According to the Education Data Initiative, the cost of medical school continues to go up each year. New news? Not really.

If you’ve taken the Medical College Admission Test (MCAT) and achieved a strong enough MCAT score, your next step is to look at medical school application processes for the typical 15 to 20 medical schools. But what should your criteria be when considering the cost of the MD or DO degree you’re pursuing?

Typical medical school costs vs. outside-the-box perspective

Let’s start from what’s typical and move into an outside-the-box perspective, some of which requires planning in advance of attendance.

Typical:

- Average costs for medical schools.

- Origination fees and accrued interest.

- Pay to zero.

Outside the box:

- No cost or low-cost premier programs.

- Military service.

- Public Service Loan Forgiveness.

- National Health Service Corp.

Average costs for medical schools

According to the Education Data Initiative, the average total cost for in-state students is $216,778 — for out-of-state students, it’s $267,198. Within the 193 accredited public and private medical school programs, total costs range from $159,620 to $256,412.

Don’t forget the fees

Travel costs associated with medical school interviews are budget line items that can add up quickly. If you visit 10 schools, nine of them will have “pay to play” expenses that you can’t get back.

Once you’ve passed medical school admissions with flying colors, now you’ve got the USMLE Step exams to worry bout.

But first, let’s put these smaller expenses aside and consider origination fees and accrued interest.

Origination fees and accrued interest

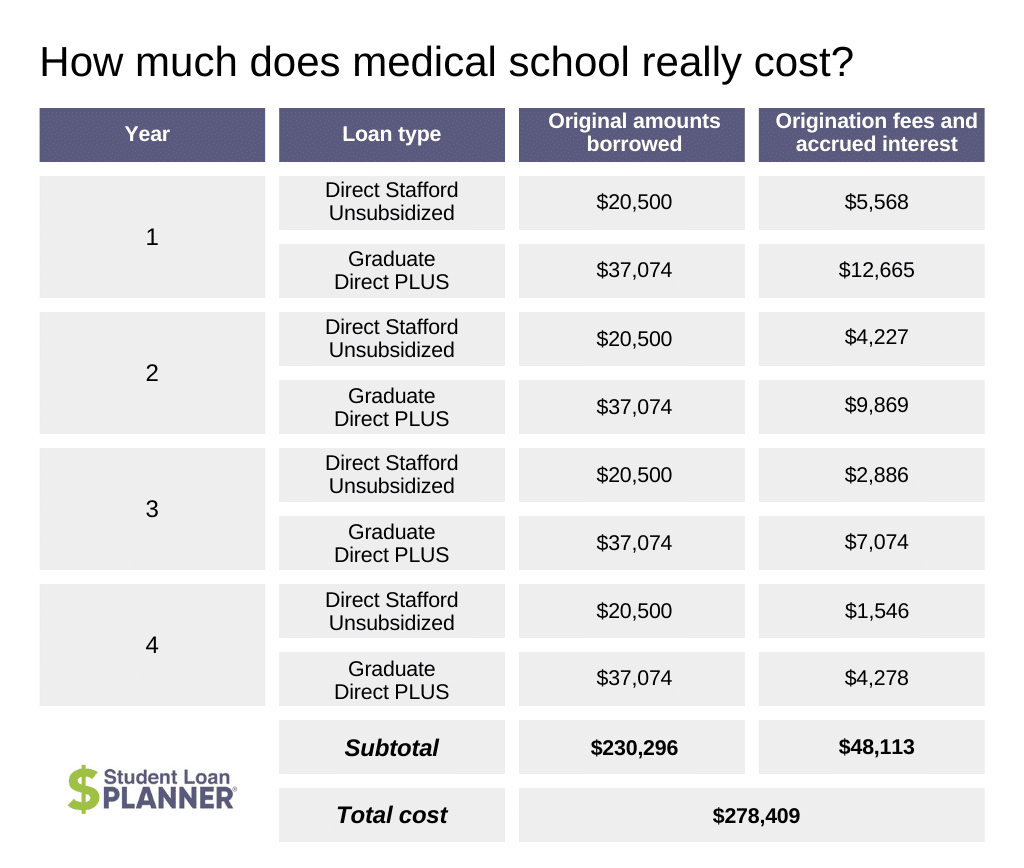

When you take out federal student loan debt for a medical education, your financial aid package depends on your financial need. However, the two types of federal loans typically offered are:

- Direct Stafford Unsubsidized Loan ($20,500 per year).

- Direct Graduate Plus Loan (the remainder, up to the annual cost of attendance).

With the Stafford Loan, the origination fee is just over 1%, and with the Graduate PLUS Loan, it is just over 4%.

The interest rates for loans can change between academic years, and there has historically been a 1% difference between the two loan types. For example, for the federal loans issued between 6/30/2023 and 6/29/2024, the interest rates are 6.54% for Direct Stafford Unsubsidized Loans for graduate students, and 7.54% for Direct Graduate PLUS Loans.

These fees are not included in the total cost estimates from above for a college of medicine. Using the most recent average total cost for all medical schools, $230,296, let’s start with an even annual amount of $57,574.

If tuition and fees don’t increase from your first year to your final year (depending on the school), then here’s what actual medical school students’ loan balances could look like:

If you attend a medical school with average costs, you’d accumulate nearly $50,000 in origination fees and accrued interest on your loans, since the loans don’t just sit there at 0% interest while you’re attending school.

Then, you have an intern year and additional training years, where income isn’t high enough to start making a meaningful dent in the amounts borrowed.

So, you get on an income-driven repayment plan, and the balance continues to accrue interest for three to seven years.

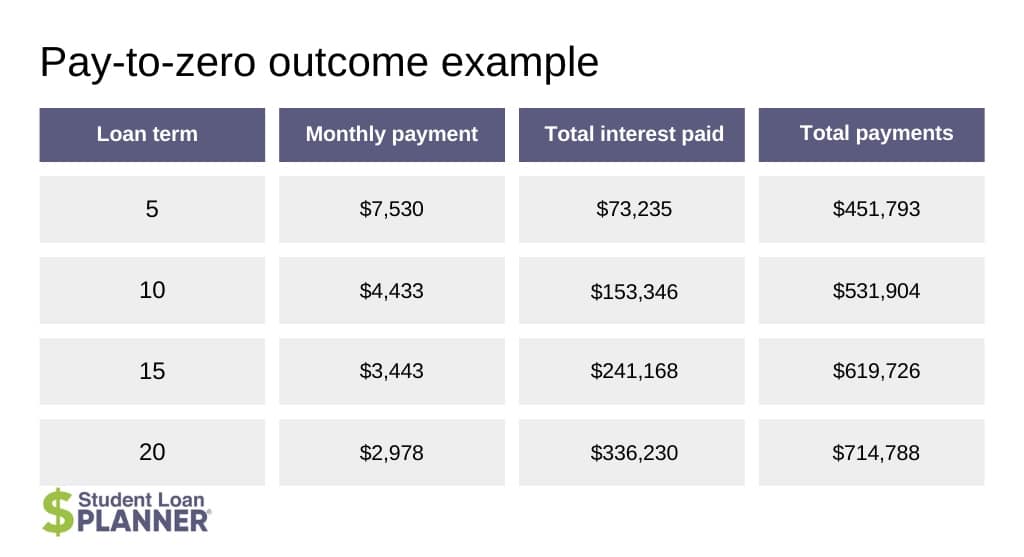

$278,409 at an effective 7.19% simple interest rate x 5 years (let’s pick a timeline) = $378,558

If you paid a little bit along the way from residency or fellowship income on an income-driven repayment plan, you might have a slightly lower balance by the time you accept the attending position. However, it doesn’t change the fact that you would have a few thousand dollar payments if you wanted to treat it like a traditional loan, to pay-to-zero one day.

Below is a quick table showing pay-to-zero outcomes with a starting balance of

$378,558 at 7.19%:

Oh, and that’s using the average medical school cost!

Think outside the box

Explore alternative options and consider low-cost or tuition-free programs when pursuing a medical education. A few private and public medical schools that are tuition-free or have tuition-reduction programs:

- New York University (NYU) School of Medicine: Offers full tuition for all current and future medical students.

- Columbia University Vagelos College of Physicians and Surgeons: Grants full-tuition scholarships to all students who demonstrate financial need.

- Kaiser Permanente School of Medicine: Provides a tuition-free program for the first five cohorts of students from 2020 to 2024.

- Dell Medical School at the University of Texas at Austin: Offers a tuition-reduction program for its students.

- Cleveland Clinic Lerner Program: Covers all full tuition and fees for its students.

Medical School Scholarships

If your intended medical school doesn’t fit neatly in the list above, there are other ways to pay for the cost of medical school tuition in advance.

In the above related post, you’ll find helpful links to the National Health Service Corp (NHSC) Scholarship Program and the U.S. Armed Forces Health Professions Scholarship Program (HPSP).

The NHSC Scholarship Program offers to pay tuition in exchange for a four-year, full-time (or eight years, part-time) service commitment in a Health Professional Shortage Area.

The HPSP Scholarship Program offers to pay for school (along with a living expense allowance) in exchange for an equal time service commitment in the U.S. Armed Forces.

For residency, you can select a civilian or military residency. Military residency doesn’t count toward the required service commitment, as an Attending Physician. However, it does count toward time in the military (which could be relevant for military benefits long-term).

Public Service Loan Forgiveness

If you’ve finished three years of training post-medical school and start working as an Attending for a nonprofit, state, or federal employer, then you could have up to 36 months of your path toward the required 120 months to get your remaining loan balance forgiven tax-free with .

Imagine you were on an income-driven repayment plan during residency, and you now earn $300,000 per year as an Attending Physician. You’ve probably paid somewhere around $10,000 in payments in residency, and your remaining seven years come at a cost of probably $2,300 per month. The total all-in cost is about $203,000, and this balance is forgiven tax-free, thanks to Public Service Loan Forgiveness (PSLF).

There’s optimization around the edges, like having your income-driven payment based on your tax return, so last year’s income could inform the next 12 months of payments.

All this does is make the $203,000 estimate for a filing single borrower a rosier outcome.

If your top school is the most expensive one on your list, because you believe it’ll set you up for residency, fellowship and the long-term, you could turn your education costs into a done deal with PSLF.

In this way, you also don’t have to feel pressured into picking a high-paying specialty. Instead, do what you feel will make you happy in your medical career choice and find ways (like PSLF) to pay less than 100% of the amount you borrowed.

How to manage medical school costs for the long-term

If you’re married, or your spouse has loans, too, use our PSLF calculator. You can also outsource this to-do to someone on the Student Loan Planner Consultant team!

If you haven’t borrowed the loans yet, a pre-debt consult probably makes more sense.

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

| Sallie Mae |

Competitive interest rates.

|

Fixed 3.49 - 15.49% APR

Variable 4.54 - 14.71% APR

|

|

| Earnest |

Check eligibility in two minutes.

|

Fixed 3.47 - 16.49% APR

Variable 4.99 - 16.85% APR

|

|

| Ascent |

Large autopay discounts.

|

Fixed 3.39 - 15.71% APR

Variable 5.01 - 15.27% APR

|

|

| College Ave |

Flexible repayment options.

|

Fixed 3.47 - 17.99% APR (1)

Variable 4.44 - 17.99% APR (1)

|