When it comes to picking out your federal student loan servicer, unfortunately, you don’t have a say in the matter. The U.S. Department of Education has complete control — it automatically assigns all borrowers to a student loan servicer.

Nelnet is a major player in federal student loan servicing and is likely to be your loan servicer. In fact, the company services nearly 20% of all federal loans. If you’ve just been assigned to Nelnet, you may wonder what to expect.

For example, does Nelnet refinance student loans? Short answer: no. But knowing where Nelnet ranks compared to other federal loan servicers and whether it's worth refinancing your Nelnet student loans to a private lender is worth looking into. Read on to find out.

Is Nelnet a good student loan servicer?

If you’ve been assigned Nelnet as your student loan servicer, you may have actually dodged a bullet. Yes, you’ve been assigned to one of the big student loan servicers. But you can be thankful that you haven’t been assigned to Navient or FedLoan Servicing — both of which have now exited the federal loan servicing business.

In a summer 2018 survey, Student Loan Planner® received 385 responses to its student loan servicer survey. Receiving 3.3 stars out of 5, Nelnet came far ahead of both FedLoan Servicing (2.8 stars) and Navient (2.7 stars).

A year later, in May 2019, Student Loan Planner® ranked each student loan servicer using complaint data from the Consumer Financial Protection Bureau (CFPB). Once again, Nelnet fared much better than Navient — which received an astounding 45% of all student loan servicing complaints — and FedLoan Servicing.

All that is good news if you have Nelnet as your servicer. But the bad news is that you could still run into issues.

While getting 3.3 stars out of 5 is better than getting 2.8 or 2.7, it’s still not great. And of the respondents to Student Loan Planner®’s survey who said they reached out to Nelnet for a problem, only 4 out of 10 said that they were able to get it resolved.

Related: The 3 Biggest Complaints Borrowers Have About Nelnet

Can I switch from Nelnet to a different federal loan servicer?

If you’ve had issues with Nelnet, you might wonder if you can just switch to a different servicer. Generally, the Department of Education doesn't allow you to switch federal loan servicers. However, you can escape Nelnet by consolidating your federal student loans.

How to switch servicers with a Nelnet student loan consolidation

One time that you can pick a new servicer is when you consolidate multiple federal loans into a Direct Consolidation Loan. If you’re considering a Nelnet student loan consolidation, here are a few things to keep in mind:

- You can only combine federal student loans during a Direct Consolidation Loan.

- You can’t get a lower interest rate. Your new loan rate will be a weighted average of the interest rates on the loans being consolidated, rounded up to the nearest one-eighth of 1%.

- You will lose credit for any qualifying monthly payments that you’ve already made toward income-driven repayment (IDR) forgiveness or Public Service Loan Forgiveness (PSLF).

With a Direct Consolidation Loan, you’ll be starting a repayment period from scratch, and you can extend repayment up to 30 years. This could make your monthly payment lower, but you’ll usually pay more in interest over the life of the loan.

In most cases, you should only consider a Nelnet student loan consolidation right before or soon after you begin repayment. Otherwise, you should probably stick with Nelnet or opt for a student loan refinance private loan instead.

Does Nelnet refinance student loans?

Nelnet launched a new subsidiary in 2020 called Nelnet Bank, which offers student loan refinancing. Nelnet Bank plans to offer private student loans and high-yield CD products as well.

While Nelnet Bank will lean on the student loan experience of Nelnet (the servicer), it's being run as a separate business entity under CEO Andrea Moss.

How to refinance Nelnet student loans with Nelnet Bank

Nelnet doesn't have to be your servicer in order to qualify for refinancing with Nelnet Bank. Any borrower with private or federal education loans can apply. Here are some of the key terms of Nelnet Bank's student loan refinancing product:

Nelnet Bank

| Rate type | Fixed and variable available |

| Terms | 5, 7, 10, 15, 20, and 25 years |

| Undergraduate loan limits | $5,000 to $125,000 |

| Graduate, doctorate, law degree loan limits | $5,000 to $175,000 |

| Graduate health professions degree loan limits | $5,000 to $500,000 |

| Minimum credit score | 680 (640 with cosigner) |

| Citizenship | U.S. citizen or permanent resident with a valid Social Security number |

Nelnet Bank doesn't charge any application fees, origination fees or prepayment penalties. Other benefits of refinancing student loans with Nelnet Bank include up to 12 months of hardship forbearance, a 0.25% autopay discount and the ability to apply for cosigner release after 24 consecutive student loan payments.

How to refinance Nelnet student loans with other lenders

Nelnet Bank isn't the only option for refinancing loans that are serviced by Nelnet. Federal student loan borrowers can apply for refinancing with any of the top refinancing lenders with competitive rates. To get the best rates when you refinance Nelnet student loans, you’ll need to have a good credit history and a good debt-to-income ratio.

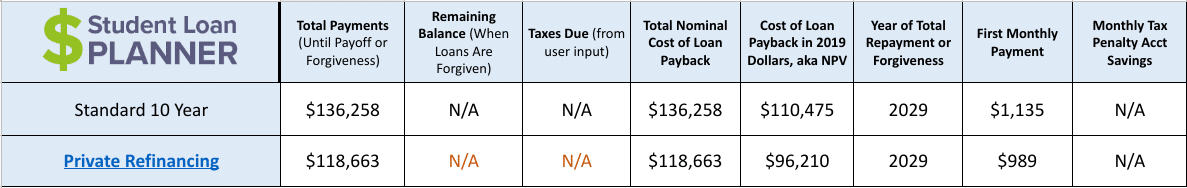

If you owe less than 1.5 times your income, student loan refinancing could be a good choice. Let’s take a closer look at the benefits and drawbacks that come with refinancing federal student loans.

What to consider before you refinance Nelnet student loans

If you’re thinking about refinancing your Nelnet student loans, you must first consider the pros and cons of the decision.

Pros of refinancing federal student loans

The biggest pro of refinancing is that you may be able to lower your interest rate.

There’s nothing that you can do to change your rate on a federal student loan. Even if you have a great credit score and a healthy income, your interest rate isn’t going to change.

But a private lender may be able to offer you a much better rate. Refinancing lenders may offer fixed interest rates or variable interest rates.

For example, let’s say that you have $100,000 worth of Nelnet student loans at an average interest rate of 6.5%. If you have great credit (such as a credit score of 740 or above) and a steady job, you may qualify for a 3.5% interest rate. By lowering your rate, you could save $17,595 over the life of your loans.

If you don't have a strong credit score, you may be able to refinance your student loans with a cosigner. A cosigner is someone with good credit who is also legally responsible for the loan if monthly payments aren't made. Because it's a huge responsibility, look into a cosigner release option.

Either way, that’s a big plus in the refinancing column and a lot of savings. Interest cost isn’t the only consideration when you’re comparing federal loans versus private student loans, however.

There are several federal loan benefits that you’d be giving up by refinancing. Let’s talk about those now.

Cons of refinancing federal student loans

Here are the three main drawbacks that you’ll need to weigh before you refinance Nelnet student loans.

Ineligible for income-driven repayment plans

One of the biggest downsides if you refinance Nelnet student loans into private student loans is you lose the ability to make income-based payments. With IDR plans, your monthly payments scale up and down with your income. IDR plans also make you eligible for forgiveness on any balance that’s remaining at the end of your loan repayment period.

But IDR plans also extend your repayment period to 20 or 25 years. That’s a long time to be stuck with your student loans. Plus, you’ll pay a lot more in interest.

If you can pay back your loans in 10 years or sooner, refinancing is usually the best financial choice. But if you’re worried that you might have a drop in income in the near future, you may want to stick with an IDR plan. And in that case, you should not refinance your federal student loans.

Ineligible for PSLF

Do you work for the government or a nonprofit organization? If so, there’s a good chance you might meet the eligibility requirements to join the Public Service Loan Forgiveness (PSLF) program. PSLF is one of the best federal student loan forgiveness programs available.

With PSLF, you can receive complete tax-free forgiveness of your remaining loan amount in just 10 years (120 qualifying payments). If you’re pursuing PSLF, you should definitely not refinance Nelnet student loans. Refinancing your student loans means that your federal loans are paid off — and you are stuck with private student loans that are not eligible for PSLF.

Note you'll be switched away from Nelnet if you join the PSLF program. If you’re accepted to PSLF, Nelnet will move your loans to MOHELA, the new exclusive loan servicer for the PSLF program.

Ineligible for the federal forbearance and deferment program

Federal student loans come with generous forbearance and deferment allowances. For instance, you can defer monthly payments on your student loans if you go back to school. And you can request forbearance if you encounter financial difficulties like medical expenses or a job loss.

When you refinance Nelnet student loans, you’ll no longer be eligible for these federal benefits. Some of the best student loan refinancing lenders do offer their own forbearance and deferment programs, however. But when you refinance your student loans, perks like that aren't promised.

Picking the right lender when you refinance Nelnet student loans

If you’ve decided that student loan refinancing is right for you, be careful about which lender you choose. Some may have origination fees that can add to the cost of the loan.

To get the most affordable loan and best interest rate, check to see that your credit score is in good shape and shop among multiple lenders.

Consider fixed- and variable-rate loans rates. But getting the lowest rate isn’t the only thing to consider. Here are a few other factors you’ll want to pay attention to.

Repayment terms

Some lenders offer loan terms that are shorter than 10 years. Shorter terms can make your monthly payment higher, but you’ll also pay less interest and get out of student loan debt faster.

If you’re looking for ultimate payment flexibility, you may want to consider Earnest, which gives you up to 180 repayment options (depending on your credit check).

Parent PLUS refinancing

Are some of your Nelnet student loans Parent PLUS Loans? If so, you’ll want to choose a lender that allows refinancing of Parent PLUS Loans. Some lenders even allow parents to transfer the loans to their child’s name during refinancing.

Forbearance and deferment

Worried about losing federal forbearance and deferment benefits? If you pick the right private lender, you may be able to get many of the same benefits anyway.

Cash bonuses

If you're approved for a student loan refinance with one of Student Loan Planner®’s partners, you might be eligible for up to $1,250 cash-back bonus.

Student Loan Planner® has worked hard to negotiate the best deals for its readers with top-tier student loan refinance companies. If you’re going to refinance Nelnet student loans, don’t leave free money on the table.

Refinance student loans, get a bonus in 2025

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

For refinancing 100k or more (bonus from Student Loan Planner®, not SoFi®)

|

Fixed 4.49 - 9.99% APR

Variable 5.99 - 9.99% APR with all discounts with all discounts |

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 4.45 - 10:49% APR

Variable 5.88 - 10.49% APR

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 4.29 - 10.24% APPR

Variable 4.86 - 10.24% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 4.99 - 8.90% APR

Variable 5.29 - 9.20% APR

|

|

|

$1,099 Bonus

For 150k+, $300 to $500 for 50k to 149k.

|

Fixed 4.88 - 8.44% APR

Variable 4.86 - 8.24% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 3.85 - 11.38% APR

Variable 4.33 - 12.35% APR with autopay with autopay |

Not sure what to do with your student loans?

Take our 11-question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, SAVE or another IDR plan, or refinancing (including the one lender we think could give you the best rate).