Parker University’s Doctor of Chiropractic (DC) program is unique by offering business tools to start your own practice in addition to the theory and practice of chiropractic care.

Before you get cracking at Parker College of Chiropractic, it’s important you strongly consider the tuition costs. When comparing the program’s total cost to your future salary, you’ll find it’s not worth it.

Parker University chiropractic tuition and total cost

Parker University‘s DC program is 3-years and 4-months. The program is completed on campus in Dallas Texas, with the exception of the final year. The final year consists entirely of clinical settings.

The Doctor of Chiropractic program is divided into trimesters. Here is how the cost breaks down:

- The total cost for one trimester is $12,560 (Tuition for one trimester in the 2019-2020 academic year is $11,560 and fees run another $1,000)

- Tuition and fees for one academic year is $37,680

- Estimated tuition and fees for the entire program (10 Trimesters) is $125,600

But Parker University’s chiropractic total cost will actually be more than this. Parker University expects DC students to spend about $9,140 on cost of living expenses per trimester. $1,250 of this estimate is for books and equipment fees.

That’s an estimated cost of another $21,700 per trimester. Multiply this by 10 trimesters and you’re looking at a hefty Parker University chiropractic estimated cost of $217,000.

Is financial planning with SLP Wealth right for you?

Looking for student loan aware financial planning custom tailored for professionals like you? Check out the discounts below for becoming a client of SLP Wealth (our SEC Registered Investment Advisory firm).

SLP Wealth, LLC (“SLP Wealth”) is a registered investment adviser registered with the United States Securities and Exchange Commission with headquarters in Durham, NC.

Estimated student loan debt for Parker College of Chiropractic

Ideally, you can substitute a portion of your tuition with grants, scholarships, and an outside source of income source. But the question is, how much of that $217,000 is going to be paid by student loans?

The 2016-17 College Scorecard reports that the average student debt from Parker College of Chiropractic is $189,229.

Doctor of Chiropractic students with six figures of student loan debt isn’t anything new. An academic study done in 2014 found that 88% of chiropractic students had between $100,000 to over $175,000 in student loan debt.

Since tuition has only increased, this number has only increased as well. Student Loan Planner® regularly sees DC clients with $200,000 to $300,000 of student loan debt.

Student loan debt like this can be debilitating. Even more so if you can’t afford to pay it off with your expected salary.

Is going to Parker College of Chiropractic worth the student loan debt?

Even though Chiropractors go to medical school, they don’t make a typical doctor’s salary. According to the Bureau of Labor Statistics (BLS) the median pay is $71,410 per year. If you’re self-employed with a private practice, there can be even lower expected earnings until you build up a client base.

Employment for Chiropractors is expected to grow by 7% between 2018 and 2028. This is good news, but not good enough to warrant taking out six figures of student loan debt.

The modest salary and the cost of Parker University chiropractic tuition aren’t going to be worth it.

Why Parker College of Chiropractic isn’t worth it

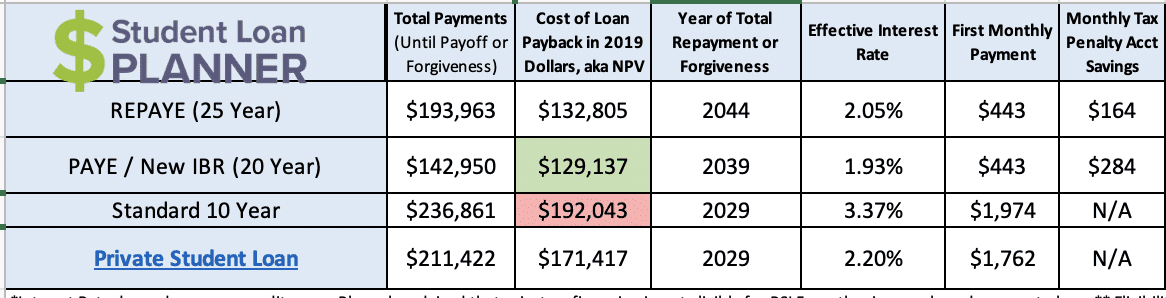

Let’s say you graduated with a little less than the average student loan debt of $170,000. You’re single, making the average chiropractic salary and have an average interest rate of 7%.

Standard payments for the 10-year repayment term would be $1,974 a month. That is nearly impossible to pay while still having a life. Not to mention you would be starting retirement savings at a much later date.

As you can see in the chart above, there is a way to get student loan forgiveness as a chiropractor. It just takes 20-25 years.

Repayment options for Parker College of Chiropractic alum

Unfortunately, most Chiropractors aren’t eligible for Public Service Loan Forgiveness. This is unfair, considering their work helps heal people, but the fact is that most jobs are in the private sector.

Instead, chiropractic grads should look into income-based repayment (IBR) forgiveness plans.

If you attended Parker College of Chiropractic or another expensive program, here is how we suggest you pay off your student loans:

1. Get on the right income-based repayment (IBR) plan

You need to sign up for the Revised Pay As You Earn (REPAYE) or Pay As You Earn (PAYE) Plan. One of these plans will give you the lowest monthly payment according to your income.

You pay on these plans for 20-25 years, then your remaining student loan balance will be forgiven.

2. Save for the “tax-bomb”

Every month you need to save money and make your payment. This is to prepare for the “tax-bomb”.

When your student loans are forgiven at the end of 20-25 years, you will need to pay taxes on that amount. This is why it’s essential to save up the money so you aren’t surprised.

How to figure out the best IBR plan for you

You can decide on REPAYE or PAYE by using our Student Loan IBR Calculator.

Let’s run another scenario:

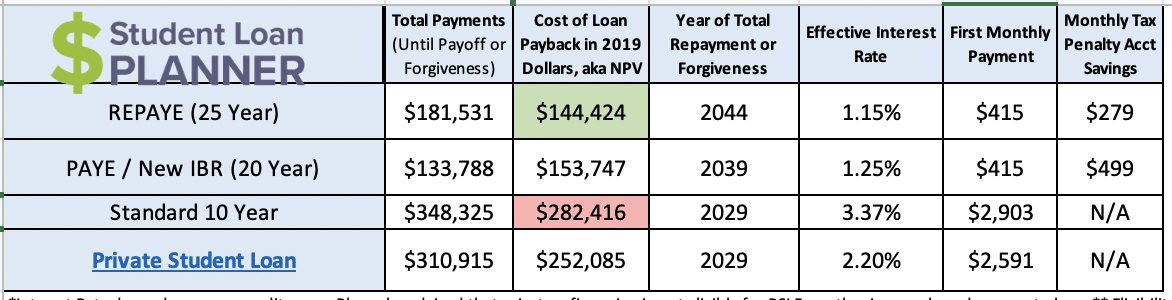

- You left Parker College of Chiropractic with $250,000 of student loans

- The average interest rate is 7%

- You got a job making $68,000 a year (a little less than average)

- You’re single and not planning to get married

As shown below, your best option is to go for the REPAYE plan. You’d pay $415 a month towards student loans and save $279 a month for taxes.

A PAYE Plan would be the same monthly payment, but you would need to save $499 a month for taxes. Which would cost you more in the long run.

Get help making a financial plan for chiropractic school

Parker University is expensive, but so are most DC programs.

If you’re still considering going to school to get your DC degree, then you’re also considering major student loan debt. Student Loan Planner® developed the pre-debt consult for just this.

We don’t want to tell you not to go after your dreams. But we do want to help you minimize your student loans and have a payback plan so you can afford to live your dreams.