Surveys have average physical therapist debt at about $96,000. According to the American Physical Therapy Association, “Despite the appeal of joining the physical therapy profession and its necessity as a vital health care service, the cost of a doctor of physical therapy degree has created a significant barrier to the ability of recent graduates to achieve financial stability, and it is a deterrent to promising students who must think carefully about the financial implications before pursuing a physical therapy career.”

Physical therapists (not physical therapy assistants — PTAs) have been burdened with the requirement of obtaining a Doctor of Physical Therapy degree (DPT) beyond a bachelor's degree or anything entry-level. Are the physical therapist student loans worth the money?

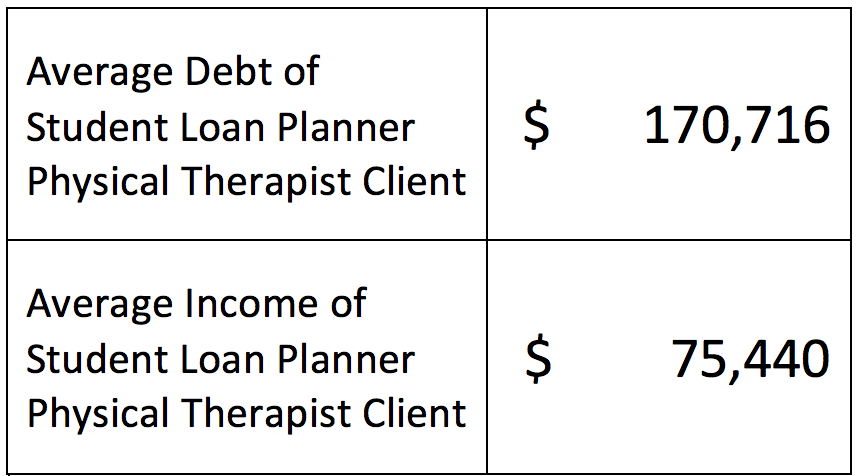

I must admit, the physical therapists who seek our help making a plan have higher than average student loan debt for their physical therapy education. We have a lot of borrowers who simply use our refinancing links to pick up a cashback bonus who we don’t speak to directly. That said, physical therapist education has become way more expensive in recent years.

Incomes and good pay have not been keeping up, despite the goal of moving the profession to a doctorate level education with a residency program or fellowships. Getting more than an undergraduate degree and learning specialties is a lot of coursework when the money isn't on par.

What are the financial implications of becoming a physical therapist?

Physical Therapist Debt to Income Ratio Keeps Climbing

If we examine our internal data, the decision to become a physical therapist looks challenging. Our clients tend to be recent or new graduates of DPT programs at PT schools. The sample size is roughly 20, so this group is small relative to our overall sample of more than 1300 clients.

Obviously, a physical therapist earning about $75,000 would have a lot of trouble paying back over $170,000 of student debt. These average numbers don’t show the DPT with $120,000 of debt but $110,000 of income.

They also don’t illustrate the $280,000 debt carried by a physical therapist graduating from the most expensive institutions.

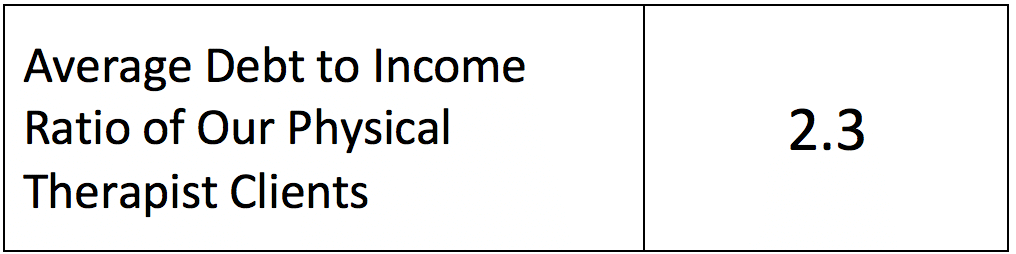

They do paint a picture of a profession in crisis. Examine the debt to income ratio below:

How to Recover Financially from Getting Physical Therapist Student Loans

Many physical therapists who have help from family with the cost of school will be OK. Others who attend lower-cost programs and who take efforts to keep borrowing low will be able to refinance.

New DPT grads with debt to income ratios above two generally need to use a forgiveness-based strategy. There are two key paths to follow.

Public Service Loan Forgiveness For Physical Therapists

If you work full-time at a not-for-profit or government employer, you will be able to utilize the Public Service Loan Forgiveness (PSLF) program. You need to make payments for 10 years on a qualifying income-based program such as the new SAVE plan (formerly REPAYE) or PAYE.

If you do this, the remaining balance can be forgiven. To be honest, physical therapists who owe as little as one times their income need to be pursuing this strategy if they qualify.

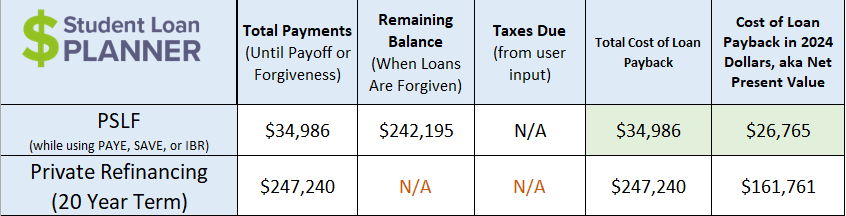

Let’s pretend Amy is our average physical therapist with $170,000 student debt at 7% and $75,000 projected income. After graduating in May 2024, she's looking at a not-for-profit hospital job versus a private practice outpatient job.

For the non-profit job, here’s what the math looks like. The cost in 2024 dollars is essentially net present value. The refinancing row is just a control so we have something to compare the forgiveness strategy to.

Loan Forgiveness for Physical Therapists in the Private Sector

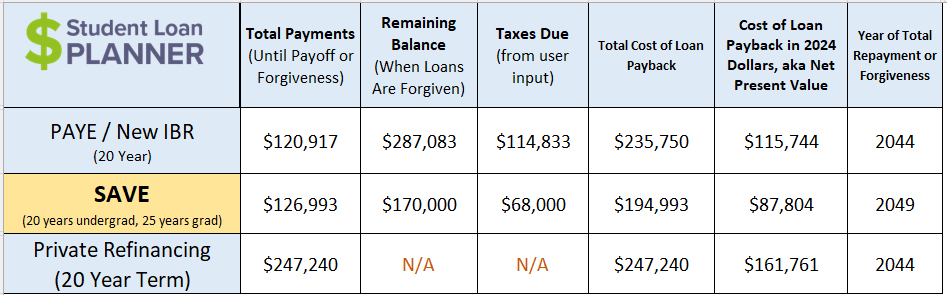

What if Amy took a $75,000 a year job in the private sector? Of course, that means she won’t be eligible for PSLF. However, all is not lost. She could pursue 25-year loan forgiveness with the SAVE plan for the lowest monthly payment or go for the 20-year PAYE program if she doesn't mind paying a little more each month.

She won’t get tax-free forgiveness, so she'll need to plan ahead to pay taxes on the forgiven balance.

While the total cost of the payments plus taxes is $194,993 overall on SAVE, the cost in today’s dollars is almost half of what you might pay by refinancing to a lower interest rate.

Plus, there's on-going debate on whether to make student loan forgiveness tax-free permanently after a forgiveness provision of the American Rescue Plan expires at the end of 2025. So, there's potential for even more savings depending on how future elections pan out. That said, you should still financially plan like you'll owe taxes for IDR forgiveness.

Rules of Thumb for Physical Therapist Loan Forgiveness

In fact, most physical therapists with debt over two times their income should be pursuing a forgiveness strategy. Obviously, PSLF is the better of the two, but not everyone wants to work full-time at a qualifying employer.

That’s why you can pursue physical therapist student loan forgiveness even if you work part-time or in the private sector if you owe too much to comfortably pay it off in less than 10 years.

Physical Therapist Student Loans Are Not the Best Financial Investment

If you are interested in money, it’s clear that it doesn’t pay to take out six figures of student debt and delay your earnings three years after undergrad for a salary that is under six figures typically. It's tough to make good money on an average physical therapist salary which according to the Bureau of Labor Statistics is $95,620 (median pay) as of May 2021, the latest available data. Exercise physiology has some similarities but pays almost half of that.

You could be an engineer, corporate employee, tech employee, nurse at a clinic, or a host of different jobs if you want to make a similar level of income quickly after graduation.

Becoming a physical therapist ensures you’ll likely always be able to find work of some sort. It does not guarantee that you’ll always be able to full-time hours in the location where you want to live. And if you do live where you want in a state like California or Connecticut, you'll have a higher cost of living as well.

I keep hearing stories about how there’s a new physical therapist school popping up every six months. I believe we’ll see trends continue to develop where the number of physical therapists grows to the point where employers of DPTs are the ones with leverage.

This will particularly be true in desirable places to live where the supply of DPTs is abundant.

You Can Still Get a Good ROI on Your DPT Degree

You can still make the math work out so that you can retire one day, buy a house, start a family, and accomplish anything you want to do, even with a huge amount of student debt.

Getting the right plan in place for managing your student loans is critical though. You need to know how to max retirement accounts, what to put away for the tax bomb, or be confident you’re making the right refinancing decision.

We can help figure that out for you of course. Making student loan plans is our primary business.

To make the most of your DPT degree, keep fixed costs low. Don’t just buy a house because everybody is doing it. Buy your car in cash, rent if you’re in a high cost of living area or move to a place like Nevada with no income taxes. Focus on having a high savings rate.

Even the most indebted physical therapist will be able to be financially secure with a high savings rate. It’s just a lot more difficult than it used to be thanks to the ridiculous cost of a physical therapist’s education.

Has physical therapy been a good long-term investment for you? Do you think you would do it over again if you had the choice? Why or why not?

Comments are closed.