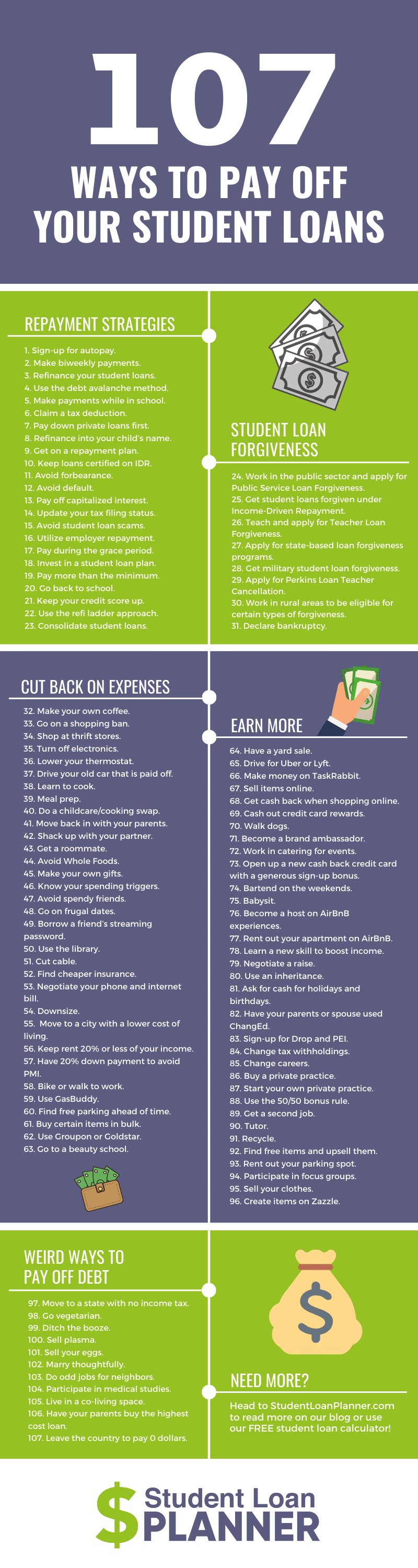

If you're sick of making student loan payments and see no end in sight, you'll love this guide with tons of ways to pay off your student loans faster and reduce your student loan balance.

We've put together our list of 107 top ideas for paying off your student loans. Sure, common advice like “make extra payments” or “use autopay” can help, but there's a whole lot more you can do to accelerate the process.

There's literally something for everyone on this list, and we're confident that using just a few of these strategies could save you thousands on your student loans as well as years of paying off your student debt.

Check out our strategies by category below and see how you can start paying off your student loans faster today.

Top Repayment strategies

1. Sign-up for autopay

You can sign up for autopay with your loan servicer and get a 0.25% interest rate reduction and effectively lower interest rate.

2. Make biweekly payments

Did you know that interest on your student loans accrues daily? Yep. It’s not just you. This can make it feel tough to get ahead and even more difficult to actually lower your balance.

One repayment strategy that helps is making biweekly payments. Simply cut your monthly payment in half and make two payments per month instead of one toward your student loan servicers.

3. Refinance your student loans

You can lower your interest rate through student loan refinancing. Check out various lenders and our cash-back bonuses.

Just be aware, you give up important benefits like income-driven repayment (IDR) and student loan forgiveness. You’ll also need good credit. If it’s a good fit, student loan refinancing can save you thousands of dollars.

4. Use the debt avalanche method

The debt avalanche method means you prioritize paying off your highest interest debt first. You make minimum payments on all of your other loans and throw any extra cash at your highest interest loan (for example, the Grad PLUS loan).

Keep up this process and until your loans are gone.

5. Make payments while in school

Still in school? Don’t wait to make payments.

You can cut down interest while forgoing in-school deferment and start chipping away at your debt and principal balance before it piles up.

6. Claim the student loan tax deduction

You can write off up to $2,500 of your student loan interest. The amount you can write off and eligibility will depend on your income, as there are phaseouts or gradual reductions in place.

You can use the 1098-E form from your loan servicer to figure out how much interest you’ve paid.

7. Pay down private student loans first

If you have both private student loans and federal student loans, prioritize paying down your private loans.

Private student loans don’t offer student loan forgiveness or income-driven repayment and have limited deferment options.

Paying off private student loans will put you in a better place with less risk.

8. Refinance into your child’s name

If you’re a Parent PLUS borrower and you and your child agree that it’s time for them to take over the loan, you can refinance into your child’s name.

Note that some, not all, lenders allow this. It can help save money on the loan and transfer responsibility.

9. Get on a Standard Repayment Plan

Federal student loans offer many different repayment plans.

The most cost-effective is the Standard Repayment Plan, which has a 10-year term. This plan can save you money on interest and the total cost of your loans in the long term.

10. Keep loans certified on IDR

If you’re on income-driven repayment, be sure to certify your loans each year.

Borrowers must recertify to stay in good standing with IDR. If you don’t, your monthly payment may revert to the Standard Repayment Plan.

11. Avoid forbearance

Forbearance can be a good option if you truly need it, but try to avoid it at all costs.

Putting your loans in forbearance and not making payments can increase the amount of interest you’ll have to eventually pay.

12. Avoid default

Borrowers enter default by failing to make a payment in 270 days. Default can lead to wage garnishment, bad credit and more.

Keep making payments and if you need to, go on an income-driven repayment plan or put your loans in deferment or forbearance rather than defaulting on your loans.

13. Pay off capitalized interest

During your grace period or periods of deferment, interest accrues on your loans. That interest gets added to your loan and then you pay interest on the new, higher total.

Make paying off capitalized interest a priority to avoid this.

14. Update your taxes to married, filing separately

If you’re on an income-driven repayment plan and are married filing jointly, your income, as well as your spouse’s income, will affect your monthly payment.

Switching to married filing separately could save you money on your monthly payment.

15. Avoid student loan scams

Ever see ads for “Obama student loan forgiveness,” “Trump student loan forgiveness” or promises that a company can get rid of your student loans? Proceed with caution.

Student loan scams are everywhere. If it feels too good to be true, it probably is.

16. Use employer repayment assistance programs

See if your employer offers any repayment assistance programs to help pay back your student loans.

Some employers might offer reimbursement or allocate funds to help. It doesn’t hurt to ask!

17. Pay during the grace period

After graduation, you get a six month grace period where you don’t have to make any student loan payments.

If you can afford it, don’t wait. Start paying the monthly payment amount during the grace period. This will help keep interest in check and prevent your balance from ballooning during the grace period.

18. Invest in a student loan plan

At Student Loan Planner®, we’re committed to helping borrowers find the best plan for their unique situations and assist with student loan repayment. We’ve found that 90% of our clients were making a projected 5-figure mistake with their student loans.

We can help get you on the right track. Get in touch to figure out the right plan for you.

19. Pay more than the minimum

A common mistake people make is only making the minimum payment on their student loans. It’s “minimum” for a reason. Pay more if you can! Challenge yourself to double payments.

If you can’t, any extra money will help chip away at interest and eventually the principal.

20. Go back to school

This can seem counterintuitive. But if you’re miserable with your job as a chiropractor and want to go back to school to become a nurse, you may be eligible for Public Service Loan Forgiveness in your new career.

21. Keep your credit score in good shape

Your credit score affects the interest rates you get on credit cards, car loans, mortgages and student loan refinancing or any new loan. Keeping your credit in good shape can be a money-saving strategy.

Always make payments on time by the due date, keep balances low on your credit cards and be mindful of opening new credit accounts.

22. Use the refinance ladder approach

Student loan refinancing is a way to save money on interest. And you can refinance your student loans more than once. Doing so can help you save even more money.

Read on to learn more about the refinancing ladder approach.

23. Consolidate federal student loans

If you have many different federal student loans, consider consolidating with a Direct Consolidation Loan.

Consolidating can make repayment easier, lower your payment and extend your repayment term. Just be aware you’ll most likely pay more in interest.

Student loan forgiveness strategies

24. Work in the public sector and apply for Public Service Loan Forgiveness

Work at a nonprofit or government agency and have federal loans? You could qualify for Public Service Loan Forgiveness (PSLF).

After making 120 payments and working at a qualifying employer for 10 years, you could get all of your loans wiped out, tax-free.

25. Get student loans forgiven under Income-Driven Repayment

If you have six-figure debt that feels impossible to pay off, you may be eligible for student loan forgiveness under an income-driven repayment (IDR) plan.

All four IDR plans forgive any remaining balances on student loans at the end of the repayment term.

26. Teach and apply for Teacher Loan Forgiveness

If you are a teacher and work at a qualifying school for five years, you could be eligible for Teacher Loan Forgiveness. With this program, you can get $5,000 or $17,500 forgiven depending on the subject you teach.

27. Apply for state-based loan forgiveness programs

Don’t just look at federal student loan forgiveness programs, but check out state-based options as well.

For example, states like New York have many forgiveness options. Be sure to check out what might be available.

28. Get military student loan forgiveness

If you’ve served in the military, you may be eligible for military student loan forgiveness. Check out the options you could qualify for.

29. Apply for Perkins Loan Teacher Cancellation

If you have Perkins loans and work as a teacher, you could qualify to get 100 percent of your loans forgiven.

30. Work in rural areas to be eligible for certain types of forgiveness

For many healthcare-related professions, working in certain rural areas could open up additional opportunities for student loan forgiveness.

31. Declare bankruptcy

We don’t recommend this route unless student loans are seriously affecting your life. It’s also incredibly difficult to get your student loans discharged in bankruptcy. You must meet several requirements and it will ruin your credit.

Tips to cut back on expenses

32. Make your own coffee

Skip the daily Starbucks and make your own coffee at home. If you don’t want to completely cut out the latte, cut back to at least a few times a week so it is more of a treat than a habit.

33. Go on a shopping ban

Commit to not shopping or spending money on anything non-essential. Going on a shopping ban can help you reset your spending habits and keep money in your pocket.

34. Ditch fast fashion and shop at thrift stores

Instead of buying new clothes, skip fast fashion and shop at thrift stores. You’ll save even more money and reduce your environmental impact.

35. Turn off electronics

When not in use or before you leave the house, turn off your electronics.

Turn off the lights, unplug your computers and don’t waste electricity. This can help lower your electricity bill.

36. Lower your thermostat

You can lower your thermostat so you use less energy and save money on your utilities.

37. Drive your old car that is paid off

If you have an old set of wheels that is paid off, keep driving it. No need to buy a new car and take out additional loans. Drive your old car until you can no longer drive it.

38. Learn to cook

If there’s one skill that can save you tons of money it’s learning how to cook. Cooking for yourself can prevent you from going out and actually help you make the things you like.

Check out YouTube cooking videos or online recipes and get started.

39. Meal prep

After learning to cook, get started meal prepping. This means planning your meals in advance so there’s never a question about what you’ll eat.

This helps eliminate the temptation to go out and spend. Check out these meal prep templates.

40. Do a childcare/cooking swap

If you have friends or neighbors that also have children, do a childcare/cooking swap. One day, they manage childcare and cooking and the next you can take over.

It helps share the responsibility and can save money on childcare and eating out.

41. Move back in with your parents

This isn’t an option for everyone but if you can, consider moving back in with your parents to turbocharge your debt repayment. You can save money on rent and put it towards your student loan debt.

Just make sure you know the rules, terms and conditions with your parents to avoid any trouble.

42. Shack up with your partner

Is your relationship getting serious? Consider moving in together and splitting the rent.

43. Get a roommate

Maybe splitting an apartment with your significant other isn’t an option but getting a roommate is. A roommate can help you cut costs.

Housing is typically a top expense, so being able to reduce the cost can fuel your debt repayment.

44. Avoid Whole Foods

Food is another big expense. Instead of shopping at “Whole Paycheck,” go to an economic grocer, like Aldis or Trader Joe’s. Look for sales and plan ahead to avoid overspending.

45. Make your own gifts

Instead of buying a gift for someone’s birthday or the holidays, make your own. Are you crafty? Artistic? Make something for them.

You can also give vouchers for free babysitting or some other way to gift an act of service.

46. Know your spending triggers

Do you find yourself shopping more when you’re bored or stressed? That could be a spending trigger.

Identify what emotions or situations trigger you to open your wallet and spend unnecessarily.

47. Avoid spendy friends

We all have those friends who don’t seem to have a budget or care about what they spend. It’s time to avoid those people for a while when trying to pay down debt.

Our peer group can influence spending habits when we want to keep up and fit in.

48. Go on frugal dates

Whether single or in a relationship, dating takes work and money. It can get expensive.

Look at frugal, but fun date ideas like hiking, going to the beach, museum free days, etc.

49. Borrow a friend’s streaming password

Do you have a friend who already has Netflix or Hulu? Would they be so kind as to share their password with you?

50. Use the library

If you want to get free books, free magazines, free movies and more, head to the library.

You can save a lot of money on books and media purchases by using this underutilized resource.

51. Cut cable

Do you have an expensive cable package? If so, ditch it for something more affordable like streaming services or go without.

52. Find cheaper insurance

Check various rates for rental insurance, health insurance, car insurance, etc. You may qualify for a lower rate.

53. Negotiate your phone and internet bill

Call your phone and internet provider to negotiate a lower rate. Having and keeping you as a customer is easier than trying to get a new one, so it doesn’t hurt to see if you can get a lower rate.

54. Downsize

If you live in a 2-bedroom and can downsize, then move and save money on rent. If you have a 1-bedroom, but a studio will do, it’s time to downsize. Have only the space you really need to save money on housing.

55. Move to a city with a lower cost of living

If you can, move away from high-priced cities like SF, NYC and LA. Consider moving to a location with a lower cost of living.

56. Keep rent 20% or less of your income

A good rule of thumb is to keep your rent to 20 percent or less of your income. Doing so can ensure you have extra room in your budget to focus on paying off student loans.

57. Have 20% down payment to avoid PMI

If you plan on buying a home, make sure you have a 20 percent down payment so you can avoid paying for Private Mortgage Insurance. If you have less than 20 percent, you’re required to get it which can cost even more.

58. Bike or walk to work

Give the car a little break and start biking or walking to work, if possible. You can save money and build your workout into your commute.

59. Use GasBuddy

Before filling up your car, check out GasBuddy.com to find the most affordable gasoline in your area.

60. Find free parking ahead of time

Before heading to a popular part of town, find out where there is free parking ahead of time. You can avoid pricey lots and searching for street parking. Google Maps can help you locate what’s in the area or you can use Spot Angels.

61. Buy certain items in bulk

You can get certain foods, spices and cleaning products in bulk at Costco. You know you’ll always need toilet paper and rice, so save some money by buying them in bulk.

62. Use Groupon or Goldstar

For your entertainment needs, use Groupon and Goldstar to slash prices on activities or restaurants around town.

63. Go to a beauty school

If you need to get a haircut, go to a local beauty school. Getting your hair cut by a student can significantly cut costs.

Simple ways to earn more

64. Have a yard sale

Declutter your place and sell the stuff you no longer use. You can have a yard sale and earn some extra cash.

65. Drive for Uber or Lyft

If you like driving, why not make some extra money driving for Uber or Lyft? You can drive on your own timeline and use the money to help pay off your student loans.

66. Make money on TaskRabbit

You can earn money and sign up to be a Tasker on TaskRabbit. Taskers can help move items, clean homes, put together Ikea furniture and more.

67. Sell items online

You can also sell some of your stuff online to reach a wider audience. Consider selling items on Craigslist, eBay, Facebook Marketplace, PoshMark and OfferUp.

68. Get cash back when shopping online

Using Rakuten, you can earn cash back when shopping at specific retailers online. They’ll send you a check or PayPal payment with your earnings once a quarter.

69. Cash out credit card rewards

If you have a cash back credit card, use those rewards and throw it at your student loans. That way you’re effectively leveraging your good credit and paying off student loans.

70. Walk dogs

If you love dogs, you can walk dogs using Rover and Wag. You get to hang around furry friends and make some extra cash to pay down debt.

71. Become a brand ambassador

Extroverts can become a brand ambassador as a side hustle. You can work sporting events, community events and grand openings handing out coupons and freebies.

You can find brand ambassador groups on Facebook and sign up with various marketing agencies like The Hype Agency.

72. Work in catering for events

If you’re experienced with food service and events, working in catering is a good side hustle. It’s one of the best ways to pay off student loans because you can earn extra money and may be able to score some leftovers.

73. Open up a new cash back credit card with a generous sign-up bonus

If you have good credit and don’t have any credit card debt (and won’t get into any), you can consider applying for a cash back credit card with a generous sign-up bonus.

To earn a sign-up bonus, new cardholders must typically meet a minimum spend within a specific period of time (e.g. “$200 bonus after you spend $500 in the first three months of opening a new account”).

74. Bartend on the weekends

To earn extra cash, consider bartending on the weekends. You can work at your local bar, do private events or work at a winery.

75. Babysit

You can go back to the OG side hustle and babysit. Tell your family and friends you’re available and willing to babysit. You can also try SitterCity.com.

76. Become a host on AirBnB experiences

You can become an AirBnB experience host and make extra cash. AirBnB experience hosts share their talent or love for their communities with tourists.

For example, you could do a coffee tour of the neighborhood, go hiking with a group to spots only locals know, etc.

77. Rent out your apartment on AirBnB

If you have extra space in your home or want to spend the weekend at your partner’s place, rent out your apartment on AirBnB.

You can earn extra money without a ton of work and use it to pay off your student loans.

78. Learn a new skill to boost income

In this changing world, you can learn a new skill to boost your income. You can take online classes and learn to code, to do graphic design and more.

You can also use YouTube, or Lynda.com.

79. Negotiate a raise

One of the best ways to pay off your student loans is to earn more through negotiating. If you haven’t done so already, negotiate a raise with your employer.

Make sure you make your case as to why it’s worth it and set up a meeting at a good time of year to help your chances.

80. Use an inheritance

If you received an inheritance or cash windfall after a family member passed, you can use that extra money to pay down student loans. That extra money won’t be coming from your typical budget so can make even more of an impact on your debt.

81. Ask for cash for holidays and birthdays

If your mom or Aunt Sally keep asking what you want for your birthday or Christmas, say you’d love help with your student loan payments or that you’d prefer cash.

82. Have your parents or spouse used ChangEd

You can have your parents or spouse sign up for ChangEd app to help turn their spare change into a student loan payment.

ChangEd rounds up purchases to the next dollar and puts the spare change toward your loans. They allow family members to create an account to help borrowers with their debt.

83. Sign-up for Drop

There are certain cash back apps where you can earn money or get gift cards effortlessly.

Using Drop, you can connect your credit and debit cards and earn points when you spend at Trader Joe’s, Starbucks or on Lyft. You don’t have to do any extra work to earn money and gift cards.

84. Change tax withholdings

If you’re getting a hefty tax refund each year, you might want to change your tax withholding. That way you can increase your current paycheck and increase your monthly student loan payments.

Consult with an accountant or tax professional if you have questions.

85. Change careers

You can consider changing careers and doing something “just for the money” if paying off student loans is urgent.

Think of your applicable and transferable skills and check out salary prospects on Glassdoor.com and Payscale.com.

86. Buy a private practice

If you’re a dentist or in a similar medical-related position, you can consider buying a private practice to earn more money. Your earning ability can increase with ownership.

87. Start your own private practice

If you can’t find a private practice to buy, consider starting your own. Owning your own practice is tough work, but could make it easier in the long run to earn more and pay off debt.

88. Use the 50/50 bonus rule

If you get an end-of-year bonus or any other kind of bonus throughout the year, utilize the 50/50 bonus rule.

You can enjoy 50 percent of the bonus and put the other 50 percent towards paying off student loans. That way you’re having fun, but also being financially smart.

89. Get a second job

Though it may not be fun, you can find a second job to earn more. You can work at Trader Joe’s, Starbucks, a bar, etc.

Use your primary income source to pay your own bills and your second job’s income for your student loans.

90. Tutor

You can earn extra money by becoming a tutor. If you’re good at science, English, or a foreign language you may be able to help students in your area and earn some extra cash.

91. Recycle

If you’re a soda or beer drinker or enjoy a lot of wine, take your cans and bottles to the recycling center to get some cash.

You’ll want to collect trash bags and go after you have accumulated quite a few, but think of it as a return on your investment and extra money for your student loans.

92. Find free items and upsell them

Ever see something on the side of the street and think “Wow, that’s in good condition. Why would someone get rid of this?”

You can take those items and put in the legwork to sell them on OfferUp, Craigslist or Facebook Marketplace.

93. Rent out your parking spot

If you live in a big city, parking spots can be killer real estate. You can use a site like Pavemint, post on Next Door, Facebook or talk to your neighbors.

94. Participate in focus groups

One of the ways you can earn more money is by participating in focus groups. It’s only a few hours and pay pretty good.

You can sign up with FocusGroup.com or look for opportunities in the Gigs section of Craigslist.

95. Sell your clothes

You can sell designer clothes you no longer want on Poshmark.

96. Create items on Zazzle

Do you feel like you have a million ideas for t-shirts or mugs, but no energy for the production part?

You can create a marketplace on Zazzle and create your own products. Zazzle handles the production and shipping so you can stick to creating.

Weird ways to pay off debt

97. Move to a state with no income tax

One way to increase your income and focus on paying off student loans is to move to a state with no income tax.

Consider moving to states like Washington, Texas or Florida to avoid income tax.

98. Go vegetarian

Eating meat can be expensive, so if you want to boost your payments, consider cutting it out for a while.

If you want, you can go even more hardcore and go vegan.

99. Ditch the booze

Alcohol can be a fun social lubricant, but there’s no denying that it’s also empty calories and can cost a ton of money.

If you want to supercharge your student loan payments, ditch the booze and use the money you’re saving to pay down debt.

100. Sell plasma

You can Google your city and plasma donation centers in your area. You may be able to earn some cash.

101. Sell your eggs

Women who meet certain requirements can potentially earn thousands of dollars selling their eggs. Make sure you’re aware of the requirements and risks beforehand.

102. Marry thoughtfully

Deciding to get married is one of the most important financial decisions you’ll ever make. Also, getting a divorce is expensive. Do your best to make sure your future spouse is truly “the one.”

103. Do odd jobs for neighbors

You can earn money doing odd jobs for neighbors like raking leaves, removing snow, helping them move, etc.

104. Participate in medical studies

You can earn extra money by participating in medical studies in your area. Just be sure to look at the requirements, pay and time commitment.

105. Live in a co-living space

Co-living spaces are on the rise. Living in what is essentially shared housing, similar to dorms can help you slash housing costs.

106. Have your parents buy the highest cost loan

We’ve seen some parents buy borrower’s highest cost loan. If that’s possible in your situation, it could help.

107. Leave the country to pay 0 dollars

Do you dream of adventure and far away lands? Consider leaving the country and you can pay zero dollars on your student loans.

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, IDR, or refinancing (including the one lender we think could give you the best rate).