Occupational therapists work in a tremendous field. It’s meaningful work that pays well and there's no shortage of jobs out there.

What could be better than helping people function and perform daily activities? It’s a rewarding profession and a great career choice. There’s one major headwind for OTs in America though: occupational therapy student loan debt.

The average OT we have worked with here at Student Loan Planner® has about $180,000 in student loans. Many have ventured into more than $200,000 of debt.

How will they figure out the best way to pay back their debt? I’ll show you some common mistakes and the best student loan repayment strategies for occupational therapy student loan debt

History of occupational therapy

Many might not know this, but occupational therapy dates back more than 2,000 years.

The Greeks and Romans helped treat mental illness with massage, exercise, music, and therapeutic baths. They were way ahead of their time!

Occupational Therapy rose to prominence in the US before World War I when Eleanor Slagle used habit training as primary treatment and she opened an OT training program in 1915.

A couple of years later, what’s now known as the American Occupational Therapy Association (AOTA) was founded to improve the quality and training of therapy.

Occupational therapists have many available career paths

Bringing it back to the present-day, most OTs can choose many different types of employment. They can work in a variety of settings including hospitals, schools, outpatient clinics, and nursing facilities. Occupational therapy practitioners may also work in corporate wellness centers and in rehabilitative settings.

About half of OTs work in either a practice or for a hospital according to the Bureau of Labor Statistics. Then there’s a three-way tie for working in schools, home health care, and nursing care facilities.

With the exception of working for a school, the average pay for the top five OT industries is somewhat consistent. They can have their pick of the type of employer, if they want to work with young people, or old people and can live pretty much anywhere in the United States.

Occupational therapists graduate with more student loan debt than anticipated

When someone decides to pursue a career in occupational therapy, their focus is usually on two things. First, they want to have a fulfilling career. And, second, they hope to have stable prospects of earning $80,000 to $90,000 per year.

But, after school, many OTs feel like they’ve bitten off more than they can chew with their student loans. As mentioned earlier, the average OT client at Student Loan Planner® has $180,000 of occupational therapy student loan debt.

Why is that the case when the total stated tuition for undergrad OT graduate school programs is much lower? The combination of higher living expenses, tuition increases each year, interest accruing on the loans, and some leftover loans from their bachelor's degree.

Most master's programs (MOT) are about three years and students can tack on another year or so to get their doctorate (OTD). For those who know that they want to become an OT, there are five-year combined bachelor's and master's degree programs out there.

But the cost to get a master's or doctorate in occupational therapy is getting increasingly expensive as tuition rises.

The good news from a financial perspective is that a doctorate is not a multi-year add-on to the master's program. And it’s not required to practice occupational therapy. This is vastly different for physical therapists as the shift has been made to the DPT designation.

The biggest mistakes occupational therapists make paying back student loans

Look, we all know that figuring out the best strategy to pay back student debt is not the easiest thing in the world. It’s almost like the industry’s goal is confusion rather than loan payoff.

The payment plans are hard to understand and borrowers get different information depending on which customer service rep they talk to. There are also companies out there preying on student loan borrowers with expensive services. These companies don’t fix the problem and, in some cases, make it worse.

We’ve found that the best way to save money is to either (a) get aggressive and throw everything you can at them, or (b) do what you can to keep your payments low and maximize loan forgiveness programs.

Here are the top two mistakes we see:

- Trying to pay back the debt in full over 15 to 30 years: OTs would end up paying a ton of extra interest on this path. And they’d often be better off going for an income-driven loan repayment program instead.

- Paying more than required when going for Public Service Loan Forgiveness (PSLF): When an OT is on the PSLF track, any extra money they throw at it goes into the oblivion, never to be heard from again. This usually takes the form of being on the wrong income-driven repayment plan or not doing everything to lower adjusted gross income (AGI) which then lowers their payments.

Best repayment strategies for occupational therapy student loan debt

In our experience, occupational therapists have three solid options that will save the most money.

- Pay off their loans aggressively with a goal of being debt-free in 10 years or less. This could involve refinancing.

- Work for a non-profit hospital or government employer (like a school) and go for Public Service Loan Forgiveness.

- Work in private practice for a home health or nursing care facility and go for taxable loan forgiveness on an income-driven repayment plan.

Note that with any of these options, you could also apply for a healthcare professional loan repayment program. These programs generally offer payment assistance to medical workers who agree to work a set number of years in high-need areas.

The National Health Service Corps (NHSC) Loan Repayment Program is one prominent example. Volunteers with Peace Corps and Americorps may also be eligible for loan cancellation. And if you consider joining the military in the future, you'll want to ask your recruiter about the Health Professions Loan Repayment Program.

To figure out which one of the three options listed above would be best for an OT depends on their specific situation.

Case study: An occupational therapist saves a boatload of money with a student loan plan

Jessica owes $210,000 in student loans with a 6.8% interest rate. She currently makes $85,000 and her husband makes $70,000 and has no student loan debt.

Jessica has been making payments on the IBR plan since 2014. This is an important point because it means she wasn't a “new borrower” by July 1, 2014. So she'll have to wait 25 years to qualify for forgiveness on the IBR plan. More recent borrowers can earn forgiveness on IBR in 20 years.

Jessica and her husband have a baby on the way and she plans to reduce her hours until their baby-to-be reaches kindergarten. She thinks her salary will drop to $70,000 for those 5 years. After that, she expects her income to bump up to $90,000 with 3% increases in income each year.

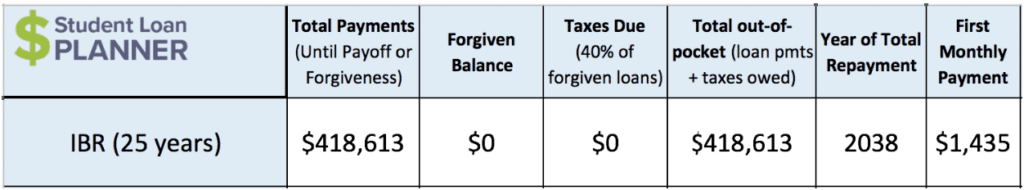

Here’s her projected cost on IBR:

This is an extremely costly plan for Jessica to be on because of all the extra interest she’d pay. She wouldn't end up receiving any forgiveness. Instead, she’d end up paying back her 6.8% loan in full over the next 20 years or so.

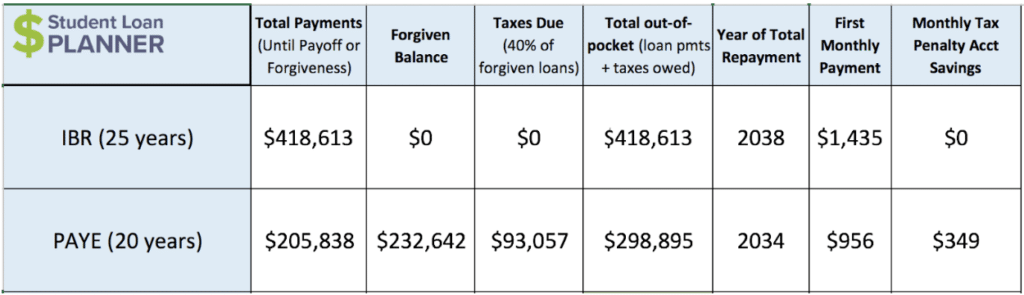

Let’s compare this to Pay As You Earn (PAYE):

PAYE is a clear winner here. If we look at the total projected out-of-pocket cost (total payments + taxes owed), Jessica is projected to save $120,000 on PAYE vs staying on IBR. Plus she’d be out of debt four years sooner.

More tangibly, she’d have lower student loan payments along the way. IBR payments for borrowers who took out their loans before July 2014 are based upon 15% of discretionary income while PAYE is 10%. That means that IBR payments are 50% more per month compared to PAYE.

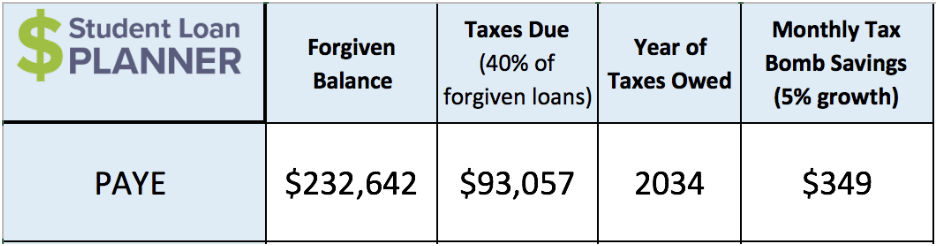

Planning for the tax bomb

Jessica now sees that PAYE is projected to save her $120,000 and she’ll be debt-free four years earlier vs IBR. The problem is that owning a projected $93,057 in 2034 is frightening. But it’s better than she thinks.

Though tax-free loan forgiveness would be better, the tax bomb is the next best thing. Let’s assume Jessica would pay about 40% in taxes on her forgiven loan balance. That means she’d only owe $0.40 for every $1.00 of student debt that gets forgiven. The other $0.60 is wiped away.

Here’s how Jessica can save up for the taxes. Her IBR payment was $1,435 and her new PAYE payment is estimated to be $956. That’s a $479 monthly savings. She can use some of that extra cash to save up for the tax bomb.

If she were to save $349 per month in an investment account for the next 16 years and earn a 5% average annual return after taxes, she’d have the money to pay the tax bomb when it’s due in 2034.

And what if Congress decides to make its temporary pause on taxable student loan forgiveness a permanent change? Well, then Jessica has a nearly $100,000 nest egg that she can put towards her retirement savings, a down payment on a home, or any other financial goal.

At the end of the consult, we talked through all the action steps to put this plan into place. Jessica is so relieved that she has a definitive plan to pay back her loans and can now focus on enjoying the arrival of her baby.

Occupational therapists can get a solid student loan plan

Your personal student loan plan may not look anything like Jessica's from our case study. For example, we assumed that all of Jessica's loans were from the federal government. But if you have private loans, you'll need a drastically different repayment strategy.

The good news is that OTs can find a clear path to pay back their student loans. A path that could not only save them significant money but give them a clear path that they understand and actions steps to get it done.

Student Loan Planner® has done over 5,100 student loan consults for clients with over $1.28 billion of student loans. No matter where you work, we can help you figure out the optimal path in just one hour.

Not sure what to do with your student loans?

Take our 11-question quiz to get a personalized recommendation for 2026 on whether you should pursue PSLF, IDR, or refinancing (including the one lender we think could give you the best rate).

Comments are closed.