Getting a Master of Business Administration (MBA) can open doors for your career. This is especially true if you graduated from one of the top-ranking business schools. The only problem is you probably shelled out $70,000 or more per year for tuition.

With numbers like these, it’s important to know the strategies for paying off MBA student loans. MBA student loan refinance is one way to deal with all of that debt. But you might be surprised to learn about your other options.

Amount of debt from MBA student loans

Since 2005, graduate students have been able to borrow up to the full cost of attendance in Grad PLUS Loans. This has essentially given graduate degree programs, like MBA programs, blank checks to receive 100% federal financial aid for whatever they charge.

With this in mind, it should be no surprise that tuition prices at graduate programs have massively increased in recent years which has also led to more graduate student loan debt. In a 2018 Bloomberg survey, half of the MBA grads from the best business schools were borrowing at least $100,000.

PayScale reports that the average MBA grad makes $90,125. It wouldn’t be accurate to take this number and address MBA debt payoff, as the career paths are too varied for this degree. For example, a financial analyst makes an average of $65,000 while a Chief Financial Officer (CFO) makes an average of $151,000.

Student loan refinancing for MBA loans might work for the CFO but not the financial analyst. Your student loan debt payoff strategy will need to be specific to your current salary and career goals.

MBA student loan refinancing vs federal loan consolidation

If you took out multiple student loans during your undergraduate and graduate studies, there are two ways that you can consolidate them into one loan. The first option is by taking out a Direct Consolidation Loan with the Department of Education. The second way is by refinancing with a private lender.

Each option has its own set of pros and cons. If you're only looking to simplify payment and change servicers, federal consolidation may be the way to go. All Direct Loan borrowers qualify regardless of their credit score. And by keeping your MBA loans with the Education Department, you'll remain eligible for federal benefits.

However, the one downside to federal consolidation is that you can't use it to lower your interest rate. So even if you have a solid credit report and low debt-to-income ratio, you won't be able to get a more attractive rate.

This is where refinancing comes in. While private lenders can match all of the flexible repayment options offered by federal student loans, they may offer significantly lower interest rates. So if you have six figures of MBA student debt, refinancing could save you tens of thousands of dollars in interest payments over the life of your loan.

When to use MBA student loan refinance options

Refinancing student loans can be done online or at your local bank or credit union. The lender pays off your student loans and issues you a new private student loan. You then have one payment and new loan terms.

When refinancing, the goal is typically to aggressively pay off your loans. This means in addition to a lower interest rate, you may also want to opt for a shorter loan repayment term to pay off your loans as soon as possible.

The hard part is deciding if refinancing MBA loans will actually work for your situation. If you have private student loans, then refinancing for a better rate is always something you want to investigate. But federal student loans are another story.

Pros and cons of federal MBA student loan refinance

With federal student loans, there are some general pros and cons of refinancing your student loans. The pros of refinancing your MBA loans are as follows:

- You could save on interest payments. The Direct Unsubsidized Loan interest for graduate students is 5.28%. The rates on Grad PLUS Loans and Parent PLUS loans are higher at 6.28%. Refinancing your student loans could get you a much lower rate.

- You’ll have just one monthly payment to manage. You could make your finances easier to keep track of by consolidating into one new loan.

- Cosigner release. If you needed a cosigner to obtain your original loan and can't remove them, refinancing could help you release them and start fresh.

A better interest rate means more money in your pocket. One payment means it’s easier to deal with, but that doesn’t mean you won’t miss a few things. The cons of refinancing your MBA student loans are as follows:

- You’ll lose federal borrower protections. Some of these beneifts, such as deferment and forbearance, can be helpful if you experience financial difficulties.

- You won’t be able to sign up for an income-driven repayment (IDR) plan.

- You'll have to submit to a credit check. You will need to have a good credit score and meet other eligibility requirements to qualify for the best rates.

From this general advice, it sounds like you still can save more money by refinancing your MBA loans into private loans. But there's a payment hack that only applies to federal loans that could align better with your career goals. Let's take a look at an example of when sticking with your federal loans, even at a higher interest rate, could save you money.

Don’t refinance your MBA student loans until you review this hack

As mentioned above, MBA salaries vary significantly. It’s both your income and your student loan amount that will determine if refinancing is a good idea or not.

The hack is keeping your federal student loans and enrolling in the Revised Pay As You Earn (REPAYE) repayment plan. REPAYE is one of the four IDR plans. The advantage of REPAYE is that the government actually helps with the interest.

If your monthly payment doesn’t cover the interest, the government will pay all your interest for up to three years on subsidized loans, then half for another three years. Under REPAYE, the government will also pay half of the interest due on your unsubsidized loans.

Editor's note: The REPAYE plan was replaced by the Saving on a Valuable Education (SAVE) plan. Learn how the SAVE plan can save you money on your MBA.

Case study #1

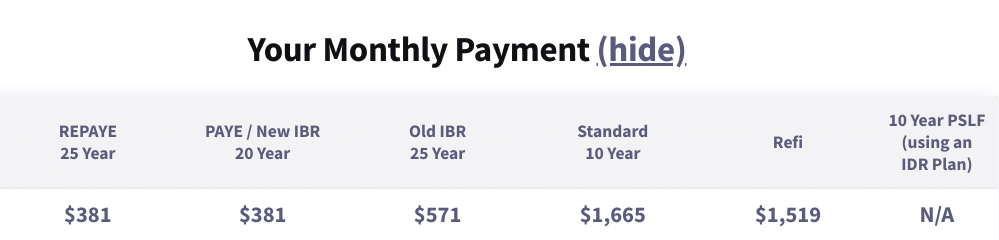

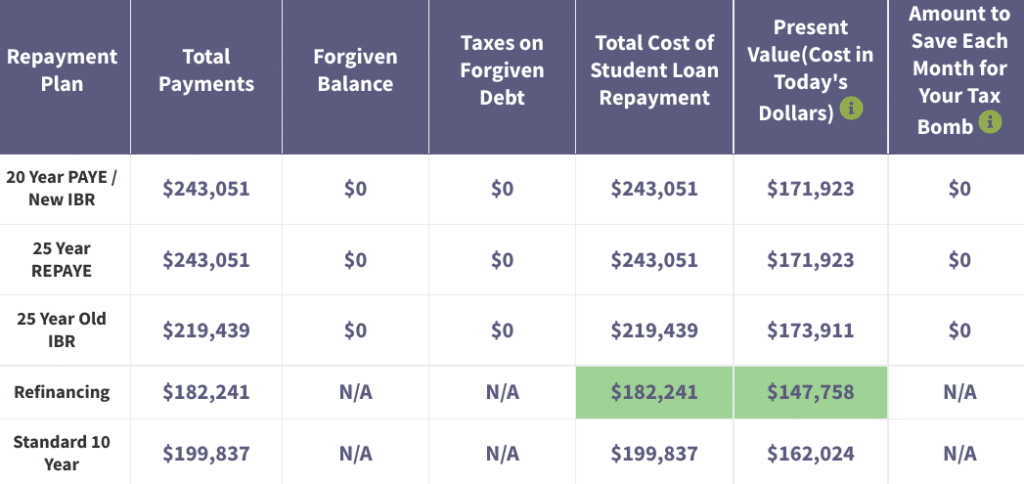

Let’s look at how this could play out for two different scenarios using the numbers mentioned above. If you left a top business school with $150,000 of student loan debt and became a financial analyst making $65,000 in your first year working, you're going to want to go with PAYE or REPAYE.

If your average federal interest rate is 6% and you’re single, your monthly payments would be around $415. That's more than $1,100 less than you'd pay with the 10-Year Standard Repayment Plan and over $1,200 less than your monthly payment after refinancing at 4%. That's a huge amount of extra monthly cash flow!

From here, you have two options moving forward:

- Go for student loan forgiveness: After 25 years, your remaining student loan balance will be forgiven through the IDR forgiveness program. You’ll need to pay taxes on the forgiven amount, so prepare for that.

- Refinance after earning more later: If you move up the pay scale in a few years, you can refinance your MBA loans then. Since half the interest is paid for, your loan balance won’t have grown as rapidly. With a higher income down the line, you may be able to aggressively pay your loans off. This can be a good option for a grad who is an entrepreneur or works at a startup.

If you go the traditional route with your MBA and land a career that pays six figures or more, it's going to make more sense for your cash flow to refinance your student loans.

Case Study #2

Now let’s say you become a CFO with a $150,000 salary and the same student loan balance of $150,000. You can pay off your loans in 10 years and then reallocate those funds toward your future investments. By refinancing, you will pay off your debt faster and save tens of thousands of dollars in interest along the way.

The general rule to follow for refinancing is this: If you owe less than 1.5 times your income, refinance and pay your loans off aggressively. But if you owe more than that, sign up for an IDR plan to make your payments more manageable.

There’s also an exception to every rule. Most MBA program grads work in the private sector. But if that’s not you, don’t refinance at all. If you work at a not-for-profit or government agency, you could qualify for total loan forgiveness through Public Service Loan Forgiveness after 10 years of payments on an IDR plan. If you qualify, this can be a better repayment option than refinancing or REPAYE.

Should you pursue an MBA student loan refinance?

When you’re looking at refinancing your MBA federal student loans, you'll want to review your cash flow needs and your career goals. If you'll be working in the private sector and expect to be making six figures in a short period of time, refinancing could be the right move.

If you do decide to pursue refinancing, make sure to compare several private lenders before making a decision. At the least, you'll want to make sure that the lender doesn't charge an origination fee or prepayment penalty.

But you'll want to look for other benefits as well, such as a formal forbearance policy, an autopay discount, and flexible repayment terms. And keep in mind that several student loan refinance companies are currently offering generous cash bonuses as well. Here are a few of our favorite refinance lenders:

- Earnest: Best for payment flexibility. Read the review.

- ELFI: Best for customer service. Read the review.

- SoFi®: Best if you're unsure where to apply. Read the review.

- Credible: Best for comparing multiple lenders. Read the review.

If you need help deciding whether you should refinance your MBA student loans, reach out to a consultant on our team. Student Loan Planner® specializes in helping people with over six figures of student loan debt. We can create a plan for you based on your individual situation and salary.

Refinance student loans, get a bonus in 2025

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

Bonus for eligible users who refinance $100k or more (bonus from SLP, not SoFi)

|

Fixed 4.49 - 9.99% APR

Variable 5.99 - 9.99% APR with all discounts with all discounts |

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 4.45 - 10:49% APR

Variable 5.88 - 10.49% APR

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 4.29 - 10.24% APPR

Variable 4.86 - 10.24% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 4.99 - 8.90% APR

Variable 5.29 - 9.20% APR

|

|

|

$1,099 Bonus

For 150k+, $300 to $500 for 50k to 149k.

|

Fixed 4.88 - 8.44% APR

Variable 4.86 - 8.24% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 3.85 - 11.38% APR

Variable 4.33 - 12.35% APR with autopay with autopay |

Not sure what to do with your student loans?

Take our 11-question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, SAVE or another IDR plan, or refinancing (including the one lender we think could give you the best rate).