Pediatric dentists are just like early childhood teachers. It's way more than just a job title.

At first impression, it seems like they’re just watching over kids and making sure their teeth are developing normally. But in reality, pediatric dentistry isn’t just about cleaning teeth. A pediatric dentist treats children and adolescents, manages and cleans secondary teeth, and more. Just like early education teachers, pediatric dentists oversee and support the proper development of children. They need years of experience.

Childhood is a volatile time of growth, so I personally (as a parent of three kiddos) am grateful there are specialists overseeing how my kids' mouths develop.

Plus, it takes true skill to keep a 3-year-old at bay while cleaning and evaluating their teeth.

People who choose careers in fields like pediatric dentistry often are driven by a desire to positively impact young children and infants. But taking on such a noble pursuit often entails taking on a lot of student loan debt, too.

To figure out if it’s worth it to take out loans to become a pediatric dentist, we’re going to look at the income potential for pediatric dentists, the cost of getting the degree, and other key factors that will affect loan repayment.

I’ll also run you through some case studies on how to pay back pediatric dental school debt, including during residency.

Let’s dive in!

Requirements to become a pediatric dentist can impact student loan repayment

Pediatric dentists go beyond a bachelor's degree and go to dental school just like other general dentists. But where a general dentist can start practicing right after graduation, pediatric dentists go through two — and occasionally three — years of residency programs after graduating.

This can put a wrinkle in their student loan repayment strategy because resident annual salaries are a fraction of what they’d make if they were to become a general dentist right away. For this reason, the short-term repayment strategy while in residency may be different than the optimal long-term strategy.

I’ll cover that in a little bit. First, let’s start with some numbers to illustrate what pediatric dentists face.

Income & Student Debt by Profession

How you compare to other

accountants stats*

| Average student debt | |

| Average income | |

| Average Debt-to-Income Ratio |

Statistics represent the population of Student Loan Planner clients in the respective profession referenced in the chart from 2017-2023. Sample excludes those in school or in training.*

Pediatric dentist student loan debt: How much do people have?

Dental school is one of the most expensive grad-level programs out there, and dentists graduate with more debt than most other professions.

The typical dentist will graduate with around $250,000 to $300,000 in student loans. Those attending private schools can add about 50% more to that number. Based on Student Loan Planner consult data, the average dentist debt is $381,000. That’s among the highest average debt we’ve consulted on by profession, and it jibes with the general data.

Even with that being the case, dental schools continue to be in high demand because of the high income potential for dentists and the relatively low risk that comes with becoming a practice owner.

Not all dentists are pleased with their average annual salary upon graduation, however. Many get paid well below average, but becoming a pediatric dentist can mitigate that by leading to even higher income potential than general dentistry.

What is the average pediatric dentist salary?

Pediatric dentists get paid a nice premium compared to general dentists. According to ZipRecruiter, the average dentist makes $190,000 per year. The same source shows that the average pediatric dentist makes $277,000. That’s almost a 50% gain on an already nice estimate salary for having a dental specialty.

Related: How to Protect Your Pediatric Dentist Salary with Disability Insurance

The metro area (or lack thereof) also impacts a dentist’s income. We’ve found that dentists who practice in more densely populated areas like New York, San Francisco, Boston, and Los Angeles tend to make less money because there are more dentists there. Those who set up a practice in more rural areas tend to make more money because they can be the only game in town. Less competition means more business and a potentially higher median salary range.

Practice ownership also plays a role. Rarely have we worked with people who own their full-time dental practice and earn less than $300,000. A good way to think about it is that profit margins from owning a dental practice are higher than an associate dentist’s payout. A higher profit margin means the practice-owning dentist makes more money even if they have the same production as their non-practice-owning counterpart.

If you want to hear more about what practice ownership entails, listen to this great podcast interview Travis Hornsby had with Zachary Kingsberg, a dental practice owner.

The best two loan repayment strategies for pediatric dentists

In our experience, pediatric dentists have two solid options that will save them the most money when paying back their student loans:

- Pay off their loans aggressively with a goal of being debt free in 10 years or less. This could involve refinancing student loans if it would lower their interest rate and they could afford the payment.

- Sign up for an income-driven repayment plan like SAVE or PAYE, make payments based upon income for 20 to 25 years, and then pay taxes on the forgiven balance.

With the first option, pediatric dentists should throw every extra dollar they can find to become debt free as quickly as possible. The second option is the exact opposite: Pick an income-driven repayment plan that will keep payments as low as possible, max out pre-tax retirement accounts to lower adjusted gross income, save up for the tax bomb, and maximize forgiveness.

The in-between strategies of paying more while on income-driven repayment or taking too long to pay back the debt after refinancing could be a needless waste of thousands of dollars. We’d rather pediatric dentists keep that money in their pockets, especially since they take such great care of our precious little kiddos.

Which option is best? It depends on the specific situation and whether the dentist is in residency.

I’ll walk you through some scenarios.

When pediatric dentists should refinance student loans

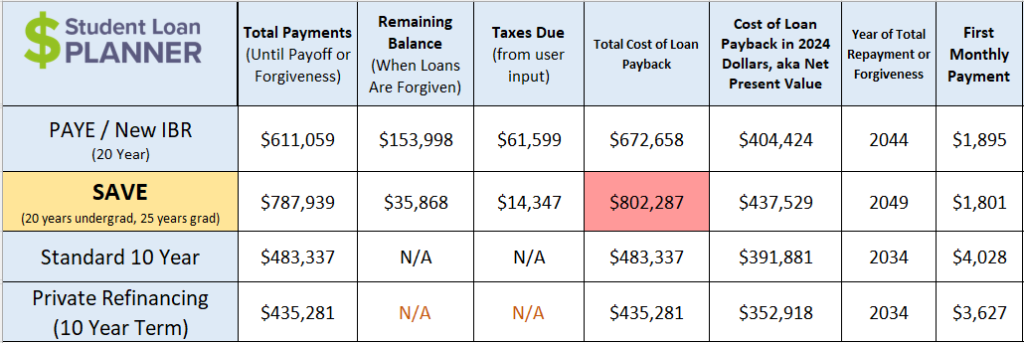

Erica is a pediatric dentist with many qualifications, experience, and certifications. She has $350,000 at 6.8% in student debt and makes $250,000. Her income is projected to grow at 3% per year. Should she take the aggressive approach or go on income-driven repayment?

This is a clear refinancing case because doing so will save Erica the most money by far.

PAYE would cost about $237,000 more to pay back her student debt and double the amount of time until she’s debt-free. She’d have to come up with an extra $1,700 per month with the aggressive approach versus her PAYE payment, but that might not be a problem on a $250,000 income.

Why refinance instead of just going on the Standard 10-Year Plan? Both plans get her debt-free in 10 years, but lowering her interest rate from 6.8% down to 4.5% will reduce the total cost of paying back her debt by nearly $50,000 and lower her monthly payment by about $401 per month!

When pediatric dentists should look at income-driven repayment

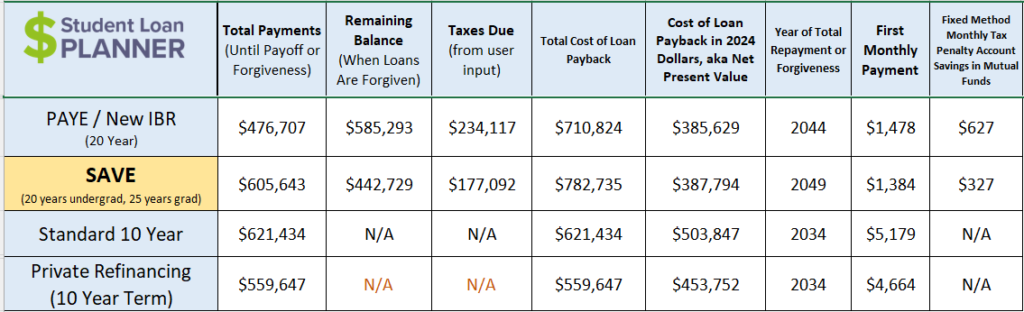

Tony is a pediatric dentist who lives in Southern California. His salary in CA is $200,000, and he owes $450,000 in student debt from dental school. He’s not planning to open his own practice, so his income should grow at the normal 3% per year.

Although it looks like refinancing would cost Tony the least money out of pocket, it isn’t actually the most affordable option for him.

If his take-home pay is about $10,000 per month, about half would go toward his refi payment over the next 10 years, leaving him with just over $5,000 for regular monthly expenses while living in expensive SoCal.

On PAYE, his payment would start at $1,478, which would leave him about $8,500 per month in take-home pay. He could have a decent lifestyle while on PAYE and save about $3,000 a month by maxing out his pre-tax retirement plan, saving for the tax bomb ($627 per month), do a backdoor Roth IRA contribution, and reach other financial milestones along the way.

Assuming his $3,000 per month would be invested and grow at 5% per year, he could build up a $465,000 nest egg in 10 years. That would continue to grow to $1,004,000 in 20 years, even after paying the tax bomb. He could also increase the amount going to savings as his income grows.

Now, let’s say he were to refinance and forgo savings for 10 years. He’d be debt-free in 10 years, then take that $4,664 payment and invest it for the next 10 years (years 11 to 20), he’d end up with $724,000. That isn’t bad, but it ends up being about $280,000 shy of going on PAYE and investing the difference in payment. Tony would have 38% more money after 20 years by being on PAYE ($1,004,000 with PAYE versus $724,000 with refinancing)!

How pediatric dentists can save money on their student loans in residency

Let’s go back to Erica. Remember that she has $350,000 in student loans at 6.8%. Now, let’s assume that this is what she graduated with before entering her two-year residency.

Erica will earn $50,000 for two years as a resident and then her salary will jump to $250,000 after those two years.

Refinancing is still the long-term play for her, but a $3,600 monthly payment while earning $50,000 is an absolute no-go. That’s all of her take-home pay! Putting her loans in forbearance isn’t a good strategy either because the interest will skyrocket over those two years.

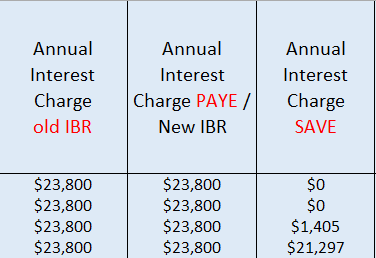

What can she do with her student loan repayment during residency that will set her up in the best position to refinance afterward? Enter the SAVE plan interest subsidy.

The normal interest charge on Erica’s loans would be $23,800 per year ($350,000 x 6.8%) no matter if she’s on PAYE or income-based repayment (IBR). But SAVE is different. The government will cover any unpaid interest that isn't covered by your SAVE monthly payment.

For example, let’s say Erica waives the grace period and starts on SAVE between graduating from dental school and starting her pediatric residency. Her payments on SAVE could actually be $0 per month for the first year of residency.

Because her payments don’t cover any interest, the SAVE interest subsidy wipes away the full $23,800 interest charge. On PAYE or IBR, her loan would accrue $23,800 in interest while having $0 payments. But on SAVE, the accrued interest doesn't grow at all.

The following year, her prior-year tax return shows only $25,000 for half a year of residency salary, so her payments would remain at $0 and she'd get the full interest subsidy on SAVE again. She'd also be able to keep a low $117 monthly payment the following year based on her $50,000 residency salary, with the government still covering the majority of interest.

Erica’s payments would be a total of $1,405 over three years, and the government would have paid almost $70,000 in interest for her. After finishing up residency and gaining her full salary, she could refinance her dental school loans and pay them back in 10 years or less.

Going on SAVE would save her just shy of $70,000 in interest and even more paying back her refinanced loans compared to putting them into forbearance during residency. SAVE then refi results in huge savings!

Is it worth it to become a pediatric dentist?

The answer is an emphatic yes!

It’s scary to think about taking out $300,000 to $400,000 in student loans for a doctor of dental surgery (DDS) or doctor of medicine in dentistry (DMD), but there’s an optimal plan to pay it back, whether you’re in Erica’s situation, where refinancing is smart, or in Tony’s situation, where PAYE is a solid option with aggressive savings on the side.

Sure, earning $50,000 for two years isn’t great, but the average salary for a pediatric dentist is $80,000 more than general dentists make. That means it takes less than three years to recoup the salary lost during those two years of residency. It’s all gravy after that.

Becoming a dental practice owner can make this strategy even more compelling.

Pediatric dentists can get a solid student loan plan

Pediatric dentists can find a clear path to pay back their dental school debt — one that could not only save them significantly more money during repayment but also give them actionable steps to follow their debt payoff plan successfully.

Student Loan Planner® has consulted on over $2.6 billion in student loan debt. We can help you figure out the optimal path in just one hour. Plus we include email support after the consult to continue to answer your questions and help you implement your plan. Learn more about our consult process here.

If your case is a pretty clear-cut refinancing case with no practice ownership in the imminent future, there’s no need to get a consult. But I'd suggest applying through our cash-back refinancing links to see if you can cut your interest rate and get affordable terms for your situation.

Income & Student Debt by Profession

How you compare to other

accountants stats*

| Average student debt | |

| Average income | |

| Average Debt-to-Income Ratio |

Statistics represent the population of Student Loan Planner clients in the respective profession referenced in the chart from 2017-2023. Sample excludes those in school or in training.*