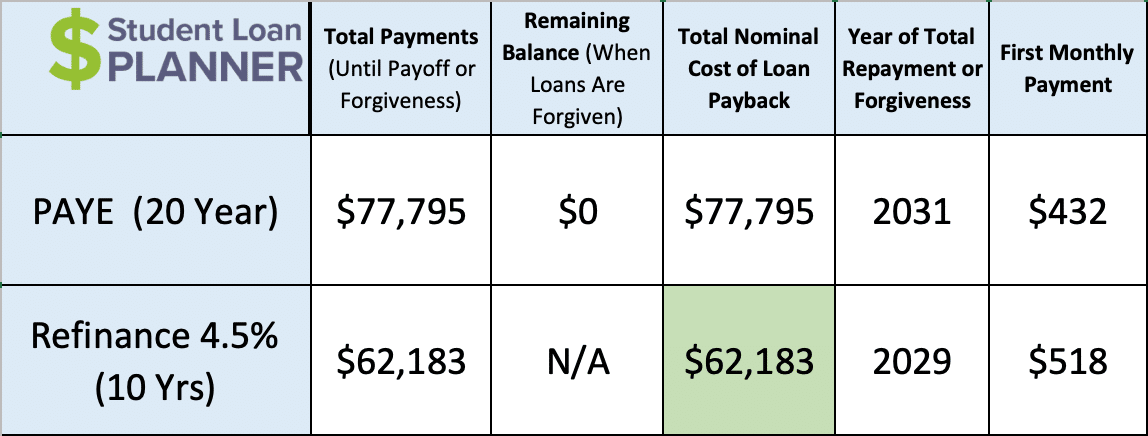

Now let’s take a look at Marc. Marc just graduated with his MBA from an in-state program and got a job in marketing. He’s making $70,000 and will get normal pay raises, which could be anywhere from 3% to 7% or more, depending on several factors. He took out $50,000 in federal loans at 6.8%.

Will refinancing or PAYE be a better way to go when it comes to student loan options? Let's find out.

Just like Amanda, refinancing is projected to save him more money than PAYE. Marc won’t make it the full 20 years on PAYE either because his payments are too high compared to the debt. He’d end up paying off the loan in full within 12 years and spending more on interest payments than he should. Refinancing to 4.5% will save him over $15,000 versus going on PAYE.

Even though Amanda went to a top MBA program and Marc went to an in-state MBA program, they’d take a similar approach to loan repayment because their student debt to MBA salary ratios are below 1.5:1.

Remember that income-driven repayment plans work better when MBA grads have 2x their income or more in student debt. If either of these people had debt from undergrad education or married someone with six-figure student loan debt, they’d definitely want to explore income-driven repayment.

Case study 2: Student loan repayment for an MBA grad starting a business

Let’s look at another example. Maria just earned her MBA from Kellogg School of Management at Northwestern University and wants to start a consulting business. She completed a detailed analysis of the consulting landscape and put together a business plan. Conservatively, her income will grow from $0 to $200,000 within five years.

Right now she has $150,000 of student debt at 6.8% but wants to invest every dollar she can in the business. What’s the best path to paying off her loans?

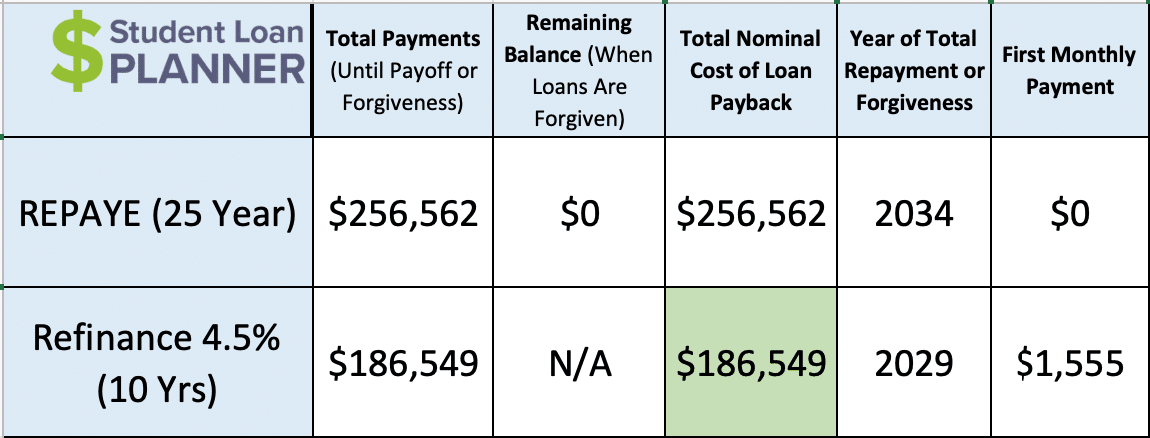

This is a little bit of a conundrum for Maria. The results show refinancing is projected to be the least expensive way to pay back her loans, but that $1,555 monthly payment is really steep considering she won’t have an income right away and wants to invest in the business.

A friend who isn’t familiar with student loans told her to put her loans in forbearance and then start paying back her loans once her business starts making money. Fortunately, she decides to do her own homework before making a decision. She comes across REPAYE, which sounded interesting.

On REPAYE she can have $0 payments without using forbearance and also get an interest subsidy. Sure would be nice to have $0 payments without having to go on forbearance!

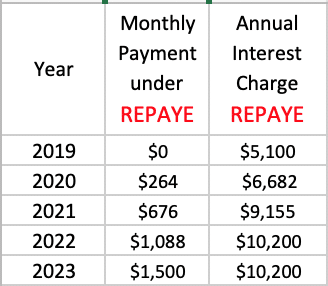

Here’s how the interest subsidy works:

The $150,000 in debt at 6.8% is an interest charge of $10,200. Under other repayment plans, any debt payments would go toward interest first. If the payments aren’t high enough to cover the interest, the remaining interest will accrue on the loan.

For example, if Maria were on PAYE or IBR with $0 payments, her loan would accrue $10,200 in interest over the next 12 months. If her payments were $3,000, her loan would accrue $7,200 in interest ($10,200 interest charge minus $3,000 in payments).

However, REPAYE wipes away half of the interest that would accrue. In Maria’s case, this would save her a lot of money, especially in the first year. Maria’s interest expense would be cut in half, and only $5,100 in interest would accrue instead of $10,200. That’s like the government making a $425 payment each month on her behalf.

As her income grows, so will her REPAYE payment. As her payment covers more interest, there is less interest to subsidize, so the interest charge on the loan goes up. In the event her payments were $3,000 for the year, the government would pay half of the $7,200 that would accrue on her loan ($3,600 for the year, or $300 per month).

Her projected interest charge would be $10,200 regardless of her calculated payment on PAYE or IBR:

Maria could stay on REPAYE for two years, which would keep her payments low as she’s building her business. She’d pay $0 in year 1 and $3,169 in year 2. All the while, the government would pay $8,618 in interest on her behalf over the two years.

In the end, Maria decides to do what we call the “REPAYE then Refi” strategy. Keep payments low and affordable while getting an interest subsidy. Once her income increases, she’d refinance and commit to aggressive repayment of the loan.

Is pursuing an MBA salary worth the student loan debt?

What’s the MBA ROI? We need to take a look at the difference in salary pre-MBA and post-MBA and the cost of attendance for the school and paying back the debt.

Looking at Amanda’s case, she’s going to end up spending $187,000 paying back her MBA debt over 10 years after refinancing. But her income will double after graduating from $75,000 to $150,000. That means she’ll recoup the cost in 2.5 years with her pay raise. Getting a top-tier MBA would definitely be worth it in that scenario.

Marc will be getting a $5,000 pay raise post-MBA — a 7% boost — but it will cost him $62,000 to pay back the $50,000 in student loans. It will take a little more than 12 years of that extra income to break even ($62,000 / $5,000 = 12.4 years).

Certainly, the ROI is much lower than Amanda’s scenario. Someone in Marc’s situation should really consider whether spending the money is worth it. It’s not necessarily a bad idea if it is the best way to get on a fulfilling career path, and the pay bump would be all gravy after 12 years.

Many people assume that getting an MBA is worth the cost no matter what, but as the research shows, it might not be as lucrative as people think.

Anyone considering an MBA should take a look at their future income and career prospects after graduating and compare that to their pre-MBA status. Student loan borrowers should evaluate their current debt load as well, especially if private loans are in the picture. It's also important to note how the prospective repayment term will affect the total costs of the loan if considering an MBA loan.

Student loan repayment on an MBA salary

I’ve laid out a few case studies to help you determine whether getting an MBA is worth the cost. Getting scholarships can help, but sometimes you need to resort to federal student aid and/or private student loans. But what if you already have your MBA and are trying to figure out the best repayment for your student loans?

Every situation is unique. Some people have more debt. Others have a spouse with student debt. Maybe you’re an MBA grad who is thinking about a change of career or starting a business and wondering how that will impact your loan repayment.

The good news is that there’s an optimal plan for you regardless of your situation.

We’ve done over 2,800 individual student loan consults advising on more than $730,000,000 in total student loan debt. If you’re looking to get a custom plan, you can check out all the details here.

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, IDR, or refinancing (including the one lender we think could give you the best rate).