If you pay your loans under an income-driven plan like ICR, IBR, PAYE, or REPAYE, you don’t use PSLF, and you still have debt outstanding after 20-25 years of payments, then you will owe income taxes on your forgiven balance.

Since most states calculate taxes based on your federal tax returns, many states include forgiven student loan debt as income to under present law. A reader sent me a tip that I investigated, and it looks like you can get excited about Minnesota becoming the first state to eliminate the student loan tax bomb.

One reason why borrowers shouldn’t freak out the taxation of forgiven student loan debt under an income-driven repayment (IDR) plan is because we have years to go before a significant number of borrowers like you face taxes. Once this happens in great numbers, I predict you’re going to see huge lobbying efforts to exclude forgiven debt from state income taxes across America.

I thought it’d be fun to show you the process of how Minnesota decided to eliminate taxes on forgiven student debt to show you what might happen in the future.

Forgiven student loan debt is normally taxed by state authorities

If you read this research brief from the Minnesota House in 2016, the author states:

“Minnesota conforms to the federal law with regard to the taxation of forgiven student loans, meaning that discharged debt that is subject to federal taxes is also subject to state taxes.”

That’s why in my student loan calculator, my default tax assumption includes a 5% state income tax rate on the forgiven balance.

There are some federal and state programs that are exempt from state income taxes by default. These would include the PSLF program and the National Health Service Corps program on the federal level.

In Minnesota, the state also excludes state loan repayment programs from taxable income as well.

Of course, the law in Minnesota used to be that forgiven debt under a 20-25 year IDR plan was taxable income.

Minnesota recognized this student loan tax bomb early

In early February 2017, Rep. Greg Davids, R-Preston introduced HF 882, a bill that:

“Would allow an individual income tax subtraction for qualified student loan debt that was discharged under Minnesota’s teacher shortage loan forgiveness program or following the completion of a qualified income-driven repayment plan, to the extent that the discharged debt was included in federal taxable income. A qualified plan would include but not be limited to the ICR Plan, the IBR Plan, and the PAYE and REPAYE Plans.”

Notice that the bill included not only existing income-driven repayment plans but also allowed for future ones yet to be created.

If you believe in eliminating taxes on forgiven student loan debt, this is a genius bill. It’s constructed in such a way to eliminate the tax burden so that Minnesota residents do not have to worry about relocating to a different state just for one year so they’re not crushed with taxes.

Confirming that Minnesota no longer taxes student loan forgiveness

If you visit the webpage of the Minnesota Department of Revenue, you’ll find that “If you have qualified education loans forgiven, you may qualify for a subtraction from income of the entire amount forgiven.”

In other words, the tax bomb is no more on the state level.

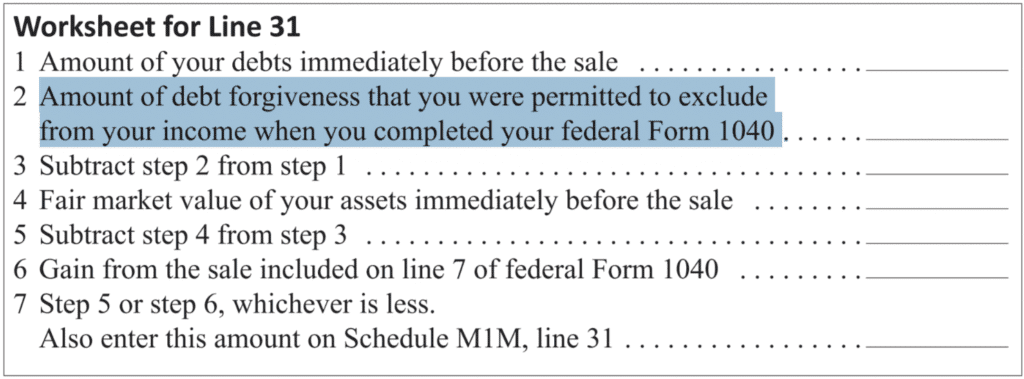

If you look at the state’s Schedule M1M, you’ll find a place to literally write down what you’re excluding from your taxable income:

The only catch that I see is that the bill eliminates state income taxes “to the extent that the discharged debt was included in federal taxable income.”

I’m not a lawyer, but that sounds like if Congress passed a bill to eliminate taxes on forgiven student loan debt, then it could be unclear if Minnesota would tax that forgiveness.

I suspect they would not, but I like to cover all the bases for you.

Other states that do not tax student loan forgiveness

Obviously, in states without an income tax, there is no tax on forgiven debt.

That means the following states would not have tax forgiven student loan debt:

- Alaska

- Nevada

- Florida

- Texas

- South Dakota

- Washington

- Wyoming

Tennessee currently only taxes dividends and interest, so it may or may not be on the list too.

When I’m making custom student loan plans for clients, many have suggested they would move to a “no income tax state” for a year or two when their balance gets forgiven. That way, they’d avoid paying tens of thousands to their state in the year of forgiveness.

Are other states working on eliminating the student loan tax bomb?

To my knowledge, Minnesota is the first state with an income tax to tackle the student loan tax bomb that many borrowers have no idea is coming.

Michigan is the only other state that I know pushed a bill through on student loan forgiveness taxes. However, the bill is incredibly narrow and only applies to combat veterans who had their loans forgiven due to a disability discharge. That bill eliminated state income taxes on forgiven debt for this class of individuals only.

That’s a nice gesture, but the action is irrelevant now that Congress changed the law. Student loans forgiven due to death or disability are now free from income tax. That federal change means most states will automatically not tax forgiveness under these death and disability scenarios either.

That said, forgiveness due to death and disability is a far cry from no taxes on student loans discharged under an income-driven plan.

That’s why what Minnesota did is so unique.

My prediction for the future of student loan forgiveness taxes

If states do choose to tax student loan forgiveness, they will find the bill uncollectable in most cases.

While readers of this blog like you will be prepared, your average borrower will be caught like a deer in headlights.

If you’re a politician, would you rather ruin voters’ credit scores and collect 10% to 20% of what’s owed, or would you rather pass a bill to eliminate taxes on student loan forgiveness and be loved for it?

The lost revenue from eliminating student loan forgiveness taxes is minimal.

Whenever you can do something that has minimal impact on revenue that’s also intensely popular with highly educated voters, you’re probably going to want to pass that as an elected representative.

At the federal level, I’d guess there’s a 60% chance lawmakers will one day eliminate taxes on student loan forgiveness under IDR plans. I think it’s more likely than not that you will not owe taxes on your student loans that get forgiven.

At the state level, my guess would be there’s an 80% chance states will eliminate income taxes on the forgiven balance once a significant number of voters get hit with the consequences.

That said, prepare for the tax bomb by investing with a place like Betterment (referral link that gets you 1 month to 1 year managed free) or Vanguard.

If you don’t need the money, you’ll be able to retire a couple years earlier than you planned.

If you want a custom analysis of all the options you’ll have for your student loans, get in touch with us and get a plan.

What do you think about Minnesota eliminating the student loan forgiveness tax? Do you think your state will follow suit? Comment below.

Not sure what to do with your student loans?

Take our 11-question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, SAVE or another IDR plan, or refinancing (including the one lender we think could give you the best rate).