Hi there, I’m Theresa! I am a wife to an amazing guy and a mother of three young energetic kids. We have been together for twelve years and married for seven. By day, I work as a recruiter. By night when the kids are in bed, I am a side hustler who writes CVs and blogs about med school loans and marriage at DocWife.com.

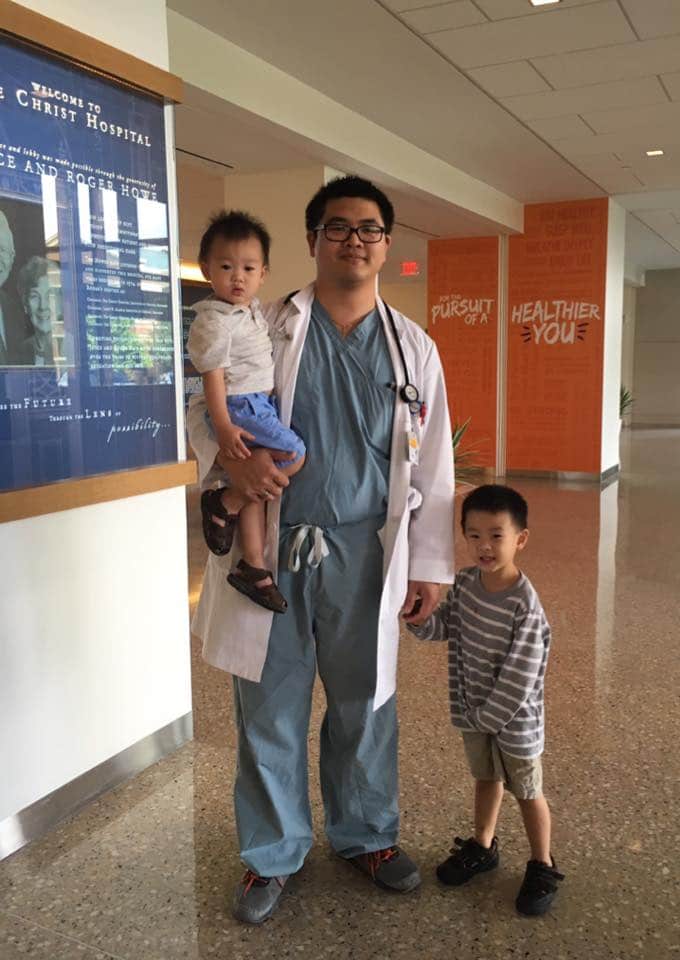

I am also a doctor’s wife.

It all started when my now-husband and I met and fell silly in love during undergrad. We graduated right as the recession hit and we were lucky that we even found jobs in our fields. Those were rough years full of uncertainty about our future job stability.

After a few years, my husband made a decision: he was going to go to medical school. It made perfect sense to me. He was very intelligent, hard-working, and incredibly kind, gentle and caring.

So, that’s how the guy who I loved — who hadn’t taken a single biology class yet — went back to school and became pre-med. After finishing four years of medical school, he completed three years of residency in internal medicine.

These days when people first meet me, they may see his MD degree and think that I married a doctor. But the truth is that I married a college student, and I made a doctor as we were married before medical school.

I watched and fully supported him every step of the journey.

It has been a road with tremendous challenge. Weeks before finishing residency, instead of joining the workforce he made the decision to continue his training and try to subspecialize in gastroenterology. To match into a GI fellowship, he had to publish his research extensively beforehand. Because he made the decision to go into GI at the last minute and didn’t publish enough, he tacked on research years to his training. Now, this road isn’t just long, it’s winding.

He had my full support once again.

Some of our friends ask me, “How can you tolerate him being a ‘forever’ doctor-in-training?”

To me, watching my husband have an adventure, and the line between working and retirement blurred down the road – what is better than that? That’s what GI is like for him, and that’s what I want for him. Time will go by no matter what he is doing, and we decided to spend the time fiercely pursuing what he loves.

So, he is a research fellow now working on a few GI projects waiting to match to a gastroenterology fellowship. And the medical journey continues.

How We Handle Finances Together

St. Exupery said, “Love does not consist in gazing at each other, but in looking outward together in the same direction.”

In our marriage, that view includes a home, kids, going on amazing trips, and doing charity side by side. We share the same hopes, goals, and dreams. But first, to be able to pursue any of this, we had to sort our finances on a day-to-day basis.

How each couple combines finances is very personal. For some, having separate his and her accounts works best. As long as separate isn’t synonymous with secret, it can work. For others, having “three pots” works best – one is his, one is hers, and a third holds the funds for shared living expenses.

Then there are some who combine them all into one joint account. This works for our family because it’s an easy transition to live off of one salary. If you’re like me, you have young kids to care for and you want to be able to exit and re-enter the workforce as you and your family need to.

Figuring out day-to-day cash flow is a necessary part of balancing med school and married life, but it isn’t the whole story. It wasn’t the hardest part for us, and probably isn’t the hardest part for most doctors and their spouses.

The hardest part is debt.

Uncovering Our Financial State

Now, our vows are to love one another for better or for worse, and for richer or for poorer. As a medical family in training, the “for worse and for poorer” is underlined: I inherited his six-figure student loans.

My ignorance of student loans was bliss at the time. I am uncomfortable remembering how comfortable I was with them. All these details were blurry:

- How much we borrowed

- What interest rate

- Who the lender even was

We welcomed our first child during the last year of medical school. While he would be working or studying for days in a row that ran on like what seemed to be weeks, I woke up before dawn to drop off our baby and worked my 9-5, dug myself from underneath the pile of laundry, put dinner on the table, attended weddings alone, shoveled the snow, and cut the grass. Every time he text me that he was coming home, he would be there for a few more hours.

With the seemingly endless, heavy mental load to raise our baby and keep our family running, we put aside student loans.

As medical school was ending and student loan payments loomed over the horizon, I thought of them again. I waded through blogs, forums, sites and did the late-night scrolling while the baby was sleeping. Toggling between a dozen tabs, I felt a mixture of overwhelm and lack of motivation. Wondering if my husband would know more than me about how to crush his student loans, we had a heart-to-heart conversation.

“How much do you think we’ve been borrowing?” I asked.

“Ballpark $40,000 a year,” he said. (Emphasis on the ballpark.) And that was all I got from him, as I saw the exhaustion in his eyes and the fatigue in his face, and went back to studying for his Step 3 Board Exam.

My husband is incredibly good at medicine. But the medical training he went through was so single-minded and intense that it precluded pursuit of knowledge in other areas of life. His aptitude as a doctor is tested on his ability to make sound choices and judgments for his patients whose lives were in his hands – and not on his ability to contribute to his IRA.

The silver lining is that throughout all of the training, he was so busy that he didn’t have the time to spend any money.

But, I am not a quitter and these loans weren’t going away on their own. Luckily for him, he married somebody who likes to take charge of our future. I got over my fears and learned the ropes to steer the ship wherever we wanted to go. I take care of us, so he can focus on his training. And you can do the same for your spouse.

Our Steps to Paying Off Med School Loans as a Married Couple

1. Finding Out Where Med School Student Loans Are

The first thing I did was find out where all his loans were held, which is the first step for anyone with student loans.

Federal loans are straight-forward. To get your federal loan information, start by making an account on the Federal Student Aid website. Then you would be able to locate your NSLDS data file, which houses all federal student loan records. Download the .txt file – a very ugly file that is chockful of loan information.

Private loans can be trickier and may require some detective work. Get a copy of both spouse’s free credit report at Annual Credit Report. A credit report is different from a credit score; a credit score is just a number. A full credit report will have more information and generally list all loans and lenders.

If you don’t see information on these reports about balance, account number, and interest rate, you can call the lenders to obtain it.

Once you have the information, for both federal and private loans, then you can sit down with your spouse and start putting together all of the pieces of the puzzle — and make a plan.

2. Identifying the Right Strategy for Paying Med School Loans

With all the loan information gathered in front of me, I was ready to crunch some numbers. There were three income-driven plans at that time, and we had to choose one of them: IBR, PAYE, and REPAYE.

Note the REPAYE plan was replaced with the SAVE plan (short for Saving on a Valuable Education). The SAVE plan comes with more generous borrower benefits, such as a higher poverty line deduction and lower monthly payments. However, it wasn't available at the time the following consultation was completed.

Deciding if PAYE was right for us was simple — my husband wasn’t eligible for it because he took out loans before 2007. Your spouse would also be ineligible if he was a freshman in college before 2007.

We were left with a choice between IBR and REPAYE. I plugged in numbers using my income, his income, and our household size of 5.

“OK, this is easy. We should take advantage of the loophole – after seeing how marriage can affect med school loans – file taxes separately, and pay $0,” I thought.

So IBR it was. I was confident we were making a super smart decision, but it wasn’t a decision I could easily discuss or compare to others. Any family who is coming out of school with six-figure student loans and a decade of medical training while raising small kids is going through an experience very unknown to outsiders.

Then I heard about Travis with Student Loan Planner® and his considerations for single and married med school students. He came highly recommended by many financial planners that I trust who work specifically with doctors with the same or even larger student loan debt. And he was engaged (at the time, now married) to a doctor.

I booked a consult to get a second opinion, even though I expected he would pat me on the back, telling what a diligent job I did figuring everything out and how good my husband had it. But I needed that confirmation for peace of mind.

I was completely wrong. Travis advised us to switch from IBR to REPAYE.

He showed me that in my previous analysis, I didn’t fully consider the sweet deal of interest subsidies that came with REPAYE, which would off-set the $500+ monthly payments I was scared of. By being on IBR instead of REPAYE, we were leaving thousands on the table!

Travis told us being on IBR was a common mistake many dual-income families make. If that describes your family, and you’re on IBR, you should triple-check your payment plan.

After making the switch from IBR to REPAYE, we were finally certain that we were in the most optimal strategy for us. With the student loan calculator that Travis makes available on his site, I could change a few variables. For example, I might add another child or become a stay-at-home mom. Then, I could see if our current strategy needs changes or not.

3. Why You Should Consult with Travis for Your Student Loan Planning Needs

Over the course of his business, his team has consulted on over $2.6 billion of student debt for families like ours.

If we had consulted with Travis at the beginning instead of at the end of residency, we would have saved tens of thousands of dollars.

Alright, so tens of thousands won’t make or break our lives with our expectant high household income. But what if I told you that with that money, we could have fully funded his 403b retirement account? In 30 years with 7% return, that could be hundreds of thousands of dollars. Now, that is a crazy amount of money.

Suddenly, booking Travis for a student loan consult doesn’t seem that expensive anymore.

The irony is that the time when you need to manage your student loans is also the time when you are at your lowest income and net worth. If that’s you, too, learn from me and don’t skimp in this area. All this time avoiding the daily latte would not have come close to the amount you could save if you get the right strategy right now. Don’t cut corners when the big bucks are on the line.

Once we were in the optimal student loan strategy, my mental load was lightened.

4. Protect Your Family With Insurance

With all of the plans in place, we protected what we had using life insurance.

While federal student loans are forgiven in case of death of total disability, it varies for private loans. It also gets complicated if you took out the loans while you lived in one of the nine community property states – Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, and Washington.

Let yourself sleep soundly at night. Buy a term life insurance policy for your spouse (if you want a place to start, get a life insurance quote here). If you have any children, take one out for you, too. In the case of the greatest nightmare, finances are going to be the least of your worries for those that are left behind.

5. Plan For Financial Success As A Family

In marriage, you combine hopes, dreams, and goals. You sink or float together.

Your spouse may become or already be the primary income earner, but no matter how high your household income is, it’s not about the money you make — it’s the money you keep.

One way to keep more of it is getting a plan in place for your student loans so you can properly manage med school loans and marriage. I’m glad we worked with Travis to solve the student loan piece, get some insurance protection, make a budget, and enjoy life along the way.

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, IDR, or refinancing (including the one lender we think could give you the best rate).

Comments are closed.