You wanted to support your child by paying a big part of the cost of their undergraduate education. After all, the Stafford loan limits only allow your son or daughter to take out a mid-four-figure loan amount every year. Plus, the financial aid office sold the Parent PLUS loan program as a source of student loans from the federal government that would cover all of the cost of attendance.

Maybe you haven't thought about how you would pay off Parent PLUS loans until recently. Unfortunately, I’ve seen plenty of families where the parent owes a huge loan balance of Parent Plus loans, and it’s interfering with their retirement goals.

If you have to pay off a Parent PLUS loan after funding your child's education, the good news is you have more options to pay it back than you think. But, many of the best options like double consolidation are being taken away from parents beginning in July 2025 due to the next IDR regulations released on June 30, 2023.

Use this Parent PLUS Loan calculator we built to see why you might not need to actually pay your Parent PLUS Loan off. We'll cover the five best strategies I’ve seen to get parents out of Parent Plus loan debt.

1. Using PSLF for Parent PLUS Loans

Many parents have a misconception that Parent PLUS loans aren’t eligible for student loan forgiveness for public servants. They might meet eligibility requirements for the Public Service Loan Forgiveness Program but face significant hurdles to qualify.

Here’s an example that might apply to you. You’ve worked for decades in the public sector and wonder if there’s a way to get your experience to count retroactively. If it was possible, you might already have the 10 years of payment history needed to receive tax-free loan forgiveness.

There are several catches. To get Parent PLUS loan forgiveness, you must:

- Consolidate Parent PLUS into a Direct Consolidation Loan.

- Make payments on the ICR plan for 10 years on the new Consolidation Loan.

- Work full-time at a qualifying 501c3 or government employer.

You might ask what the ICR program is? It stands for Income Contingent Repayment (ICR). This plan requires you to pay 20% of your income above the federal poverty line for your family size.

Calculate Your Parent PLUS Loan Payments and Forgiveness Path

Parent PLUS Loan CalculatorParent PLUS Payment Example

For example, let's say your Adjusted Gross Income (AGI) on your tax return is $42,000. Your family size is two. In this case, you would deduct the current poverty guidelines amount of $19,720 (as of 2023) from the AGI, and multiply the result by 20%. Hence, the ICR payment in this scenario would be $4,456 over the course of the year. This amount would be split up into monthly payment amounts of about $371.33.

The issue with the ICR plan is that your payments can get very high very quickly. Other income-driven repayment plan programs like SAVE and PAYE only ask for 10% of your income. Additionally, they give you a higher deduction. These payment plans are not available for Parent PLUS loans.

Hence, the typical parent who would pay off her Parent Plus loans before receiving any forgiveness. Usually, parents have not consolidated their loans yet before they contact me. Therefore, the additional 10 years of full-time work usually kills the idea as well. For some, though, PSLF could be a saving grace.

There's also the Parent Plus loophole to consider, which I'll explain more in #5 below.

2. Refinancing Parent Plus Loans into your name only

If you want to know how to pay off Parent PLUS loans quickly, refinancing is worth looking into. Virtually every major lender will agree to refinance Parent Plus loans into your name only. After all, Parent Plus loans are legally your responsibility, not your child’s.

Some parents prefer to keep it that way. The most common arrangement I’ve seen with clients and readers is, “I’ll pay for undergraduate student loans, but you pay for everything after that!”

Of course, some parents take the other side and view this loan as their kid’s loan that they’ll take on once they’re able. There’s no right or wrong answer but choosing between these approaches carries big implications for your lifestyle.

Don't let high student loan payments reduce your retirement savings

If you plan to refinance Parent Plus student loans into your name alone, you need to plan on working for another 10 years. Your 50s and 60s are prime years for deferring money for retirement. You’ll likely be in a lower income tax bracket once you quit working.

Furthermore, you can make $7,500 catch-up contributions to 401k and 403b accounts (as of 2023). This is in addition to your annual contribution limit of $22,500. This means your max retirement contribution to an employer account is increased to $30,000. If you’re married, multiply that number by two for the total contribution you could make together.

Parent PLUS loan repayment can make those contributions more difficult. I would suggest that if you do refinance Parent Plus that you get rid of it in a hurry. You want to shoot for a plan with a repayment period of fewer than five years, so you can go into retirement unburdened.

For example, a parent with $40,000 of Parent Plus loans could refinance that amount to a 4.66% fixed interest rate and pay $749 a month to have it all done within five years. That kind of payment is very doable if your child’s loan is a low to mid-five figure balance.

You’d also save thousands of dollars in interest over the life of the loan by refinancing to a lower interest rate. Additionally, you can speed up your repayment plan and save even more by making extra payments.

For a loan balance below $50,000, refinancing is usually the way to go. However, when you have more than that, the math gets much more challenging.

You should not refinance Parent Plus student loans if you’re planning to use Social Security for most of your retirement income. As we’ll see later, the math just doesn’t make sense.

3. Refinancing Parent Plus Loans into your child’s name only

Lenders like Laurel Road will allow you to refinance your Parent Plus loans into your child’s name alone.

This is a very popular option with families who had to take out loans for multiple kids for school. To transfer a Parent PLUS loan to a student or recent grad, you can refinance the debt into the child’s name. It's far superior to just having your kid write a check to you for the monthly payment.

After all, you’re paying the government at a 7.54% interest rate on a Parent Plus loan, which doesn’t make sense when you can slash the interest rate cost by refinancing.

The process is more cumbersome when you’re refinancing Parent Plus loans into your child’s name, but it’s very doable and I’ve helped readers accomplish this through my cash back bonus links.

If you’re going to transfer the student loan debt to your child’s name, you want to make sure that your kid is very financially stable. There’s nothing worse than having your entrepreneurial ambitions restrained by a huge required monthly payment.

You cannot consolidate the loan to your kid’s name and keep it with the U.S. Department of Education federal student loans system, unfortunately. The only way to get a Parent Plus loan payment based on income is to use the final strategies for paying back Parent Plus.

Related: 7 Expert Tips for Managing Parent PLUS Loan Payments If You’re Struggling

4. Going for Parent Plus Loan forgiveness as a retiree

I have seen incredibly little written about this strategy online. Using Parent Plus loan forgiveness as a retiree could allow your family to keep vastly more wealth and allow you to retire sooner.

If I’ve got your attention from that, then good because this stuff can get confusing.

The only way to get payments based on income with Parent Plus is through federal direct loan consolidation. When consolidating, you only want to include Parent Plus loans. That’s because the new Direct Consolidation Loan will only be eligible for the ICR plan, and you don’t want to mess up loans you took out for your own education that weren’t for your children.

Once you call your loan servicer and secure the consolidation, now your payments are 20% of your income (specifically Adjusted Gross Income or AGI) after deducting 100% of the poverty line for your family size.

This strategy works well for retirees depending on Social Security

This is an absolute game-changing strategy for someone with more than $100,000 of Parent Plus loan debt who relies on Social Security for most of their retirement income. In fact, according to AARP's Fact Sheet, about half of people aged 65 and older rely on Social Security for at least half of their family income. And about 25% rely on it for over 90% of their income.

We don’t have great data on this, but I’d guess that the population of Parent Plus borrowers is not as rich as elderly Americans on average. Otherwise, why borrow for your kid’s school, right?

Hence, my guess is there are hundreds of thousands, if not millions, of Parent Plus loan borrowers who will have a modest income in retirement.

5. Double consolidation: The most powerful Parent PLUS loophole

Parents living mostly off Social Security income in retirement would likely have an extremely low AGI. That's why paying 20% of your AGI minus 100% of the federal poverty line with the income-contingent repayment plan can make sense.

However, what if there was a way to pay 10% of your income instead of 20%? Middle and upper-middle-income parents who were formerly not good candidates for forgiveness could suddenly have a huge amount of debt forgiven.

We've written an entire article on the Parent PLUS double consolidation loophole.

Editor's note: Attention parents! New regulations will eliminate this loophole on July 1, 2025. If you're a parent with a higher income, you should anticipate repaying the bulk of new student loans taken out on behalf of your children.

It's not for the faint of heart, but if you're willing to put in the time following our guide on how to use it, you could cut your payments by more than half. You could also book a consult with us, and we'll walk you through the process.

That's because other income-driven repayment plans not only take a lower percent of your income, but they also give you a larger deduction before you have to pay anything (150% of the poverty line instead of 100%).

How could Parent Plus Loan forgiveness work in practice

We'll cover the ICR and Parent PLUS strategy because it's the simplest to illustrate.

Imagine Tim took out $150,000 of Parent Plus loans with a 6% interest rate for his three daughters to complete college. Tim is 64 years old and plans to retire from his job as a car mechanic at 66. He’ll claim his monthly Social Security of $1,800 a month, and Tim’s wife Margaret will claim her $1,500 a month of Social Security at that time, too.

Their income will be $60,000 combined for the next two years, and then it will drop to $39,600. Let’s assume Tim has a small pension that he makes that will bring their combined retirement income up to $45,000.

Tim could consolidate and attempt to use an economic hardship forbearance for the next two years that he’s working to avoid payments.

Then he could consolidate when he retires. He’s living on Social Security alone, and since his taxable income is above $44,000, up to 85% of his Social Security is taxable.

That makes his AGI 0.85 x 39,600 + 5,400 = $39,060.

Thus, his ICR payment would be 20% of $39,060 minus 100% of the federal poverty line for a family size of two ($19,720), which works out to about $346 a month.

Tim could pay this amount for 25 years, and then his forgiven balance would be considered taxable income. At that point, Tim would be 91 years old. Who do you think would win in a collection of a six-figure balance, Tim or the IRS?

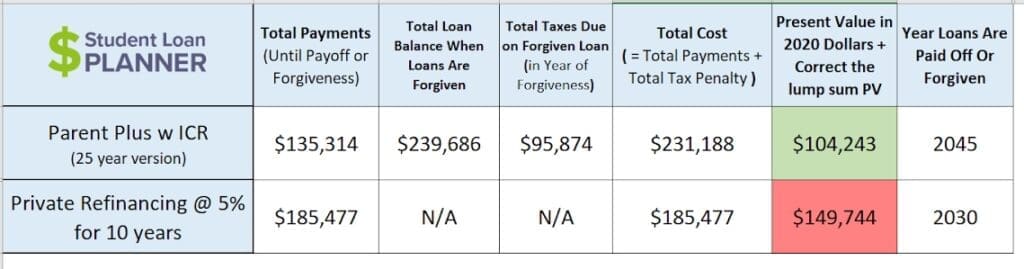

Here’s a summary of what the above scenario would look like.

My guess is that the IRS would apply the insolvency rule and wipe away the debt. I doubt he would have to pay that $95,000 tax bomb. Tim could also agree to some installment payment that’s a percent of his income, or he could have already passed away and not have to worry about it anymore.

How to drastically reduce your payments with double consolidation

As mentioned, there are other income-driven repayment plans that factor in a lower percentage of your income. For example, the Pay As You Earn (PAYE) plan uses 10% of your discretionary income. But to access these additional student loan repayment plans, you'll need to take advantage of the Parent PLUS double consolidation loophole.

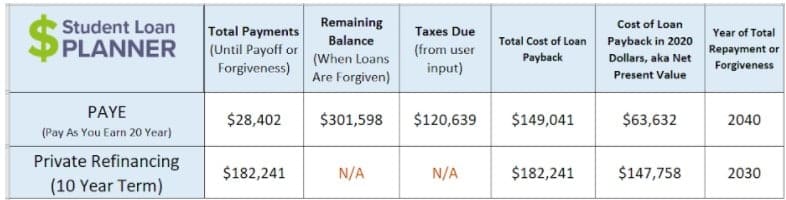

So, what would your payment look like if you used the double consolidation strategy with PAYE?

Using Tim and Margaret's previous example, his PAYE payment would be 10% of $39,060 minus 150% of the federal poverty line for a family of two ($19,720), which would drop his payment down to just $97 per month.

Tim could then make 20 years of payments and have his remaining balance forgiven. Here's the kicker. His total payments would come out to about $28,000, which is a huge savings compared to the $135,000 he'd pay under the ICR plan in the previous example.

Note that the PAYE plan will no longer be available through double consolidations in July 2024.

If you have no retirement income except Social Security, your student loan payment is probably $0

Keep in mind that the reason Tim and Margaret had a payment at all is that their total income was in the mid-five figures.

If we were just talking about a single parent living on one Social Security paycheck alone, then it’s very likely the payment would have been $0.

There are plenty of retirees living well on only Social Security checks in South Florida. The nice part about this strategy is that if you have very little saved for retirement, even though you owe a bunch for your child’s education, you can still actually retire.

That’s a game changer for many families out there.

FAQ for Parent PLUS Loans

Here are some of the more common questions we get from parents who owe a ton of debt for their child or children's education.

Yes, students can take on their parents' PLUS loans by refinancing through a couple of private student loan lenders mentioned earlier in the article. And as an added bonus, refinancing can help score a lower interest rate and save thousands in total interest costs.

Federal Parent PLUS loans are not eligible for Income Based Repayment, Pay As You Earn, or Saving on a Valuable Education (SAVE). The only income-driven repayment plan Parent PLUS is eligible for is Income Contingent Repayment (ICR). Even then, you must first consolidate your Parent PLUS loan through studentloans.gov to be eligible.

Yes, you can refinance through a private lender if you wish to pay off your loans faster and you’re not planning to use Social Security for most of your retirement income. Our refinancing partners have best-in-class welcome bonuses paid in addition to lower interest rates.

The interest you pay towards a student loan, including a PLUS loan, may score you a break at tax time. Currently, the most you can deduct is either $2,500 or the total amount of student loan interest you paid, whichever is less. This is an above-the-line deduction, meaning you do not have to itemize to claim it.

The student loan interest deduction is subject to a phaseout based on income.

If you don't pay your Parent PLUS loan, it will go into default. The government can garnish your wages or Social Security to get paid, so do not take this action as there are better repayment options available.

Strategically Pay Off Parent PLUS Loans or Plan on Expensive Mistakes

Parent Plus is the red-headed orphan stepchild of the Department of Education's student loan portfolio. There are about 3.7 million Parent PLUS loan borrowers, and many owe a loan balance of six figures. If that’s you and you're looking to learn everything you need to know about Parent PLUS loans, you’re not alone.

The total interest cost is higher, so at first glance, it might seem like refinancing is always the answer if you want to make Parent PLUS loans affordable. However, if you look at the math, it’s a lot more complex. If you know you need student loan refinancing, check out some of the cash back bonus links on our site.

If you want a custom plan, that’s what we specialize in. Feel free to reach out to us with the button below.

If you're currently trying to pay off Parent PLUS loans, we'd love to hear what you're going through. Just post a comment below, and we'll respond.

Refinance student loans, get a bonus in 2025

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

For refinancing 100k or more (bonus from Student Loan Planner®, not SoFi®)

|

Fixed 4.49 - 9.99% APR

Variable 5.99 - 9.99% APR with all discounts with all discounts |

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 4.45 - 10:49% APR

Variable 5.88 - 10.49% APR

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 4.29 - 10.24% APPR

Variable 4.86 - 10.24% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 4.99 - 8.90% APR

Variable 5.29 - 9.20% APR

|

|

|

$1,099 Bonus

For 150k+, $300 to $500 for 50k to 149k.

|

Fixed 4.88 - 8.44% APR

Variable 4.86 - 8.24% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 3.85 - 11.38% APR

Variable 4.33 - 12.35% APR with autopay with autopay |

Not sure what to do with your student loans?

Take our 11-question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, SAVE or another IDR plan, or refinancing (including the one lender we think could give you the best rate).

Comments are closed.