Over the past year, nearly everyone has experienced mental health challenges due to the pandemic. The isolation, grief, anxiety, depression and looming fear were ever-present. On top of that, there was uncertainty, loss of income and precarious financial situations.

Even with financial help from the CARES Act — which froze student loan payments and slashed interest rates to 0% — people are still feeling the heavy burden of debt.

Our March 2021 mental health survey of over 2,300 high-debt student loan borrowers found that 1 in 14 respondents experienced suicidal ideation at some point during their repayment journey.

Of those reporting having had suicidal thoughts at some point due to student debt, half of that group reported that they had felt that way in the past year despite unprecedented student loan payment and interest relief.

Suicidal ideation due to student debt increased from our 2019 mental health survey, which found that 1 in 15 people felt suicidal at some point over their student debt, which is alarming given the student loan relief offered in the past year along with the looming restart of payments for millions of borrowers in September.

Key findings

- 1 in 14 survey respondents had suicidal ideation at some point due to student loan debt

- Debt-to-income ratio is the main factor for mental health struggles due to student loans

- Respondents who owed more than two times what they earned were 2.5x more likely to experience suicidal ideation compared to borrowers who owed less than their earnings

- 1 in 8 single women who owe more than twice their income had suicidal ideation due to student loans

- For single women earning less than $50,000, suicidal ideation rose to 1 in 6 respondents

- Enrollment in generous forgiveness programs such as PSLF did not seem to reduce the risk of suicidal ideation due to debt.

- 1 in 8 unemployed borrowers and those earning $50,000 or less experienced suicidal ideation due to student loans

- Six-figure earners with student debt balances greater than 2x their earnings experienced a spike in suicidal ideation from 4% to 8%

What we found is that putting payments on hold or eliminating interest for a period of time was not the magic solution to alleviate student loan stress. Though respondents’ stress around student loan debt went down this past year due to the freeze, the mental health toll is still significant.

“I am constantly thinking about student loans and how much I have. It drives my every decision from how often I go to the grocery store to if I can afford to visit my family for the month,” reported one respondent.

The most dangerous statistic: Your debt-to-income (DTI) ratio

When looking at the data, it’s clear there’s one major risk factor for suicidal ideation due to student loan debt. DTI ratios heavily impacted the likelihood that a borrower would entertain thoughts of harming themselves because of their debt burden.

A DTI ratio illustrates how much of your income goes toward debt and is measured by taking your student debt divided by your income. A ratio above 2-to-1 makes it extremely difficult to pay back debt using traditional methods, whereas a ratio below 1-to-1 is easier to pay back. Even a high income doesn’t wash away the mental health woes, as those making six-figures may owe six figures of debt too.

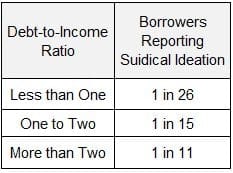

For borrowers with a DTI of less than one, meaning they owed less than they earned, 1 in 26 people experienced suicidal ideation. But when debt crept up, suicidal ideation skyrocketed.

For respondents who had a DTI between 1 and 2, 1 in 15 experienced suicidal ideation. For those who had a DTI greater than two, 1 in 11 experienced suicidal ideation due to student debt.

We also noticed that once respondents owed more than they earned, they reported higher levels of hopelessness and depression due to student loan debt.

There seems to be significant wisdom in the rule of thumb that you should be careful about attending a degree program where you'll owe more in student debt than you'll earn. Unfortunately, due to student loan policy and the explosion of the cost of education, owing more than you earn is the new norm for many borrowers.

Source: March 2021 Student Loan Planner® Mental Health Survey

Generous forgiveness programs did almost nothing to help the mental health burden of student debt

In theory, putting payments and interest on hold and offering forgiveness through Public Service Loan Forgiveness (PSLF) would help ease the worries of borrowers. But our survey revealed that this isn’t the reality for many high-debt borrowers.

There was no discernable difference in suicidal ideation between people who were pursuing PSLF and those who were not. We found 1 in 15 people pursuing PSLF expressed suicidal ideation. Another 1 in 15 who are not pursuing PSLF also expressed suicidal ideation. So, in other words, a forgiveness plan with strings attached related to a career isn’t the answer.

The number of respondents who experienced ideation increased to 1 in 11 if they were unsure of what repayment plan they were using. Knowing what you're doing with your student debt by no means eliminates the mental health risk. However, not having a plan at all is worse.

As it relates to Public Service Loan Forgiveness (PSLF), there’s a 10-year commitment to work in public service. One common sentiment expressed throughout the survey is a feeling of being trapped in a job or career.

High-debt borrowers pursuing PSLF might feel like their only escape is sticking with a job or field for 10 years to get student loan forgiveness. Unlike income-driven repayment, PSLF borrowers get student loans forgiven, tax-free. But the mental health cost is high, especially for those with unruly debt amounts.

For PSLF borrowers, 10% of those who owed double their income or more reported suicidal ideation due to student loans. Only 2.7% of PSLF borrowers who owed less than they earned reported feeling that way at some point.

That makes no logical sense, as PSLF forgives a person's debt completely tax-free. Additionally, the payments are the exact same regardless of the size of your debt amount. This is perhaps some of the best evidence present in this survey of the true psychological burden of a debt that makes you feel like you don't have options.

One respondent put it succinctly,

“Student Loans make me feel like my life isn’t my own. A time that should be filled with excitement and new experiences is instead filled with dread and uncertainty.”

Student debt weighed heavier on women

When it comes to student loan debt and suicidal ideation, it’s clear that it’s a women’s issue. Our data found that 1 in 18 men experience suicidal ideation due to student loans. For women, that risk increases to 1 in 13.

Relationship status also has a greater effect on the likelihood of women experiencing suicidal ideation, compared to men. In fact, suicidal ideation was 62% higher for single women than it was for married women.

For single women, who owed less than what they earned, 1 in 30 experienced suicidal ideation. Given the DTI effect, that number jumped to 1 in 8 for single women who owed more than twice their income.

Women already earn less thanks to the gender pay gap and are also pursuing education at higher rates than men. One could hypothesize that women are more likely to owe more as well as earn less while pursuing the same degree, which adds to the debt-to-income ratio evidence of the mental health danger of student loan debt.

We see the same DTI affect for high-earning single women as well. For single women earning six figures, 1 in 17 considered suicide at some point because of student loan debt.

But for single women earning less than $50,000 per year? A whopping 1 in 6 single women considered suicide due to the weight of student loans.

Regardless of income, student debt weighs heavily when it comes to making big life decisions and navigating life stages.

One woman stated that she had,

“Constant anxiety about affording things and hesitation for major life experiences. Such as having a child, buying a house, buying a car, buying my own practice, or having a wedding. Half my six figure income goes to student loan debt and will be for the next 23 years.”

Another respondent echoed the same sentiments,

“My federal student loans total nearly 5x my annual salary now and have only grown while I've made 5+ years of qualified, on-time payments. This seemingly insurmountable financial burden is something that continues to be extremely challenging to navigate some of life's bigger milestones: home ownership, starting a family, retirement, etc.”

Lack of income or lower income is a contributing factor

Relatively low or nonexistent income resulted in higher rates of mental health struggles and suicidal ideation. We found that borrowers who lost income completely, like those faced with unemployment, experienced higher instances of suicidal ideation.

1 in 8 respondents who were unemployed or earning less than $50,000 experienced suicidal ideation due to student loan debt. Among respondents making six figures, suicidal ideation doubled from 4% to 8% if they owed two times or more compared to their earnings.

Income isn’t an automatic fix. Our survey data shows that 1 in 17 respondents who had their income rise this past year still experienced suicidal thoughts from student loans.

Any way you look at this data, your debt-to-income ratio is a hazard to your mental health.

Policy changes that could lessen the mental health crisis around student loans

As we’ve navigated the COVID-19 crisis this past year and see signs of hope and recovery, it’s clear that the student loan crisis isn’t going away.

Despite a payment freeze and 0% interest rates for approximately 18 months, the share of borrowers reporting suicidal ideation due to student loans in 2021 increased in the past two years since we first launched this mental health survey in 2019.

That's alarming, and there are no easy fixes. That said, solutions likely need to focus on lowering the current and future debt-to-income ratios of borrowers. Here are some that could be considered:

- Instituting caps on how much tuition a school can charge

- Student loan cancellation, particularly for the lowest income borrowers facing the most economic hardship

- Bankruptcy protections allowing borrowers in the worst financial situations a way out

- Changing or capping borrowing limits

- Surgeon General's warning about the risk to mental health from significant student debt burdens

- Civil penalties for institutions that intentionally misstate student outcomes in order to increase enrollment

- Reduction or elimination of federal financial aid for schools whose graduates consistently have high debt-to-income ratios

From 2007 to 2017, the cost of public universities increased by 31%. Stagnant wages and soaring debt are only adding to the mental health crisis related to student loans, making people feel trapped.

Loan cancellation could have sweeping mental health and economic benefits and provide relief after a tough year full of anxiety. However, while 85% of the respondents in this survey supported at least some student debt cancellation, only 32% supported canceling all of it.

Borrowers want to be able to invest in their education, better themselves and their families, and not have student debt hold them back.

Student loan debt and the risk it poses to mental health is a significant public health risk. Hopefully, policymakers will try to make meaningful change rather than just put a band-aid on a problem that continues to get worse.

*If you ever have suicidal thoughts or are facing a mental health crisis, please call 1-800-273-TALK, that's 1-800-273-8255

Methodology

We surveyed 2,358 Student Loan Planner® readers from our email list. Eighty-five percent of respondents are between the ages of 18 to 39. Sixty-eight percent of respondents have six figures of student loan debt. The respondents were 65% females and 35% males.

Refinance student loans, get a bonus in 2025

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

Bonus for eligible users who refinance $100k or more (bonus from SLP, not SoFi)

|

Fixed 4.49 - 9.99% APR

Variable 5.99 - 9.99% APR with all discounts with all discounts |

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 4.35 - 10:49% APR

Variable 5.88 - 10.49% APR

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 4.35 - 10.74% APPR

Variable 4.86 - 10.74% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 4.99 - 8.90% APR

Variable 5.29 - 9.20% APR

|

|

|

$1,099 Bonus

For 150k+, $300 to $500 for 50k to 149k.

|

Fixed 4.88 - 8.44% APR

Variable 4.86 - 8.24% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 3.99 - 11.09% APR

Variable 4.31 - 12.05% APR with autopay with autopay |

Not sure what to do with your student loans?

Take our 11-question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, SAVE or another IDR plan, or refinancing (including the one lender we think could give you the best rate).