I love the definition of mental health counselor from allpsychologyschools.com. It’s a simple one, but very meaningful:

Mental health counselors help clients learn how to make healthy decisions about themselves, their relationships and their futures.

Many people suffer from depression, anxiety, bipolar disorder, PTSD, ADHD, and other psychological issues. Mental health counselors guide people to make healthy decisions while managing and overcoming what they can.

Today, mental health counselors are needed more than ever. With COVID-19, staying at home by yourself or with family, and social distancing, there is a surge in mental health issues, and it will take people some time to recover.

It takes a compassionate, patient and supportive person to become a mental health counselor, and there are more than 100,000 of them in the U.S.

But is becoming a mental health counselor worth the cost? We’ll take a look at how much mental health counselors earn annually, how much it costs to become a mental health counselor, and what student loan repayment looks like.

Mental health counselor income and career outlook

The median income for a licensed mental health counselor was around $51,240, according to US News & World Report in 2022.

Counselors can specialize in a number of different areas, and specializing in mental health is toward the bottom in terms of income. Child and family social workers and school counselors make more than mental health counselors; substance abuse counselors make about the same.

As needed as mental health counselors are, that median compensation is below the average college graduate who earns close to $52,000 per year.

That being said, the job market and future growth in this profession are becoming robust.

Mental health has become a hot-button issue, and more people are seeking the help of counselors. The job market for mental health counselors is projected to grow by about 30,000 over the next 10 years, which is above the average job in terms of percentage.

So, what does it take to become a mental health counselor and enter this field?

Income & Student Debt by Profession

How you compare to other

accountants stats*

| Average student debt | |

| Average income | |

| Average Debt-to-Income Ratio |

Statistics represent the population of Student Loan Planner clients in the respective profession referenced in the chart from 2017-2023. Sample excludes those in school or in training.*

Requirements to become a mental health counselor

Becoming a mental health counselor is a worthy pursuit, and it takes years of advanced training and experience to be able to practice. Here’s are the field’s requirements:

- Earn a bachelor’s degree in psychology, counseling, sociology or social work.

- Earn a master’s or doctoral degree in mental health counseling from an accredited institution, including internship or practicum.

- Complete 3,000 hours of supervised clinical experience completed within two years.

- Pass the National Counselor Exam or the National Clinical Mental Health Counselor Exam.

- Register with the state’s counselor licensure board.

States may have different requirements, so get in touch with your state to see what is required.

All in all, it could take four to five years after graduating from undergrad to become a mental health counselor. It’s a long but worthwhile path.

In the end, a mental health counselor will earn the credential of licensed professional counselor (LPC), or in some states, it could be licensed clinical professional counselor (LCPC) or licensed mental health counselor (LMHC).

Fortunately, the debt load isn’t too steep compared to other graduate-level programs, though it’s certainly not cheap.

Mental health counselor student loan debt

Many master’s in counseling degrees will range from $40,000 to $80,000 in tuition for about 60 credit hours and can be completed either in the classroom or online. There are expensive programs like Northwestern and USC, which can cost over $100,000.

Debt loads can be minimized, as it is possible to work part time (and possibly full time) while getting a master’s in counseling. That income earned while in school can pay for living expenses and maybe even reduce the loans taken out for tuition.

The average debt load among mental health counselors we’ve seen at Student Loan Planner® is $78,000.

How does one pay back that amount of debt while making under $50,000 on average? Let’s take a look at loan repayment options for mental health counselors.

The best student loan repayment strategy for a mental health counselor

In our experience, mental health counselors have three solid options that will save them the most money paying back their student loans:

1. Pay off their loans aggressively with a goal of being debt free in 10 years or less. This plan could involve refinancing student loans if it would lower the interest rate and the borrower could afford the payment.

2. Work for a nonprofit institution or government employer and go for Public Service Loan Forgiveness (PSLF).

3. Sign up for an income-driven repayment plan like PAYE or REPAYE, make payments based on your income for 20 to 25 years, then pay taxes on the forgiven loan balance.

With the first option, borrowers should throw every extra dollar they can find to be debt free. The remaining options are the exact opposite: Pick an income-driven repayment plan that will keep payments as low as possible and maximize forgiveness.

Anywhere in between these options could be a needless waste of thousands of dollars. To figure out which one of these options would be best for you depends on your specific situation.

Case study: Mental health counselor in private practice

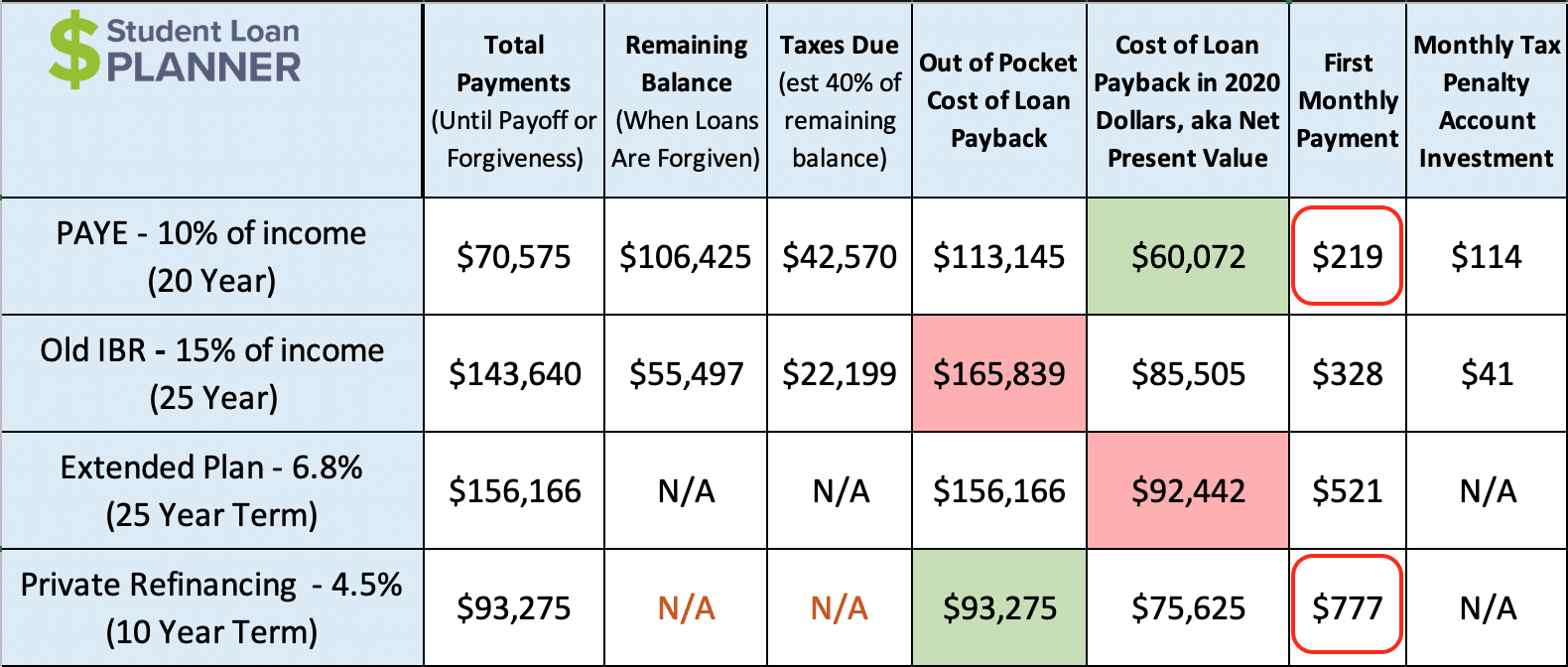

Let’s take a look at two case studies. Both have the same amount of debt $75,000 at 6.8% and work in a private practice. The only difference is their income.

Let’s start with Sam. He’s earning $45,000 working in a private practice, and his income is projected to grow steadily at 3% per year.

Let’s rule out Income-Based Repayment and the Extended Plan from our comparison because those are by far the most expensive plans. That leaves Sam with two choices: PAYE or refinance.

On the surface, it looks like refinancing will save him the most money. It will cost $93,275 to pay back the loan over 10 years, which is the least amount out of pocket. The problem is that he’ll have to make monthly payments of $777 for 10 years. That’s a huge chunk of his $3,000 monthly take-home pay and leaves very little, if anything, to live on and save up for his financial future.

PAYE is actually the better option for him because of its affordability. His first monthly payment would be $219, and he’d want to be saving up $114 per month for the tax bomb. That’s $333 per month, which saves him more than $400 per month compared to refinancing. Imagine what he could do to reach his goals with an extra $400 per month.

It will end up costing him an extra $20,000 to pay off his loans versus refinancing, but he also gets to spread repayment out over 20 years instead of 10, which makes the cost in today’s dollars less than refinancing. Plus, he can reach his other financial goals along the way.

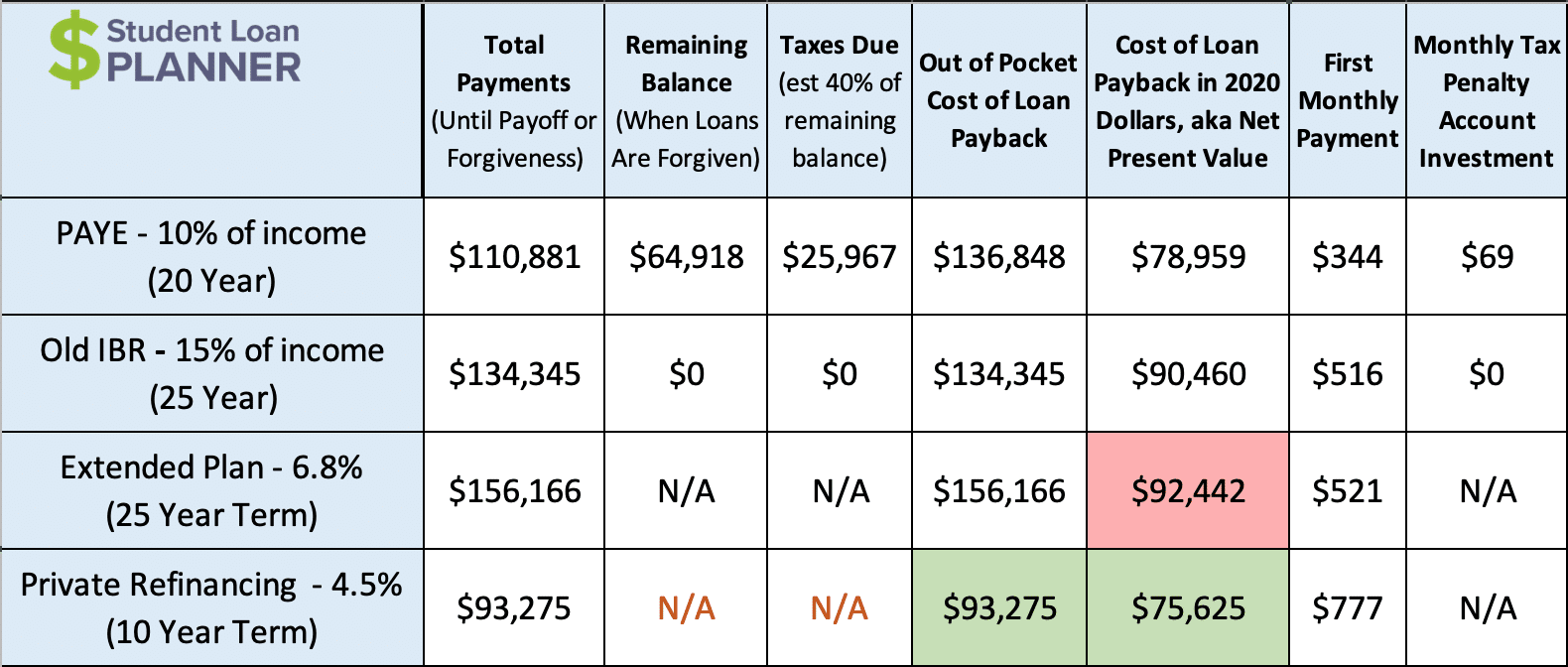

Now let’s take a look at Sara. She has a solid private practice and is earning a nice $60,000. She also has $75,000 of student debt just like Sam.

Once again, IBR and the extended plan are by far the most expensive since those are by far the most expensive plans. That leaves Sara with two choices: PAYE or refinance.

These two repayment options are pretty close on the surface if you look at the net present value (the cost in today’s dollars). That’s because Sara is taking home an extra $1,000 per month versus Sam, so it moves the cost of PAYE closer to refinancing.

That higher income means she’d have the money to attack these loans and get rid of them in 10 years or less by refinancing, unlike Sam.

But she also has a golden opportunity. She could take her higher income to save in pre-tax retirement accounts. Doing so would reduce her adjusted gross income (AGI), which is the number used to calculate an income-driven repayment payment.

Let’s say that Sara decides to do PAYE and puts $1,250 per month into a pre-tax retirement plan. That would be $15,000 for the year, which would reduce her AGI from $60,000 to $45,000, (right about where Sam’s AGI is).

In 20 years, if those monthly contributions earned a 5% annualized return, Sara would end up with $513,792 in her nest egg. Plus, this approach would reduce the cost of paying back her loans on PAYE from a projected $136,868 to $113,145 — that’s $23,723 in savings in paying back her loans.

There are two factors to consider here:

- How much can Sara put toward savings and debt?

- Does she want to optimize her wealth or is she very debt averse and just wants to get rid of if?

If she can come up with $1,250 per month after expenses to put toward debt and retirement, then she can choose PAYE and save aggressively. Or, she can refinance, put the $1,250 toward her debt, and be free of student debt in less than six years.

In the end, Sara and I would have a discussion to figure out what she’s capable of putting toward her savings and debt. Then we’d flesh out which approach resonates with her more because the numbers between PAYE and refinancing are fairly close.

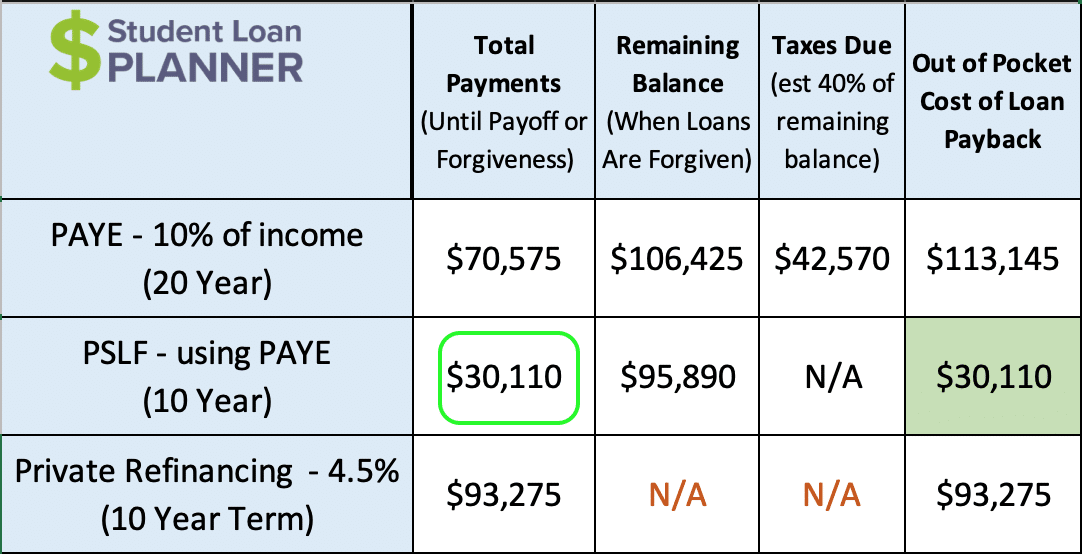

Case study: Mental health counselors and Public Service Loan Forgiveness

Now let’s take a look at a hypothetical example involving a mental health counselor pursuing Public Service Loan Forgiveness (PSLF). Briana, who is working for a nonprofit organization as a mental health counselor, makes $45,000 and is eligible for PSLF.

In order to get PSLF, Briana needs to check these three boxes:

- Direct Federal Student Loans (not FFEL or private loans)

- Work full time or two part-time jobs equaling 30 hours per week at a nonprofit or government employer

- Make payments on an income-driven repayment plan (PAYE, REPAYE, IBR)

She checks the first two boxes. Now we just need to figure out which IDR plan she should choose.

The goal here is to keep Briana’s payments as low as possible and maximize student loan debt forgiveness. Because PAYE is based upon 10% of discretionary income, has a payment cap, and she can exclude spousal income by filing taxes separately if she’s married, that is the option we’ll go with.

Compare PAYE without PSLF to PAYE with PSLF versus refinancing:

In this comparison, PSLF wins in a landslide.

PAYE with PSLF versus PAYE without PSLF would actually be identical over the first 10 years. The difference is that PSLF offers tax-free loan forgiveness after 10 years of payments, while PAYE on it’s own is 20 years of payments with taxable loan forgiveness.

PAYE with PSLF is projecting to save Briana $40,000 in payments versus PAYE, as well as a saving on a $42,570 tax bomb. It also gets her debt free in 10 years instead of 20 years.

Refinancing would cost her a ton of money if she’s PSLF eligible. You can also see by the chart that PSLF would end up saving her about $63,000 over 10 years paying back her loans versus refinancing. Both are 10-year plans, so she’d be debt free in the same amount of time.

PSLF is by far the least expensive way to get rid of student loans. Briana would want to make sure she’s saving aggressively on the side to bolster her financial situation and also as a contingency plan in case there is a change in career path.

Is mental health counselor income worth the student debt?

From a purely financial perspective, investing in becoming a mental health counselor is not worth the cost. The average college graduate makes about the same or more money as a mental health counselor.

But mental health counselors aren’t generally in it for the money, and the country needs more of them. The cost to become a mental health counselor is typically below six figures, which is much lower than other graduate schools, so it won’t necessarily wreck aspiring counselors’ finances.

The future is also looking brighter for mental health counselors. Above-average demand could lead to pay increases that outpace other professions. And many amazing counselors can make more than the average income because they are fantastic at what they do.

No matter what, mental health counselors can design a student loan plan to optimally pay back their loans regardless of going for PSLF or going into private practice.

Mental health counselors can get a solid student loan plan

Despite reviewing some straightforward scenarios in these case study examples, chances are your situation is unique and could require a customized plan. Some of the questions you might face in coming up with that plan include:

- Is there a spouse in the picture?

- Do they have student loans or not?

- What is the difference in income between you two?

- What does your career path look like?

- What other financial goals are in the picture that you want to accomplish along the way?

Mental health counselors can find a clear path to pay back their student loans by getting a custom plan based upon their unique circumstances. Your custom strategy needs to put you on a clear path with steps to get debt free.

Student Loan Planner® has performed over 3,600 student loan consultations for clients totaling over $900,000,000 of student loan debt. Whether you work for a private practice, are going for PSLF, or are in another employment situation we can help you figure out the optimal path in just one hour.

Plus, we include email support after the consultation to continue to answer your questions and help you implement the plan. Learn more about our consultation process here.

Income & Student Debt by Profession

How you compare to other

accountants stats*

| Average student debt | |

| Average income | |

| Average Debt-to-Income Ratio |

Statistics represent the population of Student Loan Planner clients in the respective profession referenced in the chart from 2017-2023. Sample excludes those in school or in training.*