Does your employer offer student loan assistance? Student loan benefits are typically included under companies’ “financial wellness” umbrella, which is growing in popularity.

But will the new Biden IDR plan make the student loan assistance employer benefit obsolete? We don’t think so.

How many companies actually offer student loan assistance?

In a 2021 study from the Employee Benefit Research Institute, only 17% of the participants offered a student loan assistance employer benefit. The study looked at financial well-being benefits like financial planning education, money management tools and credit/debt counseling. In comparison, 43% of participants offered tuition reimbursement while in school.

Student loan assistance ranks lowest on the priority list of financial well-being programs offered by employers. It hasn’t been the most important benefit in the past, but the myriad of changes in student loans since COVID forbearance started in March of 2020 could change that going forward.

Thirty-one percent of companies plan to offer student loan assistance in the future, in addition to the 17% that already do. There’s hope out there.

What student loan benefits do employers offer?

We wrote about student loan repayment benefits that were updated as a result of the CARES Act. In Section 2206 of the CARES Act, Congress amended the law to allow employers to contribute up to $5,250 to your student loans.

Then, in the Consolidated Appropriations Act of 2021, Congress extended this benefit for five years. This benefit is even more attractive because neither employers nor employees have to pay income taxes on the funds.

In other words, employers can pay a benefit tax-free to employees, and employees can pay their loans with pre-tax money. Everyone wins.

What can borrowers do with the $5,250 benefit?

Interestingly, employers can pay these funds to the student loan servicer or directly to the employee. This is really important for income-driven repayment plans.

If your employer pays $5,250 directly to Great Lakes or Mohela toward your $400,000 student loan balance each year, it’s not much of a benefit. Using simple math, it would take over 75 years to pay off your student loan balance, assuming zero interest accrual. Not ideal.

If your employer pays you the $5,250 directly, you can break that down into monthly income-driven payments. Your employer covers $437.50 per month of your student loan payments. If you owe something like $500 per month, that’s huge.

How does Biden’s student loan forgiveness impact employer student loan assistance?

Though currently on hold due to multiple lawsuits and a trip to the Supreme Court, Biden’s student loan forgiveness could mean $10,000 or $20,000 of tax-free student loan forgiveness for millions of borrowers.

It’s our belief that the Biden Administration will do everything in its power to ensure this goes through.

When it comes to student loan employee benefits, this potential forgiveness won’t have as big of an impact on borrowers with student loan balances greater than, say, $100,000. There are also income limitations to the cancellation, so it won’t affect all borrowers.

The $5,250 student loan assistance employee benefit is still valuable, despite potential student loan cancellation.

Will the new IDR plan render employer student loan assistance obsolete?

As we head to the end of 2022, we live in strange student loan times. The Biden Administration and the Department of Education worked together to pass two waivers, student loan cancellation, and a new income-driven repayment plan in a very short amount of time.

In the wake of the 2022 midterm elections, we are seeing many of these initiatives challenged, and we expect more challenges going forward.

The point is, take the following with a grain of salt.

What are the key points of the Biden IDR plan?

IDR plans are confusing. We know this. The new plan from the Biden Administration hopes to simplify income-driven repayment for borrowers.

Here are the important takeaways:

- Undergraduate borrowers will pay 5% of their discretionary income, compared to 10% to 20% of income under older plans.

- Graduate borrowers with some undergraduate loans will receive a weighted average of 10% and 5% of discretionary income according to each loan balance.

- The federal poverty line for most IDR plans is currently 150%. This new plan would increase to 225% of the federal poverty line. That means you get a bigger break on your monthly payment.

- There’s a huge interest accrual benefit. The government will subsidize 100% of your unpaid interest each year.

What will the Biden IDR plan look like in practice?

Considering the complexity of income driven repayment plans, the Biden IDR plan could vastly simplify things. Right now, you might pay 10%, 15% or 20% of your discretionary income. Not all borrowers are eligible for all repayment plans, and it’s pretty hard to figure out which plans you qualify for.

Using our Biden IDR Plan student loan calculator, consider a borrower with $250,000 of student loans, $50,000 (20%) of which are from their undergraduate education.

The borrower makes $125,000 per year, and their spouse makes $75,000 per year. They are legally married and file taxes jointly.

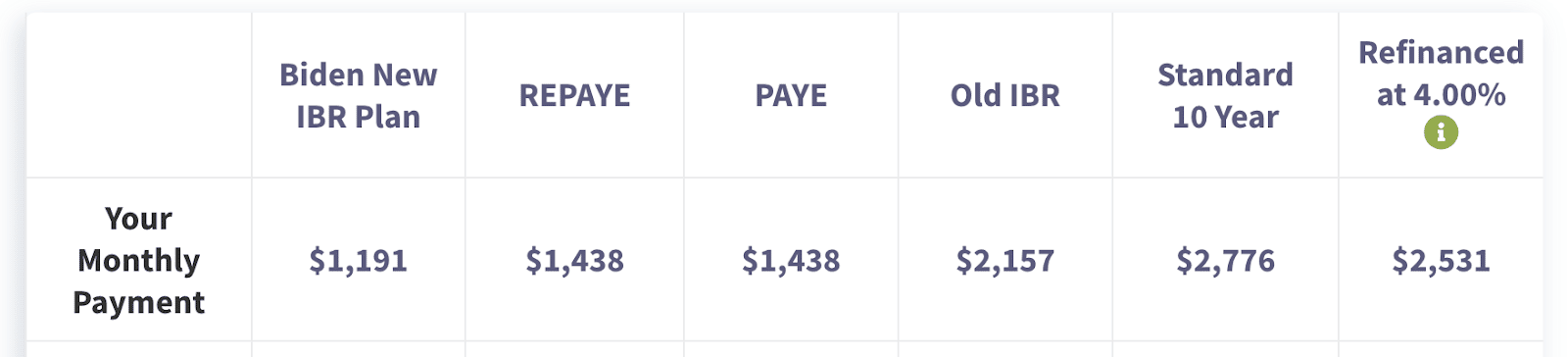

We estimate a monthly payment of around $1,200 per month under the Biden IDR plan. Compared to other repayment options, like REPAYE, you could save nearly $250 per month.

A student loan assistance employer benefit of $5,250 paid directly to the employee covers over four months of payments under this IDR plan.

We don’t know this yet, but if the Biden IDR plan allows borrowers to file taxes separately, the employer student loan assistance will be even more valuable.

Will the employer student loan assistance program be worth it?

Most borrowers who come to Student Loan Planner have a student loan balance greater than $50,000. Even if that borrower gets $20,000 of cancellation and gets on the Biden IDR plan, they still have a $30,000 balance.

If your employer offers $5,250 in annual student loan assistance, would you take it? I would.

Should I seek an employer who offers student loan assistance?

Should you plan your future career around student loan assistance? Think of it as a nice value-add as opposed to a necessary benefit. Up to 50% of companies are considering this benefit. Its value depends on your unique student loan situation.

The student loan assistance employer benefit is valuable to both you and your employer for tax reasons. If you are on an IDR plan and have small monthly payments, this benefit could cover your student loan payments in full. This could change your student loan path completely.

If you have a large balance and large monthly payments, the Biden IDR plan could reduce those monthly payments, and the employer student loan assistance could ease your monthly pain.

When your employer foots the bill for some of your student loan obligations, you can pursue other financial goals or save each month for the potential student loan forgiveness tax bomb.

Don’t give up on this unique employee benefit! Schedule a call with us to review your options.

Not sure what to do with your student loans?

Take our 11-question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, SAVE or another IDR plan, or refinancing (including the one lender we think could give you the best rate).