Orthopedic surgeons specialize in treating conditions of the musculoskeletal system, including disorders of the bones, joints, ligaments, nerves, muscles and tendons. According to Medscape’s Medscape Physician Compensation Report 2019, orthopedic surgery is the highest-paid of all medical specialties.

Unlike other medical specialties, an orthopedic surgeon’s patients aren’t typically dealing with life-or-death illnesses. Instead, orthopedic surgeons use the latest medical technology to help patients regain mobility and relieve pain. Other orthopedists focus on sports injuries, and some even get the opportunity to treat professional athletes.

There’s a lot to love about orthopedic surgery work if you’re considering it as your own medical specialty. But orthopedic surgery is also one of the top five medical specialties with the highest student loan debt, according to the American Medical Association.

Is the orthopedic surgeon salary worth student loan debt? Yes, especially if you’re strategic about what you do after residency.

Education and training requirements to become an orthopedic surgeon

Orthopedic surgeons begin their education journey by earning a four-year bachelor’s degree. Next, they must pass the MCAT before enrolling in medical school and earning their medical degree (MD), which typically takes another four years.

After finishing medical school, physicians who want to pursue an orthopedic surgery speciality must apply for open residency positions. According to the American Medical Association (AMA), positions at orthopedic residency programs are some of the most competitive of all medical specialties.

If you’re one of the lucky med school grads who has landed a spot at an orthopedic surgery residency program, you’ll need to spend a minimum of five years there. After five years of resident training, orthopedic surgeons are eligible to sit for the American Board of Orthopaedic Surgery exam.

Orthopedists who plan to specialize in sports medicine or surgery of the hand will need to complete additional residency or fellowship training in order to become eligible for board certification. In all, the average orthopedic surgeon can expect to dedicate 13 to 15 years to their education and training.

Average orthopedic surgeon salary

Each year, Medscape releases its Physician Compensation Report. Orthopedics has been in the top five of highest-paid specialties in each of its last five reports. And, in the 2019 edition, orthopedics came in at No. 1 with an average orthopedic surgeon salary of $482,000.

Self-employed orthopedists earn more than their employed counterparts. The average salary of a private orthopedic surgeon salary was $505,000, compared to $459,000 for employed orthopedists.

Related: Disability insurance for orthopedic surgeons: costs and where to buy it

Orthopedic surgeon student loan debt

Recently, the AMA released a list of the five medical specialties that saddle graduates with the most student debt. The list was based on data from a JAMA Internal Medicine research letter that included responses from over 13,610 medical school graduates from 2010-2016.

Orthopedics tied for No. 2 on the list, with a median orthopedic surgeon debt total of $190,000. The study also found that 74.2% of orthopedic surgeon graduates had some student debt, and 27% had a student debt load of over $200,000.

These numbers are even more concerning when you consider that the first five to seven years of repayment for many orthopedics occur during residency. Medscape found that the average orthopedic surgeon resident makes $60,700 — that’s nearly eight times less than what board-certified orthopedic surgeons earn.

Income & Student Debt by Profession

How you compare to other

accountants stats*

| Average student debt | |

| Average income | |

| Average Debt-to-Income Ratio |

Statistics represent the population of Student Loan Planner clients in the respective profession referenced in the chart from 2017-2023. Sample excludes those in school or in training.*

Best student loan repayment strategies for orthopedic surgeons

The data above shows that many orthopedic surgeons are dealing with crushing student debt. If you’re currently in residency, your student loan payments could be creating a serious cash flow problem.

So, how should an orthopedic surgeon approach student loan repayment? In our experience, orthopedic surgeons have three main options:

- Join an income-driven repayment (IDR) plan

- Pay off loans aggressively

- Pursue Public Service Loan Forgiveness (PSLF)

Let’s take a look at the pros and cons of each student debt repayment strategy to help you decide which option is right for you.

1. IDR: best for orthopedic surgeon residents

If you’re in residency and you’re struggling to afford your student loan payments, getting on an IDR plan could relieve the burden. Depending on the plan that you choose, your payment is limited to 10% to 20% of your discretionary income.

But which IDR plan should you choose? Let’s take a look at a fictional case study for “Karen,” an orthopedic surgeon who graduated with $190,000 in student loans. For the sake of illustration, we’ll assume that all of Karen’s student debt are federal loans with an average interest rate of 6%. We’ll also assume that she’ll make an average of $60,700 during six years of residency before jumping up to a starting orthopedic surgeon salary of $400,000 with a 3% annual raise.

If Karen doesn’t have Parent Plus loans, she’ll immediately want to cross the Income-Contingent Repayment (ICR) plan off her list of options. Unlike the other IDR plans that base payments on 10% of discretionary income, ICR payments are twice as high — 20% of your discretionary income.

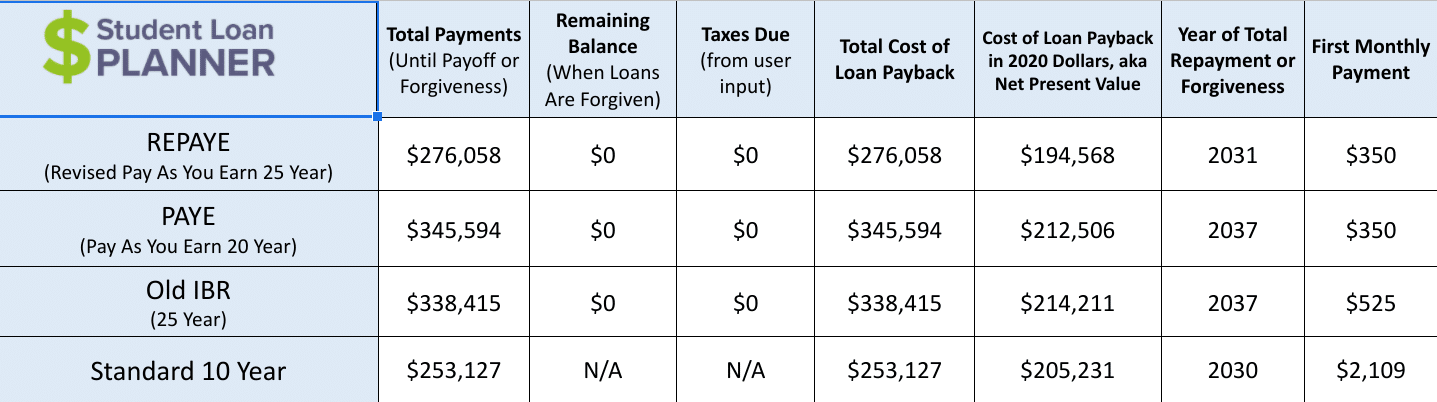

Assuming that none of Karen’s loans are Parent Plus loans, eliminating ICR leaves her with a choice between: REPAYE, PAYE or IBR. By plugging in her numbers to the Student Loan Planner® calculator, Karen can quickly see how much she’d pay toward her loans monthly and overall with each income-based plan.

The calculator shows that each of these plans will be more expensive over the long haul compared to the Standard 10-year plan. Although Karen would pay $253,000 overall with the standard repayment plan, she’d pay between $276,000 to $345,0000 through IDR.

Check out the massive difference in first monthly payments, however. While her first payment would be over $2,100 with the 10-year plan, her first payment would be $350 to $525 with IDR. That would make a dramatic difference in Karen’s cash flow situation.

Between the three IDR plans, REPAYE is the winner here. It ties with PAYE for lowest first monthly payment at $350. But REPAYE would cost her nearly $70,000 less overall. Use the Student Loan Planner® calculator to find the best IDR plan for you.

2. Aggressive repayment: best for private practice owners

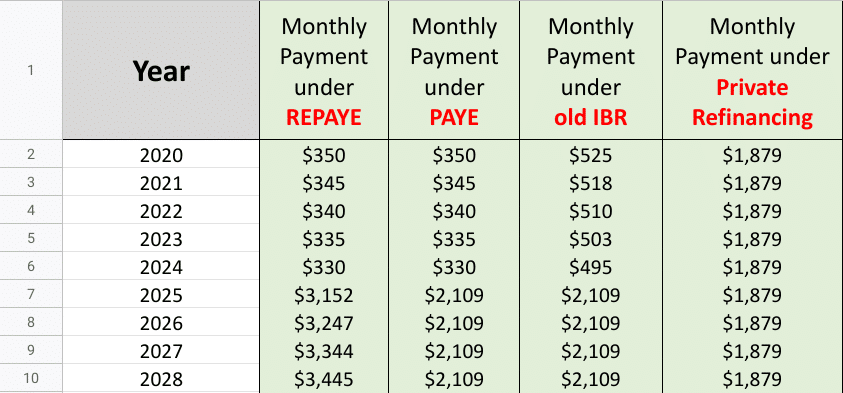

If you’re an orthopedic surgeon who has finished residency and already own your own private practice, IDR likely won’t help you. Going back to our example with Karen, notice how her IDR monthly payments jump in year seven in response to her salary increasing to more than $400,000.

With PAYE and IBR, Karen’s payments would be equal to what she’d pay with the Standard 10-year plan. And with REPAYE, her payments would actually be over $1,000 higher at $3,152.

If you’re a private practice owner earning $400,000 or more, your best bet is to pay off your student loans as fast as you can to reduce interest charges.

Let’s look again at Karen’s case to see how much she could save by taking an aggressive payment strategy. By year seven of repayment (when her salary and IDR payments would spike), her loan balance would have grown to over $208,000 on the REPAYE plan.

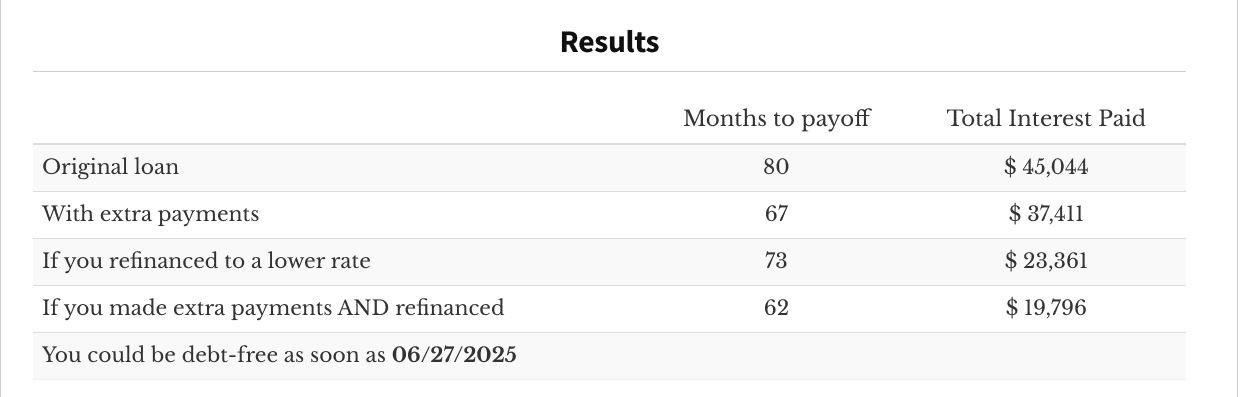

Let’s plug Karen’s numbers into the Student Loan Planner® student loan payoff calculator to see how much she’d save by making additional payments of $500 per month. We’ll also check to see how much Karen could save if she refinanced at a 3.5% interest rate.

The results show that Karen would save over $7,600 by paying $500 extra per month. But notice that she could actually save even more — $21,683 — by refinancing to a lower rate. And if Karen combined refinancing with $500 extra payments, she’d save a total of $25,248.

3. PSLF: best for nonprofit employees

Do you work for a nonprofit hospital or clinic or for a public medical facility or university? If so, you may be eligible for the most generous federal student loan forgiveness program — PSLF.

With PSLF, you’ll make payments on an IDR plan. That means you’ll be able to take advantage of the lower payments during residency that we discussed above. Instead of having to wait 20 to 25 years to earn forgiveness, however, PSLF program participants can receive full, tax-free forgiveness in as little as 10 years (120 qualifying payments).

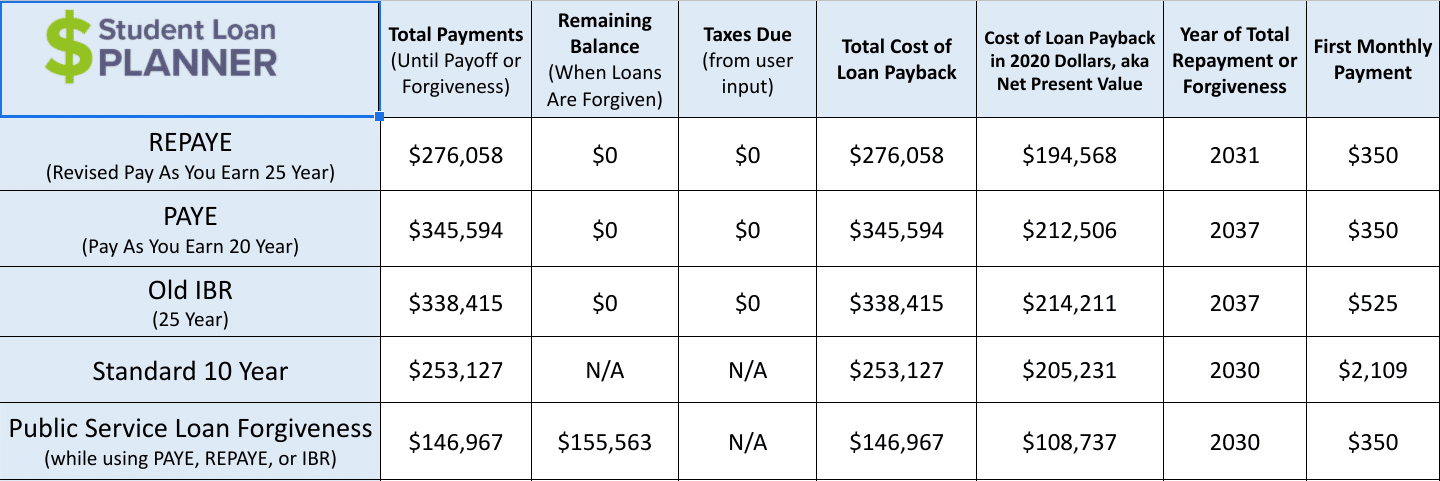

Let’s imagine that Karen decided to take a job at a nonprofit hospital after she finished residency. Take a look at how much money she could save by pursuing PSLF:

PSLF would be Karen’s most affordable student loan repayment strategy. Not only would it be $129,000 to $196,000 cheaper than all three IDR plans, but it would even be over $100,000 cheaper than the Standard 10-year plan.

If you’re an orthopedic surgeon who works for a qualifying nonprofit employer, you need to apply for PSLF.

Should orthopedists delay their private practice plans to pursue PSLF?

At first glance, owning your own practice can seem like the best option because self-employed orthopedists make an average of $50,000 per year more than employed orthopedists.

But to truly compare private practice ownership to nonprofit employment, you need to add the value of PSLF to your nonprofit salary. The long residency requirements for orthopedists can actually make PSLF more valuable to them than for physicians in medical specialties with shorter residency periods.

Most orthopedic surgeons will spend an average of six years in residency whether they pursue PSLF or not. So, that means the typical orthopedist would only need to make four years of higher IDR payments before they’d qualify for PSLF forgiveness.

For these reasons, Travis Hornsby, founder of Student Loan Planner®, estimates that the typical orthopedic surgeon could get $113,900 of pre-tax annual salary value from PSLF. That far outpaces the potential extra $50,000 in annual salary. The math indicates that PSLF’s value could make it well worth your while to take a nonprofit position after residency.

But here’s the great thing — many orthopedists can have their cake and eat it, too. After just four to five short years of working for a nonprofit employer, orthopedists could earn their PSLF forgiveness — after which, they can move forward with their dreams of private practice ownership.

Orthopedic surgeons can get a solid student loan plan

Not sure which repayment strategy would save you the most money? Student Loan Planner® can help. We’ve worked with over 3,800 clients to create comprehensive repayment plans for over $972 million of student debt.

Whether you own a private practice, work at a nonprofit hospital, or have another employment situation, we can help you figure out your best path forward to eliminate your student debt. Plus, our consultants offer email support after the meeting to answer any additional questions. Book your consultation today.

Income & Student Debt by Profession

How you compare to other

accountants stats*

| Average student debt | |

| Average income | |

| Average Debt-to-Income Ratio |

Statistics represent the population of Student Loan Planner clients in the respective profession referenced in the chart from 2017-2023. Sample excludes those in school or in training.*