You might have received a mildly alarming notification in your inbox lately letting you know that your loans are moving away from the MOHELA website. Some borrowers are actually keeping MOHELA as their servicer but getting a new web portal login.

Other borrowers are losing MOHELA entirely.

Additionally, borrowers pursuing Public Service Loan Forgiveness (PSLF) will no longer use MOHELA as their source of truth for progress tracking in the PSLF program.

We’ll cover what you need to know about the move away from MOHELA and how it affects your student loans.

Most borrowers aren’t actually leaving MOHELA

The vast majority of borrowers aren't leaving MOHELA — they're simply moving to a new online portal to access their loans.

Instead of going to the MOHELA website, borrowers will navigate to mohela.studentaid.gov.

You’ll be able to perform all the same tasks for your loans on this new website that you did on the old one.

Why is Federal Student Aid getting rid of the MOHELA website?

They’re trying to reduce the amount of work that servicers are responsible for directly.

The Department of Education wants a single portal for all borrowers to manage their loans, in part due to the complexity and non-standardized performance of servicers.

As the dot gov URL suggests, this is the Department of Education trying to take a more direct and active role in servicing.

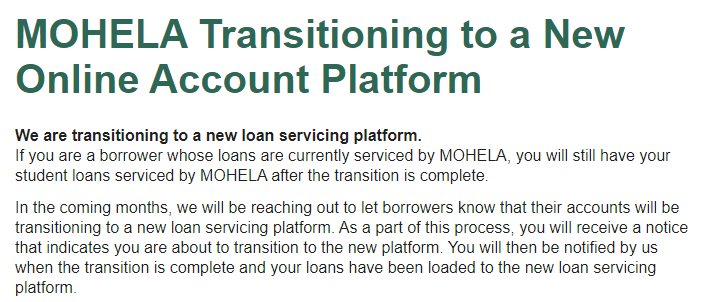

Here’s a sample of the notice borrowers are seeing if their loans are moving to the new portal (instead of leaving MOHELA entirely).

Will you need to create a new account for this new MOHELA portal?

Yes. Here's what you’ll need to do:

- Create a new online account.

- Update your contact information.

- Update the address for bill pay (if you’re paying manually with bill pay, which is uncommon).

Many borrowers will likely get lost in the shuffle as most won't think to create a new online account.

MOHELA is changing the backend processing system

In the background, MOHELA is leaving their long-time servicer processing technology called COMPASS. This is a legacy system from FedLoan/PHEAA. They’re moving to a new system that Aidvantage and EdFinancial use, which hopefully will streamline servicer performance.

There’s a potential that borrower information will not move over smoothly, though. At least one physician reader of ours reported that their loans showed up twice in their credit report during their transfer, causing them to have to go through a more challenging underwriting process when buying a home.

Know that there could be data problems. Watch your credit score and financial information to make sure no errors are made in this transfer.

Who is losing MOHELA entirely as their servicer?

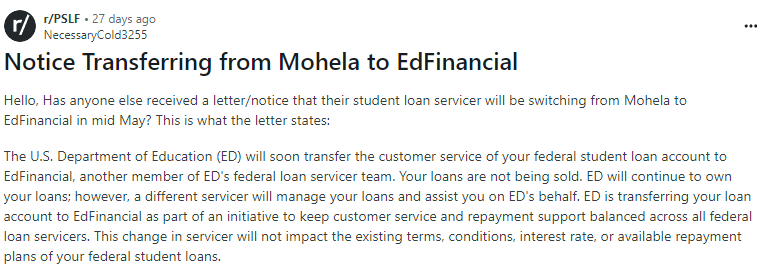

The Department of Education is picking a terrible time to try to “balance the portfolio” of servicers they work with. Approximately 1 million borrowers are being moved from MOHELA to EdFinancial in an attempt to balance the number of customers each servicer gets.

This is going to create a lot of confusion for the folks who move over.

The Administration has tried to give more forgiveness to borrowers through the IDR waiver program, but at the same time, the servicer back end is changing.

So, while most borrowers currently at MOHELA are keeping their servicer, a large number are losing MOHELA entirely.

If you're among the borrowers who get moved away from MOHELA, you’ll want to create a new account at EdFinancial and update all of your contact information.

Here’s one borrower’s experience who received a notice that they'd be losing MOHELA as their servicer.

Will PSLF borrowers lose MOHELA, too?

Borrowers currently purusing PSLF won't lose MOHELA as their servicer, but they'll need to submit their forms and monitor progress towards PSLF on the federal student aid website going forward.

Additionally, new PSLF program applicants will stay at their current servicer instead of moving to MOHELA.

What to do when the MOHELA transfer happens

Servicer moves usually create a lot of stress for borrowers. Announcements about the changes typically sell all the potential benefits while ignoring the problems that happen every time a borrower’s account gets moved to yet another new place.

The current portfolio of servicers doesn’t even have that much experience managing federal student loans, especially loans that are actively in repayment.

Here are some action steps to take when MOHELA moves your loans:

- Take a screenshot of your payment amounts and due dates before the move.

- Monitor studentaid.gov.

- Make sure your balance is correct.

- Check your NSLDS file after the transfer.

- Take a deep breath and know that if something breaks, it can likely be fixed with a complaint to the FSA (Federal Student Aid) office.

If you need help making sure you have a plan in place for your loans that'll hold up to one (or many) servicer transfers over time, get a consult with one of our experts.

Refinance student loans, get a bonus in 2026

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

Bonus for eligible users who refinance $100k or more (bonus from SLP, not SoFi. Terms apply.)

|

Fixed 4.24 - 9.99% APR

Variable 5.99 - 9.99% APR with all discounts with all discounts |

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 3.72 - 9.99% APR

Variable 5.88 - 9.99% APR

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 4.25 - 10.24% APPR

Variable 4.86 - 10.24% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 4.74 - 8.75% APR

Variable 5.04 - 9.05% APR

|

|

|

$1,099 Bonus

For 150k+, $300 to $500 for 50k to 149k.

|

Fixed 4.88 - 8.44% APR

Variable 4.74 - 8.24% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 3.01 - 10.15% APR

Variable 3.03 - 11.41% APR with autopay with autopay |

Not sure what to do with your student loans?

Take our 11-question quiz to get a personalized recommendation for 2026 on whether you should pursue PSLF, IDR, or refinancing (including the one lender we think could give you the best rate).