Becoming a doctor can be a rewarding career in many ways, but the path to get there is a tough one. Medical school is a grind. And the tuition costs are high. This grind continues after graduation when residency and loan repayment start to hit. There is a bit of good news, though.

The jobs for physicians, income potential and student loan repayment options make paying off medical school debt one of the easiest types of student debt to pay off out there compared to other graduate-level programs. That being said, there are plenty of ways to mess it up.

There are a ton of factors that go into the optimal loan repayment strategy for doctors. The two main factors you need to evaluate in order to pay back your student loan debt, however, are:

- How much do you owe?

- What is your income?

Let’s clear up the mistakes to avoid and the best ways to pay off medical school debt.

How much medical school debt do doctors graduate with?

The median physician graduates with $200,000 in student debt, according to an Association of American Medical Colleges (AAMC) survey. But we’ve seen numbers much higher than that.

Here at Student Loan Planner®, the average debt for medical school graduates we've advised is $328,000. That’s more than 60% higher than the AAMC survey results. Why is this the case?

For one thing, we’ve noticed that MDs graduate with medical school debt in the $200,000 range while DOs often graduate with debt north of $300,000. That’s just from grad school. The physician clients we work with come in with debt from undergrad that has been deferred and accruing interest as well. Many haven’t been using the most optimal student loan strategy. Others have used deferment and forbearance all the way through residency (more on that later).

Either way, multiple six-figures in medical school loans can seem scary. Before we get into that, let’s lighten it up a bit by talking about the nice income statistics.

How much do doctors make?

How much do doctors make can be a trick question because it all depends on what kind of medicine they practice. There are just over 750,000 doctors in the U.S. according to the BLS. Physician salaries vary greatly based upon the area of focus or specialty.

That 750,000 doctor number is split about 50-50 between specialists who make an average salary of $344,000 according to Medscape's 2021 Compensation Report and primary care physicians who make $242,000.

Dissecting it even further, the highest physician salary belongs to plastic surgeons and orthopedic doctors. They each earn above $500,000 on average. The lowest physician salary belongs to pediatricians, who earn $221,000 on average.

That’s nearly a $300,000 difference between the highest and lowest compensated specialty.

Student loan repayment can also look vastly different between the radiologist who makes $413,000 and the family medicine doctor who makes $236,000 on average.

Related: How to buy disability insurance for radiologists & what it costs

Repayment options for borrowers with medical school debt

Here at Student Loan Planner®, we’ve done 5,500 consults and advised on over $1.3 billion of student debt. Our experience shows there are two optimal ways for physicians to pay off student loans. These options happen to be on opposite ends of the spectrum.

Option 1: Aggressive payback

For people who owe 1.5 times their income or less (e.g., physicians with a salary of $250,000 and loans totaling $375,000 or less) and aren’t working for a Public Service Loan Forgiveness (PSLF)-qualifying employer should throw every dollar they can to pay back their loans as fast as possible.

How long should it take to pay back medical school debt? No more than 10 years. Often it involves refinancing to get a lower interest rate and making extra payments whenever possible. This strategy works best for physicians working in private practice with no opportunity for loan forgiveness programs.

Option 2: Pay as little as you can and save aggressively instead

For people who owe more than twice their income (e.g., a physician with a salary of $250,000 and student loans totaling $500,000 or more) or who work for a PSLF-eligible employer, the goal is to get on an income-driven repayment plan that will keep their payments low and maximize loan forgiveness.

Most physicians we work with take this path if they’re going for PSLF or if they have a spouse with six-figure student debt as well.

That being said, physicians could benefit by starting on this repayment path as a resident with that low starting salary. Then they can either move to a more aggressive approach or stay on the PSLF path when they become an attending physician.

Related: The Doctor’s Dilemma: PAYE vs. REPAYE vs. New REPAYE for Student Loan Repayment

Med school debt repayment for physicians working in private practice

Loan repayment for doctors in private practice is usually pretty straightforward. The majority of them make more money than they would working for a PSLF-qualifying employer, so they owe less than 1.5 times their income in student loans.

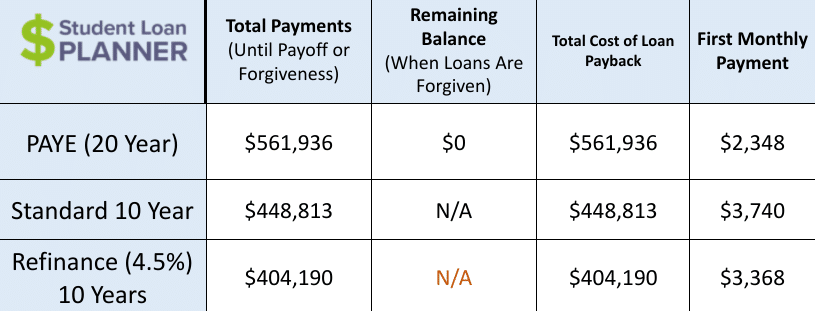

Let’s use an example of Martin, who owes $325,000 or student loans at 6.8% and is earning $300,000.

Refinancing is the clear winner here. Martin will be debt free in 10 years by refinancing to 4.5% and paying $3,368 per month.

The PAYE plan ends up being the most expensive option because his income is high compared to his debt. He ends up paying off a 6.8% loan before he gets to the 20th year where any leftover loans would be forgiven. In fact, he pays off the loans in full over 15 years. That costs him $157,000 more in interest compared to refinancing.

Refinancing saves money on interest. The 10-year standard repayment plan is $44,000 more expensive because of the extra interest paid on a 6.8% loan versus a 4.5% loan.

Martin is a clear-cut refinance case. He’ll save tens of thousands of dollars by refinancing compared to the next best option. Compare student loan refinancing lenders and current bonuses.

Med school debt repayment for physicians working for a non-profit or government employer

The Public Service Loan Forgiveness program (PSLF) is one of the more powerful loan repayment strategies that many doctors are eligible for. It can work out for a physician to pay a fraction of what they owe in loans and have the rest forgiven tax-free.

To get PSLF, physicians need to meet the following three criteria:

- Have Direct federal loans: You’ll know if the loan has “Direct” in the name or “DL” (e.g., Direct Stafford, Direct Grad Plus, etc). The best thing to do is to check the NSLDS website to check out the loan types. Any FFEL loans or Perkins Loans won’t be eligible for PSLF but can go through consolidation to become Direct loans and, therefore, PSLF eligible. You can consolidate loans on your own for free without having to pay for it, so beware of people trying to charge you for federal loan consolidation.

- Pay on one of the income-driven repayment (IDR) plans. Only payments made while on an IDR plan (PAYE, REPAYE, IBR, ICR) count towards PSLF forgiveness. Conversely, the graduated, standard, and extended plan payment plans all do not count.

- Be employed full-time at a not-for-profit or government employer: If you work in a nonprofit hospital, in academia or for the government, you could be eligible for PSLF. Residency and fellowship employment usually count toward PSLF too. So if your long-term goal is to work for this type of employer, start getting credit toward PSLF immediately.

After making 120 qualifying monthly payments, you can apply to have the remaining loan balance forgiven tax-free. These payments don’t have to be consecutive.

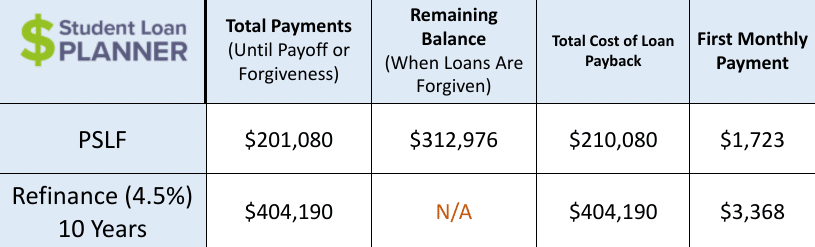

Let’s say that Martin is now looking at a PSLF-qualifying job earning $225,000 and still owes $325,000. He decided to use up his forbearance in residency rather than make payments, so he still has 10 years to go (this is a big mistake we’ll review in a little bit).

Martin uses PAYE while going for PSLF. It ends up costing only $210,080 to pay back $325,000 of loans. Refinancing would end up costing $196,000 more than the PSLF projection in this case. That’s a ton of money!

This example demonstrates why PSLF is such an important program to look at. Now, had Martin started repayment during residency, these PSLF projections would be substantially lower because he’d have three years of payments based upon a much lower discretionary income.

Should Martin take the PSLF job just to get his loans forgiven? Absolutely not! Taking the $300,000 private practice salary would pay him $75,000 more per year. That’s $750,000 in missed income over 10 years to save $196,000 in student loan payments, which would be a horrible tradeoff. The good news is that there’s a right repayment strategy for him depending on which career path would be more fulfilling to him.

Check out our top PSLF tips to learn more best practices to save money.

How to pay off med school debt while in residency or fellowship

As I alluded to before, residents can make a major mistake paying back their debt if they don’t start loan repayment while in residency (and possibly in fellowship) and instead use deferment or forbearance.

I’ll lay out two scenarios as examples: The first is for doctors who are going for PSLF. The second will be for doctors who will be working in private practice. Let’s see how starting repayment in residency will impact their loan repayment.

Example 1:

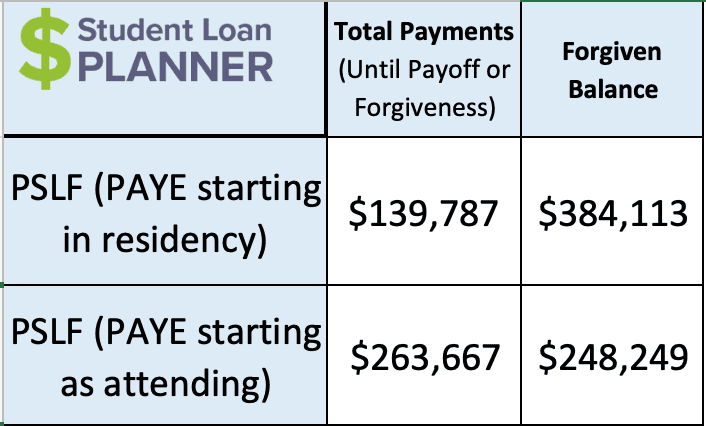

Sarah has $325,000 in medical school student loans at 6.8% interest and is going for PSLF. She starts in residency making $60,000 with $2,000 raises each year. She’ll make $240,000 when she becomes an attending physician in three years with 3% raises each year.

Here’s the difference if she selects PAYE starting right after graduating from medical school and gets credit toward PSLF versus starting after completing residency:

Sarah could save $123,880 paying back her loans over 10 years if she starts loan repayment while in residency rather than when she becomes an attending physician. That’s nearly $125,000 in savings! Plus, if she waits until becoming an attending physician, that pushes off forgiveness by three years.

She can get three years of credit toward PSLF when her IDR is based on a much lower salary while in residency instead of having all of her payments based upon her attending physician salary.

Example 2:

Now, let’s take a look at Michael, who plans to join a private practice and not pursue PSLF. He also has $325,000 in medical school student loans at 6.8% interest.

If he refinances his loans down to 4.5% or a 10-year term, he’d be on the hook to pay $3,368 per month. That’s not going to happen on the $60,000 resident salary. So, he decides to defer paying back his loans until he becomes an attending physician.

Putting his loans in forbearance means that he’ll add about $66,300 in interest over those three years. He’ll then have to refinance $391,300 of student loans when he becomes an attending.

REPAYE could be a good option for him. It provides an interest subsidy that could cut about $30,000 of interest off of his loan with affordable payments while in residency, which would certainly be worth the time to do it.

Other factors that impact medical school loan repayment

We’ve gone through some very general loan repayment options for physicians, there’s often more to it than that. For instance, each of the case studies above assumed that all of the debt was in federal student loans. But if you have private student loans, the entire discussion changes.

Private lenders don't offer nearly as many benefits as the federal government. Income-driven repayment isn't an option neither is PSLF. For this reason, most private student loan borrowers should focus on trying to refinance to the lowest-possible interest rate. And if you're willing to work in a critical shortage facility for a few years, you may also want to apply for the NSHC Loan Repayment program.

There are plenty of other factors to consider when picking the best plan. Here’s a small sampling of variables that can impact which loan repayment strategy is best:

- Career path and aspirations

- Spousal income and student loan situation

- When you first took out the loans

- Whether you live in a community property state or not

- What monthly payment you can afford

Check out the Student Loan Planner® Podcast Episode 41 on the 26 things that make your loan situation unique.

Physicians need a plan to pay back their medical school debt

With all of those factors combined with the size of the debt, doctors should focus on getting the optimal student loan strategy immediately upon graduating and almost certainly before starting residency.

If not, it could mean wasting hundreds of thousands of dollars by starting too late or getting on the wrong student loan repayment strategy. We’d rather that money stay in your pocket and help get you to get closer to financial freedom.

The biggest obstacle keeping doctors from getting the right strategy in place is having limited time and energy to figure this out. Plus, there’s a sea of shady characters and misinformation out there.

Rather than sifting through the mountains of information, we can clear it all up for you in a short amount of time. Student Loan Planner® has done over 5,500 student loan consults for clients with over $1.3 billion of student loans. We can help you figure out the optimal path in just one hour with a consult.

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).