Countless medical school rankings exist and there's lots of info you can find at the Association of American Medical Colleges website. If you want to know the student to faculty ratio, research output, average MCAT scores, GPA, or specialty strengths. You can find that out easily. What you can’t find is med schools ranked by the financial impact they’ll have on your life.

In my experience advising more than 1,000 people on student loan debt, I’ve found six types of medical schools based on their financial impact on an individual and his or her finances. You probably went to one of these kinds of schools or you’re considering it.

While we have a list of over 41 forgiveness options for physicians after medical school, I’d prefer if students would know what they’re getting themselves into on the front end before diving in and completing medical board exams.

If you go to medical school in the next four years, you’ll probably leave with an average debt of between $150,000 and $500,000 in student debt. That range is huge for medical school graduates. Also, I should mention almost none of the cost of attendance estimates I compiled below include the cost of loan origination fees, accrued interest during medical school, and tuition/cost of living increases.

If you already have med school debt, see if you agree with our medical school rankings by how much they’ll hurt your financial future.

Amazing Value: Free Medical Schools

School | Cost of Attendance Estimates (4 years) |

Cleveland Clinic Lerner COM | Living costs only |

NYU COM | Living costs only |

The Cleveland Clinic Lerner College of Medicine of Case Western Reserve University has offered free medical school tuition for about 10 years. Talk about a good deal! The only catch is that they only have about 30 spots per class.

“Free med school” became a category though when NYU announced the elimination of tuition. The media went crazy over NYU’s exciting announcement that they would no longer charge tuition. More proponents soon followed.

Other prestigious medical schools seem to be moving in a similar direction with tuition reduction and scholarships.

When I lived in Philadelphia, I heard that the Perelman School of Medicine at the University of Pennsylvania started giving out 25 full-tuition scholarships each year.

The main catch to “free tuition medical schools” is that you might still need to borrow to pay for the cost of living. Many of these famous medical schools are located in expensive big cities.

Hence, you might still need a student loan budget of $100,000 to $150,000 even with no tuition for your medical education. After all, NYC rent isn’t cheap (but certainly beats other lousy places). That will be a different story if you live in a small community or one of the more rural states or rural regions. For example, going to the University of Kentucky.

Lowest cost med schools: in-state, public colleges of medicine

For whatever reason, Texas has a lot of low-cost medical schools for in-state residents. Random states like New Mexico and West Virginia also have attractive in-state tuition rates for medical college.

Interestingly, I could see a situation where a med student at NYU leaves with more student debt with $0 tuition than a Texas Tech student with approximately $20,000 tuition. The reason is the cost of living expenses.

At a prestigious medical school, even if you get free or nearly free tuition, you will still have to borrow to cover living expenses unless you have money saved up already.

If you pay typical rent in a big coastal city of $2,000 a month, travel a bit to see friends and family, go out to eat and drink with friends, and go out on dates during school, you’ll probably have $40,000 a year of loans to take out.

Some of the lowest cost medical schools do not list their living expenses estimate on their website. If that’s the case, I used $20,000 per year as my estimate for how much students would borrow to cover indirect expenses from medical school.

However, when I was an undergrad, my rent was $275 a month (we semi-legally squeezed five guys into a three-bedroom house). In med school, I imagine you’d want a little higher standard of living, but I could easily see a single student living on $600 a month in rent. If you’re frugal, you might borrow as little as $15,000 a year in living expenses.

Hence, some grads might come out with as little as $125,000 to $150,000 in medical school debt if they live carefully on a budget.

If you can’t get a scholarship to a prestigious medical school, going to a low cost in-state option is the next best thing for general practitioners to get their requisite training.

School | Cost of Attendance Estimates (4 years) |

Texas Tech University HSC | $150,704 |

University of New Mexico | $158,852 |

Marshall University (WV) | $189,693 |

Tolerable: in-state, modest cost medical schools

Once you pass the amazing $15,000 to $30,000 range of ultra low-cost public med schools, you get into the tolerable middle. Most public med schools will have significantly lower costs for in state residents.

This is mainly because public universities receive appropriations from their state legislatures. While these appropriations have gone down as a percentage of college revenue, they are still significant.

Since state taxpayers consent to these subsidies, schools limit them to in state residents.

Expect yearly tuition in the tolerable middle range to average $35,000 to $45,000 per year if you meet state requirements.

While this debt would take a while to pay back in lower-earning specialties with lower salaries, you could certainly accomplish debt freedom in under 10 years on a budget.

Above this tier of medical schools, I would get nervous about the amount of debt I would need to borrow. I’d ask myself if the stress of medical training and the lifestyle is worth the return. After all, you can make money in a lot of ways. Medicine is not something that’s worth doing for the money. I'd also look at residency placement numbers and make sure I wasn't making a hasty decision.

School | Cost of Attendance Estimates (4 years) |

University of Iowa (Carver COM) | $237,030 |

Univeristy of Florida | $263,704 |

University of Michigan | $251,910 |

Same education, higher cost: out of state public colleges of medicine

Going to an out of state public medical school will cost you about the same amount of money as a private medical school. So whether you're out of state in Colorado or Florida, Utah or California, compared to the in-state rate, expect to pay $100,000 to $150,000 more over four years.

Public universities look at out of state graduate students as part of their profit education models. Certainly, going to an out of state public med school is a better decision than attending a for-profit med school. If you’re trying to choose between an out of state public or the Caribbean for-profit medical school, in my view it’s not even a contest. Go with the public out of state option.

If I wanted to go into a highly competitive specialty program, I’d pay attention to schools’ placements. After all, if I could double my chances of getting placed into neurosurgery residency programs by paying out of state tuition at Ohio State vs a local in state medical school that just opened, I might go the “more prestigious” route to maximize my chances.

Other than that, I don’t see a good reason to go to an out of state for med school if you have an option to go in state. Of course, if you plan on pursuing the Public Service Loan Forgiveness program (PSLF), one of the best federal loan forgiveness programs, it might not matter what you borrow.

The only reason I’d choose an out of state public school over a private school would be if there was a chance that I could get in-state residency after a couple years and get the in-state tuition rate. That would make me lean towards the public medical school option, all things equal.

School | Cost of Attendance Estimates (4 years) |

University of Kansas | $367,564 |

Univeristy of Utah | $378,304 |

Ohio State University | $357,596 |

How can private med schools charge this tuition?

The only reason private med schools don’t get ranked as the very worst in terms of cost is that they often have large endowments they use to discount the price of attendance. For example, Feinberg School of Medicine at Northwestern University lists a total cost of attendance of $358,407 for all four years, according to their website.

However, they list the average med school debt for their Class of 2017 at $181,463. This figure is almost half of the current listed price. What I expect is that a lot of students get major grants and scholarships (based on the school being named after a big donor).

However, if you attend a private school like this, expect shenanigans with accounting that obscure what you’ll really obtain in debt if you don’t receive a grant or scholarship.

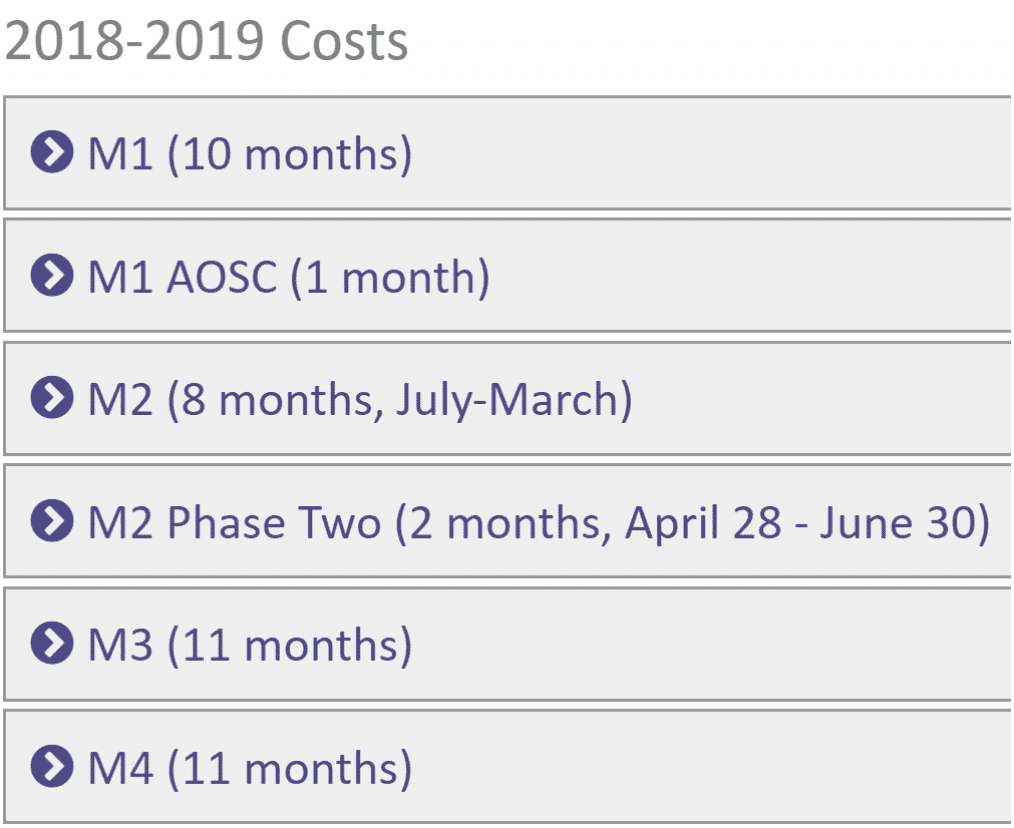

For example, look at the public information Northwestern lists for the budget you should plan for.

Source: Northwestern University website

The budget does not include a single 12-month period over four years. Med school calendars might operate over 10 or 11-month windows, but human beings and rental contracts last 12 months.

Hence, if you believe their published cost of attendance, right away you need to add a low five-figure amount to cover the cost of rent, travel, and living during the months they didn’t cover in their budget. All of the high cost private medical schools listed the cost of attendance similar to this, so I shouldn’t solely pick on Northwestern.

For example, each year of medical school you must pay thousands in loan origination fees. Vagelos College of Physicians and Surgeons at Columbia University makes no mention of this in their cost of attendance.

Other private schools I looked at make this omission as well. However, in fairness Keck School of Medicine at USC listed the almost $3,000 yearly fees on their site.

Here’s a list of some high cost private medical schools. In reality, if you go to one of these big name, high-cost schools without any of the generous grants they sometimes provide, expect to have more than $400,000 in debt at graduation. While that may mean you can access good training programs, it'll cost you and be more than face value.

Keep in mind these figures do not include tuition increases or accrued interest you’ll build up over four years. I guess they also don’t include you getting free tuition if a billionaire decides to pull an NYU and make all tuition-free, but don’t hold your breath.

School | Cost of Attendance Estimates (4 years) |

Columbia University | $382,747 |

Keck School of Medicine (USC) | $393,697 |

Feinberg School (Northwestern) | $358,407 |

University of New England | $344,140 |

For-profit medical schools: a growing trend

Med school accreditation bodies long prevented for-profit medical schools for decades. That’s why for-profit schools such as Ross University and St. George’s University located themselves in foreign shores on the Caribbean outside of US jurisdiction. However, in the 1990s, the American Bar Association lost an anti-trust case against for-profit law schools. Essentially, the court found that the ABA did not have a right to withhold accreditation just because of a law schools for-profit status.

That precedent made med school governing bodies change their own rules.

The liberalization of student loan borrowing in the mid-2000s finally comforted investors enough to take a stab at opening new for-profit programs at medical schools.

For whatever reason, most of these new schools are osteopathic instead of allopathic. A disproportionate number of primary care physicians graduate from osteopathic schools with DO degrees instead of MD degrees.

Many of these institutions claim to fill a specific need in their communities, such as providing more primary care practitioners in rural areas (such as the new Idaho school).

What’s interesting is that many of these med schools have estimated costs of attendance that are lower than the highest cost not for profit medical schools.

There are a few reasons I would discount this lower sticker price:

- A for-profit medical school is more likely to drastically increase tuition

- I trust for-profit medical schools less because their incentive structure is organized around rewarding investors

- You will likely have a harder time getting top residency slots coming from a for-profit medical school

- Four-year completion rates will be lower at a for-profit medical school than a more prestigious counterpart

- You are much less likely to get a major scholarship or grant at a for-profit medical school (after all, it’s for profit)

One of the most important factors in choosing the right student loan plan for a new physician is your expected debt to income ratio. If you go to Columbia University, you might have $400,000 of medical school debt, but you’ve got a better chance at matching into an orthopedic surgery residency.

If you go to Rocky Vista University, you’re a lot more likely to get a primary care residency.

If you make $400,000 as an orthopedic surgeon, paying $400,000 of medical school debt is much easier than if you were a $180,000 a year family medicine doctor.

Ross University and St. George’s University are also for-profit medical school options. They’re located in the Caribbean although Ross is going through some relocation moves right now after the hurricane they experienced.

If I had to go to a for-profit med school, I would choose one in the U.S. I’ve heard horror stories coming out of Caribbean schools that as many as half of an entering class doesn’t finish and get a degree. In an attempt to make sure residency match percentages are high, I’ve heard the schools aggressively weed out students in the first couple of years.

Anecdotally, I’ve heard stories of 20% to 50% dropout rates at schools like American University of the Caribbean and St. George’s University.

If you have a lot of medical school debt but no degree, that’s a massive waste of money and time. Hence, even if you end up with more debt, I think there’s little doubt you’re better off at an expensive not for profit private medical school over a for-profit medical school.

School | Cost of Attendance Estimates (4 years) |

Rocky Vista University | $371,875 |

California Northstate University | $368,659 |

Burrell College of Osteopathic Medicine | $320,660 |

Idaho College of Osteopathic Medicine | $302,600 |

What did you think of our medical school rankings?

Did you come out owing what you thought you would in med school debt? What advice would you give to current applicants to medical school on what to look out for when trying to make a decision on where to go? Where would these programs be in your med school rankings?

If you have over $100,000 of medical school debt and want a plan for it, just reach out and we can tell you how our service works to see if it’s a good fit for you.

Wondering how to reduce med school debt? The good news is no matter what you owe, you can manage your money wisely, afford retirement, own a home, take nice vacations, etc. The path is just narrower the more debt you have.

If you’re serious about regaining control of your debt and paying it off sooner, please schedule a consult with us.

Did you attend any of these med schools? What was your experience like?

Refinance student loans, get a bonus in 2025

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

Bonus for eligible users who refinance $100k or more (bonus from SLP, not SoFi)

|

Fixed 4.49 - 9.99% APR

Variable 5.99 - 9.99% APR with all discounts with all discounts |

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 4.49 - 9.99% APR

Variable 5.88 - 9.99% APR

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 4.25 - 10.24% APPR

Variable 4.86 - 10.24% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 4.74 - 8.75% APR

Variable 5.04 - 9.05% APR

|

|

|

$1,099 Bonus

For 150k+, $300 to $500 for 50k to 149k.

|

Fixed 4.88 - 8.44% APR

Variable 4.74 - 8.24% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 3.99 - 10.30% APR

Variable 4.20 - 11.41% APR with autopay with autopay |

Comments are closed.