Making top money as an optometrist is getting harder and more ODs graduate with $200,000+ in debt forcing them to seek out loan forgiveness and pay back their loans over 20+ years.

Optometrists Graduate With $80,000 More Debt Than Estimated

Optometry students sign up for school thinking that they will graduate with about $120,000-$150,000 in loans with the promise of making nice 6-figure incomes. That sounds like a sound financial decision.

But between tuition increases each year and the cost of living, the average optometry student debt for many ODs can be $200,000+.

That amount of debt shifts them from being able to pay it back in 10 years or less to 20 years or more. The loans stick around and pester them for 2x as long.

OD Compensation Growth Is Inflated

In most professions, people with more experience make more money. That’s certainly true in optometry but not to the extent it used to be.

It’s true that the highest earners in optometry usually have the most experience, but that compensation is due to owning their own practice for years. That level of pay may not be an option for newly graduated ODs.

With the combination of online exams and commercial practices railroading private optometrists as well as meager insurance reimbursements and higher deductibles, pay is becoming capped.

The ceiling for Optometrist pay seems to be moving downward.

Even The Almighty Is Struggling

Luxottica is the dominant force in optometry. They are as big as you can get in any industry.

They not only own LensCrafters, Pearle Vision, and Target Optical, but they also own many of the name brand frames. On top of that, they also own the 2nd largest vision insurance company, EyeMed.

Their brands are powerful and widely demanded so they force optometry practices to carry an inventory and send out much of the work to the manufacturers. That squeezes profits for the store because expenses end up being much higher which limits the ability to generate revenue from the retail operation.

It’s almost like telling a restaurant that they can charge for the food, but they need to keep a large supply of liquor and the revenue from drinks needs to be sent to the landlord.

But with all of Luxottica’s power and might, their revenue and gross profit have been flat to slightly down over the last 3 years due in major part to online competition.

If they’re struggling to make money, then what hope is there for private practices? This could lead to commercial optometry leases becoming less favorable to ODs over time.

Related: Complete Guide to Buying Disability Insurance for Ophthalmologists

How Does All Of This Effect Paying Back Student Loans?

When it comes to working on your finances after optometry school, an OD is still going to make a nice living, but the long-term income growth may be capped in the mid $100,000s. When you combine that with owing more than $200,000 in student loans, paying back student loans may take longer.

The longer loan repayment gets drawn out, the more mistakes that can be made along the way, potentially costing Optometrists $10,000s more.

Common Mistakes that Optometrists Make with their Student Loans

Along with the student loan burden, confusing payment plans and poor guidance cost Optometrists even more money. Here are common mistakes we’ve avoided or corrected during our Student Loan Planner® consults.

Optometrists Refinance Before Exploring Loan Forgiveness

Once someone goes through private refinancing, they give up the opportunity to have their loans forgiven in the future. Their only option is to pay it all back. This can leave some OD students in big-time debt.

Let’s assume that Jan has $225,000 of loans at 6.5%. Jan starts out making $110,000 and the salary grows to $125,000 within 5 years and 3% thereafter.

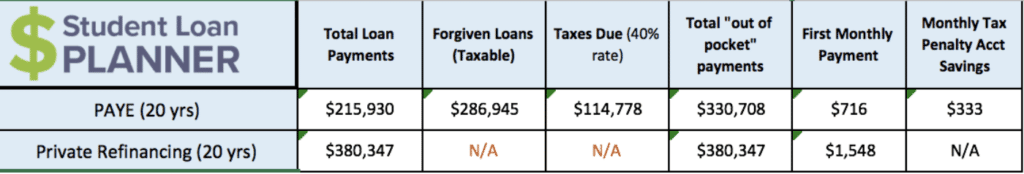

(We’re comparing student loan forgiveness for optometrists with Pay-As-You-Earn (PAYE) vs refinancing at 5.5% with a 20-year term.)

Let’s start with the monthly payments:

The first payment under PAYE is $800/month less than refinancing which gives Jan some cash flow flexibility. In fact, PAYE payments only reach $1,220/month in the 20th year. Even then, that’s still nearly $300 less/month.

Jan can use that extra $300-$800 a month to bolster savings, pay down other debt, and save for taxes when the loans are forgiven.

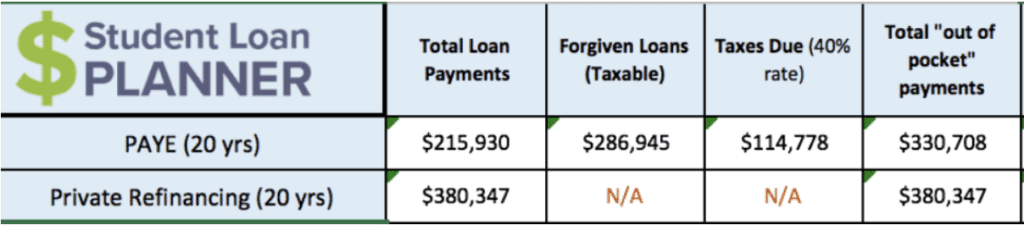

Now let’s look at the total out of pocket cost of PAYE vs refinancing:

The total loan payments if Jan were to refinance is $380,347 over 20 years vs. $215,930 under PAYE. The refinancing payments are $164,000 more than PAYE!

If you included the estimated taxes owed when the loans are forgiven under PAYE, it’s still only $330,708 out of pocket for a $50,000 savings vs private refinancing.

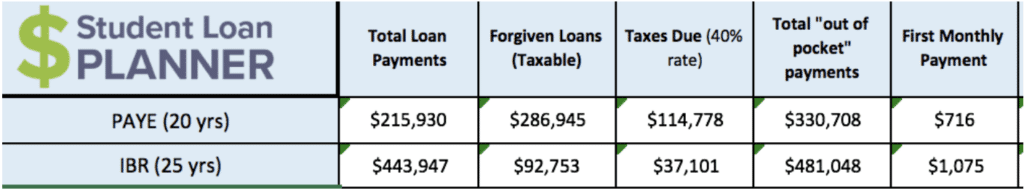

IBR Could Cost Jan $150,000 And 5 More Years vs. PAYE

Now let’s look at what would happen if Jan stayed on IBR instead of switching to PAYE.

Jan’s total out of pocket costs under IBR is estimated to be $481,048 over 25 years. That includes the estimated taxes owed (40% tax rate) on the forgiven balance.

With PAYE, the total estimated out of pocket costs would only be $330,708. PAYE would save Jan more than $150,000!

2 other bonuses: Jan’s payments would be 33% less the whole way and debt freedom would come 5 years sooner.

Marrying Someone Without Reevaluating Your Student Loan Strategy

Let’s say Jan gets married 5 years down the road to a spouse earning $60,000.

On income-driven repayment plans (PAYE, SAVE, IBR, etc), a change in income means that student loan payments change.

Depending on how they file taxes, Jan’s student loan payment could jump up about $400-$500 a month on PAYE. That is fairly significant so it’s important to plan accordingly to have that extra money to go toward student loans and explore options to lower the payments.

How Can Jan Make The Best Decision For Paying Back His Loans?

If Jan and I worked together, I’d ask these questions to help him figure out the best way to pay back his student loans:

1. Talk career goals.

Jan and I would talk through career goals like starting a private practice, buying into a partnership, working the commercial route, etc.

Starting or buying into a private practice would require a solid savings plan. We’d find a path that would keep student loan payments low so Jan could maximize their savings.

Aside from getting on the right repayment plan, we’d talk through other strategies to lower AGI which would lower loan payments even more.

2. Is the prospect of marriage on the table anytime soon?

Getting married can have a huge impact on an OD’s loan payment strategy including skyrocketing monthly payments and an increase of $10,000s in out of pocket loan costs.

If marriage is close by, then we’d want to take Jan’s future spouse’s income prospects and student loans into the equation. To save the most money, the two of them would need a mutually agreed upon, unified approach to paying back the student loans.

3. Are Jan’s income prospects realistic?

When Jan and I talk through future income, I’d want to make sure that income doesn’t rise much above $140,000 unless there’s some sort of unusual circumstance. If one’s income projections are too optimistic, it might sway which repayment option would look to be the best.

We’d want to play around with a few different income trajectories to see how refinancing or a different repayment strategy might come into play.

Soaring Student Loans Do Not Need to Create Financial Doom for Optometrists

There is a path to debt freedom for all Optometrists. A path that could save them tens of thousands of dollars. The question is, which one would be best for an OD’s career trajectory and the lifestyle they’d want to live.

Student Loan Planner® has done 800+ student loan consults with clients and assisted with over $200,000,000+ of outstanding loans. We can help you figure out the optimal path for your optometry student loans in just 1 hour.

If your student loans are squeezing your monthly budget, leave a comment below.

Comments are closed.